At Counterpoint, we’ve been championing diversifier strategies for a while now—like the wise old friend who keeps reminding you to bring an umbrella just in case. These strategies have proven time and again that they can boost portfolio performance by bringing something fresh to the table—something different from your usual stock-and-bond duo.

If recent years were a rollercoaster, 2022 and 2023 were the loops that made investors queasy, as stocks and bonds decided to wobble together right when we needed balance. Fast forward to 2025, and the market’s mood swings have only turned up the volume. It’s no surprise more investors are trading in their classic 60/40 mix for the sleeker, more diversified 50/30/20 model. Turns out, a little shake-up might be exactly what portfolios needed.

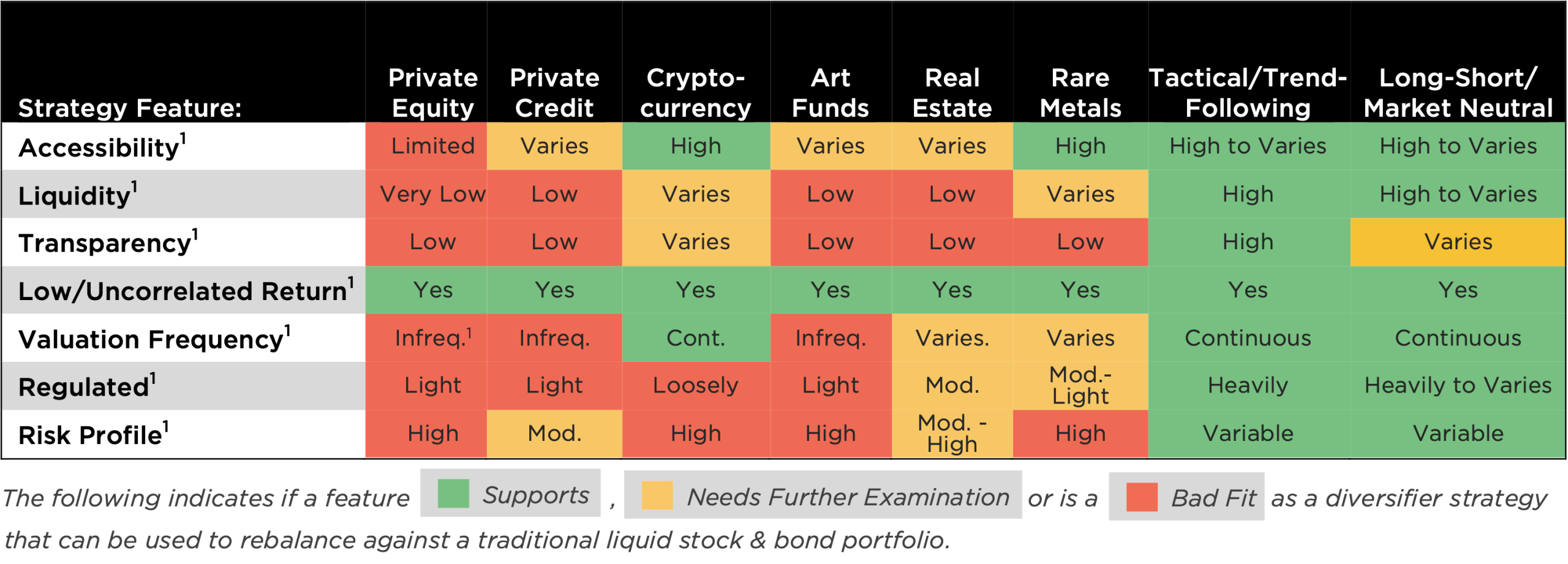

While investors may now have cracked the code that diversifiers are likely a must-have in their investment toolkit – now what? With a smorgasbord of options on the table, how do investors figure out which ones deserve an allocation on their portfolio’s plate?

Interested in Private Equity or Private Credit?

Thinking about stepping off the Wall Street treadmill and into the private investment jungle? Welcome to the wild world of Private Equity and Private Credit, where the stakes are higher, the rides are bumpier, but the rewards can be juicier. These investments give you access to deals the public markets never see with less day-to-day drama than stocks (thanks infrequent valuation!) and the chance to earn fatter returns (hello, illiquidity premium!), it’s a playground for those who like their portfolios a little more exclusive. Private equity and credit often specialize in industries, regions or types of deals leading to specialized expertise that can create competitive advantages and generate alpha.

But before you cannonball into the private pool, know that it’s deep—and there’s no shallow end. These investments can tie up your money for years, like a long-term relationship with no exit hatch. Transparency1? Think foggy glasses, not crystal clear. You’ll also need to pick your managers like you pick your brain surgeon—very carefully. So if you’re game for a less liquid, more hands-on adventure with some serious due diligence and high fees, private markets might just be your next thrill ride.

What About Cryptocurrency or Art Funds?

If you’re looking to break up with boring old stocks and bonds, cryptocurrency and art funds might just be your exciting new fling. Crypto is the wild child of the investment world—digital, decentralized, and dancing to its own beat. It’s got the thrill of volatility and the charm of potential high returns, plus it may act as a modern-day shield against inflation. On the flip side, art funds let you invest with your heart and your wallet. Imagine your money tied up in masterpieces instead of market indexes—it’s part culture, part capital growth, and fully off the beaten path.

But every whirlwind romance has its red flags. Crypto, for all its buzz, can be a rollercoaster of price swings, regulation gray areas, and hacking horror stories. Art funds, meanwhile, may sound glamorous, but they can be as opaque2 as a foggy Monet.

(Art valuations can be highly subjective and influenced by trends, making price transparency and predictability more difficult than in traditional markets.) Pricing isn’t always clear, getting your cash out can take time, and the fees can nibble at your returns like moths on a canvas. So if you’re thinking about diving in, make sure you bring some curiosity, caution, and a solid safety net.

Maybe Private Real Estate or Rare Metals?

Diving into rare metals or real estate can add some serious spice to a plain old portfolio of stocks and bonds. Think of rare metals like lithium or gold as the cool, shiny assets with unique powers—whether it’s powering electric cars or potentially acting like financial armor during inflation or global chaos. Real estate, on the other hand usually appreciates over time, and can even give you tax breaks. Plus, both tend to zig when the stock market zags, which can help smooth out the ride when markets get bumpy. Private real estate (direct property ownership) shows a very weak positive correlation (almost negligible) with the stock market, meaning their returns tend to be independent.

But don’t jump in without reading the fine print. Rare metals can be moody—prices

bounce around with global politics and demand swings, and they’re not always easy to sell in a hurry. Real estate might sound stable, but it’s a heavyweight commitment—big money down, ongoing upkeep, and it can drag if interest rates rise or local markets slump. So, while they can definitely boost your portfolio’s personality, they come with quirks that not every investor may be ready for.

Tactical / Systematic Trend-Following Strategies?

Trend-following strategies, like the Counterpoint Tactical High Yield Fund (CPITX), are like financial bloodhounds—they seek to hold riskier assets when prices are rising or stable, and move to safer havens when things start falling. Unlike stocks and bonds, which often stumble together during market turmoil, these strategies have historically been shown to help investors reduce drawdowns, often thriving when everything else is in chaos like during equity drawdowns or inflationary environments when traditional assets often struggle. They hunt for trends across all sorts of markets and stick to a strict, no-emotion rulebook. The benefit of trading like a robot helps investors avoid injecting emotion into the trade, where the fear-of-missing-out (FOMO) or fear of losses can adversely impact human behavior, plus holding tactical strategies designed to help manage risk can be a great sidekick when your traditional portfolio is feeling the heat.

But trend-following isn’t all smooth sailing. When markets get stuck in a rut or bounce around aimlessly, these strategies can end up spinning their wheels, racking up losses and transaction costs or treading water. Plus, you’re basically handing the reins to an algorithm—so if you’re the type who needs to understand every move your money makes, it might feel like trusting a GPS you’ve never met. The ride can be bumpy at times, but for those willing to hang on, the destination might be worth it.

Long Short or Market Neutral Mispricing Strategies?

Quantitative multi-factor long-short or market neutral mispricing strategies, like the Counterpoint Tactical Equity Fund (CPIEX), are like the brainy kids of the investment world—they use artificial intelligence, math, data, and empirical evidence to spot which stocks may be undervalued (go long!) and which may be overpriced (go short!). Unlike traditional investments that ride the ups and downs of the market, these strategies march to their own beat, which can add some much-needed balance to portfolios when things get rocky. Plus, because everything is run through models and algorithms, there’s often less room for gut feelings and human error—just cool, calculated decision-making.

But let’s not pretend these strategies are all fun and games. They can be complex, a bit opaque, and sometimes finicky. Not all models are created equal, and if the data’s bad or the market starts behaving weirdly, things can go sideways fast. And when too many managers chase the same signals, it can get crowded fast. Bottom line? These strategies can be powerful tools, but they’re best handled by investors who know the risks and have reviewed the relevant prospectuses before investing in the world of quants.

Conclusion

At Counterpoint, we believe the best diversifier strategies for investor portfolios are:

- Systematic and follow a quantitative process that is consistent and seeks long-term growth.

- Designed to provide meaningful diversification benefits for portfolios by offering low to uncorrelated return to traditional fixed income and equity markets.

- Liquid so investors can potentially realize diversification benefits right away and/or systematically rebalance their portfolio to reduce overall volatility and drive performance over the long run.

Systematic diversifier strategies composed of liquid assets can potentially act like the seatbelts and airbags of your portfolio when traditional assets crash. While they aren’t likely to be flashy in a joyride bull market, they can make a big difference when the road gets bumpy. Sure, they might trail the pack when markets are zooming ahead, but their low to uncorrelated nature can make them a valuable asset to include in a traditional liquid stock and bond portfolio when volatility spokes and chaos calls. These strategies aim to smooth out the ride, minimize drawdowns, and free up managers to pounce when opportunity knocks—often when investor emotions are running high. Think of them as your financial sidekick that were created with a quantitative plan of attack when the market throws a tantrum.

Download our recent quick-guide:

The Counterpoint Quick Guide to Diversifier Strategies

This quick guide is designed to help advisors and clients evaluate different diversifiers’ suitability for their portfolios.