San Diego, California – February 11, 2025 – Counterpoint Funds, a quantitative mutual fund and ETF provider specializing in diversifier strategies, today announced that the Counterpoint Tactical Income...

READ MOREThe Fund’s strategy is designed to limit downside portfolio volatility. The Fund seeks to achieve superior risk-adjusted tax-free returns by dynamically changing credit quality exposure in municipal bonds in response to shifts in market behavior.

The Fund uses price-driven trend-following models to tactically allocate the portfolio in order to manage risk.

Counterpoint’s empirical research of market history has shown price levels can be an effective predictor of future volatility, and can be utilized to seek an improvement to risk-adjusted returns relative to passive benchmarks.

The Fund seeks tax-exempt income by investing in mutual funds and ETFs of high-yield or high-quality municipal bond instruments. The Fund leverages proprietary quantitative trend-following models to reduce exposure to declines in the high-yield municipal bond market.

The Fund is designed to limit downside portfolio volatility by tactically allocating according to market conditions. The portfolio is constructed based on empirical research of market history and price-driven trend-following models to manage risk.

The Fund primarily invests in mutual funds and ETFs of high-yielding municipal bonds when the model indicates a stable or upward-trending market. Investments shift to mutual funds of higher quality municipal money market and/or other short-term municipal securities when the model indicates a downward-trending market.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

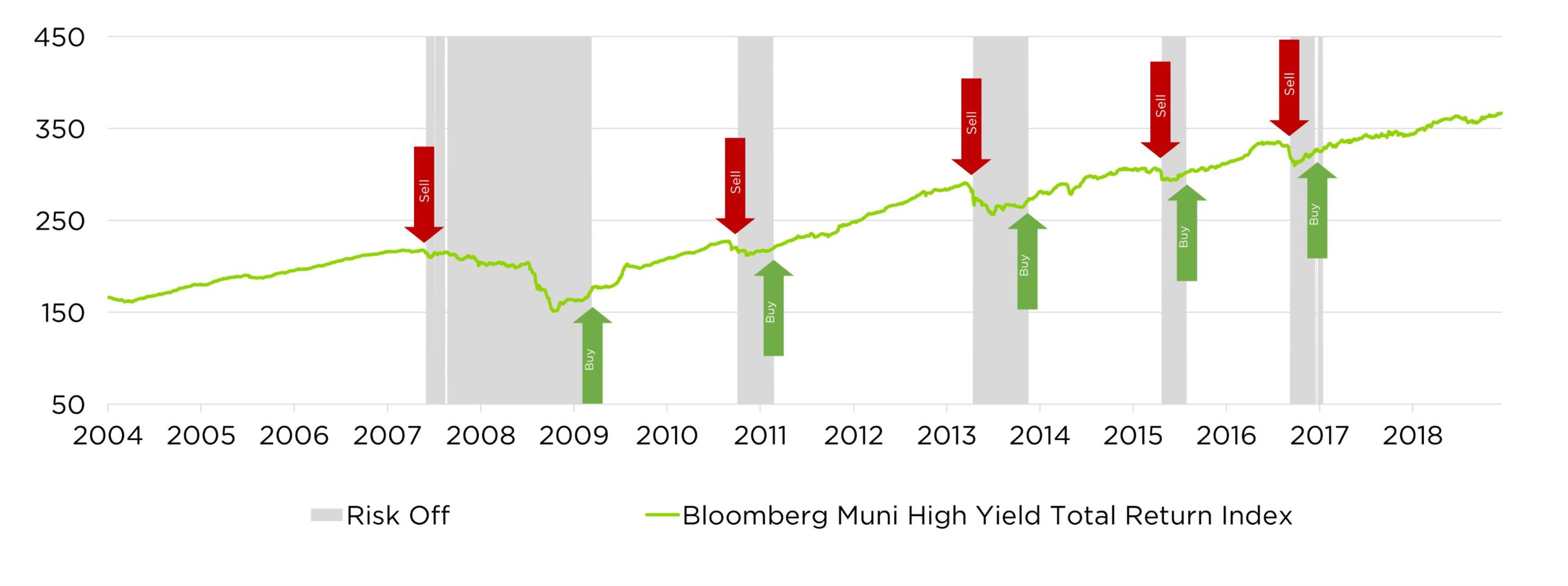

Source: Bloomberg. The above stylized example depicts trading signals to a tactical strategy on the Municipal High Yield bond market. The strategy uses crosses above and below the included index’s 200-day moving average to create buy and sell signals. Several signals are omitted to improve readability. The Fund does not use the 200-day moving average in its strategy, but employs a similar trend following approach.

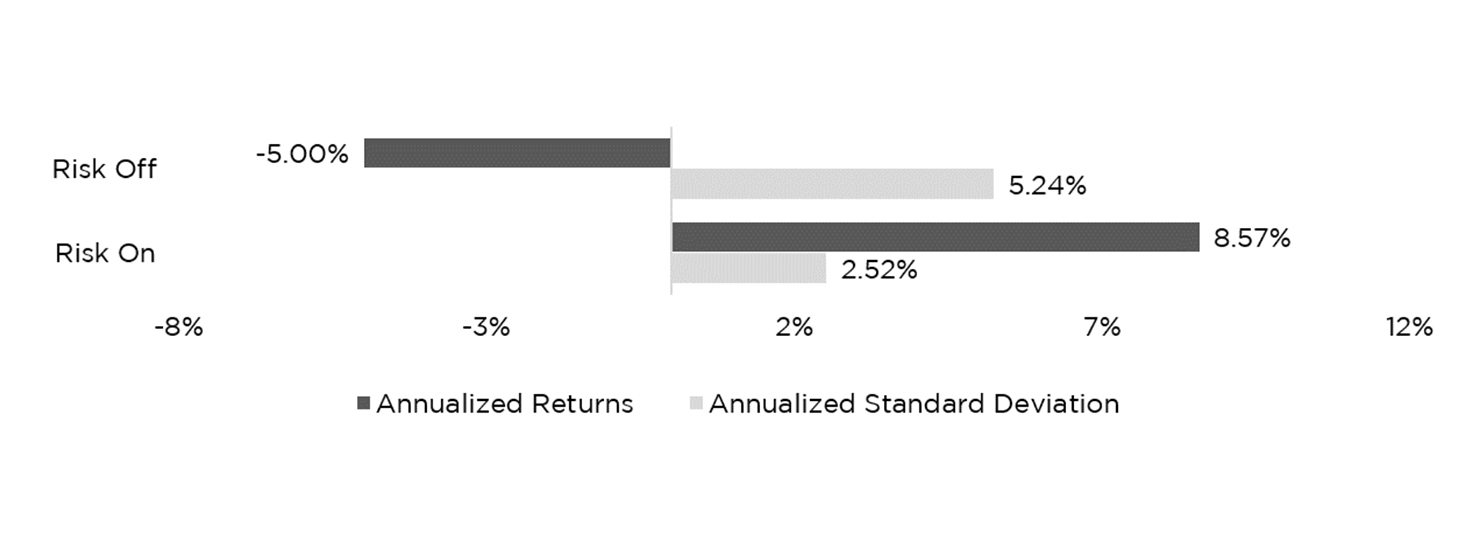

Source: Bloomberg. The above results depict returns and risk of the untradeable Bloomberg Muni High Yield Total Return Index while Risk Off (when the index is below its 200-day moving average) and Risk On (when the index is above its 200-day moving average).

The Fund does not use the 200-day moving average in its strategy, but employs a similar trend-following approach.

Risk Off: The period of time where the Muni High Yield Index is below the 200-day moving average. A trend-following strategy would sell the asset class in a risk off state.

Risk On: The period of time where the Muni High Yield Index is above the 200-day moving average. A trend-following strategy would buy the asset class in a risk on state.

The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

San Diego, California – February 11, 2025 – Counterpoint Funds, a quantitative mutual fund and ETF provider specializing in diversifier strategies, today announced that the Counterpoint Tactical Income...

READ MOREYear-ahead commentary is challenging for us: We don’t have a crystal ball, and we believe predictions contribute more to investment mistakes than outperformance. But the New Year does...

READ MOREHow should an investment advisor think about building a portfolio for clients? Or how should an investor think about building a portfolio for themselves? Many investors agree that...

READ MORE| As of April 24, 2025 | As of March 31, 2025 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Return Since Fund Inception (Annualized) | Year to Date | 1 Year Return | Standard Deviation (Annualized) | Return Since Fund Inception (Annualized) | Year To Date | 1 Year Return | 3 Year Return (Annualized) | 5 Year Return (Annualized) | |

| TMNIX | 3.47% | -1.62% | 1.78% | 2.61% | 3.55% | -1.33% | 0.93% | 2.45% | 3.02% |

| TMNAX Without Sales Load | 3.22% | -1.68% | 1.52% | 2.61% | 3.30% | -1.39% | 0.58% | 2.21% | 2.77% |

| TMNAX With Sales Load (4.5%) | 2.54% | -6.07% | -3.05% | 2.61% | 2.60% | -5.80% | -3.98% | 0.64% | 1.83% |

| TMNCX | 2.45% | -1.87% | 0.86% | 2.61% | 2.52% | -1.59% | -0.09% | 1.45% | 2.01% |

| Bloomberg Municipal Bond Index | 1.78% | -1.78% | 0.77% | 4.32% | 2.03% | -0.22% | 1.22% | 1.53% | 1.07% |

The performance data displayed here represents past performance, which is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until January 31, 2022 to ensure that the net annual fund operating expenses exclusive of Acquired Fund Fees and Interest/Dividends on Short Sales will not exceed 1.25%, 2.00%, and 1.00% attributable to Class A, Class C, and Class I shares, subject to possible recoupment from the Fund in future years.

Bloomberg Barclays Capital High Yield Municipal Bond Index is an unmanaged index made up of bonds that are non-investment grade, or unrated by Moody’s Investors Service with a remaining maturity of at least 1 year. Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high-yield, fixed-rate corporate bond market. The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features.

Ticker TMNAX TMNCX TMNIX

CUSIP 66538R102 66538R201 66538R300

Share Class Class A Class C Institutional

Minimum Investment $5,000 $5,000 $100,000

Minimum IRA Investment $1,000 $1,000 $100,000

Management Fee 0.70% 0.70% 0.70%

Estimated Acquired Fund Expenses 0.47% 0.47% 0.47%

Estimated Other Fund Expenses (Maximum Net of Waiver) 1.08% (0.30%) 1.08% (0.30%) 1.08% (0.30%)

12b-1 Distribution & Marketing 0.25% 1.00% None

Estimated Total Annual Operating Fees 2.50% 3.25% 2.25%

Estimated Total Annual Operating Fees (After Waiver) 1.72% 2.47% 1.47%

Fund Inception Date June 11, 2018

The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until January 31, 2022 to ensure that the net annual fund operating expenses exclusive of Acquired Fund Fees and Interest/Dividends on Short Sales will not exceed 1.25%, 2.00%, and 1.00% attributable to Class A, Class C, and Class I shares, subject to possible recoupment from the Fund in future years.

Top Holdings – as of March 31, 2025

BlackRock Liquidity Funds MuniCash 86.47%

Nuveen High Yield Municipal Bond Fund 6.41%

Goldman Sachs High Yield Municipal Fund 2.59%

Invesco Rochester Municipal Opportunities Fund 2.41%

AB High Income Municipal Portfolio 0.98%

PIMCO High Yield Municipal Bond Fund 0.33%

CDXHY43 Swaption Put 105 07/16/2025 0.1%

US BOND FUTR OPTN Jul25P USN5P 116.0 Comdty 0.08%

American High-Income Municipal Bond Fund 0%

T Rowe Price Tax-Free High Yield Fund Inc. 0%

Portfolio holdings are subject to change, vary over time and should not be considered a recommendation to buy any individual security.

| Dividend Rate | Ex Date | Fund Share Class | Long Term Gain | NAV | Pay Date | Record Date | Short Term Gain |

|---|---|---|---|---|---|---|---|

| 0.0352 | 2025-03-28 | Counterpoint Tactical Municipal I | N/A | 10.48 | 2025-03-31 | 2025-03-27 | N/A |

| 0.0270 | 2025-03-28 | Counterpoint Tactical Municipal C | N/A | 10.3 | 2025-03-31 | 2025-03-27 | N/A |

| 0.0331 | 2025-03-28 | Counterpoint Tactical Municipal A | N/A | 10.47 | 2025-03-31 | 2025-03-27 | N/A |

| 0.0327 | 2025-02-27 | Counterpoint Tactical Municipal I | N/A | 10.78 | 2025-02-28 | 2025-02-26 | N/A |

| 0.0247 | 2025-02-27 | Counterpoint Tactical Municipal C | N/A | 10.59 | 2025-02-28 | 2025-02-26 | N/A |

| 0.0307 | 2025-02-27 | Counterpoint Tactical Municipal A | N/A | 10.76 | 2025-02-28 | 2025-02-26 | N/A |

| 0.0201 | 2025-01-30 | Counterpoint Tactical Municipal I | N/A | 10.73 | 2025-01-31 | 2025-01-29 | N/A |

| 0.0118 | 2025-01-30 | Counterpoint Tactical Municipal C | N/A | 10.54 | 2025-01-31 | 2025-01-29 | N/A |

| 0.0180 | 2025-01-30 | Counterpoint Tactical Municipal A | N/A | 10.71 | 2025-01-31 | 2025-01-29 | N/A |

| 0.0457 | 2024-12-18 | Counterpoint Tactical Municipal I | N/A | 10.82 | 2024-12-19 | 2024-12-17 | N/A |

| 0.0394 | 2024-12-18 | Counterpoint Tactical Municipal C | N/A | 10.64 | 2024-12-19 | 2024-12-17 | N/A |

| 0.0413 | 2024-12-18 | Counterpoint Tactical Municipal A | N/A | 10.8 | 2024-12-19 | 2024-12-17 | N/A |

| 0.0278 | 2024-11-27 | Counterpoint Tactical Municipal I | N/A | 11 | 2024-11-29 | 2024-11-26 | N/A |

| 0.0193 | 2024-11-27 | Counterpoint Tactical Municipal C | N/A | 10.82 | 2024-11-29 | 2024-11-26 | N/A |

| 0.0257 | 2024-11-27 | Counterpoint Tactical Municipal A | N/A | 10.98 | 2024-11-29 | 2024-11-26 | N/A |

| 0.0288 | 2024-10-30 | Counterpoint Tactical Municipal I | N/A | 10.87 | 2024-10-31 | 2024-10-29 | N/A |

| 0.0212 | 2024-10-30 | Counterpoint Tactical Municipal C | N/A | 10.7 | 2024-10-31 | 2024-10-29 | N/A |

| 0.0268 | 2024-10-30 | Counterpoint Tactical Municipal A | N/A | 10.86 | 2024-10-31 | 2024-10-29 | N/A |

| 0.0270 | 2024-09-27 | Counterpoint Tactical Municipal I | N/A | 11.06 | 2024-09-30 | 2024-09-26 | N/A |

| 0.0187 | 2024-09-27 | Counterpoint Tactical Municipal C | N/A | 10.88 | 2024-09-30 | 2024-09-26 | N/A |

| 0.0248 | 2024-09-27 | Counterpoint Tactical Municipal A | N/A | 11.04 | 2024-09-30 | 2024-09-26 | N/A |

| 0.0292 | 2024-08-29 | Counterpoint Tactical Municipal I | N/A | 10.95 | 2024-08-30 | 2024-08-28 | N/A |

| 0.0205 | 2024-08-29 | Counterpoint Tactical Municipal C | N/A | 10.77 | 2024-08-30 | 2024-08-28 | N/A |

| 0.0270 | 2024-08-29 | Counterpoint Tactical Municipal A | N/A | 10.93 | 2024-08-30 | 2024-08-28 | N/A |

| 0.0300 | 2024-07-30 | Counterpoint Tactical Municipal I | N/A | 10.89 | 2024-07-31 | 2024-07-29 | N/A |

| 0.0204 | 2024-07-30 | Counterpoint Tactical Municipal C | N/A | 10.71 | 2024-07-31 | 2024-07-29 | N/A |

| 0.0276 | 2024-07-30 | Counterpoint Tactical Municipal A | N/A | 10.87 | 2024-07-31 | 2024-07-29 | N/A |

| 0.0265 | 2024-06-27 | Counterpoint Tactical Municipal I | N/A | 10.81 | 2024-06-28 | 2024-06-26 | N/A |

| 0.0185 | 2024-06-27 | Counterpoint Tactical Municipal C | N/A | 10.64 | 2024-06-28 | 2024-06-26 | N/A |

| 0.0245 | 2024-06-27 | Counterpoint Tactical Municipal A | N/A | 10.79 | 2024-06-28 | 2024-06-26 | N/A |

| 0.0320 | 2024-05-30 | Counterpoint Tactical Municipal I | N/A | 10.6 | 2024-05-31 | 2024-05-29 | N/A |

| 0.0229 | 2024-05-30 | Counterpoint Tactical Municipal C | N/A | 10.43 | 2024-05-31 | 2024-05-29 | N/A |

| 0.0296 | 2024-05-30 | Counterpoint Tactical Municipal A | N/A | 10.58 | 2024-05-31 | 2024-05-29 | N/A |

| 0.0299 | 2024-04-29 | Counterpoint Tactical Municipal I | N/A | 10.59 | 2024-04-30 | 2024-04-26 | N/A |

| 0.0209 | 2024-04-29 | Counterpoint Tactical Municipal C | N/A | 10.42 | 2024-04-30 | 2024-04-26 | N/A |

| 0.0277 | 2024-04-29 | Counterpoint Tactical Municipal A | N/A | 10.57 | 2024-04-30 | 2024-04-26 | N/A |

| 0.0257 | 2024-03-27 | Counterpoint Tactical Municipal I | N/A | 10.75 | 2024-03-28 | 2024-03-26 | N/A |

| 0.0175 | 2024-03-27 | Counterpoint Tactical Municipal C | N/A | 10.58 | 2024-03-28 | 2024-03-26 | N/A |

| 0.0236 | 2024-03-27 | Counterpoint Tactical Municipal A | N/A | 10.73 | 2024-03-28 | 2024-03-26 | N/A |

| 0.0286 | 2024-02-28 | Counterpoint Tactical Municipal I | N/A | 10.7 | 2024-02-29 | 2024-02-27 | N/A |

| 0.0210 | 2024-02-28 | Counterpoint Tactical Municipal C | N/A | 10.54 | 2024-02-29 | 2024-02-27 | N/A |

| 0.0265 | 2024-02-28 | Counterpoint Tactical Municipal A | N/A | 10.69 | 2024-02-29 | 2024-02-27 | N/A |

| 0.0230 | 2024-01-30 | Counterpoint Tactical Municipal I | N/A | 10.62 | 2024-01-31 | 2024-01-29 | N/A |

| 0.0147 | 2024-01-30 | Counterpoint Tactical Municipal C | N/A | 10.45 | 2024-01-31 | 2024-01-29 | N/A |

| 0.0213 | 2024-01-30 | Counterpoint Tactical Municipal A | N/A | 10.6 | 2024-01-31 | 2024-01-29 | N/A |

| 0.0347 | 2023-12-18 | Counterpoint Tactical Municipal I | N/A | 10.59 | 2023-12-19 | 2023-12-15 | N/A |

| 0.0256 | 2023-12-18 | Counterpoint Tactical Municipal C | N/A | 10.43 | 2023-12-19 | 2023-12-15 | N/A |

| 0.0324 | 2023-12-18 | Counterpoint Tactical Municipal A | N/A | 10.57 | 2023-12-19 | 2023-12-15 | N/A |

| 0.0256 | 2023-11-29 | Counterpoint Tactical Municipal I | N/A | 10.34 | 2023-11-30 | 2023-11-28 | N/A |

| 0.0171 | 2023-11-29 | Counterpoint Tactical Municipal C | N/A | 10.18 | 2023-11-30 | 2023-11-28 | N/A |

| 0.0234 | 2023-11-29 | Counterpoint Tactical Municipal A | N/A | 10.32 | 2023-11-30 | 2023-11-28 | N/A |

| 0.0173 | 2023-10-30 | Counterpoint Tactical Municipal I | N/A | 10.13 | 2023-10-31 | 2023-10-27 | N/A |

| 0.0099 | 2023-10-30 | Counterpoint Tactical Municipal C | N/A | 9.97 | 2023-10-31 | 2023-10-27 | N/A |

| 0.0152 | 2023-10-30 | Counterpoint Tactical Municipal A | N/A | 10.11 | 2023-10-31 | 2023-10-27 | N/A |

| 0.0278 | 2023-09-28 | Counterpoint Tactical Municipal I | N/A | 10.13 | 2023-09-29 | 2023-09-27 | N/A |

| 0.0193 | 2023-09-28 | Counterpoint Tactical Municipal C | N/A | 9.97 | 2023-09-29 | 2023-09-27 | N/A |

| 0.0257 | 2023-09-28 | Counterpoint Tactical Municipal A | N/A | 10.1 | 2023-09-29 | 2023-09-27 | N/A |

| 0.0334 | 2023-08-30 | Counterpoint Tactical Municipal I | N/A | 10.2 | 2023-08-31 | 2023-08-29 | N/A |

| 0.0242 | 2023-08-30 | Counterpoint Tactical Municipal C | N/A | 10.04 | 2023-08-31 | 2023-08-29 | N/A |

| 0.0310 | 2023-08-30 | Counterpoint Tactical Municipal A | N/A | 10.18 | 2023-08-31 | 2023-08-29 | N/A |

| 0.0272 | 2023-07-28 | Counterpoint Tactical Municipal I | N/A | 10.41 | 2023-07-31 | 2023-07-27 | N/A |

| 0.0185 | 2023-07-28 | Counterpoint Tactical Municipal C | N/A | 10.25 | 2023-07-31 | 2023-07-27 | N/A |

| 0.0253 | 2023-07-28 | Counterpoint Tactical Municipal A | N/A | 10.39 | 2023-07-31 | 2023-07-27 | N/A |

| 0.0273 | 2023-06-29 | Counterpoint Tactical Municipal I | N/A | 10.43 | 2023-06-30 | 2023-06-28 | N/A |

| 0.0180 | 2023-06-29 | Counterpoint Tactical Municipal C | N/A | 10.27 | 2023-06-30 | 2023-06-28 | N/A |

| 0.0248 | 2023-06-29 | Counterpoint Tactical Municipal A | N/A | 10.41 | 2023-06-30 | 2023-06-28 | N/A |

| 0.0304 | 2023-05-30 | Counterpoint Tactical Municipal I | N/A | 10.38 | 2023-05-31 | 2023-05-26 | N/A |

| 0.0219 | 2023-05-30 | Counterpoint Tactical Municipal C | N/A | 10.22 | 2023-05-31 | 2023-05-26 | N/A |

| 0.0282 | 2023-05-30 | Counterpoint Tactical Municipal A | N/A | 10.36 | 2023-05-31 | 2023-05-26 | N/A |

| 0.0290 | 2023-04-27 | Counterpoint Tactical Municipal I | N/A | 10.49 | 2023-04-28 | 2023-04-26 | N/A |

| 0.0214 | 2023-04-27 | Counterpoint Tactical Municipal C | N/A | 10.33 | 2023-04-28 | 2023-04-26 | N/A |

| 0.0270 | 2023-04-27 | Counterpoint Tactical Municipal A | N/A | 10.47 | 2023-04-28 | 2023-04-26 | N/A |

| 0.0371 | 2023-03-30 | Counterpoint Tactical Municipal I | N/A | 10.49 | 2023-03-31 | 2023-03-29 | N/A |

| 0.0281 | 2023-03-30 | Counterpoint Tactical Municipal C | N/A | 10.33 | 2023-03-31 | 2023-03-29 | N/A |

| 0.0349 | 2023-03-30 | Counterpoint Tactical Municipal A | N/A | 10.47 | 2023-03-31 | 2023-03-29 | N/A |

| 0.0332 | 2023-02-27 | Counterpoint Tactical Municipal I | N/A | 10.36 | 2023-02-28 | 2023-02-24 | N/A |

| 0.0256 | 2023-02-27 | Counterpoint Tactical Municipal C | N/A | 10.21 | 2023-02-28 | 2023-02-24 | N/A |

| 0.0313 | 2023-02-27 | Counterpoint Tactical Municipal A | N/A | 10.35 | 2023-02-28 | 2023-02-24 | N/A |

| 0.0395 | 2023-01-30 | Counterpoint Tactical Municipal I | N/A | 10.71 | 2023-01-31 | 2023-01-27 | N/A |

| 0.0339 | 2023-01-30 | Counterpoint Tactical Municipal C | N/A | 10.55 | 2023-01-31 | 2023-01-27 | N/A |

| 0.0376 | 2023-01-30 | Counterpoint Tactical Municipal A | N/A | 10.69 | 2023-01-31 | 2023-01-27 | N/A |

| 0.0195 | 2022-12-19 | Counterpoint Tactical Municipal I | N/A | 10.53 | 2022-12-20 | 2022-12-16 | N/A |

| 0.0111 | 2022-12-19 | Counterpoint Tactical Municipal C | N/A | 10.38 | 2022-12-20 | 2022-12-16 | N/A |

| 0.0171 | 2022-12-19 | Counterpoint Tactical Municipal A | N/A | 10.51 | 2022-12-20 | 2022-12-16 | N/A |

| 0.0076 | 2022-11-29 | Counterpoint Tactical Municipal I | N/A | 10.52 | 2022-11-30 | 2022-11-28 | N/A |

| 0.0053 | 2022-11-29 | Counterpoint Tactical Municipal A | N/A | 10.5 | 2022-11-30 | 2022-11-28 | N/A |

| 0.0099 | 2022-10-28 | Counterpoint Tactical Municipal I | N/A | 10.5 | 2022-10-31 | 2022-10-27 | N/A |

| 0.0003 | 2022-10-28 | Counterpoint Tactical Municipal C | N/A | 10.35 | 2022-10-31 | 2022-10-27 | N/A |

| 0.0079 | 2022-10-28 | Counterpoint Tactical Municipal A | N/A | 10.48 | 2022-10-31 | 2022-10-27 | N/A |

| 0.0168 | 2021-12-20 | Counterpoint Tactical Municipal I | 0.2722 | 10.68 | 2021-12-21 | 2021-12-17 | N/A |

| N/A | 2021-12-20 | Counterpoint Tactical Municipal C | 0.2722 | 10.61 | 2021-12-21 | 2021-12-17 | N/A |

| 0.0108 | 2021-12-20 | Counterpoint Tactical Municipal A | 0.2722 | 10.68 | 2021-12-21 | 2021-12-17 | N/A |

| 0.0193 | 2021-09-29 | Counterpoint Tactical Municipal I | N/A | 10.99 | 2021-09-29 | 2021-09-28 | N/A |

| 0.0096 | 2021-09-29 | Counterpoint Tactical Municipal C | N/A | 10.92 | 2021-09-29 | 2021-09-28 | N/A |

| 0.0169 | 2021-09-29 | Counterpoint Tactical Municipal A | N/A | 10.99 | 2021-09-29 | 2021-09-28 | N/A |

| 0.0186 | 2021-08-30 | Counterpoint Tactical Municipal I | N/A | 11.12 | 2021-08-30 | 2021-08-27 | N/A |

| 0.0095 | 2021-08-30 | Counterpoint Tactical Municipal C | N/A | 11.05 | 2021-08-30 | 2021-08-27 | N/A |

| 0.0162 | 2021-08-30 | Counterpoint Tactical Municipal A | N/A | 11.12 | 2021-08-30 | 2021-08-27 | N/A |

| 0.0182 | 2021-07-29 | Counterpoint Tactical Municipal I | N/A | 11.18 | 2021-07-29 | 2021-07-28 | N/A |

| 0.0090 | 2021-07-29 | Counterpoint Tactical Municipal C | N/A | 11.11 | 2021-07-29 | 2021-07-28 | N/A |

| 0.0163 | 2021-07-29 | Counterpoint Tactical Municipal A | N/A | 11.18 | 2021-07-29 | 2021-07-28 | N/A |

| 0.0227 | 2021-06-29 | Counterpoint Tactical Municipal I | N/A | 11.1 | 2021-06-29 | 2021-06-28 | N/A |

| 0.0130 | 2021-06-29 | Counterpoint Tactical Municipal C | N/A | 11.03 | 2021-06-29 | 2021-06-28 | N/A |

| 0.0201 | 2021-06-29 | Counterpoint Tactical Municipal A | N/A | 11.09 | 2021-06-29 | 2021-06-28 | N/A |

| 0.0180 | 2021-05-27 | Counterpoint Tactical Municipal I | N/A | 11.05 | 2021-05-27 | 2021-05-26 | N/A |

| 0.0108 | 2021-05-27 | Counterpoint Tactical Municipal C | N/A | 10.98 | 2021-05-27 | 2021-05-26 | N/A |

| 0.0156 | 2021-05-27 | Counterpoint Tactical Municipal A | N/A | 11.04 | 2021-05-27 | 2021-05-26 | N/A |

| 0.0201 | 2021-04-29 | Counterpoint Tactical Municipal I | N/A | 10.98 | 2021-04-29 | 2021-04-28 | N/A |

| 0.0115 | 2021-04-29 | Counterpoint Tactical Municipal C | N/A | 10.91 | 2021-04-29 | 2021-04-28 | N/A |

| 0.0184 | 2021-04-29 | Counterpoint Tactical Municipal A | N/A | 10.98 | 2021-04-29 | 2021-04-28 | N/A |

| 0.0236 | 2021-03-30 | Counterpoint Tactical Municipal I | N/A | 10.87 | 2021-03-30 | 2021-03-29 | N/A |

| 0.0153 | 2021-03-30 | Counterpoint Tactical Municipal C | N/A | 10.8 | 2021-03-30 | 2021-03-29 | N/A |

| 0.0212 | 2021-03-30 | Counterpoint Tactical Municipal A | N/A | 10.87 | 2021-03-30 | 2021-03-29 | N/A |

| 0.0228 | 2021-02-25 | Counterpoint Tactical Municipal I | N/A | 10.81 | 2021-02-25 | 2021-02-24 | N/A |

| 0.0144 | 2021-02-25 | Counterpoint Tactical Municipal C | N/A | 10.74 | 2021-02-25 | 2021-02-24 | N/A |

| 0.0207 | 2021-02-25 | Counterpoint Tactical Municipal A | N/A | 10.81 | 2021-02-25 | 2021-02-24 | N/A |

| 0.0173 | 2021-01-28 | Counterpoint Tactical Municipal I | N/A | 10.99 | 2021-01-28 | 2021-01-27 | N/A |

| 0.0094 | 2021-01-28 | Counterpoint Tactical Municipal C | N/A | 10.92 | 2021-01-28 | 2021-01-27 | N/A |

| 0.0153 | 2021-01-28 | Counterpoint Tactical Municipal A | N/A | 10.98 | 2021-01-28 | 2021-01-27 | N/A |

| 0.0291 | 2020-12-21 | Counterpoint Tactical Municipal I | 0.0909 | 10.83 | 2020-12-21 | 2020-12-18 | N/A |

| 0.0189 | 2020-12-21 | Counterpoint Tactical Municipal C | 0.0909 | 10.77 | 2020-12-21 | 2020-12-18 | N/A |

| 0.0265 | 2020-12-21 | Counterpoint Tactical Municipal A | 0.0909 | 10.83 | 2020-12-21 | 2020-12-18 | N/A |

| 0.0228 | 2020-11-27 | Counterpoint Tactical Municipal I | N/A | 10.81 | 2020-11-27 | 2020-11-25 | N/A |

| 0.0149 | 2020-11-27 | Counterpoint Tactical Municipal C | N/A | 10.74 | 2020-11-27 | 2020-11-25 | N/A |

| 0.0208 | 2020-11-27 | Counterpoint Tactical Municipal A | N/A | 10.8 | 2020-11-27 | 2020-11-25 | N/A |

| 0.0197 | 2020-10-29 | Counterpoint Tactical Municipal I | N/A | 10.62 | 2020-10-29 | 2020-10-28 | N/A |

| 0.0116 | 2020-10-29 | Counterpoint Tactical Municipal C | N/A | 10.55 | 2020-10-29 | 2020-10-28 | N/A |

| 0.0176 | 2020-10-29 | Counterpoint Tactical Municipal A | N/A | 10.61 | 2020-10-29 | 2020-10-28 | N/A |

| 0.0252 | 2020-09-29 | Counterpoint Tactical Municipal I | N/A | 10.67 | 2020-09-29 | 2020-09-28 | N/A |

| 0.0182 | 2020-09-29 | Counterpoint Tactical Municipal C | N/A | 10.61 | 2020-09-29 | 2020-09-28 | N/A |

| 0.0229 | 2020-09-29 | Counterpoint Tactical Municipal A | N/A | 10.67 | 2020-09-29 | 2020-09-28 | N/A |

| 0.0192 | 2020-08-28 | Counterpoint Tactical Municipal I | N/A | 10.7 | 2020-08-28 | 2020-08-27 | N/A |

| 0.0123 | 2020-08-28 | Counterpoint Tactical Municipal C | N/A | 10.64 | 2020-08-28 | 2020-08-27 | N/A |

| 0.0171 | 2020-08-28 | Counterpoint Tactical Municipal A | N/A | 10.7 | 2020-08-28 | 2020-08-27 | N/A |

| 0.0173 | 2020-07-30 | Counterpoint Tactical Municipal I | N/A | 10.73 | 2020-07-30 | 2020-07-29 | N/A |

| 0.0097 | 2020-07-30 | Counterpoint Tactical Municipal A | N/A | 10.73 | 2020-07-30 | 2020-07-29 | N/A |

| 0.0267 | 2020-03-30 | Counterpoint Tactical Municipal I | N/A | 10.43 | 2020-03-30 | 2020-03-27 | N/A |

| 0.0293 | 2020-03-30 | Counterpoint Tactical Municipal C | N/A | 10.39 | 2020-03-30 | 2020-03-27 | N/A |

| 0.0263 | 2020-03-30 | Counterpoint Tactical Municipal A | N/A | 10.43 | 2020-03-30 | 2020-03-27 | N/A |

| 0.0048 | 2020-02-27 | Counterpoint Tactical Municipal I | N/A | 10.77 | 2020-02-27 | 2020-02-26 | N/A |

| 0.0569 | 2019-12-27 | Counterpoint Tactical Municipal I | N/A | 10.41 | 2019-12-27 | 2019-12-26 | N/A |

| 0.0474 | 2019-12-27 | Counterpoint Tactical Municipal C | N/A | 10.4 | 2019-12-27 | 2019-12-26 | N/A |

| 0.0544 | 2019-12-27 | Counterpoint Tactical Municipal A | N/A | 10.41 | 2019-12-27 | 2019-12-26 | N/A |

| 0.0232 | 2019-11-27 | Counterpoint Tactical Municipal I | N/A | 10.44 | 2019-11-27 | 2019-11-26 | N/A |

| 0.0153 | 2019-11-27 | Counterpoint Tactical Municipal C | N/A | 10.43 | 2019-11-27 | 2019-11-26 | N/A |

| 0.0212 | 2019-11-27 | Counterpoint Tactical Municipal A | N/A | 10.44 | 2019-11-27 | 2019-11-26 | N/A |

| 0.0193 | 2019-10-30 | Counterpoint Tactical Municipal I | N/A | 10.42 | 2019-10-30 | 2019-10-29 | N/A |

| 0.0110 | 2019-10-30 | Counterpoint Tactical Municipal C | N/A | 10.4 | 2019-10-30 | 2019-10-29 | N/A |

| 0.0173 | 2019-10-30 | Counterpoint Tactical Municipal A | N/A | 10.41 | 2019-10-30 | 2019-10-29 | N/A |

| 0.0235 | 2019-09-27 | Counterpoint Tactical Municipal I | N/A | 10.47 | 2019-09-27 | 2019-09-26 | N/A |

| 0.0152 | 2019-09-27 | Counterpoint Tactical Municipal C | N/A | 10.45 | 2019-09-27 | 2019-09-26 | N/A |

| 0.0213 | 2019-09-27 | Counterpoint Tactical Municipal A | N/A | 10.47 | 2019-09-27 | 2019-09-26 | N/A |

| 0.0172 | 2019-08-29 | Counterpoint Tactical Municipal I | N/A | 10.54 | 2019-08-29 | 2019-08-28 | N/A |

| 0.0086 | 2019-08-29 | Counterpoint Tactical Municipal C | N/A | 10.53 | 2019-08-29 | 2019-08-28 | N/A |

| 0.0151 | 2019-08-29 | Counterpoint Tactical Municipal A | N/A | 10.54 | 2019-08-29 | 2019-08-28 | N/A |

| 0.0275 | 2019-07-30 | Counterpoint Tactical Municipal I | N/A | 10.37 | 2019-07-30 | 2019-07-29 | N/A |

| 0.0201 | 2019-07-30 | Counterpoint Tactical Municipal C | N/A | 10.35 | 2019-07-30 | 2019-07-29 | N/A |

| 0.0252 | 2019-07-30 | Counterpoint Tactical Municipal A | N/A | 10.37 | 2019-07-30 | 2019-07-29 | N/A |

| 0.0210 | 2019-06-27 | Counterpoint Tactical Municipal I | N/A | 10.33 | 2019-06-27 | 2019-06-26 | N/A |

| 0.0131 | 2019-06-27 | Counterpoint Tactical Municipal C | N/A | 10.32 | 2019-06-27 | 2019-06-26 | N/A |

| 0.0191 | 2019-06-27 | Counterpoint Tactical Municipal A | N/A | 10.33 | 2019-06-27 | 2019-06-26 | N/A |

| 0.0353 | 2019-05-30 | Counterpoint Tactical Municipal I | N/A | 10.31 | 2019-05-30 | 2019-05-29 | N/A |

| 0.0260 | 2019-05-30 | Counterpoint Tactical Municipal C | N/A | 10.3 | 2019-05-30 | 2019-05-29 | N/A |

| 0.0330 | 2019-05-30 | Counterpoint Tactical Municipal A | N/A | 10.31 | 2019-05-30 | 2019-05-29 | N/A |

| 0.0270 | 2019-04-29 | Counterpoint Tactical Municipal I | N/A | 10.2 | 2019-04-29 | 2019-04-26 | N/A |

| 0.0186 | 2019-04-29 | Counterpoint Tactical Municipal C | N/A | 10.19 | 2019-04-29 | 2019-04-26 | N/A |

| 0.0248 | 2019-04-29 | Counterpoint Tactical Municipal A | N/A | 10.2 | 2019-04-29 | 2019-04-26 | N/A |

| 0.0269 | 2019-03-28 | Counterpoint Tactical Municipal I | N/A | 10.17 | 2019-03-28 | 2019-03-27 | N/A |

| 0.0190 | 2019-03-28 | Counterpoint Tactical Municipal C | N/A | 10.16 | 2019-03-28 | 2019-03-27 | N/A |

| 0.0251 | 2019-03-28 | Counterpoint Tactical Municipal A | N/A | 10.17 | 2019-03-28 | 2019-03-27 | N/A |

| 0.0293 | 2019-02-27 | Counterpoint Tactical Municipal I | N/A | 10.01 | 2019-02-27 | 2019-02-26 | N/A |

| 0.0216 | 2019-02-27 | Counterpoint Tactical Municipal C | N/A | 10 | 2019-02-27 | 2019-02-26 | N/A |

| 0.0273 | 2019-02-27 | Counterpoint Tactical Municipal A | N/A | 10.01 | 2019-02-27 | 2019-02-26 | N/A |

| 0.0254 | 2019-01-30 | Counterpoint Tactical Municipal I | N/A | 9.93 | 2019-01-30 | 2019-01-29 | N/A |

| 0.0178 | 2019-01-30 | Counterpoint Tactical Municipal C | N/A | 9.92 | 2019-01-30 | 2019-01-29 | N/A |

| 0.0236 | 2019-01-30 | Counterpoint Tactical Municipal A | N/A | 9.93 | 2019-01-30 | 2019-01-29 | N/A |

| 0.0104 | 2018-12-20 | Counterpoint Tactical Municipal I | N/A | 9.93 | 2018-12-20 | 2018-12-19 | N/A |

| 0.0013 | 2018-12-20 | Counterpoint Tactical Municipal C | N/A | 9.92 | 2018-12-20 | 2018-12-19 | N/A |

| 0.0080 | 2018-12-20 | Counterpoint Tactical Municipal A | N/A | 9.93 | 2018-12-20 | 2018-12-19 | N/A |

| 0.0045 | 2018-11-29 | Counterpoint Tactical Municipal I | N/A | 9.92 | 2018-11-29 | 2018-11-28 | N/A |

| 0.0025 | 2018-11-29 | Counterpoint Tactical Municipal A | N/A | 9.92 | 2018-11-29 | 2018-11-28 | N/A |

| 0.0109 | 2018-10-30 | Counterpoint Tactical Municipal I | N/A | 9.92 | 2018-10-30 | 2018-10-29 | N/A |

| 0.0029 | 2018-10-30 | Counterpoint Tactical Municipal C | N/A | 9.92 | 2018-10-30 | 2018-10-29 | N/A |

| 0.0090 | 2018-10-30 | Counterpoint Tactical Municipal A | N/A | 9.92 | 2018-10-30 | 2018-10-29 | N/A |

| 0.0252 | 2018-09-27 | Counterpoint Tactical Municipal I | N/A | 9.99 | 2018-09-27 | 2018-09-26 | N/A |

| 0.0213 | 2018-09-27 | Counterpoint Tactical Municipal C | N/A | 9.99 | 2018-09-27 | 2018-09-26 | N/A |

| 0.0255 | 2018-09-27 | Counterpoint Tactical Municipal A | N/A | 9.99 | 2018-09-27 | 2018-09-26 | N/A |

| 0.0361 | 2018-08-30 | Counterpoint Tactical Municipal I | N/A | 10.08 | 2018-08-30 | 2018-08-29 | N/A |

| 0.0203 | 2018-08-30 | Counterpoint Tactical Municipal C | N/A | 10.08 | 2018-08-30 | 2018-08-29 | N/A |

| 0.0300 | 2018-08-30 | Counterpoint Tactical Municipal A | N/A | 10.08 | 2018-08-30 | 2018-08-29 | N/A |

| 0.0149 | 2018-07-30 | Counterpoint Tactical Municipal I | N/A | 10.05 | 2018-07-30 | 2018-07-27 | N/A |

| 0.0149 | 2018-07-30 | Counterpoint Tactical Municipal C | N/A | 10.05 | 2018-07-30 | 2018-07-27 | N/A |

| 0.0149 | 2018-07-30 | Counterpoint Tactical Municipal A | N/A | 10.05 | 2018-07-30 | 2018-07-27 | N/A |

| 0.0069 | 2018-06-28 | Counterpoint Tactical Municipal I | N/A | 10.03 | 2018-06-28 | 2018-06-27 | N/A |

| 0.0069 | 2018-06-28 | Counterpoint Tactical Municipal A | N/A | 10.03 | 2018-06-28 | 2018-06-27 | N/A |

Mutual Funds involve risk including the possible loss of principal. Past performance is no guarantee of future results. There is no assurance the Fund will meet its stated objectives. The Fund is a new fund and does not have a performance record and the above index performance is not intended to serve as a proxy for the Fund’s future performance.

Bloomberg Barclays Capital High Yield Municipal Bond Index is an unmanaged index made up of bonds that are non-investment grade, or unrated by Moody’s Investors Service with a remaining maturity of at least 1 year. Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high-yield, fixed-rate corporate bond market. The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features.

5516-NLD-09/01/2021

We’ve received your request for the featured event collateral. A Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your meeting request and a Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your event registration request and will be in touch shortly.

Subscribe to stay up to date on Counterpoint Funds and receive our monthly perspective.

We have received your application and look forward to reviewing your qualifications for the role. If your application seems like a good fit, we will contact you to discuss next steps.

Thank you again for your application and interest in joining the Counterpoint team!

We’ve received your message. A Counterpoint Funds team member will contact you soon.

Subscribe to stay up to date and receive our monthly perspective.