As we pass the start of 2024, the dance of inflation and changing interest rates continues to be top of mind for many investors. With pressure for rate cuts starting to rise, what options do investors have to manage duration risk in their fixed income portfolios today that can also potentially perform when the interest rate pendulum has begun to swing the other direction?

Tactical high yield strategies have historically been shown to deliver improved performance managing interest rate risk as compared to traditional buy-and-hold strategies. Tactical high yield has shown resilience whether interest rates have risen – or fallen – unusually rapidly. This benefit illustrates why tactical high yield is an effective complement and diversifier to traditional fixed income holdings.

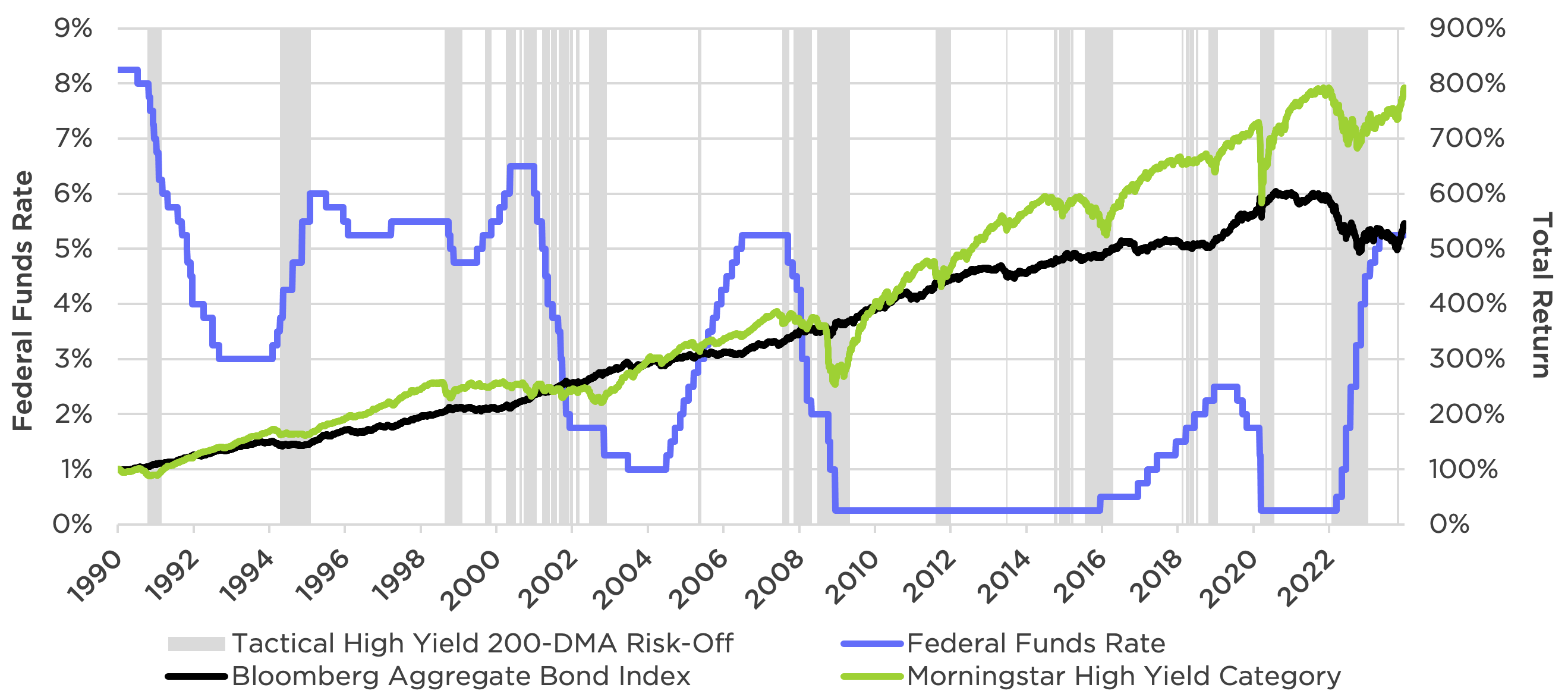

Risk-Off Signals for High Yield – 01/01/1990 to 12/31/2023

Source: Morningstar. Time period is 01/01/1990 to 12/31/2023. For illustrative purposes only. The Tactical High Yield 200-DMA Strategy is defined by buying the Morningstar High Yield Category when it closes above its 200-day moving average the prior day. The strategy entirely switches to exposure of the Bloomberg US Treasury 3-5 Year Index when the Morningstar High Yield Category closes below its 200-day moving average.

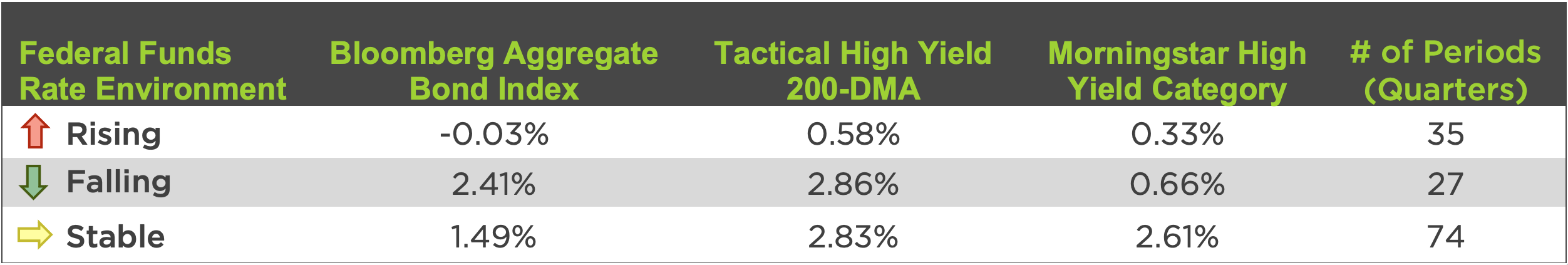

The table below illustrates the average quarterly performance of various fixed income asset classes during quarterly financial periods experiencing either rising, falling or stable rate environments. While it may be intuitive that a tactical high yield strategy like CPITX, outperforms core bonds as rates rise and credit risk works to the strategy’s benefit, it also turns out that tactical high yield has historically displayed robust performance in falling rate environments as well.

Average Quarterly Performance During Periods of Rising, Falling & Stable Rates

Conclusion

While no strategy works well in all environments, tactical high yield has displayed resilience amid pronounced interest rate moves, whether those moves were upward or downward. That historical record may be attractive to investors who are concerned about potentially persistent volatility in interest rates going forward.

As investors contemplate the prospect of rising or falling interest rates, they should consider their fixed income portfolios’ duration as a measure of interest rate risk. One way to manage the possibility of further rate sensitivity is to consider strategies that have lower duration and a systematic approach to managing portfolio downside. Tactical high yield is one such option.

Register for our upcoming live-webinar event:

The Counterpoint Spring 2025 Fixed Income Update

Tuesday, April 29th

11:00 AM – 12:00 PM PT | 2:00 PM – 3:00 PM ET