By now it’s more-or-less official: Rising interest rates are part of the foreseeable future. Current inflation figures, recent central bank commentary, and continued COVID related supply chain issues are evidence that today’s rising rate environment is likely to persist. Some investors may be contemplating a long-term interest rate shift – a 1980s-flavored Volker 2.0. Does all of this mean there’s a lot of pain on the horizon for fixed income investors? Not necessarily.

When rate increases are on the table, we believe it’s critical to measure the duration of clients’ fixed income portfolios. Duration directly measures interest rate sensitivity in fixed income holdings.

Tactical High Yield vs. High Yield vs. Short-Term Treasuries vs. Intermediate Core Bonds – Duration

As shown above, high yield fixed income and short-dated Treasuries both have lower duration, or interest rate sensitivity, than core bonds. While we wouldn’t suggest simply swapping out core bonds for high yield, we do believe high yield has certain advantages in a rising rate environment. And it’s worth keeping in mind that in the past, tactical high yield strategies have invested in short duration Treasuries and cash equivalents when risk-off – helping to reduce a portfolio’s interest rate sensitivity.

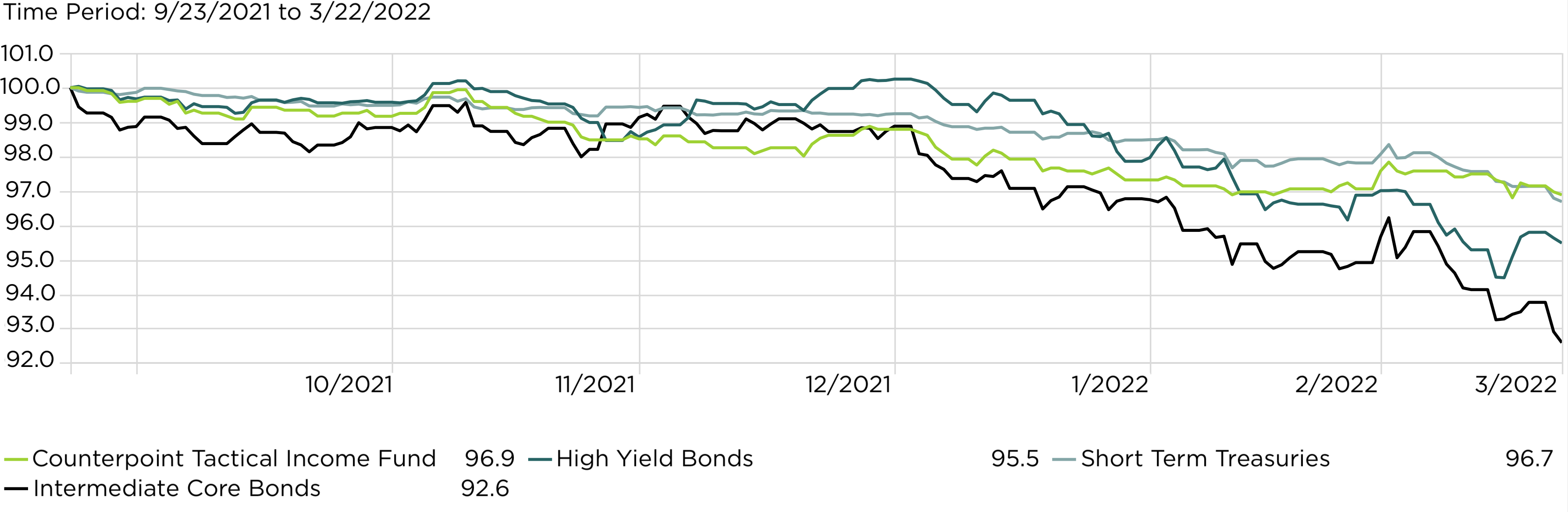

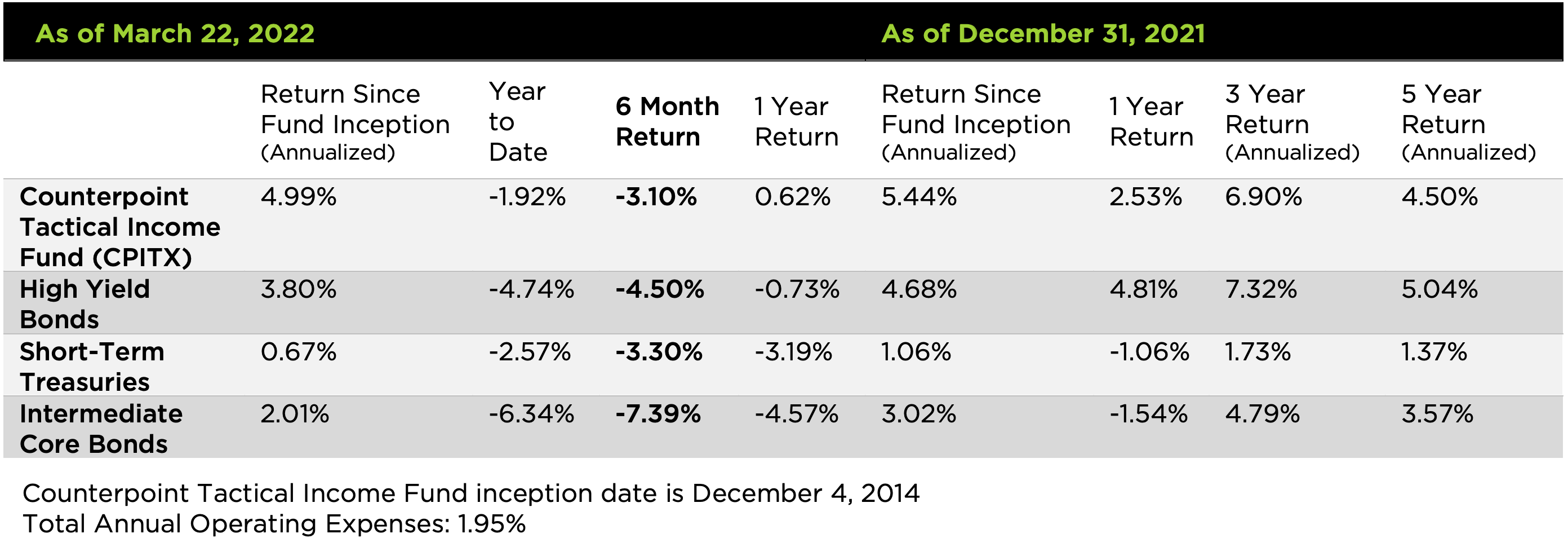

CPITX vs. High Yield vs. Short-Term Treasuries vs. Corporate Bonds – Last 6-Month Return

The chart above compares recent performance of our Counterpoint Tactical Income Fund against traditional fixed income categories. CPITX, represented in bright green, pivots between high yield corporate credit when the high yield index is above its moving average (“Risk On”), and otherwise invests in short-term Treasuries and cash equivalents (“Risk Off”). Please note how Counterpoint Tactical Income Fund mimics the performance of high yield when risk-on. When risk-off, it behaves more like short-term Treasuries. In both cases it shows lower interest rate risk than core bonds.

The performance data displayed here represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free 844-273-8637.

A tactical high yield strategy seeks to boost income, specifically when trends favor a “risk-on” position in high yield. High yield bonds tend to pay larger coupons than investment grade bonds to compensate for their greater risk. This added yield, especially following periods of market stress, has the potential to benefit investors who prize cash flows. Additionally, due to its return profile relative to risk, the strategy may also be suitable for a wide variety of investment portfolios as a diversifier.

As investors contemplate rising interest rates, they should consider their fixed income portfolios’ duration as a measure of interest rate risk. One way to manage the possibility of further rate increases is to consider strategies that have lower duration and a systematic approach to managing portfolio downside. Tactical high yield is one such option.