Investors that seek to boost investment income might consider tactical high yield strategies, as they have historically offered attractive cash flows and a strong risk-reward profile. Any investment that seeks higher returns carries additional risk. What may distinguish tactical high yield investing from other higher-income opportunities, however, is that it explicitly seeks to actively manage the additional risk through systematic trend-following signals. While following these signals can lead to increased trading costs and challenged performance in sideways, volatile markets, and while no strategy is guaranteed to repeat its past results, empirical research has shown the strategy may be viable for investors with longer time horizons.

Tactical trend following in high yield credit seeks to boost income, specifically when trends favor a “risk-on” position in high yield. High yield bonds tend to pay larger coupons than investment grade bonds to compensate for their greater risk. This added yield has the potential to benefit investors who prize cash flow or whose strategies involve reinvestment of income.

Tactical high yield strategies prioritize risk mitigation and potential downside, targeting high risk adjusted returns. In stressed markets, these strategies target a “risk-off” posture, investing in lower-yielding short-term Treasuries or cash. If high yield bonds enter prolonged downturns, investors using tactical trend following strategies may experience a reduction in investment yields. However, this risk-off posture aims to help mitigate drawdowns, facilitating opportunistic investment when assets may be cheap on a fundamental basis.

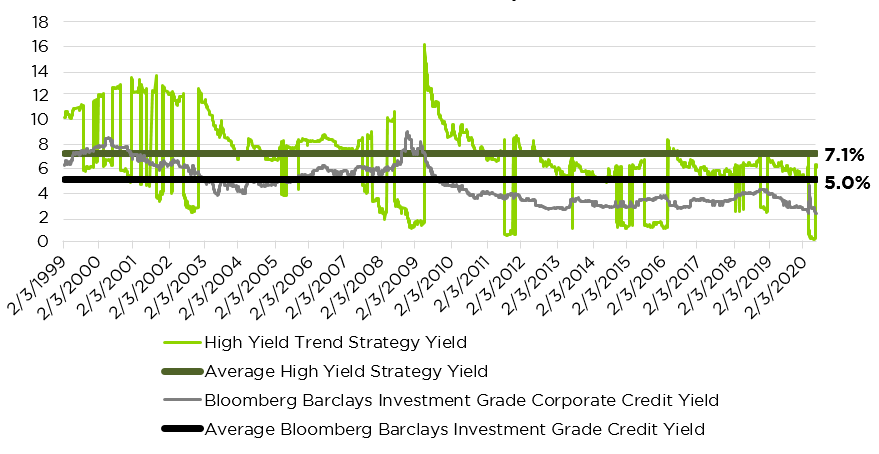

Yield Comparison – Trend Following in High Yield vs. Buy and Hold Investment Grade Corporate Credit

The chart above compares the historical yields of a traditional buy-and-hold strategy in investment-grade corporate credit to that of a strategy that tactically invests in high yield corporate debt. The High Yield Trend Strategy Yield, represented in bright green, pivots between high yield corporate credit when the total return index is above its 200-day moving average (“Risk On”), and otherwise invests in short-term Treasury securities (“Risk Off”). The average yield for each strategy is the simple average yield over the time period shown. For the tactical strategy, the average yield reflects all yields, including both when the strategy is “Risk On,” and when it is “Risk Off.”

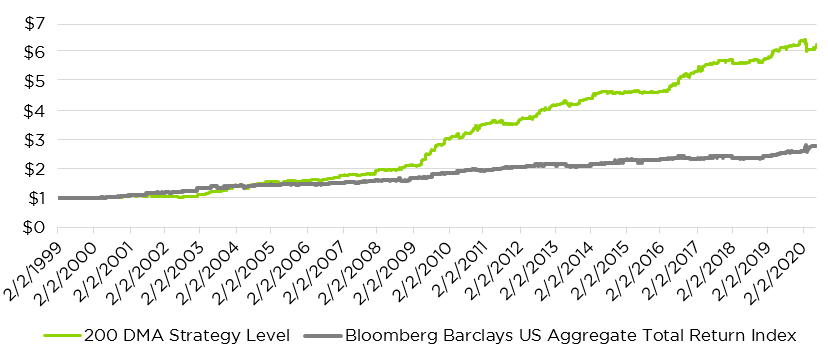

Tactical High Yield Strategy vs. Passive Investment Grade Bond Investment

Investors looking for the potential to boost fixed income returns might consider tactical trend following in high yield credit. The strategy can help investors target higher fixed income returns while explicitly targeting a reduction in portfolio drawdowns, potentially addressing some of the downside risk associated with investment in high yield credit. For advisors who value liquidity and the opportunity to reinvest their income, historically the strategy has shown a cash flow profile that can make it an attractive option. Additionally, due to its return profile relative to risk, the strategy may also be suitable for a wide variety of investment portfolios and risk tolerances.