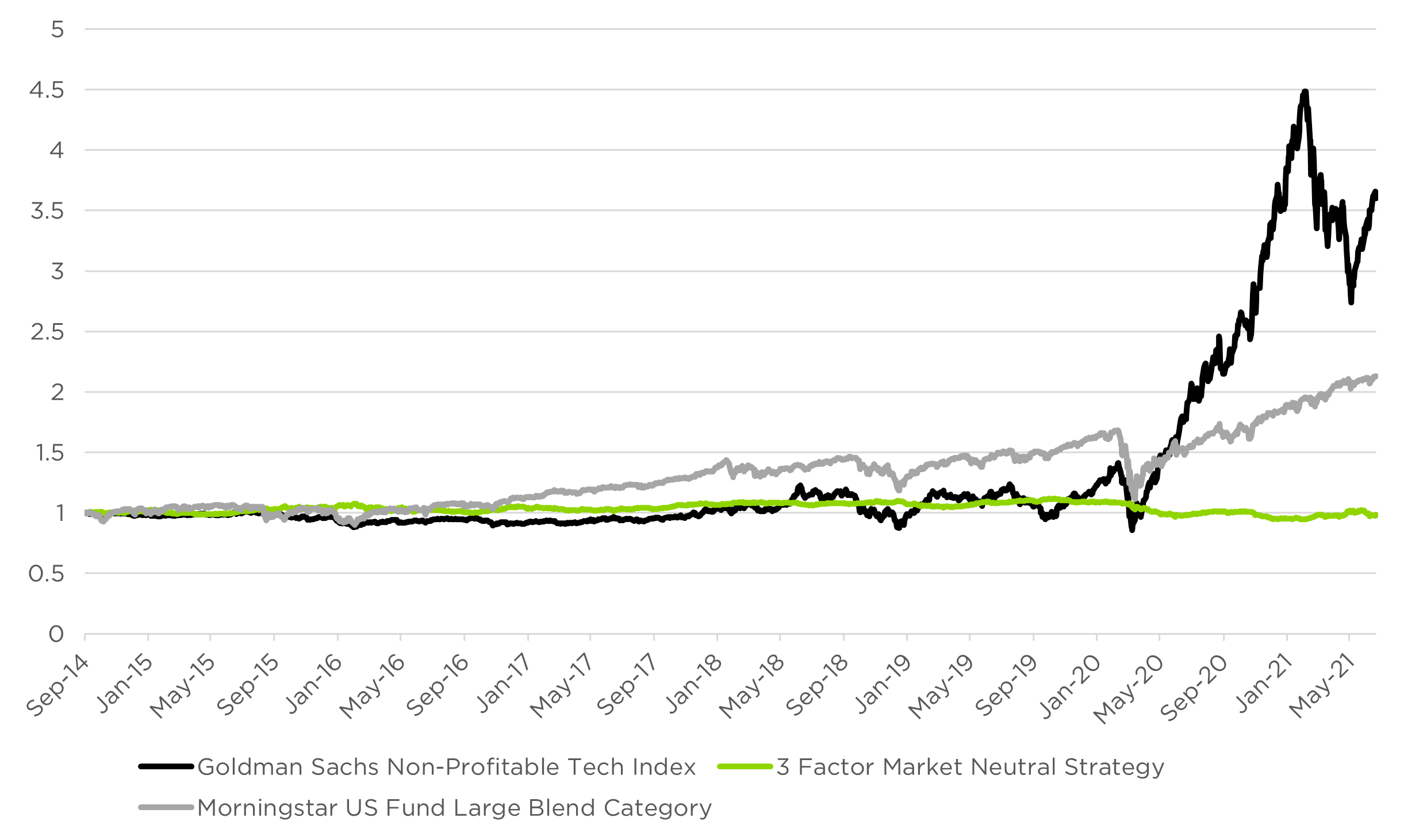

In 2020, innovation-focused visionaries and YOLO option traders on Reddit message boards were an unmistakable force in the U.S. stock market. Unprofitable tech companies and meme stocks (“stonks”) went nearly vertical – more than quadrupling off the COVID-19 lows before peaking in February of this year.

Returns – US Stocks, Unprofitable Tech, and a Multifactor Strategy During the YOLO Wave

As powerful as the YOLO wave has been, it has pretty much flown directly in the face of what the academic research and finance PhDs have to say about stocks. Factor investing strategies, which put that research into practice, have suffered tremendously as YOLO stocks took flight. Factor strategies are built on longstanding findings like:

- Cheaper stocks tend to outperform expensive ones (Value)

- Stocks that have been going up, keep going up; stocks that have been going down, keep going down (Momentum)

- Profitable companies tend to outperform (Profitability)

In the YOLO era, some investors have been much better off ignoring the professors and instead logging onto Reddit message boards to look for the latest Wall Street Bets gamma squeeze play – or investing in thematic, actively managed ETFs that leaned into the rally. It’s been a fun, rebellious period where everyday investors have been able to stick it to all nerds and know-it-alls who believe in factors like value, momentum, or profitability. (Note: The Counterpoint Tactical Equity Fund uses a factor stock selection model that targets returns to strategies similar to the value, momentum, and profitability strategies discussed here.)

But even if an investing revolution is afoot, it’s not without its back-and-forth. Over the past few months, the Reddit playbook has started to look slightly less invincible. By late July, expensive, money-losing stocks had dropped around 28% from highs reached in February. Over the same period, factor investing strategies have risen around 12%. After getting shoved into lockers from 2016 through 2020, the factor nerds have at least been able to tape their glasses back together in the first half of this year.

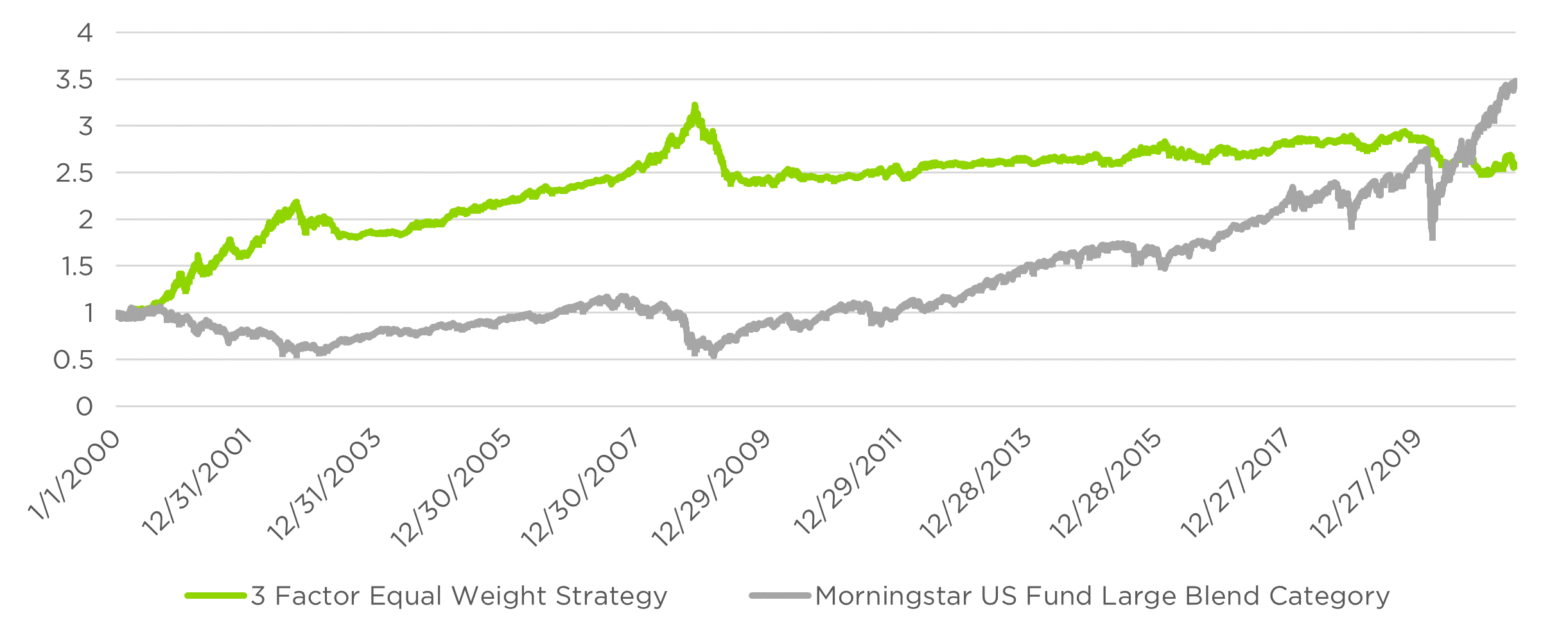

The recent past doesn’t tell us anything about what’s going to happen next in stock investing. But we do think long-term history can be informative. The below chart shows the returns to U.S. large-cap stocks compared to returns to an equal-weighted portfolio of three factor strategies – value, momentum, and profitability.

Factor Investing Strategy vs. US Large-Cap Stocks, 2000 – 2021

Starting in 2000, factor-driven strategies outperformed U.S. large-caps as the stock market digested the collapse of the dot-com bubble. Factors again proved their diversification benefit during the Financial Crisis of 2008, although they gave back many of those gains amid the postcrisis recovery. With a few minor exceptions, U.S. stocks have been outperforming factor strategies ever since.

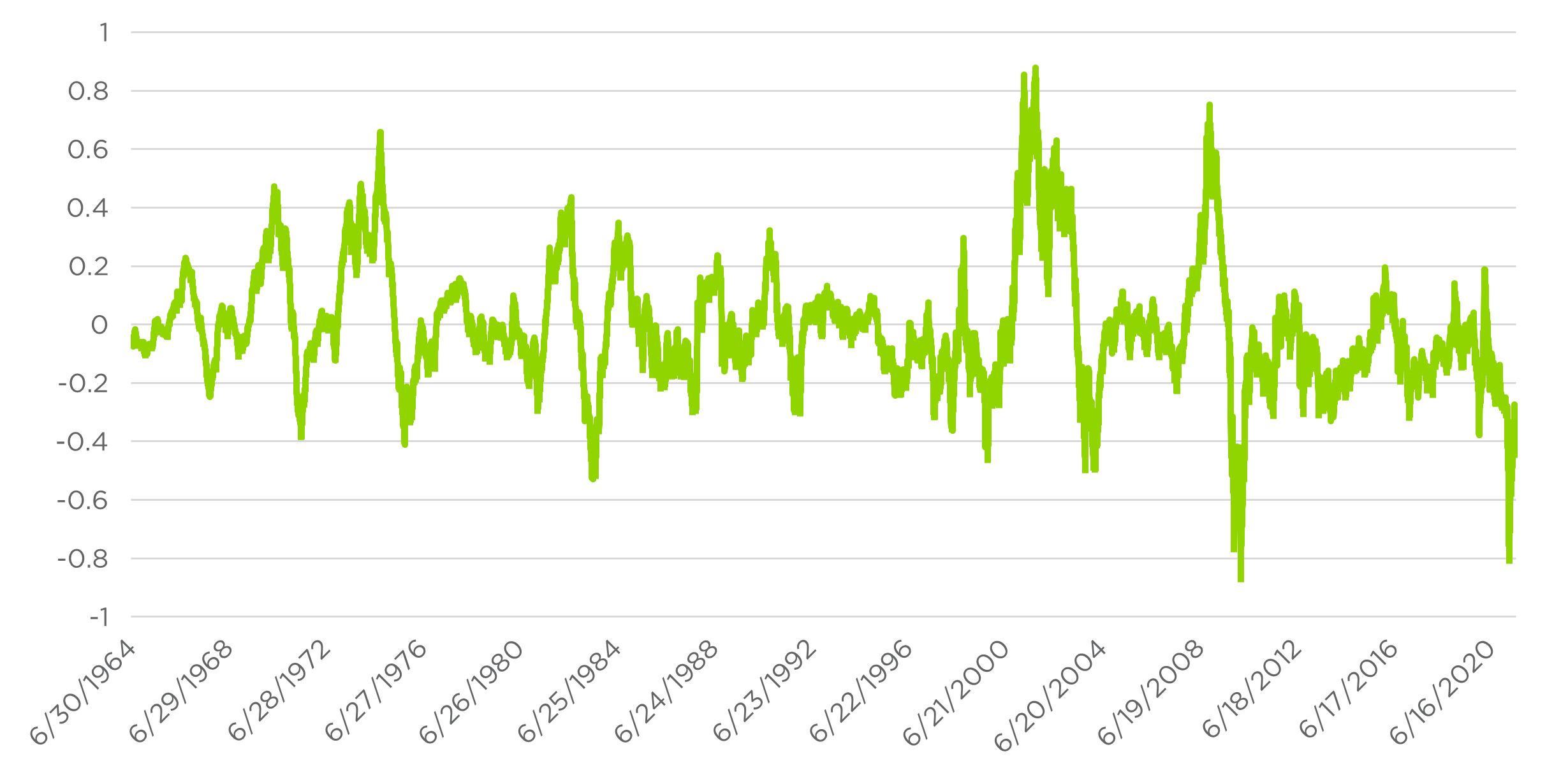

Below we show a very-long-term chart that shows the relative annual performance of our 3-factor portfolio against the S&P 500. When the line is above zero, factor strategies outperformed; when below, factor strategies underperformed. Since 1965, factor strategies have outperformed stocks about 42% of the time. In the past decade, factors have underperformed much more consistently.

Factor Investing Strategy vs. US Large-Cap Stocks, Rolling 12-Month 1964 – 2021

Another YOLO wave could easily emerge tomorrow, and factor strategists could easily get shoved back into their lockers. But for investors who may be skeptical about recent behavior in U.S. equity markets, a systematic equity diversifier strategy may deserve consideration as a supplement to traditional stock-and-bond strategies. When considering such strategies, investors should keep a few things in mind:

- Long-only strategies are unlikely to fully deliver on factor strategy returns; much of the benefit of factor allocations comes from shorting stocks with poor factor exposure.

- Some active strategies targeting factor returns may be subject to style drift, especially if they follow a more discretionary, qualitative process.

- Keep in mind multifactor strategies’ negative returns in past years and size positions according to how much short-term drag is acceptable.

Like many investment managers, we avoid direct predictions of short-term market behavior. However, it’s worth remembering that over the long run factor strategies do have positive historical returns, despite their recent weakness. Factor strategies have also fallen out of favor during the YOLO period, meaning many investors may consider whether they are underinvested in these strategies. Whatever may happen going forward, factor investing is designed to benefit when investment returns more closely track toward fundamentals and a bubble-like environment recedes. Based on that strategy objective and their strong diversification potential, investors may want to take another look at factor equity strategies as they navigate our post-YOLO world.