As crazy as it sounds, the YOLO traders of 2020 and 2021 are not necessarily doomed. These call option – happy investors, who frequent the /r/WallStreetBets message boards on Reddit, appear to invest more for boredom reduction or revenge than for wealth accumulation. They have contributed to some wild volatility in individual stocks and cryptocurrencies, most notably GameStop, AMC, and Bitcoin. These traders are avatars of the 2020 and 2021 stock market, where value-oriented strategies suffer, cash burning companies do well, and many asset prices are subject to the whims of bored home-gamers shut in by a global pandemic.

Common sense and the stone-cold basics of fundamental investing should spell doom for this retail crowd, which targets heavily shorted companies and buys without regard to price (top-ticking a stock seems to be a point of pride, in fact.)

And yet, the WallStreetBets gang may be primed to keep pace with more traditional and conservative investors… IF they can implement a simple (but infinitely less entertaining) strategy from here. The strategy is as follows:

- Step 1: Buy every money-losing company trading on a U.S. exchange with a market cap greater than $1 billion.

- Step 2: Wait 20 years without taking any action at all.

- Step 3: Enjoy the fruits of a reasonably successful investment career.

We base the contours of this strategy on a recent historical analogy: At the peak of the dot-com boom, online message boards were teeming with enthusiastic day traders eager to bid up stock prices. Most investors had likewise set aside traditional valuation metrics. The eventual result was the dot-com crash and a lot of pain for many buy-and-hold investors.

But that market-wide catastrophe doesn’t tell us what would have become of investors who had great long-run conviction in richly valued cash burners. So, to find out, we created a YOLO portfolio of all the $1 billion money losers on the market as of December 31, 1999 and tracked its returns to the present day. The result is a little bit shocking:

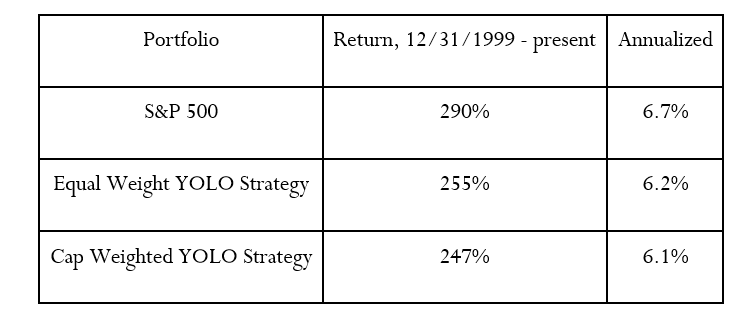

YOLO vs. S&P 500

A systematic allocation to an unlevered YOLO portfolio at the end of 1999, plus a strong diversified buy-and-hold philosophy, would have left an investor in reasonable shape — only trailing the S&P 500 by around half a percentage point per year. Taken as a group, the popular stocks in today’s market are far from doomed, and if the dot-com peak is any guide, they can deliver reasonable returns over the next couple decades.

Of course, it seems unlikely that many of today’s day traders are following these investment disciplines. Their trading appears concentrated in called options, which adds leverage to their positions, and their focus on one or two stocks at a time seems to preclude the 160-name portfolio our dot-com success strategy calls for. As for their ability to buy and hold for 20 years, that also seems unlikely. Unfortunately, it appears all of these strategic components would’ve been key to the 1999 YOLO investor’s chances for success.

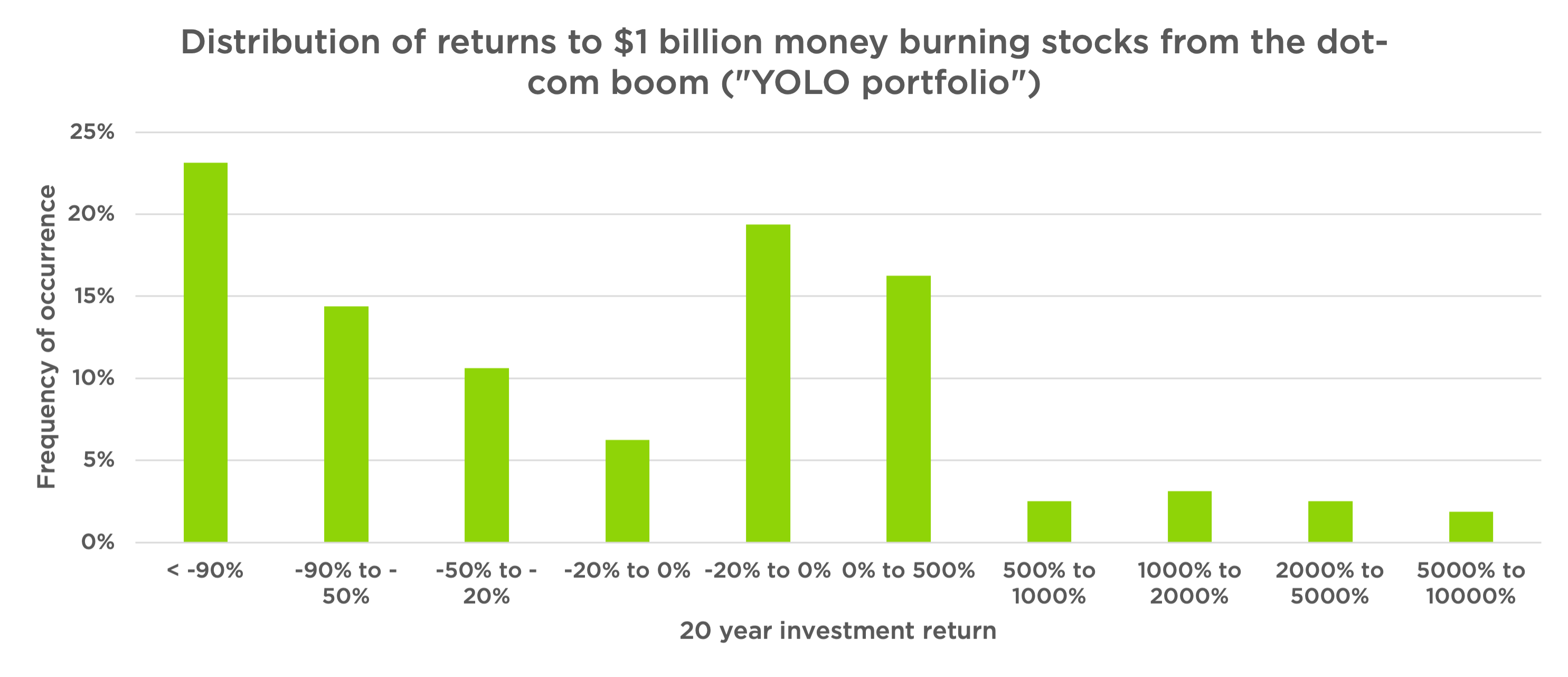

Of the 160 stocks in the YOLO Portfolio, 23% lost more than 90% of their value. And if you leave out a few gigantic performers, the return profile goes “splat.”

For investors who are trying to pick a few companies from within this set, the prognosis is not good: The most likely outcome is that you’ll lose nearly everything, and more than half the time you’ll be dead money or worse. Failure to include the top 5 YOLO performers in a portfolio cuts annualized returns down to around 4% for an equal weight portfolio and down to 1% in a market cap weighted portfolio. With only a 3% chance of picking any of the YOLO portfolio’s success stories, the Reddit stock picker faces a steep long-term climb.

Many investors understand that frothy and bizarre market behavior can be a sign of poor expected returns going forward. The performance of the biggest money losers from the 2000 dotcom bust till now illustrates the strength of diversification and a long-run time horizon, even when selecting from a set of questionable investment opportunities. It also illustrates the difficulty of betting against arguably shakier companies; a few of them may go to the moon despite their expensive valuations.

In an environment where equity markets may be vulnerable and enthusiasm for volatile individual names is escalating, it’s critical that investors allocate to some strategies with a systematic focus on portfolio downside management. As we’ve said before: We believe there are alternatives that can help investors, as long as they show long-run statistical validation and a track record for reasonable long-run returns. As the market shifts from There Is No Alternative to U.S. stocks (TINA) to You Only Live Once (YOLO), such risk management strategies may deserve yet more serious consideration.