“When are you going risk-off?” Investors in any sort of tactical allocation strategy want to know: What type of event, what type of environment, what sort of information will affect the risk-on or risk-off decision? Could an election result do it? How about an unemployment or GDP number? The Fed’s upcoming interest rate decision, maybe? A setback or advance in the fight against a global pandemic?

It’s natural to focus on risk right now. Anyone who’s been following the news can provide a long list of “what-ifs” that could potentially bring about a market downturn. On top of that, managing risk becomes all the more challenging in an

environment dominated by low interest rates and expensive stock valuations.

The truth is: We believe investors should seek reliable tools that help manage broad market risk. While it’s natural to be curious about what lies ahead, it’s important to deploy systematic strategies that attempt to align portfolios with investor risk tolerances. It can be tempting to try to time the market yourself but doing so may increase the risk of biased decisions that can impair long-run returns. For many investors and advisors, it may be preferable to outsource tactical decisions to dedicated managers. Outsourcing saves time spent trying to monitor market indicators – freeing up investors to make other important portfolio decisions. And outsourcing leaves the implementation to dedicated professionals who have firm conviction in the process.

It’s critical that every investor decide on a risk management strategy that is suitable to their goals and risk tolerance, then make a strong commitment to that strategy. Investors who trust in their processes can afford to be less reactive to potentially misleading headlines.

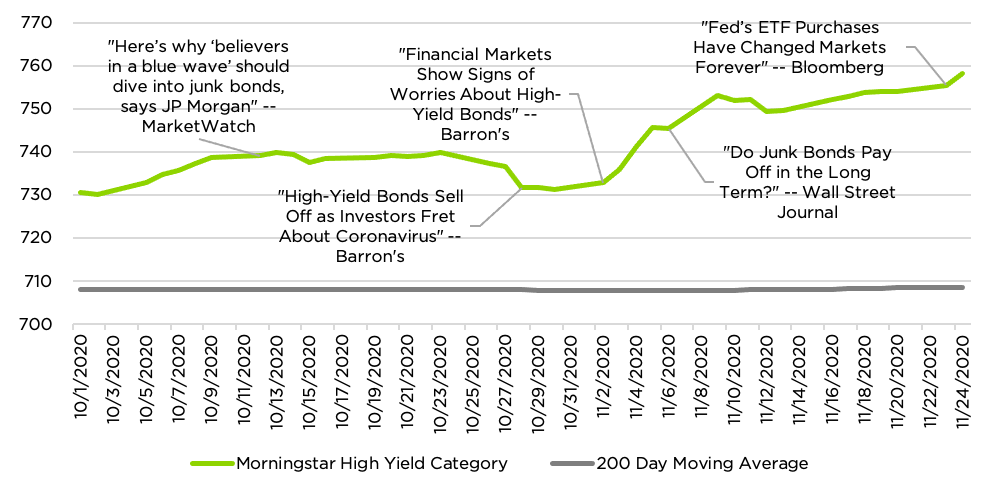

Morningstar High Yield Category, its 200-day Moving Average Signal and Selected News Headlines

Source: Morningstar.

The chart above shows returns to the high yield asset class along with market headlines that could easily prompt an investor to reevaluate a position. It also shows a 200-day moving average for high yield. Despite all the headlines, a 200-day moving average strategy would have produced no risk-on or risk-off signals during the period. The point here is that a pre-established strategy can help an investor navigate through challenging times without having to cope with each turn of the markets.

We believe it’s human nature to want the comfort of certainty. News headlines, economic figures, central bank decisions: they all beg for us to respond, triggering our emotions, urging us to take action. The trouble is, if investors make these types of in-the-moment decisions, they may fall into a couple big traps:

• It’s difficult to measure and repeat a process driven by subjective judgment.

• Subjective judgment often leads to biased decisions and mistakes, leaving investors worse off.

It’s our view that investors should have clear risk management strategies in place that are systematic and have robust track records. Buy and hold, rebalancing, tactical asset allocation, alternatives — all can play a part in a solid approach to financial market risk. One thing is key: We believe the focus should be on staying with the long-term plan, not imagining what event may trigger a sudden shift in asset prices. One way to stay focused on the long term may be to include diversifier strategies like tactical trend following in high yield due to its reliance on objective, quantitative signals.

Current market conditions (especially low interest rates and high equity market valuations) have driven investors to make uncomfortable risk/return decisions, potentially allocating to strategies with more downside than they’d prefer. Systematic trend following strategies have a historical track record for managing downside volatility and may provide investors with an attractive tool for managing risk in this challenging environment.