Tactical high yield strategies have historically shown an ability to mitigate drawdowns while boosting fixed income returns, but no strategy is perfect in all circumstances. This raises the question: When does tactical high yield underperform these goals? When do tactical high yield strategies not work?

We reviewed some historical examples where tactical high yield showed less-than-stellar results. Each instance arose during a period of systemic shock, where many traditional asset classes faltered, and investors had few places to “hide.” And even though tactical high yield struggled, there remained a case for investor patience each time. Investors should prepare for occasional challenges for any strategy and remember to focus on the long-term reward of a well-considered plan. Now let’s explore some rough patches for tactical high yield.

The Great Bond Massacre of 1994

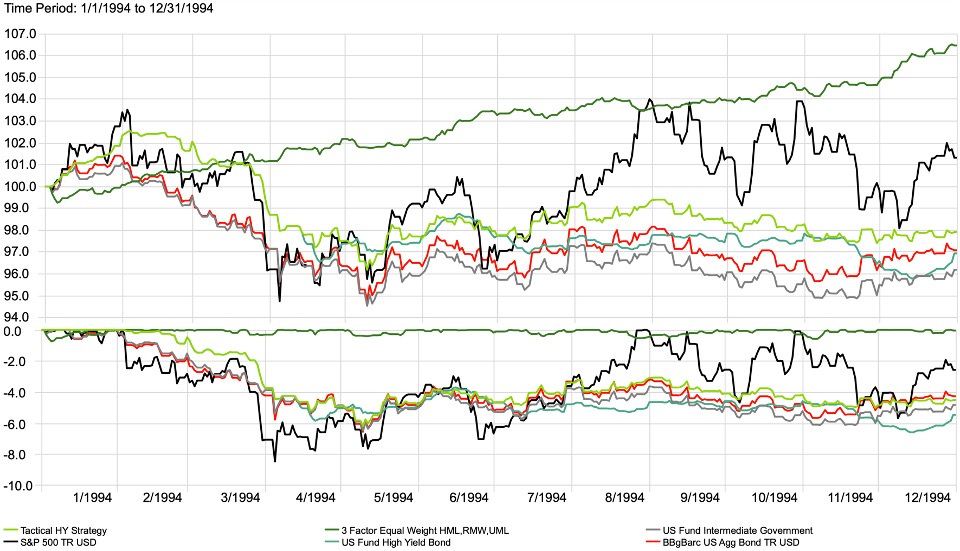

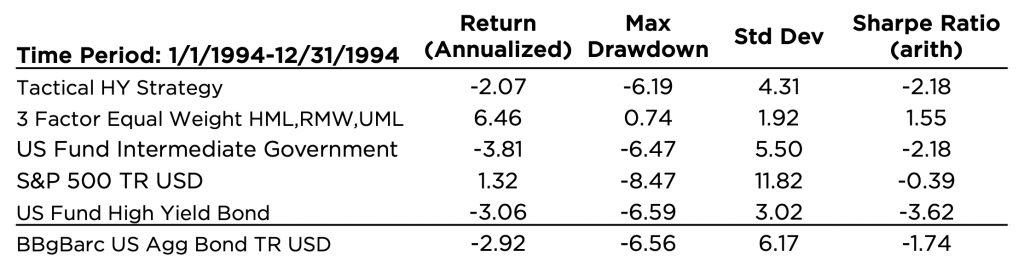

It shouldn’t shock anyone that a tactical high yield fixed income strategy would struggle during an event called the “Great Bond Massacre of 1994.” Starting in U.S. and Japanese markets, yields on 30-year treasuries rose around 200 basis points in the first 9-months of the year, spreading to global markets shortly thereafter. With long-term rates rising in every major country, the worldwide decline in bond values in 1994 was on the order of $1.5 trillion.[1]

It was not a great time to hold bonds, regardless of your strategy.

By the end of 1994 Tactical High Yield returned -2.07% with a max drawdown of -6.19% – not high marks for a strategy focused on downside mitigation. There was a silver lining. The strategy avoided the slightly worse returns and deeper drawdowns of the Barclays Aggregate Bond Index and U.S. High Yield Bond Category. U.S. Intermediate Treasuries fared even worse due to their heavy interest rate exposure. In this instance, tactical high yield underperformed, but there were few safe havens among traditional asset classes, and most investors would have struggled in 1994. Interestingly, the 3-Factor Equal Weight Market Neutral equity strategy was the only strong performer, experiencing a max drawdown of only 0.74% and ended the year up 6.46%. Although tactical high yield tends to help buffer portfolios against interest rate spikes, a big enough shock can still challenge the strategy.

‘Black Monday’ 2011

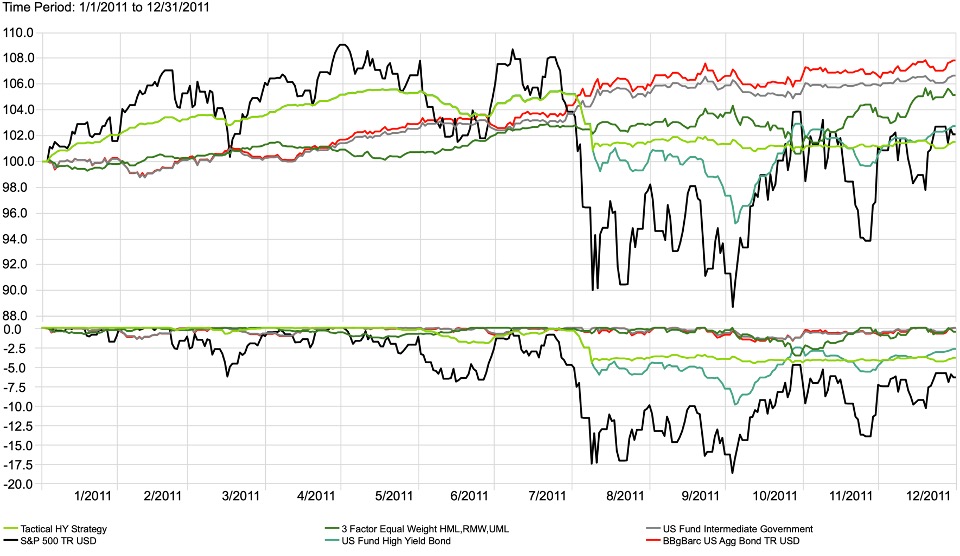

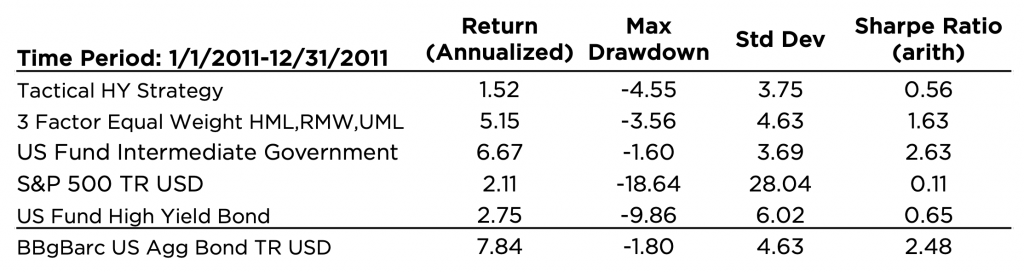

U.S. and global stock markets crashed on August 8th, 2011, following Standard & Poor’s downgrade of U.S. sovereign debt from AAA, or “risk free”, to AA+. Financial pressure had been mounting worldwide as many nations engaged in deficit spending following the 2007-2008 financial crisis. Unexpected political turmoil around raising the U.S. debt ceiling, amplified by struggles among government-backed lenders Fannie Mae and Freddie Mac, led the global stock market to experience a prolonged selloff.

An unprecedented downgrade of U.S. sovereign debt and aggressive Federal Reserve response made for a bumpy ride for bond holders.

Given the short lead time and unprecedented nature of the incident, the 200-day moving average Tactical High Yield strategy responded a little slower than investors might prefer, experiencing a drawdown of -4.55% in August. Meanwhile, the Federal Reserve, citing slow economic growth and continuing weakness in overall labor market conditions, decided to extend the average maturity of its security holdings to apply downward pressure on longer-term interest rates[2] – effectively flattening the yield-curve. This in turn limited Tactical High Yield’s “risk-off” return, and the strategy ended the year up only 1.52%. The 2011 experience is another example of an unprecedented and very rapid systemic shock – this time complicated by an unusual response by the Fed. Again, such circumstances are challenging to Tactical High Yield, as well as many other investing strategies.

Uncertainty, Volatility and Overvaluations in 2018

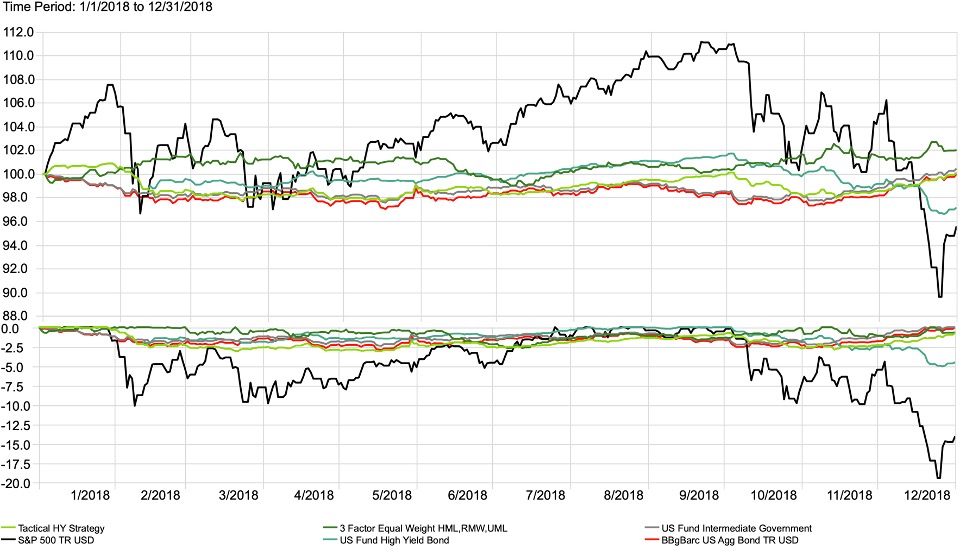

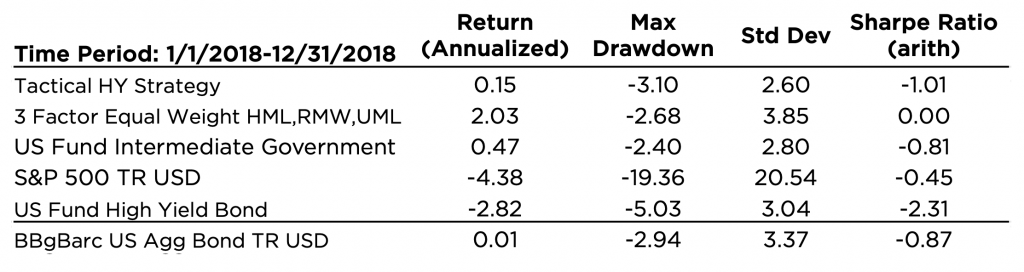

Numerous factors impacted the U.S. stock market in 2018. A renewed discussion of tariffs, four rate hikes by the Federal Reserve, and the passage of a large corporate tax cut sent large and sometimes conflicting signals through financial markets. U.S. investors experienced whipsaw-like stock market volatility. The S&P 500 was up or down more than 1% sixty-four times during the year, with the Dow swinging 1,000 points in a single session, something that has only occurred eight times in its history, and five of those took place in 2018.[3]

A white-knuckle adventure for stock investors combined with high liquidity accompanied lackluster bond performance.

The volatility profile of high yield bonds relative to equities have historically served tactical trend-following strategies very well, offering investors strong returns while mitigating drawdowns. This was not the case in 2018, where whipsaw trading left the strategy wrong-footed in the fourth quarter especially. Tactical High Yield experienced a max drawdown of -3.10 and returned 0.15 for the year. This was the classic example of a challenging market for Tactical High Yield – a choppy, sideways market generates a higher number of “false signals,” contributing to churn and weakened performance.

Conclusion

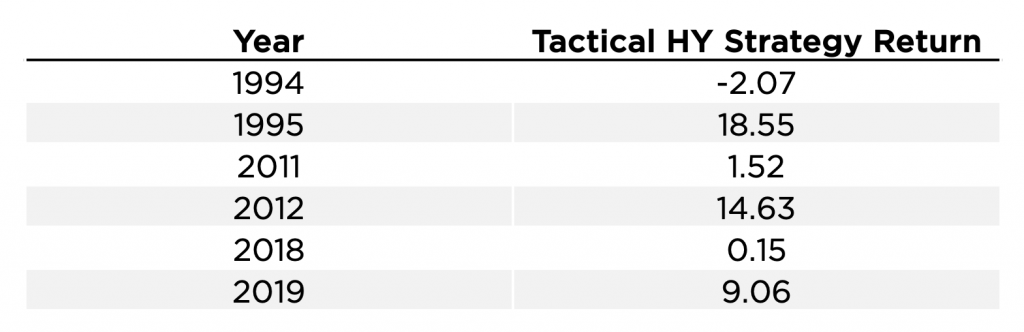

The historical examples mentioned above display the worst of the worst for binary trend-following strategies in high yield. This might seem like a reasonable case against Tactical High Yield strategies. Not so, once you consider how the strategy performed following their most challenging years.

Remember, tactical high yield strategies perform well when the market is appreciating, but historically outperform following periods of market stress as high yield markets recover. Investors are best served to remember that systemic shocks will tend to contribute to broad financial market volatility, prompting many strategies to suffer. When such shocks create hesitant, sideways trading in high yield bond markets, Tactical High Yield strategies will tend to struggle. Over the long run, however, such strategies have historically tended to reward patient investors with strong risk-adjusted returns and a systematic process aimed at managing portfolio downside.