Let’s imagine a hypothetical client walks into a financial advisor’s office.

“Good morning, Ms. Advisor.”

“Good morning, Mr. Client. I hope you’re enjoying this sunny weather. What would you like to talk about today?”

“I’m loving the weather, thanks for asking. I’d like to make some changes to my portfolio.”

“Interesting. Can you elaborate?”

“I’d like to take about 1/5 of my portfolio and invest it in just seven technology stocks with expensive valuations.”

Many advisors would probably consider this client request as an opportunity for education about the benefits of diversification.

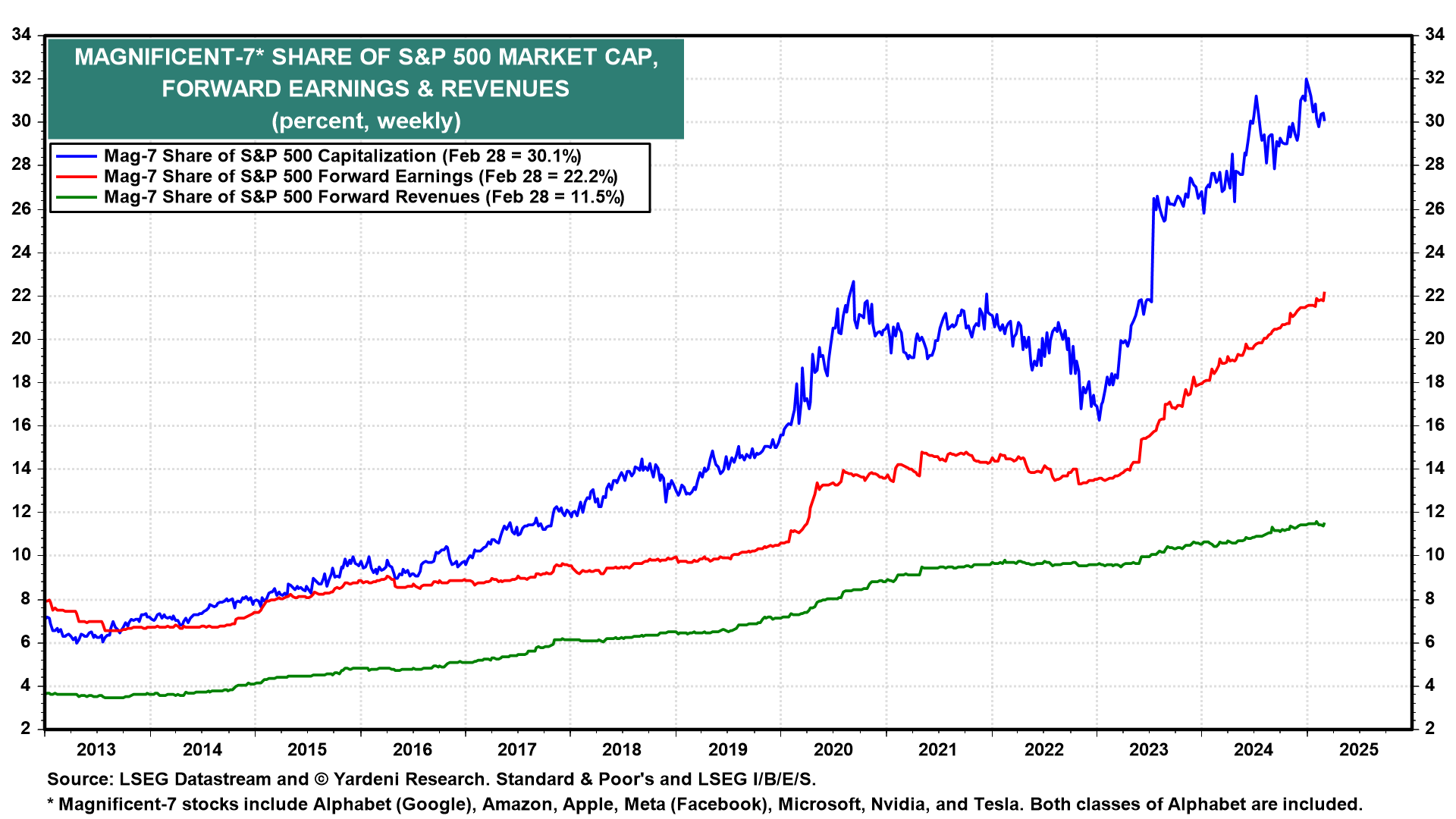

And yet, many advisors are implementing something similar to this hypothetical client request every day: The Magnificent 7 technology stocks that have led the recent market rally account for 30% of the S&P 500’s market capitalization. That means, that in many traditional 60%-40% stock-and-bond portfolios, nearly 20% of the assets (18% – 30% of the 60%) are invested in only seven stocks, all of which rely heavily on technology development and investors’ expectations about AI innovation. In practice, many investors who allocate to funds tracking the S&P 500 and Nasdaq are implicitly endorsing this concentration.

It’s understandable: Modern portfolio theory suggests that an optimal allocation strategy “owns the market,” represented by capitalization-weighted stock indexes and broadly diversified bond portfolios. But when the market is driven by only a few dominant stocks, investors should consider how and when it might be prudent to manage the risk that this group of adored companies might show weakness going forward.

One straightforward way to manage this risk, while maintaining exposure to the broad stock market, is to invest in strategies that equally weight all their holdings, regardless to market cap. An equal-weight S&P 500 portfolio, for example, would allocate 0.2% of assets to each stock in the S&P, reducing the weight of the Magnificent 7 to 1.4%. (The Counterpoint Quantitative Equity ETF targets 50 equal-weighted US stock holdings of 2% each: The most concentration in the Magnificent 7 it could target would be 14%. So far, exposure has ranged between 0% and 6%.) By reducing the percentage of assets invested in the Magnificent 7, an investor can adjust how much his or her personal outcomes is decided by the fate of these several companies.

Another, more differentiated way to manage concentration risk in US stocks is to allocate to a long-short strategy whose aim is to profit when mispricings are corrected, such as the Counterpoint Tactical Equity Fund. This fund is designed to pursue uncorrelated market neutral returns. It also contains a tactical component that targets participation in extended bull markets and avoidance of extended bear markets in capitalization-weighted indexes.

Investors who are concerned about potential risks associated with stock market concentration and recent leadership by the Magnificent 7 do have some tools available to help diversify their sources of return. Equal-weighted stock portfolios have historically been shown to help reduce some of the risks associated with top-heavy cap-weighted indexes, and market neutral diversifier strategies create even more potential for differentiated portfolio performance.

Of course, the Magnificent 7 era has been great for cap-weighted investors in the S&P 500 and Nasdaq 100, and some investors may argue that the concentration by these dominant firms is justified. We don’t disagree, but it’s important to remember that past performance is not indicative of future returns, and that this concentration risk can be managed while still preserving some exposure to cap-weighted index strategies.