After more than a decade of near-zero returns on short-term high quality investments like money market funds, short-term treasuries, and CDs, many investors are finding these instruments attractive today. The 2-year Treasury was recently yielding 4.2%, more than 25 times the return investors could expect a year ago.

This rate of return on the short end of the curve has some investors loading up on these instruments. This is a low- (often close to zero) volatility area of the market, and the returns look solid.

However, investors should remember that these lower-risk assets can have lower returns than other opportunities. Advisors who allocate to money markets and similar investments should be cautious about potentially setting their clients up for lower long-run returns.

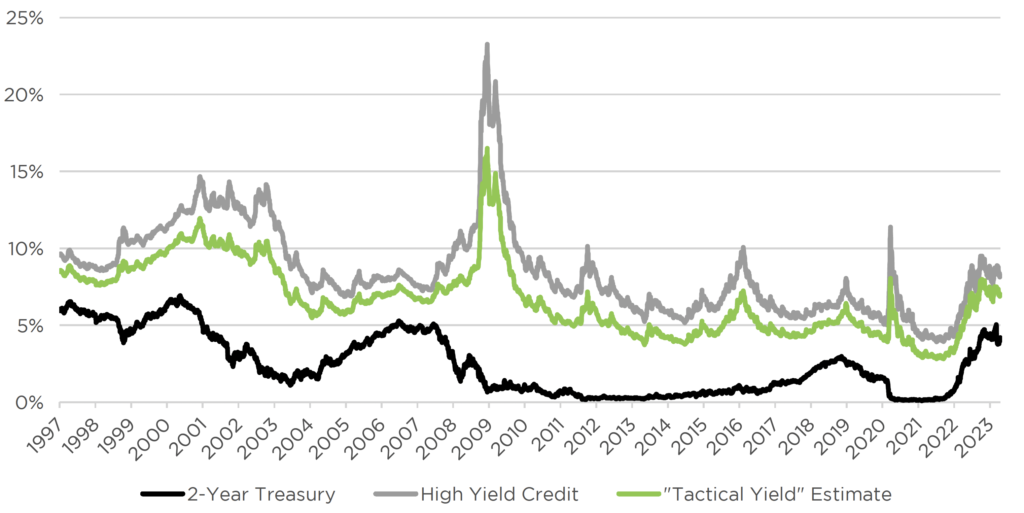

Historically, as rates rise on the less-risky side of fixed income, there have usually been additional returns to be had for investors with tolerance for some additional risk. The chart below compares historical yields on two investments: 2-year Treasuries and high yield corporate credit. The third line, in green, represents an estimated yield on a tactical high yield strategy.

Fixed Income Yields: 1997 to Present

The market has historically offered a greater yield for tactical high yield and high yield investors. High yield’s average premium since the late 90s has been more than 6%. Tactical high yield has yielded an average of 4.25 percentage points more than Treasuries. The gap has been there whether rates were recently rising, falling, or holding steady. The observation holds today, as well. Our tactical high yield estimate currently has a yield of 2.8 percentage points more than short-term high quality instruments.

Parking assets in money markets and CDs has historically meant expecting meaningfully lower returns. Investors who are reallocating into shorter-term instruments now should consider the impact on their ability to reach return targets and long-term financial goals.

Meanwhile, when held through an entire market cycle tactical high yield has shown the potential to improve long-run portfolio returns while mitigating risk. Amid the recent rise in short-term rates, investors shouldn’t forget that other asset classes may offer an attractive premium above those rates, even when factoring in additional risk.

After tactical high yield’s solid performance vs. longer-duration fixed income in 2022, some advisors have begun to mentally position tactical strategies alongside lower-yielding, lower volatility asset classes like money markets, CDs, and T-bills. But we believe the two are not good long-term substitutes. While tactical high yield’s and short-term high quality investments have similar benefits on the risk side, investors need to remember that over a full cycle tactical high yield strategies have also earned greater returns – creating additional opportunities as longer-term allocations within client portfolios.