Tactical high yield strategies historically have been shown to improve long-run portfolio returns and risk. When used alongside traditional 60-40 stock-and-bond allocations, tactical high yield has a historical track record of improving absolute returns while mitigating downside. It’s a rare combination that sometimes gets lost among all the details investors should consider.

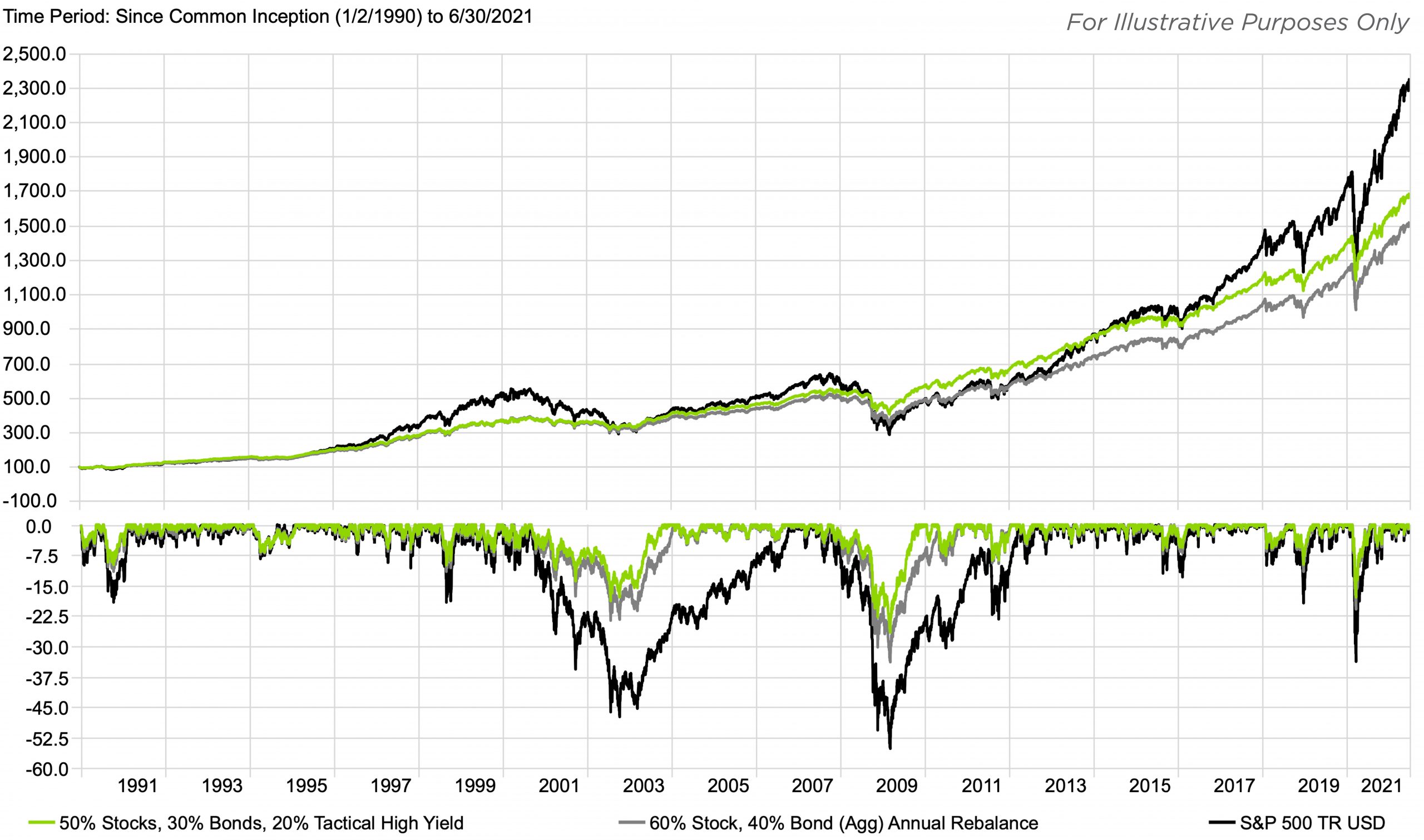

Here’s what we mean by improved returns and risk. The below charts show the returns to an all-stock portfolio, a 60-40 stock-and-bond portfolio, and a “50-30-20” portfolio that allocates 50% to stocks, 30% to bonds, and 20% to a tactical high yield strategy. The green line, which represents the portfolio that includes tactical high yield, shows a greater total return than the 60-40 portfolio over the past 20 years and shallower drawdowns as well.

Traditional 60/40 Portfolio vs. 50/30/20 with Tactical High Yield

The proposition is straightforward enough that it can fade into the background, especially as investors sweat lots of details – like interest rate risk, ESG strategies, tax policy shifts, and what to do in a post-YOLO stock market.

Of Course, Tactical High Yield Has Its Bad Years

All strategies occasionally deviate from their core mission, delivering performance that leaves investors scratching their heads. Tactical high yield is no exception, which raises the question: How bad might it have been to have been invested in tactical high yield strategies during their worst periods, from a total portfolio perspective?

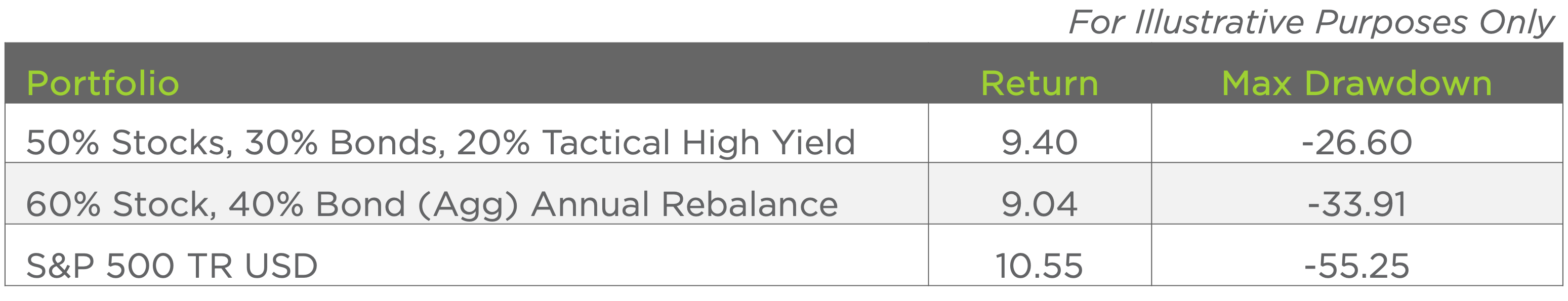

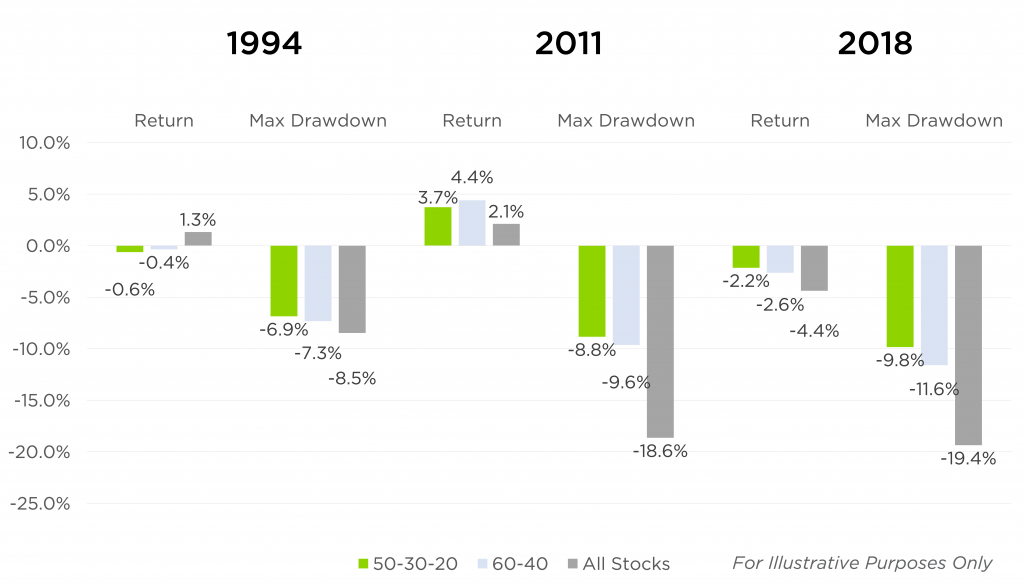

In years when tactical high yield turned in some its worst performances, the strategy still more or less earned its keep within a portfolio. The table below compares the returns and risk performances of three portfolios during challenging years for tactical high yield. The “50-30-20” portfolio represents a blend of 50% stocks, 30% bonds, and 20% tactical high yield. The “60-40” portfolio represents the traditional blend of 60% stocks and 40% bonds, and “All Stocks” represents a portfolio composed entirely of equities.

Source: Morningstar.

In each “bad year” for tactical high yield, the 50-30-20 strategy dragged modestly on returns compared with the 60-40 portfolio – 26 basis points in 1994, 67 basis points in 2011, and 48 basis points in 2018. But at the same time, the tactical high yield strategy contributed to a shallower max drawdown. Keeping in mind that the 50-30-20 portfolio has a reduced exposure to stock market risk (and return), the trade-off seems reasonable in each instance. Meanwhile, by maintaining an objective to mitigate portfolio drawdowns, tactical high yield strategies create the potential for investors to rebalance from a position of strength into assets that may have become cheap on a fundamental basis.

In brief, even during years when tactical high yield strategies disappointed and/or lagged other asset classes, they still did what a diversifier should do – limit portfolio volatility, often with some sacrifice of return. Their contributions during these periods are the type many investors may be willing to accept in pursuit of asset class diversification and reasonable long-run returns.

Conclusion

Portfolios benefit when investors allocate to strategies with differentiated sources of return and genuine diversification potential. Tactical high yield strategies have a track record of delivering these benefits. In fact, over the past several economic cycles tactical high yield has supported robust absolute and risk-adjusted performance, supporting portfolios in times of market stress while offering the potential for improved returns. While no strategy is perfect and no one can predict the future, tactical high yield strategies have been reasonable contributors to portfolio performance even in their weakest moments.