Investor confidence for most has been shaken in recent months amid a rise in long-term interest rates and a pullback in the tech stocks that have led our current bull market. Some wonder whether we are headed for a new inflationary era due to excessive stimulus, an end to a tech-dominated bull market in U.S. stocks, or both.

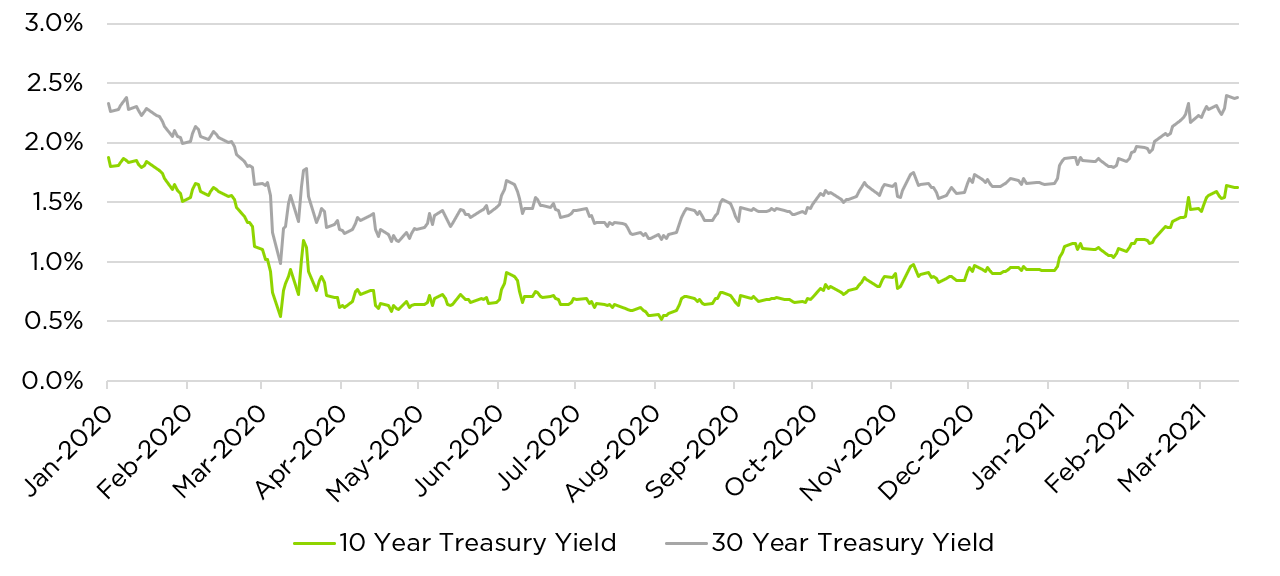

10 Year and 30 Year Treasury Yields

Source: Bloomberg LP. Long-term interest rates have risen from historic lows to start 2021.

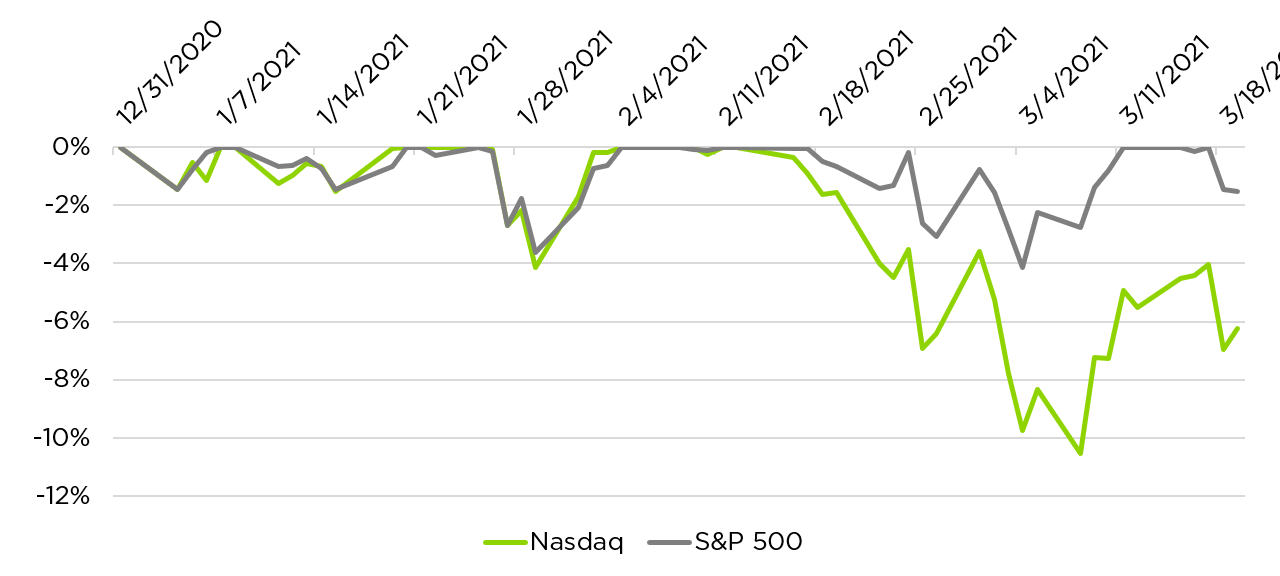

Major Stock Market Indices in 2021

Source: Bloomberg LP. Tech stocks briefly entered a correction in mid-March.

As many investors gear up for possible changes, they might consider strategies with potential to perform reasonably well in a variety of scenarios. Such strategies can make portfolios less vulnerable to sudden surprises – and less dependent on an individual investor’s ability to predict the future.

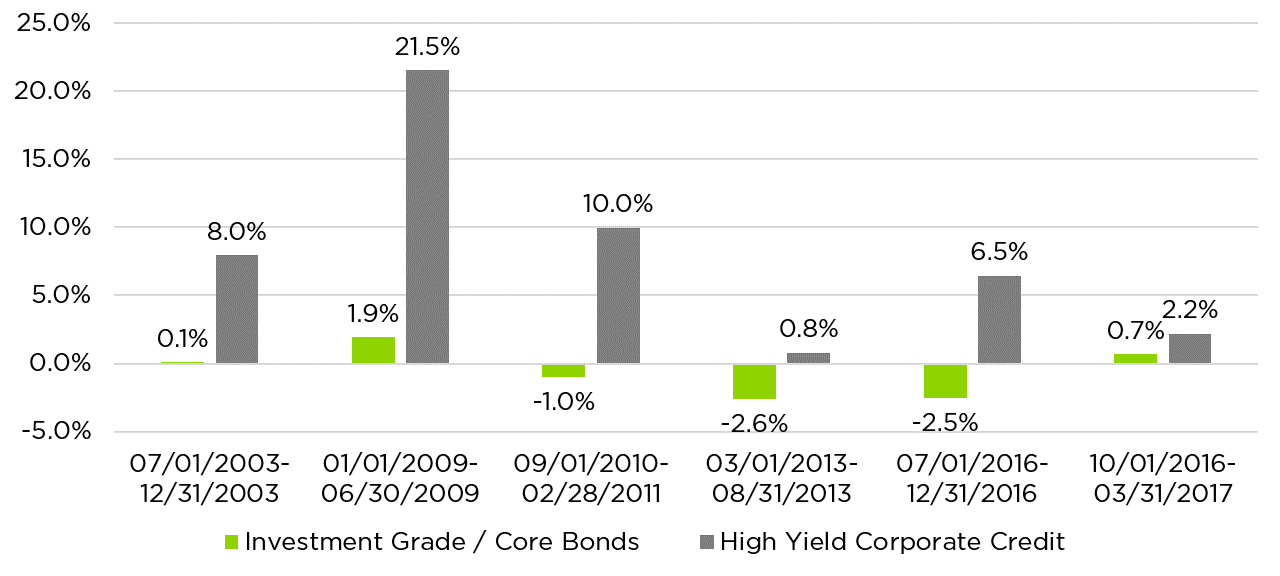

Most High Yield Bonds Have Shown Resilience to Rising Rates

Over the past six months, as Treasury yields rose sharply, high yield has compared well, returning 5.9%, vs. -2.9% for core investment grade bonds. Since 2000, the 10-year Treasury yield has occasionally spiked by 1 percent or more in only six months. During each period, high yield outperformed core bonds.

6-Month Returns During Interest Rate Spikes

Source: Bloomberg LP. “Investment Grade / Core Bonds” are represented by the Bloomberg Barclays Aggregate Index. “High Yield Corporate Credit” is represented by the Morningstar High Yield Index. “Interest Rate Spikes” are defined as the six-month period during which the 10-Year Treasury Yield has risen by at least 100 basis points.

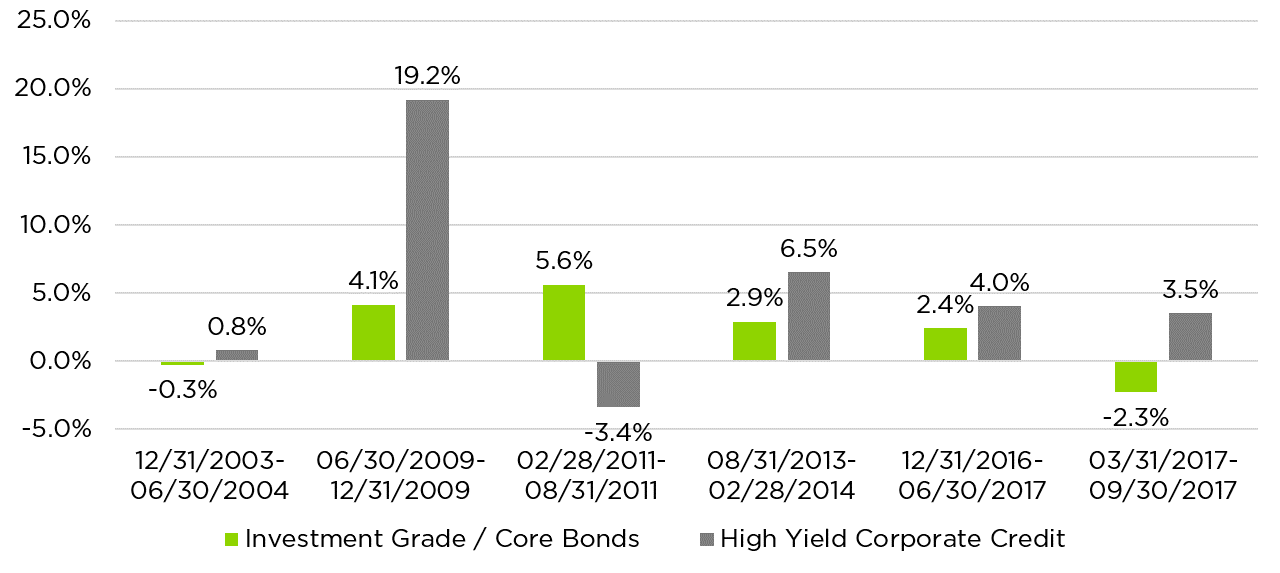

Historically, the six months following such interest rate spikes, high yield bonds have tended to hold their own against investment grade corporate credit.

6-Month Returns After Interest Rate Spikes

Source: Bloomberg LP.

This apparent resilience owes to a couple underappreciated features of high yield. First, high yield generally has lower interest rate risk than investment grade credit. Second, high yield’s increased credit risk tends to pay off in rising rate environments, when the economy is growing and inflation is a concern but risky borrowers have an easier time making payments.

Tactical High Yield Targets Resilience Amid Downturns

One trade-off for high yield’s strength in rising rate environments is its downside when rates are falling. Tactical high yield strategies seek to mitigate this risk by looking for downtrends in high yield and targeting risk-off positioning as those trends emerge.

Allocating a portion of a fixed income sleeve to tactical high yield strategies has the potential to position portfolios for a variety of scenarios:

- Reasonable performance relative to investment grade or core bonds in rising rate environments

- Potential for increased income when “risk on”

- Systematic risk management seeks to mitigate drawdowns in falling rate or recessionary environments

As investors start to question markets’ future direction, now may be the time to “get creative” with nontraditional or diversifier strategies such as tactical high yield. Amid a possible shake-up in equity and fixed income markets, tactical high yield strategies can provide flexibility and potentially show resilience regardless to the future direction of interest rates, the economy, or the stock market.