When considering tax-free tactical high yield strategies in general, like the Counterpoint Tactical Municipal Fund (TMNIX), investors often ask where it fits within a tax-free fixed income portfolio, or what category it belongs to. Because TMNIX is designed as a low-correlation diversifier of tax-free fixed income portfolios, it defies neat categorization.

However, this challenge can be balanced by the contributions TMNIX (and other systematic diversifier strategies) can make to a variety of bond fund categories. Let’s take a look at the case for assigning TMNIX to a few different buckets as defined by Morningstar categories:

-

- High Yield Muni Bonds

-

- Short Muni Bond

-

- Long Muni Bond

-

- Intermediate Muni Bond

-

- Bloomberg Municipal Bond Index

As we’ll see, a tactical high yield municipal strategy’s tactical nature enables it to contribute alongside a number of popular fixed income strategies.

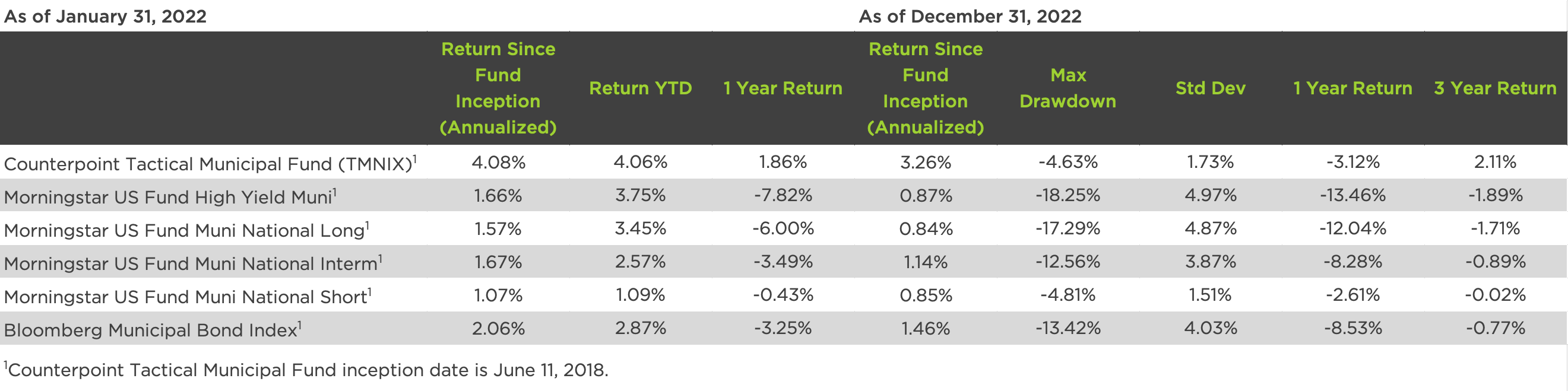

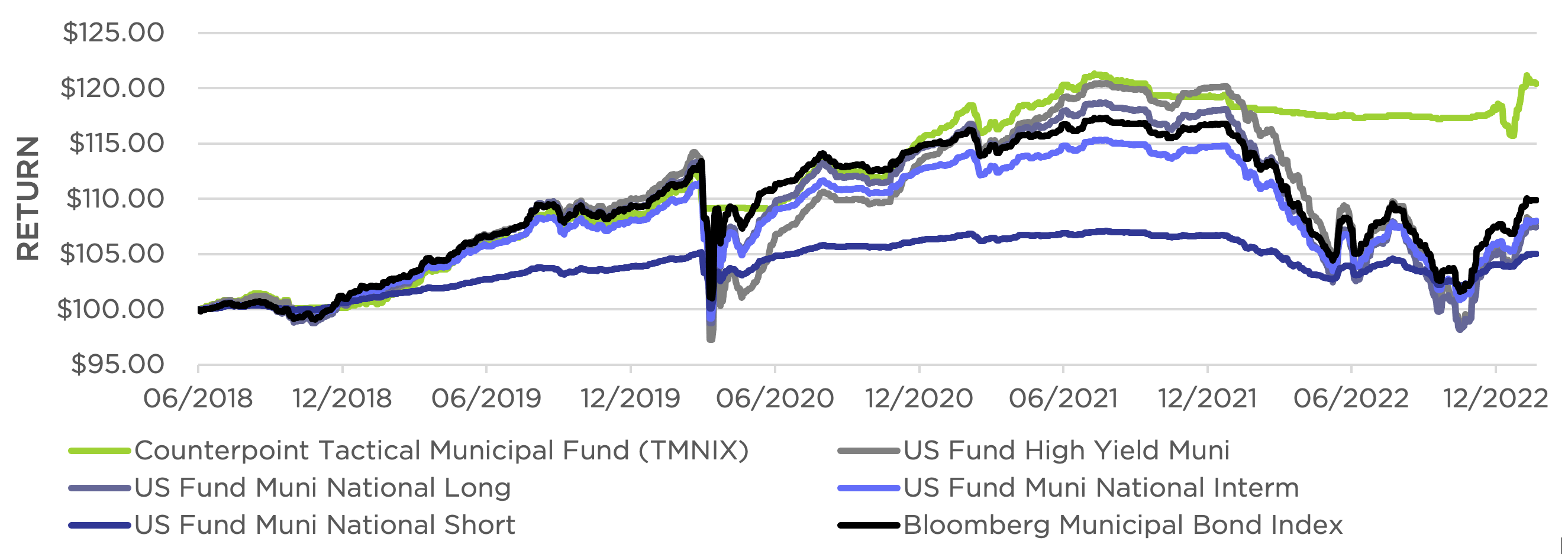

Return of $100 – 06/11/2018 to 01/31/2023

Is TMNIX Just a Municipal High Yield Fund?

High yield trend following strategies like TMNIX invest in high yield municipal funds when “risk-on,” so many investors tend to think of these strategies as municipal high yield strategies. But the numbers tell a slightly different story.

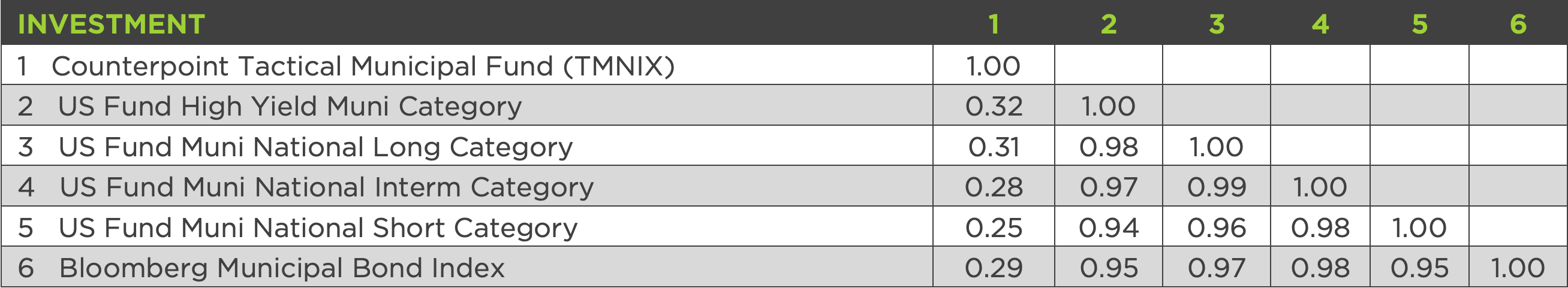

Correlations – TMNIX and Morningstar Bond Categories

On the surface, TMNIX has not historically shown a strong overall resemblance to any of its potential categories – including municipal high yield. Its strongest relationships are with US Fund Muni National Long, and US Fund High Yield Muni bond categories – but the correlations are still fairly weak, topping out at 0.32 with the US Fund High Yield Muni category. (As a reminder, correlation is a scale from -1 to +1, where -1 means the strategies move exactly opposite, 0 means they have no relationship, and +1 means they are in lock step.)

Where Does TMNIX Contribute to Portfolios?

Typically, a tax-free fixed income portfolio will seek to behave similarly to its category – US Muni Long Bond portfolios should behave like the US Fund National Muni Long Bond category, etc. This objective can balance against another important goal – an optimal risk-return profile.

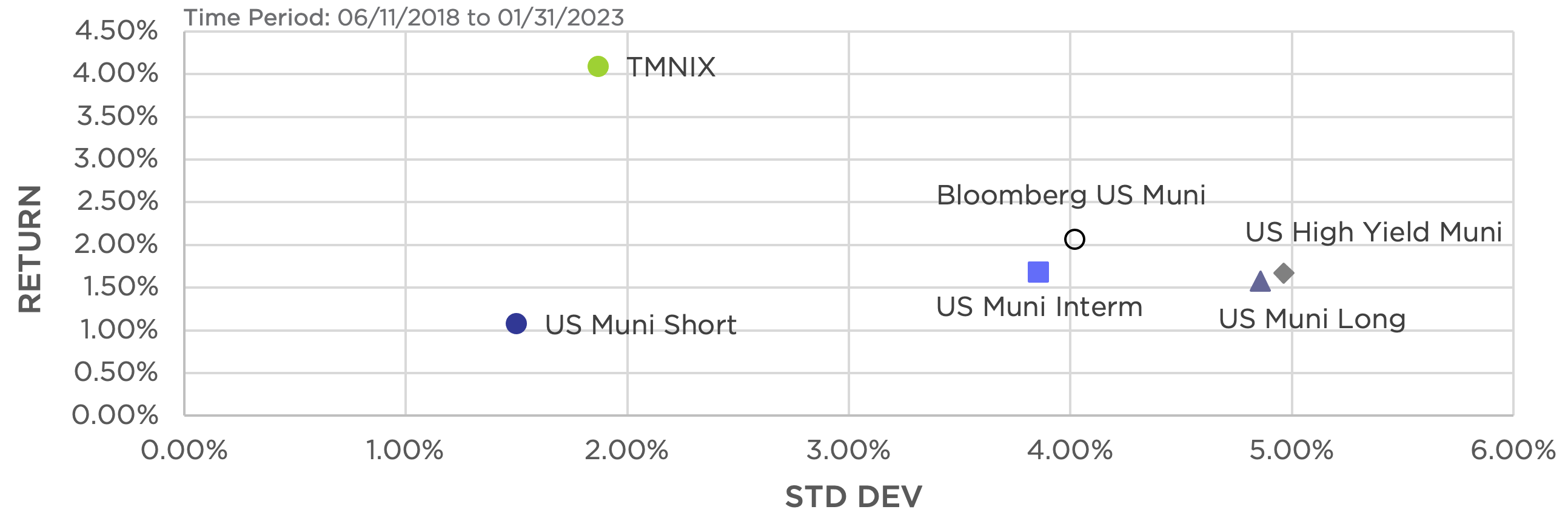

The chart below shows how TMNIX has historically contributed to a portfolio’s risk reward profile as compared to other Muni bond categories. The chart measures risk on the x-axis (riskier is further to the right) and return on the y-axis (more return as you go up). The return and standard deviation of a fund improves as they go up and to the left.

TMNIX vs. Various Muni Categories

Another way to analyze an investment’s fit within a category is to match its risk/volatility/standard deviation against the category. One reason investors use categories is to set expectations, especially expectations around risk. From the risk point of view, TMNIX is historically least like the high yield bond category, and instead has looked more like the nontraditional, multisector, and core-plus categories.

Whatever the category, adding a sleeve of TMNIX to a muni bond portfolio historically would have contributed on both a risk and return basis – adding return while reducing portfolio volatility.

Conclusion

Counterpoint Tactical Municipal’s categorization depends on which criteria are most important to the decision.

-

- Correlation analysis: TMNIX’s strongest relationship historically has been with US High Yield Munis.

-

- Volatility: When assessing historical risk, TMNIX has the most in common with the US National Muni Short category.

-

- Portfolio Contribution: There can be meaningful historical benefits to including Counterpoint Tactical Municipal in a hypothetical model covering any of the four categories.

In our opinion, TMNIX can be most useful as a diversifier of tax-free bond holdings, and we believe a reasonable allocation could replace up to 40% of an investor’s tax-free bond sleeve. However, in conversations with investors and advisors, there has tended to be a natural gravitation toward thinking of the strategy as a long municipal or high yield municipal bond strategy replacement. This owes in large part to investors’ understanding that the strategy invests in high yield municipal bond markets when risk-on and displays low correlation with other traditional municipal bond categories.