How We Think About Junk Rallies

Since the market bottomed on April 8, 2025, investors have witnessed a highly speculative, “pro-junk” environment. Stocks with weak fundamentals—richly valued, unprofitable companies often fueled

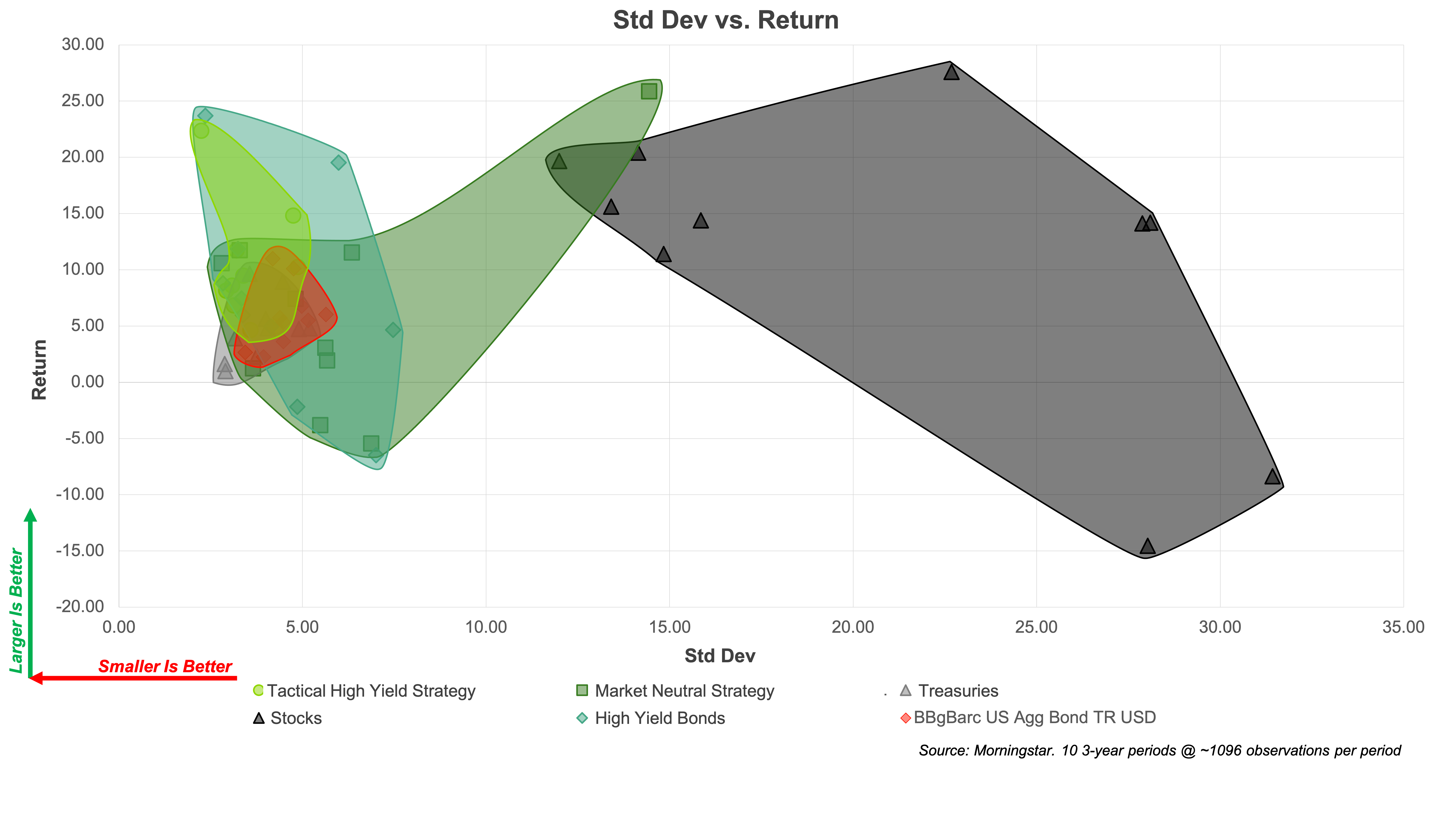

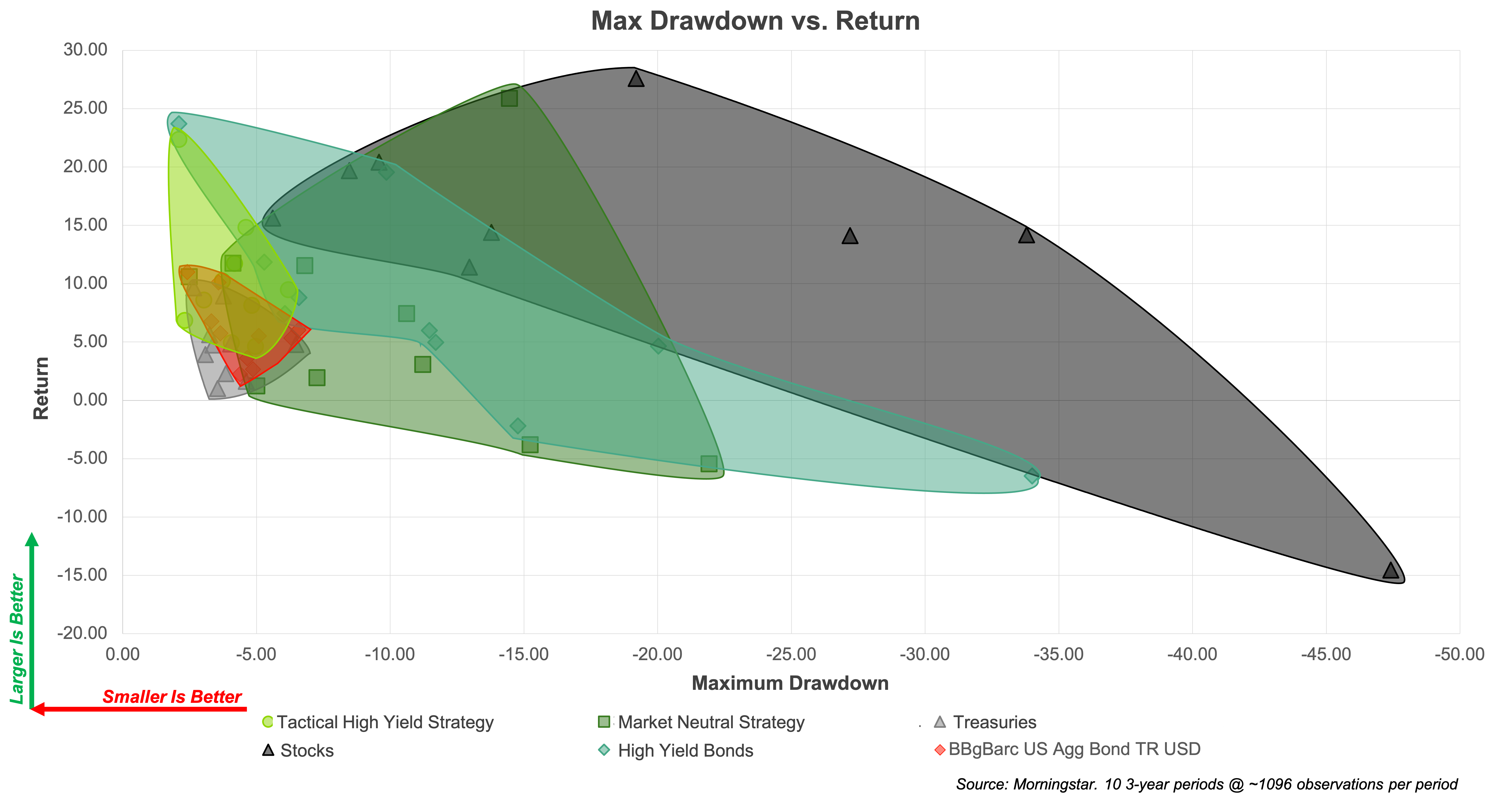

Diversifier strategies seek to strengthen portfolios by functioning as a separate asset class, distinct from stocks and bonds. They target differentiated risk-reward profiles, attempting to support portfolios when traditional assets are stressed. Because of their unique role, diversifiers do not always perform in lock step with other investments.

Source: Morningstar. Displayed above are the standard deviation and return of different asset classes using the S&P 500 Total Return Index to represent “Stocks”, Morningstar US Fund High Yield Bond Category to represent “High Yield Bonds”, Morningstar US Fund Intermediate Government to represent “Treasuries,” and the Bloomberg Barclays US Aggregate Bond Index. Source: Kenneth French Data Library. The 3 Factor Market Neutral Strategy delivers the risk-free rate plus the simple average of returns to value, profitability, and momentum portfolios. Each factor portfolio is long the ⅓ of all stocks with the greatest factor exposure and short the ⅓ of stocks with the lowest factor exposure. The model multifactor portfolio is neither optimized for risk-adjusted returns nor does it improve stock selection with an aggregate model. Multifactor portfolio returns include the long-run risk free rate and do not factor in transaction costs, variables that would drag on returns. The High Yield Strategy is defined by buying the Morningstar High Yield Category when it closes above its 200-day moving average the prior day. The strategy entirely switches to exposure of the Bloomberg U.S. Treasury 3-5 Year Total Return Index when the Morningstar High Yield Category closes below its 200-day moving average.

Source: Morningstar. Displayed above are the standard deviation and return of different asset classes using the S&P 500 Total Return Index to represent “Stocks”, Morningstar US Fund High Yield Bond Category to represent “High Yield Bonds”, Morningstar US Fund Intermediate Government to represent “Treasuries,” and the Bloomberg Barclays US Aggregate Bond Index. Source: Kenneth French Data Library. The 3 Factor Market Neutral Strategy delivers the risk-free rate plus the simple average of returns to value, profitability, and momentum portfolios. Each factor portfolio is long the ⅓ of all stocks with the greatest factor exposure and short the ⅓ of stocks with the lowest factor exposure. The model multifactor portfolio is neither optimized for risk-adjusted returns nor does it improve stock selection with an aggregate model. Multifactor portfolio returns include the long-run risk free rate and do not factor in transaction costs, variables that would drag on returns. The High Yield Strategy is defined by buying the Morningstar High Yield Category when it closes above its 200-day moving average the prior day. The strategy entirely switches to exposure of the Bloomberg U.S. Treasury 3-5 Year Total Return Index when the Morningstar High Yield Category closes below its 200-day moving average.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses. The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

Source: Morningstar. Displayed above are the max drawdown and return of different asset classes using the S&P 500 Total Return Index to represent “Stocks”, Morningstar US Fund High Yield Bond Category to represent “High Yield Bonds”, Morningstar US Fund Intermediate Government to represent “Treasuries,” and the Bloomberg Barclays US Aggregate Bond Index. Source: Kenneth French Data Library. The 3 Factor Market Neutral Strategy delivers the risk-free rate plus the simple average of returns to value, profitability, and momentum portfolios. Each factor portfolio is long the ⅓ of all stocks with the greatest factor exposure and short the ⅓ of stocks with the lowest factor exposure. The model multifactor portfolio is neither optimized for risk-adjusted returns nor does it improve stock selection with an aggregate model. Multifactor portfolio returns include the long-run risk free rate and do not factor in transaction costs, variables that would drag on returns. The High Yield Strategy is defined by buying the Morningstar High Yield Category when it closes above its 200-day moving average the prior day. The strategy entirely switches to exposure of the Bloomberg U.S. Treasury 3-5 Year Total Return Index when the Morningstar High Yield Category closes below its 200-day moving average.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses. The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

No strategy works all the time, and prudent risk management often means not every investment should be moving in the same direction at the same time. A blend of alternatives with stocks and bonds can potentially extend the risk-management benefits associated with traditional asset class diversification. Over the long run, diversifier strategies have tended to provide investors with reasonable returns as well as attractive risk-management benefits, making them suitable for many types of portfolios.

Inflation puts investment grade bond portfolios at risk, especially when interest rates are already low. Tactical trend following in high yield credit has potential to capitalize on high yield’s historical resilience in rising rate environments, while managing the downside associated with added credit risk.

Since the market bottomed on April 8, 2025, investors have witnessed a highly speculative, “pro-junk” environment. Stocks with weak fundamentals—richly valued, unprofitable companies often fueled

The Counterpoint Tactical Equity Fund (CPIEX) combines two investment approaches in a single fund: The fund layers these strategies on top of one another: Returns

At Counterpoint, we’ve been championing diversifier strategies for a while now—like the wise old friend who keeps reminding you to bring an umbrella just in

Watch Chief Investment Officer & Partner, Michael Krause and Daniel Krause, Partner & Head of Sales at Counterpoint Mutual Funds, provide an update on Counterpoint’s fixed income funds, as well as share our fall investment outlook on fixed income performance.

In simple univariate tests, the disposition effect for a stock nearly disappears if the portfolio is at a gain. We find a large disposition effect when the portfolio is at a loss. The portfolio-driven disposition effect that we document is not explained by extreme returns, portfolio rebalancing, simultaneous transactions, or

Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges. Past performance is no guarantee of future results.

© 2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

5516-NLD-09/01/2021

We’ve received your request for the featured event collateral. A Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your meeting request and a Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your event registration request and will be in touch shortly.

Subscribe to stay up to date on Counterpoint Funds and receive our monthly perspective.

We have received your application and look forward to reviewing your qualifications for the role. If your application seems like a good fit, we will contact you to discuss next steps.

Thank you again for your application and interest in joining the Counterpoint team!

We’ve received your message. A Counterpoint Funds team member will contact you soon.

Subscribe to stay up to date and receive our monthly perspective.