A rapid spike in interest rates to start 2021 has prompted many investors to rethink their approach to core fixed income. Today, US fiscal policy seems to be tilting toward big spending. The possibility of inflation – and further rate increases – looms large. Meanwhile, many investors may not realize how much interest rate risk they’re taking. Core bonds’ vulnerability to rising rates has steadily risen since the 2008 financial crisis; these assets now face greater interest rate risk than they have in a generation.

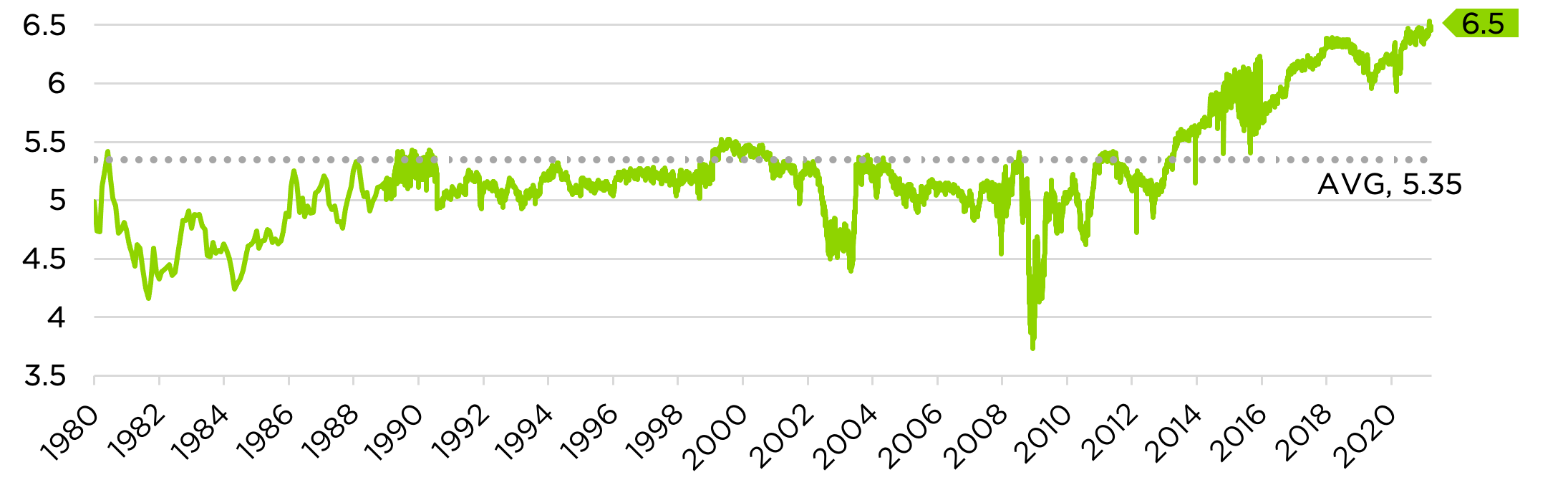

The chart below illustrates the point. As a refresher: Duration is a measure of a bond’s sensitivity to interest rates. If a bond has a duration of 5 years, for example, then a 1% increase in interest rates will prompt a 5% decline in the bond’s price, all else equal. A higher duration means more interest rate risk.

Bloomberg Barclays U.S. Aggregate – Modified Duration

With a duration of 6.5 in 2021, the Barclays US Aggregate Index is expected to drop 6.5% for every 1% increase in interest rates. Core bonds have 20% more interest rate sensitivity than the historical average over the past four decades, and the measure is at a multi-decade high.

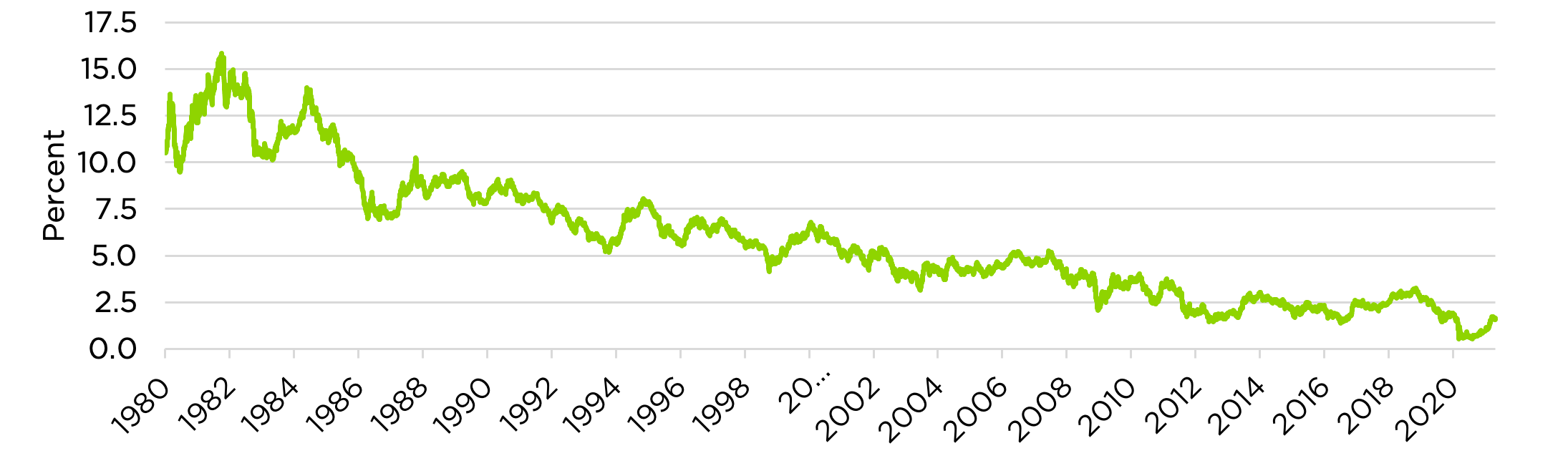

Investors have long used a simple and effective strategy to combat interest rate risk: a long-term mindset. If you hold a conforming bond until maturity, its price fluctuations don’t matter. Plus, when coupon rates are high, a bond’s cash flows can help offset occasional price fluctuations. But when coupon rates are low, as they are today (even after the interest rate spike of Q1 2021), investors begin to feel less compensated for price fluctuations, and it can get harder to focus on the long term.

10-Year Treasury Constant Maturity Rate

Advisors should be aware of two issues when considering clients’ core fixed income holdings.

- Core bonds are significantly more sensitive to further rises in interest rates than they’ve been historically.

- Low interest rates may not make up for price declines within core bond holdings the way they once did.

Investors who were uncomfortable with price action in their bond portfolios earlier this year may need to prepare for additional discomfort should interest rates rise further.

Meanwhile, advisors may need to look for creative solutions to a low-rate environment where even traditionally stable fixed income assets may be a bit riskier than investors are used to. We believe investors should still hold bonds despite their shortcomings; we’re skeptical of wild you-only-live-once bets on stocks. But systematic diversifier strategies (especially trend following strategies in high yield credit) have potential to mitigate interest rate risk within bond allocations while seeking to support portfolios during falling-rate, recessionary environments. As traditional asset classes show increasing potential to challenge investors’ patience and emotions, it becomes more important to consider strategies designed to help them weather fluctuating market conditions.