One of the most common questions we hear from advisors and their clients is: How does A.I. actually work in quantitative investing?

While the jargon around machine learning may sound intimidating, the core idea is surprisingly intuitive. A.I. is fundamentally a prediction engine—one that looks to large amounts of historical data to estimate what is likely to happen next.

A.I. is a Prediction Engine

At its core, artificial intelligence is fundamentally a prediction engine. It learns patterns from historical data to anticipate what is likely to happen next. When Amazon recommends the next product you might buy, it is drawing on millions of customers’ past behavior to forecast what will resonate with you. Netflix uses the same principle, analyzing viewing histories to determine what you are most likely to stream next. Even Zillow’s home-price estimates are built on historical sales of comparable properties. In every case, the underlying mechanism is the same: A.I. makes a prediction based on patterns in the data.

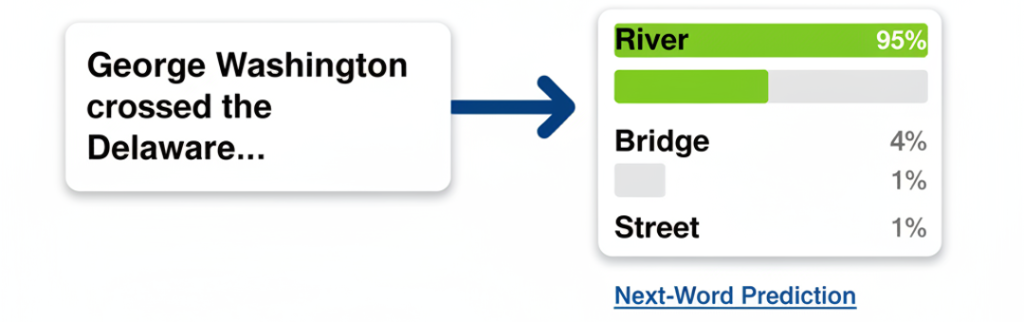

Large language models (LLMs) like ChatGPT operate on this same predictive foundation, but instead of forecasting purchases or home values, they predict language—one word at a time. When a model begins a sentence such as “George Washington crossed the Delaware…” it evaluates billions of examples of similar sequences to determine the most likely next word. The model may surface a distribution of plausible options— “river,” “bridge,” “street”—but identifies “river” as the best continuation. This word-by-word forecasting is what makes conversational A.I. feel coherent and intelligent. Ultimately, whether the task is recommending a movie or generating text, A.I. is best understood as a highly sophisticated prediction machine powered by the patterns of the past.

A.I. in Stock Investing

A.I. applies the same predictive logic to stock investing that it brings to consumer platforms. Consider the Counterpoint Tactical Equity Fund (CPIEX), a strategy that leverages machine learning for stock selection1 with access to roughly seven thousand global stocks—each with its own multidimensional profile. Every security has characteristics that can be used to estimate its future return: value characteristics like earnings-to-price, momentum signals such as past-six-month returns, profitability measures, short interest levels, analyst revisions, etc. By training on historical datasets, A.I. can identify how stocks with specific combinations of these characteristics behaved in the past. If a stock today shows an earnings-to-price ratio of 0.1 and a recent 20% run-up, A.I. can locate all historical instances of stocks with similar profiles and analyze what typically happened next. This allows the model to make an informed estimate—grounded in precedent rather than intuition—regarding future performance.

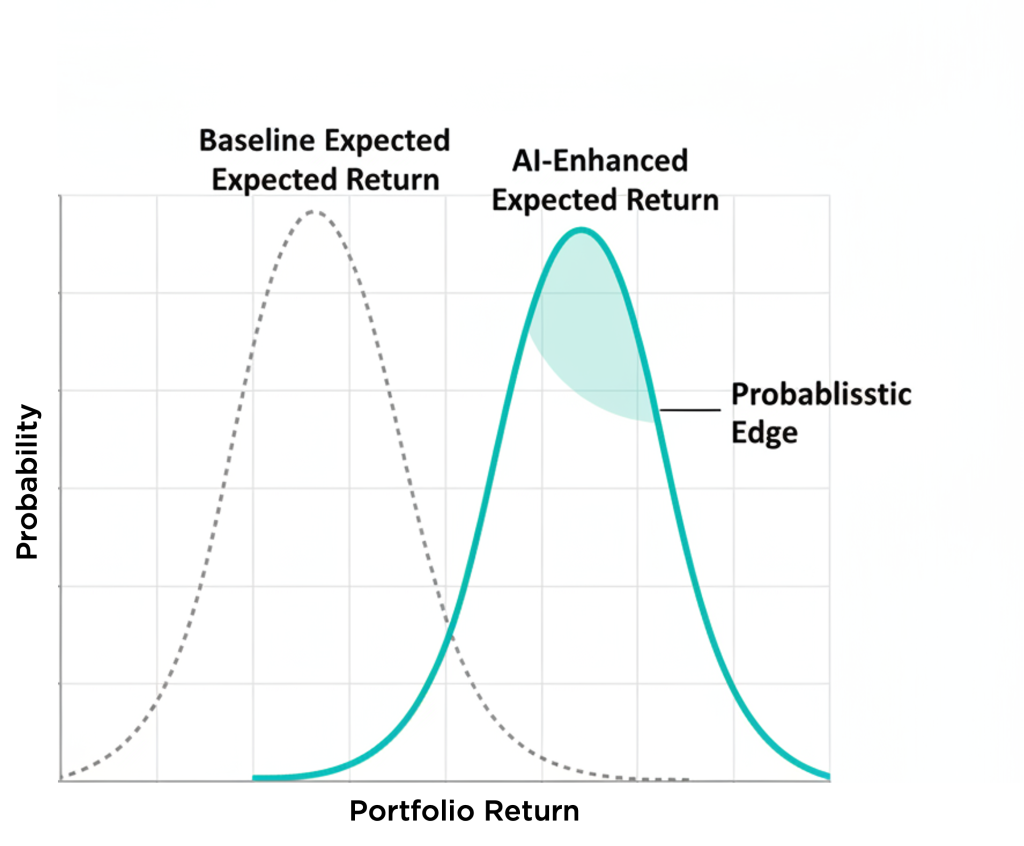

No model will ever predict markets perfectly, but if A.I. can be right more often than it is wrong, the cumulative effect can translate to a meaningful shift in a portfolio’s expected return. The engine systematically tilts toward stocks whose characteristics historically aligned with stronger outcomes, while reducing exposure—or even shorting—stocks that resemble past underperformers. The result is an investment process that learns from millions of historical data points, continually refining its understanding of which patterns matter in driving returns going forward.

What A.I. is Good At

At its core, A.I. is good at two things:

First is uncovering relationships between variables—what data scientists call interaction effects. Sometimes, the combined influence of two characteristics is far greater than the sum of their individual contributions. Think of a Zillow-style home-price model: a 3,000-square-foot home may add $500,000 in value, and an ocean view may add another $500,000. But a 3,000-square-foot home with an ocean view may command something closer to $2 million because those attributes reinforce each other. A.I. learns these subtle relationships,—which are nearly impossible to detect with simpler analytical methods.

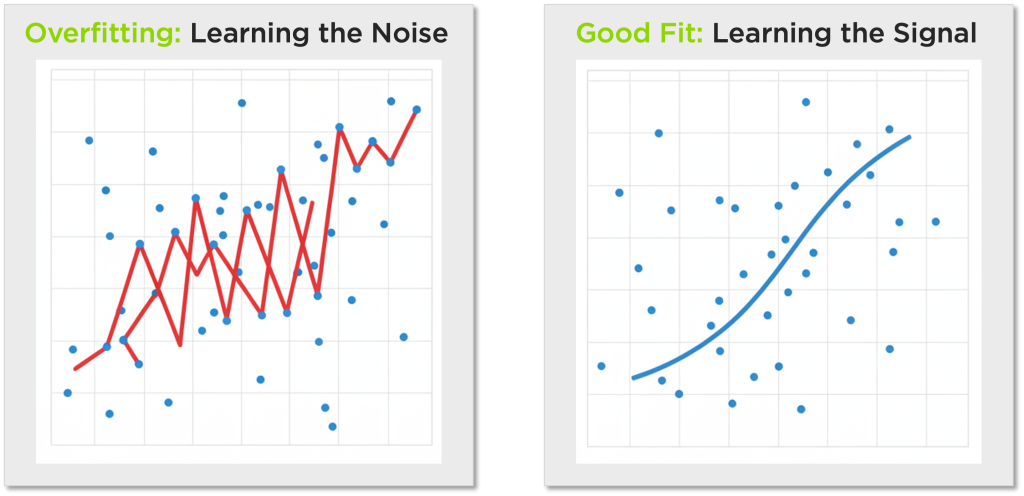

Second is separating real, predictive signal from meaningless noise—also known as regularization. Given enough data, it’s easy for a traditional model to “explain” the past perfectly by latching onto irrelevant quirks, such as the precise stadium attendance when a baseball player happened to hit a 98-mph line drive. That produces a flawless historical fit but a terrible forecast.

A.I. avoids this trap by penalizing overly complex explanations and prioritizing variables with true causal or predictive value while discarding noise. These two strengths—identifying interaction effects and filtering out noise—are exactly what make A.I. so powerful in equity investing. With thousands of potential data points across financial statements, market behavior, and fundamentals, A.I. can determine which variables matter, which combinations drive returns, and which signals are real enough to inform better, more forward-looking decisions.

Don’t Underestimate the Human Factor

Humans still play a critical role in shaping effective prediction systems. A.I. can only work with the information it’s given, and humans ultimately decide what goes into these models. At Counterpoint, our starting point isn’t a brute-force search for signals—it’s academic research grounded in economic theory. We select variables because they reflect real economic mechanisms, not statistical coincidences. This matters because the quality of the inputs directly determines the quality of the outputs. As the classic line in data science goes: garbage in, garbage out.

By ensuring the inputs reflect how markets actually work, we give A.I. the structure it needs to produce insights that are robust, interpretable, and useful for investors.

Conclusion

As A.I. becomes more embedded in the investment landscape, its true value will come not from automating judgment, but from augmenting it. The most durable advantages arise when human insight and machine-driven pattern recognition work together—when economic theory shapes the inputs, and A.I.’s pattern recognition power refines the outputs. For advisors and investors, the takeaway is straightforward: A.I. is not a black box, nor is it a speculative fad. It is a disciplined, data-driven tool that, when paired with sound research and human oversight, helps uncover relationships too complex for intuition alone. In a world where markets evolve quickly and information grows exponentially, combining human understanding with A.I.’s ability to learn from the past offers a clearer, more consistent path toward informed, resilient investment decisions.