Artificial intelligence (AI) technology can help improve investment processes, but it’s important to understand how. No AI/machine learning technology that we know of solves the problem of an uncertain future – whether in investing or elsewhere. However, as a tool that systematically and comprehensively integrates the most compelling academic research about what drives stock returns, AI represents a major step forward in stock picking and a large potential advantage for stock investors.

An Analysis Force Multiplier for Stock Selection

AI has not created a crystal ball. Instead, it has the potential for creating the equivalent of the largest team of investment analysts ever assembled – a team that comprehensively studies every stock in its universe and integrates significant patterns that help predict stock returns over its historical dataset.

One way to think about stock-picking is in terms of relationships. For many investors, investing in individual stocks is about buying the ones that have great expected returns (or at least great expected risk-adjusted returns.) Given a mission

to find the stocks with potential to go up the most, an ideal stock picker would follow some version of this process:

- Gather all the most relevant information affecting stocks’ future prospects.

- From that information, identify how that information relates to the stock under consideration.

- Identify what information is most or least relevant to future returns.

- Uncover how different factors affecting return expectations interact with each other.

- Avoid emotional/psychological biases and mistakes that would mess up the prediction.

Many stock pickers follow some variation of this rubric, using tools like stock screens, technical analysis, SEC filings analysis, valuation multiples, and more to generate return forecasts.

Superior Processing Power & Pattern Recognition

From one perspective, it makes sense to try: The human brain is very good at detecting patterns, whether they appear in nature or in the stock market. Humans often can’t help but look for patterns and find structure in the information coming their way – even when those patterns turn out to be illusions. While pattern recognition is nothing new across the animal kingdom, one of the many cognitive capabilities of humans that far exceeds that of all other animals is the human brain’s capacity for superior pattern processing. This superiority has

historically remained true when compared to computer algorithms, but is this still the case? And is it sufficient to “beat the market”?

One prevalent investment philosophy says “no.” Passive indexing supposes that on average security selection is not worth the time and money invested in trying to identify attractive stocks. Markets are efficient enough, the argument goes, and humans make enough mistakes trying to outperform, that it’s simply better to hold funds that invest in entire stock markets, and earn the returns the economy generates for companies.

Counterpoint Funds is founded on the belief that markets are largely efficient, but that human beings make enough mistakes that a systematic investment approach can profitably exploit those mistakes, in certain situations.

Today, Artificial Intelligence has entered the stock-picking chat. Advanced machine learning models power ChatGPT and its ability to draw upon its vast training data to identify patterns and relationships between words, phrases, and grammatical structures. A similar approach can also be used to systematically identify patterns in stock performance – the variables that combine to generate reliable (on average) forecasts for individual stock returns.

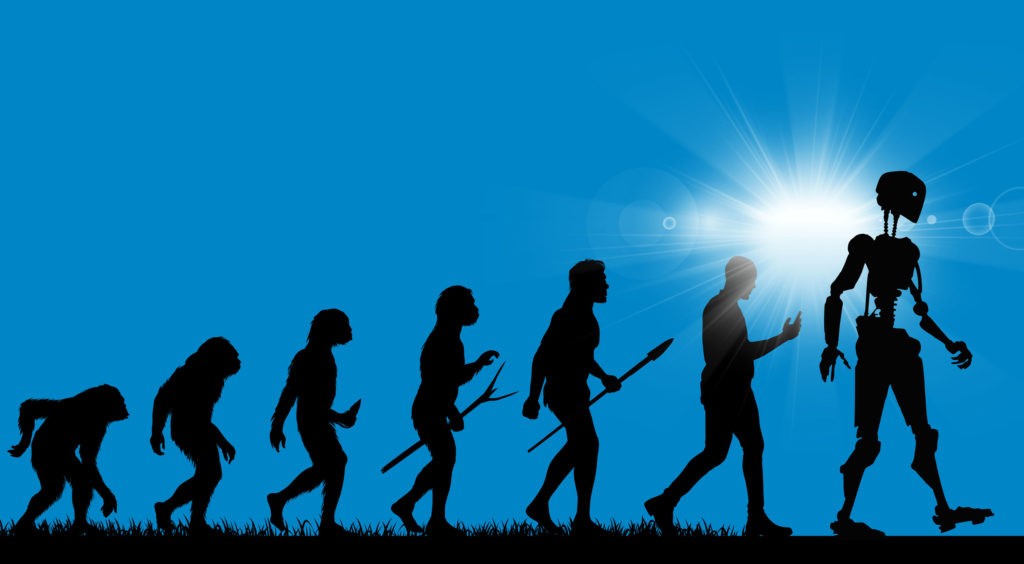

More an Evolution Than Paradigm Shift in Investing

Returning to the five-step process for picking stocks outlined above: A single investor – or even a large team of analysts – performing an analysis on individual securities, would face logistical, cognitive, and emotional hurdles to profitable stock picking.

Logistically, it takes time, effort, and attention to assess factors like earnings, valuation, sentiment, and more that could reasonably affect a stock. In a global universe of 7,000

developed market stocks, it would be easy to miss an opportunity because one hadn’t the time to look at it!

Artificial intelligence may give investors the best chance to correctly integrate and synthesize the relevant information to actively select stocks within a given market. By identifying variables that show statistical confidence as predictors of returns, by systematically identifying the relationships among all those variables, and by dispassionately producing ongoing return forecasts, machine learning/AI models today can function as extremely large, fast, comprehensive, and unemotional teams of analysts. They can apply the same patterns humans have identified through the history of stock markets to seek excess returns:

- Value: Cheap stocks tend to outperform expensive stocks.

- Momentum: Stocks with the most positive recent returns tend to outperform stocks with the most negative recent returns.

- Profitability: The most profitable stocks tend to outperform the stocks with weak or negative profitability.

- Volatility: Less volatile stocks tend to outperform more volatile stocks.

AI and machine learning models are nothing new for quant managers, but they bring an added advantage beyond well-studied factor phenomena. They have the potential to identify when a combination of the factors above creates a yet-greater potential for opportunity, as well as when certain factors combine to create a more muted expectation.

Watch our most recent equity on-demand webinar: