Some investors seem to be having a difficult time making definitive decisions so far in 2023. Conventional wisdom holds that a long-term strategic allocation makes the most sense, the difficulty is in the execution. Attention grabbing headlines and rarely seen events may leave some investors wondering whether – and how – to stay the course. As the Fed continues to navigate stubborn inflation along with a seemingly vulnerable economy, a few concerning data points have caught some investors’ attention. The fixed income markets in particular have experienced some notable dislocations.

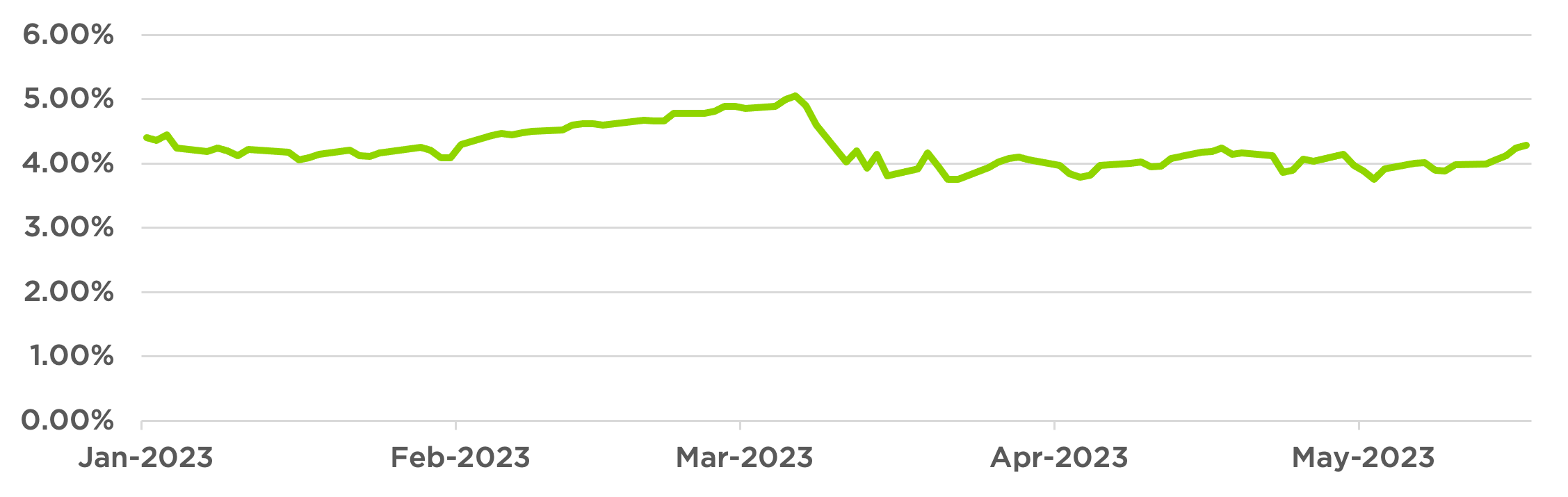

In March, amid the failures of Silicon Valley and Signature Bank, the yield on the 2-year Treasury dropped a half a percentage point in a single day – the type of flight to safety we’ve only seen this century after the September 11 attacks and amid the 2008 housing bust.

2-Year Treasury Yield

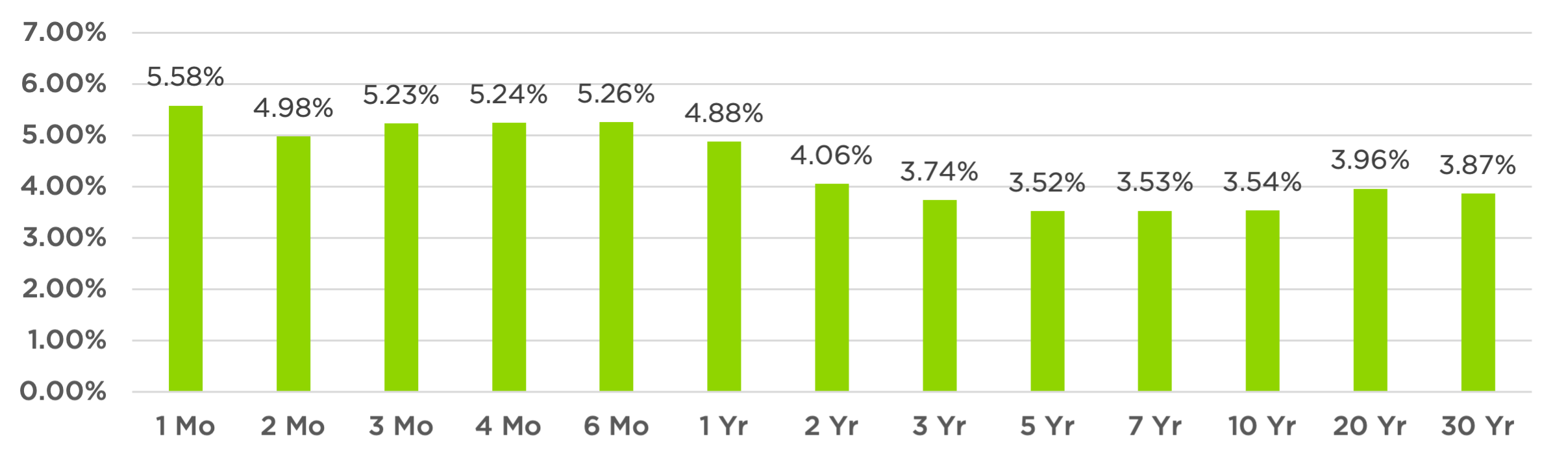

Meanwhile, across the US Treasury market, the yield curve remains sharply inverted, and a “kink” has developed at the very short end. Investors are now demanding 2 more percentage points annualized to loan the government money for 30 days than they are demanding to loan the government money for 10 years.

Treasury Rates, 5/16/2023

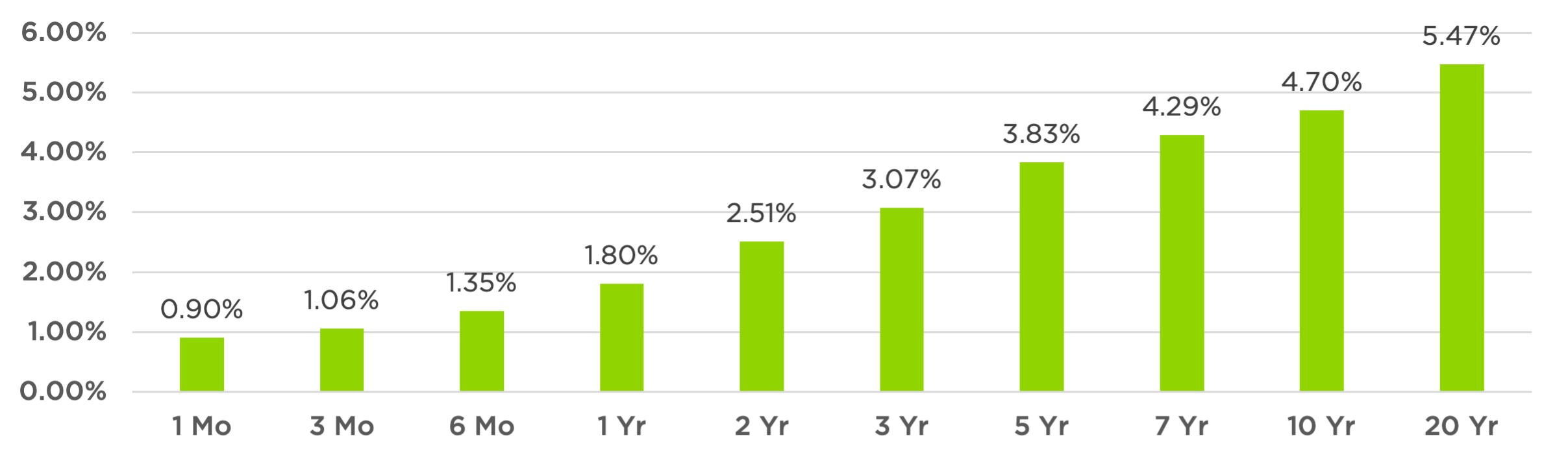

An inverted yield curve has a long and well supported history as a predictor of recessions. However, the timing of such a disruption is unfortunately not so easily forecast. A “healthier” yield curve tends to show interest rates generally rising toward longer maturities. In “risk-free” securities, the mere amount of time an investor is lending money should be one of the main factors affecting the rate. Lend for longer, earn more interest. Here’s one example of such a yield curve, from the middle of the early 2000’s housing boom, when the economy was generally thought to be growing healthily.

Treasury Rates, 5/16/2004

Unfortunately, no one really knows how or when an inverted yield curve might “normalize” back to a more conventional structure. There are several possibilities:

-

- A recession could prompt the Fed to lower rates on the short end (potentially creating a tailwind for muni high yield’s credit risk);

-

- Persistent inflation could force market participants to price long-term bonds for a greater inflation premium (potentially punishing muni investors for the category’s extensive duration);

-

- Some combination of the two;

-

- Or neither.

The potential benefit of a systematic tactical strategy is its unemotional approach to managing downside risk within the portfolio. Counterpoint’s tactical fixed income strategies have historically shown resilience in the face of credit risk-related disruptions to the municipal market (COVID crash of 2020) as well as interest rate risk related disruptions (rate hikes of 2022).

For investors who are looking at the yield curve and recent banking disruptions and are uncertain what if anything they might do, systematic risk management strategies offer an opportunity to take an unemotional approach to downside risk, potentially buffering portfolios against rising volatility while pursuing reasonable long-run returns.