Given the volatility that has marked the first half of 2023, we wanted to briefly address how advisors can help clients balance opportunities in today’s fixed income environment. It should come as no surprise (thank you human nature) that investors are often tempted to time markets as market dynamics change. Managing this temptation to time markets has historically meant convincing clients not to over allocate into stocks. But this year, the same issues are popping up in bonds following the rise of 5%-yielding CDs and an inverted yield curve.

Traditionally, an investor might have simply looked at the average yield of an investment over the past year to help decide what to invest in today. However, this simplification can lead to unexpected results, because it overlooks the multiple roles that bonds typically play in a diversified portfolio:

-

- Income (Yield) is a return measure for an investment over a set period of time.

-

- Total Return is the percentage change in the value of an investment, and/or cash flows (income/yield) which the investor receives from that investment.

-

- Capital Preservation is a conservative investment strategy (a traditional role for bonds) where the primary goal is to preserve capital and prevent loss or offset equity volatility.

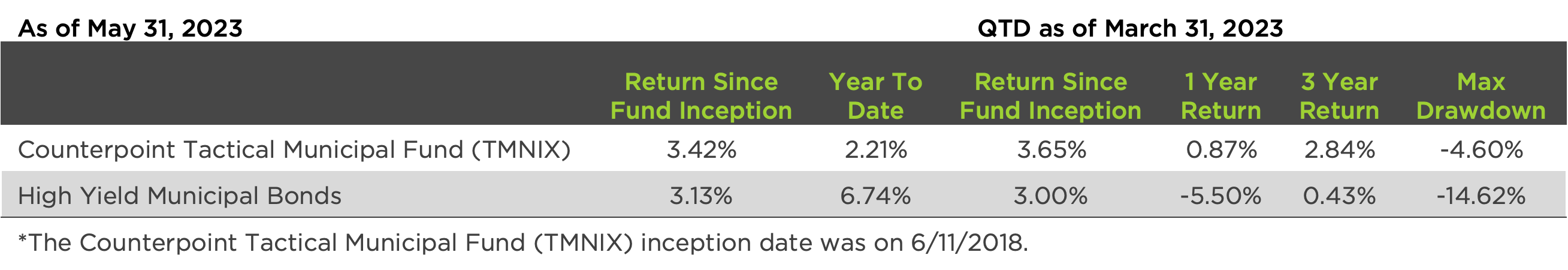

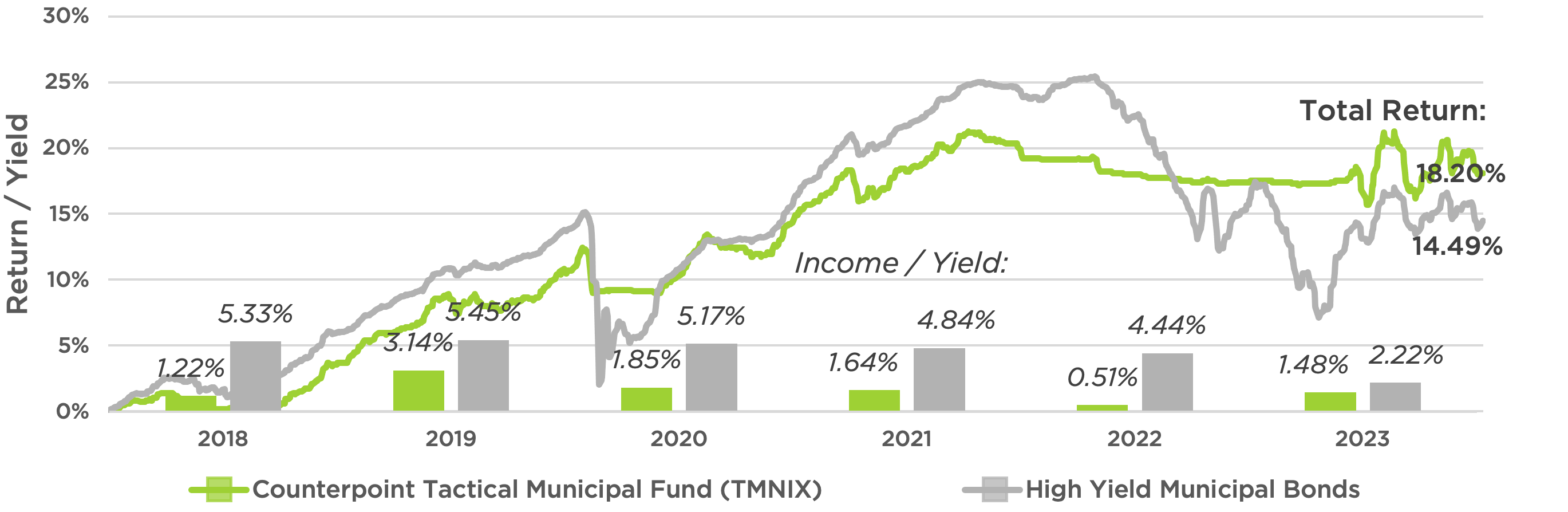

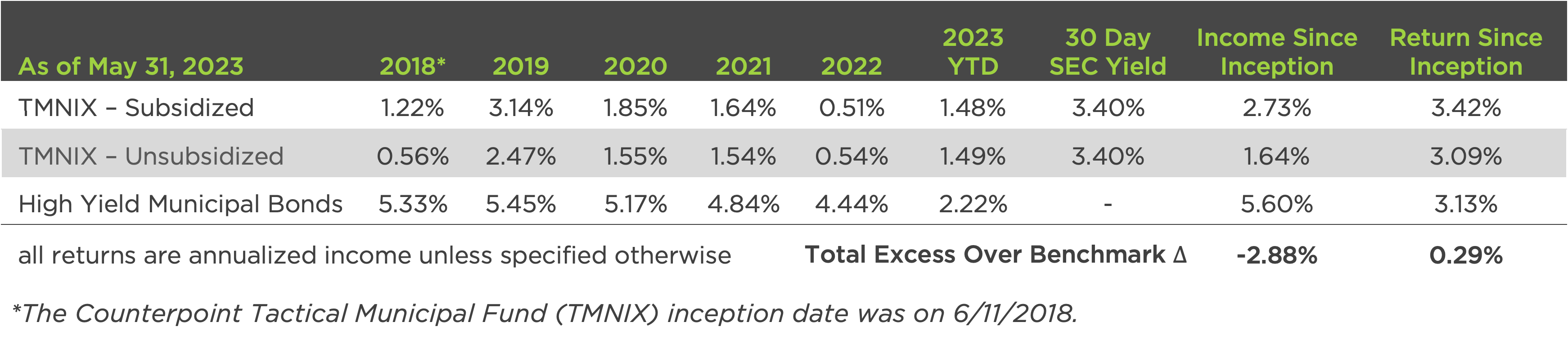

We believe that each of these factors should be properly balanced against the needs and goals of each client. The tax-free fixed income example below explores how these factors interact. The chart shows a passive high yield muni strategy and a tactical high yield muni strategy, such as the Counterpoint Tactical Municipal Fund (TMNIX). Notice how income, total return, and capital preservation interact in each example.

TMNIX vs. High Yield Municipal Bonds – Yield & Return

A quick reminder that a tactical strategy’s yield and return depend on the strategy’s positioning. When “risk-on” the yield and return will be driven by the yield and return in the high yield muni markets, and when “risk-off” the yield and return of tactical high yield will be driven by muni money markets.

Historically, tactical high yield muni strategies like TMNIX have captured a meaningful proportion of portfolio upside associated with investment in high yield municipal markets. Unlike traditional high yield municipal bond funds however, tactical high yield muni strategies don’t always track high yield muni as they prioritize downside risk mitigation via trend-following. The historical result of this process, as of May 11, 2023, may seem highly attractive annualized return profile (3.40%) given the fund’s maximum drawdown (-4.63%) since inception.

Bringing this back to the multiple roles that bonds play in a portfolio:

-

- Income (Yield): Whether using tactical or total return, the past year’s average yield didn’t help an investor predict what was going to happen in the coming year. While the tactical strategy had more years of lower yield than the passive, it did have a higher yield as well in 2021.

-

- Total Return: Although there are periods when the tactical strategy lags the passive strategy – especially during sharp snapback rallies like in 2020 and late 2022 – tactical high yield’s downside risk mitigation has supported superior total return since inception.

-

- Capital Preservation: Over the life of TMNIX, it has been historically shown to be superior to passive municipal counterparts from a downside risk standpoint.

TMNIX is just one example of why we believe it is important that the yield characteristics of a fixed income fund should be considered alongside the fund’s overall objective to see if they best align with needs and goals of your clients. If for instance your clients are worried about drawdowns, tactical high yield could be a nice diversifying complement to a tax-free portfolio. If your clients are instead looking to be opportunistic, tactical offers the potential to “keep powder dry” when looking for opportunities to buy the occasional sharp dip in muni markets.