Environmental, social, and governance (ESG) stock investing strategies are designed to make the world a better place by investing in companies that rate highly on such metrics. While its global impact is still unknown, we believe ESG is unlikely to boost returns much – or provide much protection against stock market risk. Because ESG investing is mostly the same as investing in the broad market from a risk and return standpoint, investors should look for other strategies if they’re trying to manage equity risk in a challenging environment.

Is ESG a Fad, or Dangerous? Probably Not

ESG strategies dominated in 2020 as investors looked for companies with high ratings for social justice and environmental responsibility. 2020 was also a year when emotional considerations often outweighed traditional financial metrics. Most notably, the You-Only-Live-Once (YOLO) investors on Reddit waged campaigns to boost their favorite stocks and cryptos, often completely disregarding fundamentals. With all the warm fuzzies it provides, one has to wonder whether is ESG a similar fad. After all, one of the all-time great scholars of the stock market thinks ESG strategies are redundant.

The stock market’s current emotional tenor and ESG’s intuitive appeal raise the question: Is ESG, like YOLO, contributing to a frothy-acting stock market? Fortunately, the data doesn’t seem to indicate that type of mania in ESG strategies. We looked at ESG ratings for 1770 US-traded stocks and compared how the top 10% of ESG stocks compare with the bottom 10% – and the total ESG universe – on some key investing measurements.

ESG Stocks Are Basically Your Typical Large-Caps, But More Expensive

Top ESG scorers are a lot like more stable large-cap stocks investors tend to think of as being “safer.” They’re larger, a little less volatile, and a little more profitable than “anti-ESG” companies. Top ESG companies’ main drawback relative to poor ESG performers is they’re more expensive — but they’re valued roughly in line with the overall market, so it’s a modest issue. The biggest gripe an investor might have with an ESG allocation is that its relatively lower volatility might come with a slight drag on returns.

In sum, from the quantitative point of view ESG is not all that different from investing in the broad stock market — maybe even a little less risky, and with potential for a little less reward.

ESG Is Unlikely to Save You in a Downturn

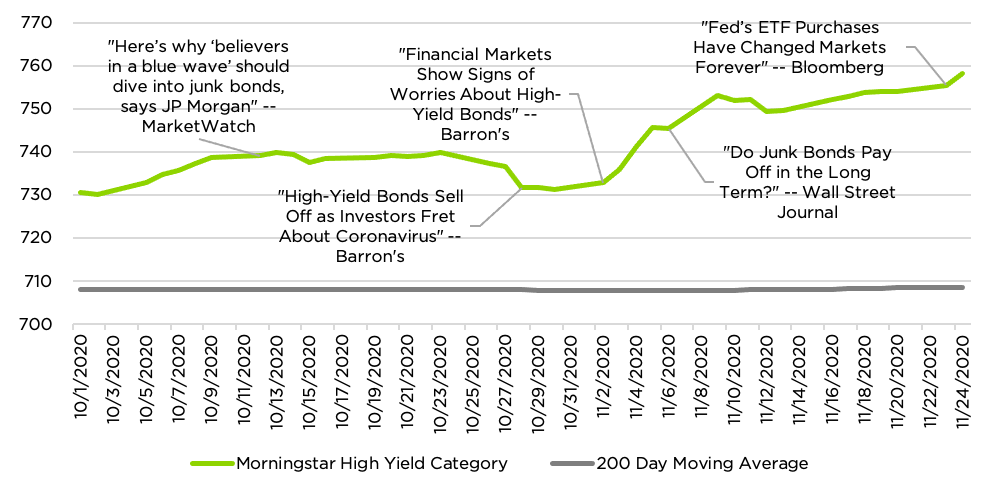

Unfortunately, ‘a little less risky than the market’ is small comfort in today’s environment. Absolute valuations are steep, interest rates are rising but still low, and wild YOLO traders on Reddit seem to rule the roost. Whether or not investors believe in ESG’s world-changing power, it still pays to structure portfolios so they can hold up in times of broad market turbulence – or seek reasonable returns without adding undue risk. We believe systematic diversifier strategies can help investors diversify away from stock market risk while providing reasonable absolute returns. As such they provide balance when investors attempt to adjust their equity market exposure due to interest in thematic strategies like ESG. That characteristic is especially useful when low interest rates create problems for traditional balanced portfolios, investors are tempted to chase yield, and ESG strategies may provide only a small buffer against possible future turbulence.