Even when you’re sure a tax hike is coming; we believe you probably should avoid making any hasty decisions about your exposure to tax exempt municipal bonds.

In the wake of November’s presidential election and Georgia runoffs that shifted control of the Senate, investors are rightly considering possible changes in tax policy — and what such changes could mean for their portfolios.

Investors have been paying special attention to municipal bonds, wondering whether their exemption from federal taxes might be attractive under a more tax-prone Democrat administration with a long-shot chance at controlling Congress. If tax rates do go up, the effective after-tax yield on taxable corporate bonds should go down, all else equal. So, the argument goes, rising tax rates should give a tail wind to munis, since interest income is usually safe from federal taxes.

Can bond investors profitably trade on an expected tax hike?

We don’t think so, at least from a historical standpoint. If munis respond predictably to tax changes, we should see a pattern in their historical returns in the months before and after-tax legislation. If munis have historically performed well around tax hikes (and poorly around tax cuts), we might have some basis for a strategy. If on the other hand we can’t see any such relationship, we might be out of luck.

Before we jump into the analysis, keep in mind that interest rates are key drivers of muni bond returns. To control for interest rate movements, we’re going to look at what Munis earn above or below the returns of a Treasury bond with similar duration. This “Muni return minus Treasury return” gives us a “pure muni return” that controls for the effect of interest rates. While this approach isn’t perfect, because nominal yields on Treasuries are normally higher than those on munis, it’s “good enough for government work” when looking at policy impacts.

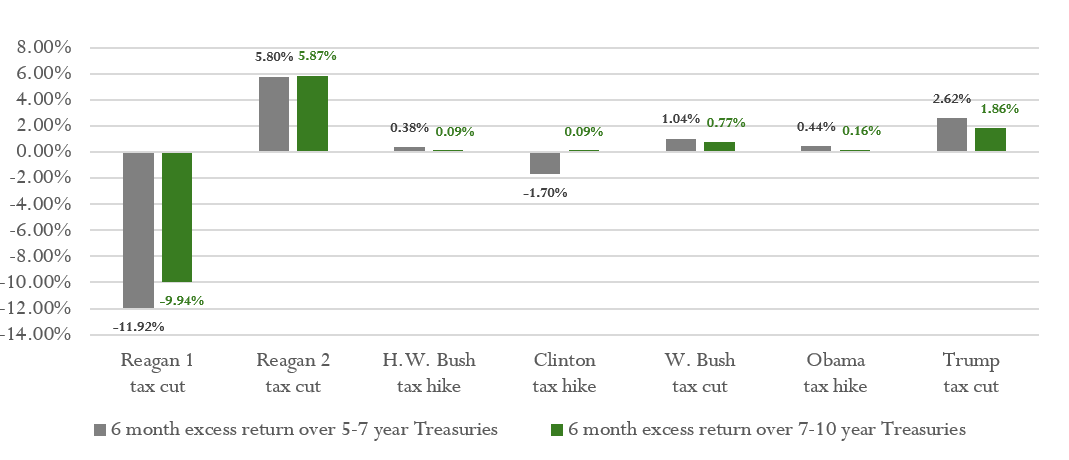

Muni bond 6-month excess returns in tax legislation periods

Using this “pure muni return” framework, we calculated the excess returns on a municipal bond index in the six months surrounding (the three months before and the three after) major pieces of tax legislation from the past 40 years. For example, Ronald Reagan signed his first tax cut in August 1981. Muni bond excess returns compared with Treasuries from June through November of that year were roughly -10%.

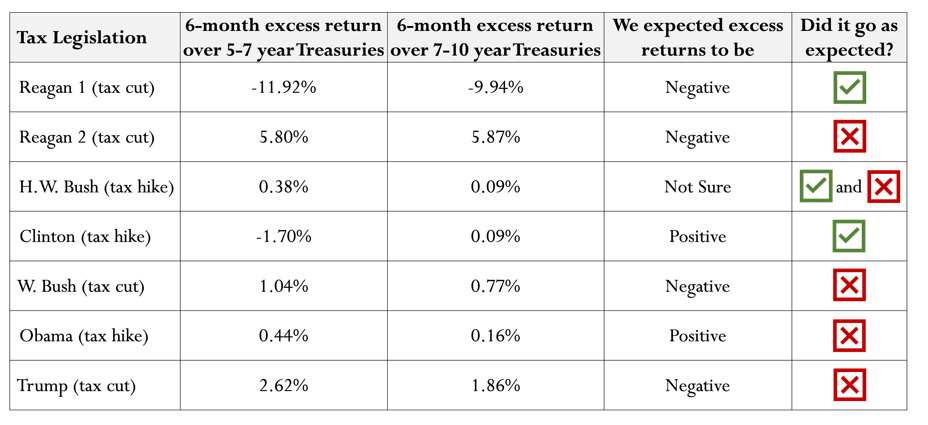

Put bluntly, trading munis around tax legislation hasn’t worked. Muni underperformance was consistent with our expectation for the first Reagan tax cut, and possibly for the H.W. Bush and Obama tax hikes, although the returns there are close enough to zero to potentially just be statistical noise. Meanwhile, munis traded in the opposite direction our strategy predicted in all other scenarios.

Of the seven changes in tax policy we tracked, only one was a true victory for our Muni strategy: The first Reagan cut, which dropped the top income tax rate from 50% to 30%, one of the biggest tax cuts in U.S. history. The other victories are odd: The H.W. Bush tax hike was minor and unexpected — Bush had famously campaigned on a promise of no new taxes. Muni returns around Obama’s tax hike were positive, but very close to zero. All of the other would-be tax trades went against our system, creating clear losers a majority of the time.

What about trading around election time?

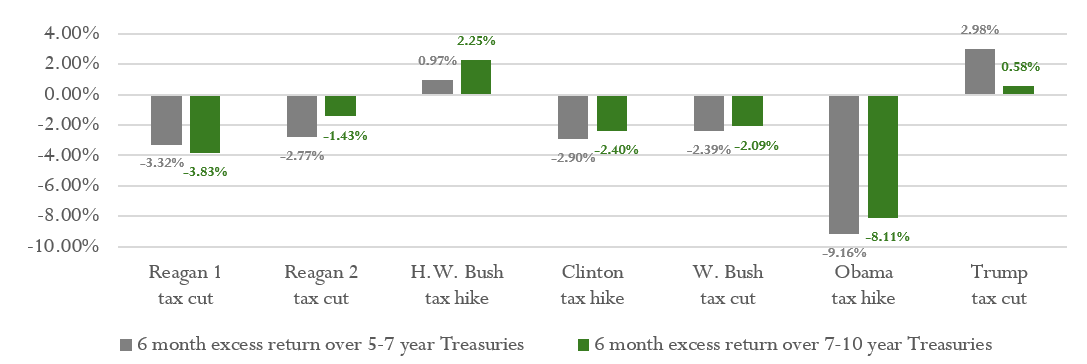

What if the market responds not to tax legislation, but instead to the election of the official who would go on to sign it into law during his term?

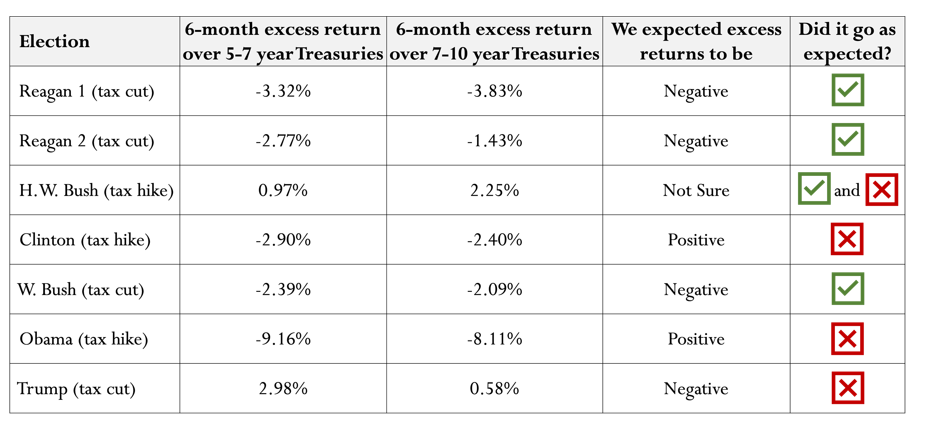

Muni bond excess returns in elections that resulted in tax legislation

Taking a position in munis three months before and exiting the trade three months after an election would have had a better batting average than trying to trade the legislation itself (3 or 4 successful trades out of 7, depending on how you view the H.W. Bush tax hike). But on average, thanks to a severely wrong trade surrounding the 2008 election, returns to this trading strategy were slightly negative. Also keep in mind: This strategy assumes the investor knows ahead of time a) who will win; b) that the winner will pass tax legislation during the coming term; c) the direction of the tax rate. That’s a tall order.

While it’s intuitively appealing to load up on munis ahead of a possible tax hike, there’s just not much in policy history to suggest muni performance tracks well against tax rate changes – either as it’s implemented or during the election that leads to the change. It may be helpful to recognize that tax policy is really just one subset of the many drivers of muni bond performance, which include: 1) interest rates, 2) muni-specific risks that affect the underlying cashflows of municipal debt and 3) liquidity mismatches from fund flows during crises.

We believe investors looking to tax-optimize their portfolios are probably better off determining an optimal long-term strategic allocation to municipal bonds and related funds rather than try to time the market based on who’s in the White House. However, systematic tactical asset allocation strategies have been shown to help manage risk in high yield municipal bonds, especially during crises when investors in muni-related products may all be crowding for the exits, as we saw during the crisis of 2008 and again during the COVID correction in spring of 2020. Investors targeting munis for tax-exempt current income may want to consider tactical trend following strategies instead of intuitively appealing ideas with no clear track record for managing risk or targeting attractive opportunities.