When it comes to investing in general, investors should not lock themselves into any single way of looking at stocks. Cheap stocks don’t always do the best. More profitable stocks don’t either. Nor stocks with great momentum. Although each of these types of stocks has been shown by academic research to outperform the broad market in the long run, at any given time one or more of these approaches can underperform – sometimes substantially.

Investors can best reap the benefits of strategies targeting cheap stocks, profitable stocks, or momentum stocks by diversifying across approaches, creating a portfolio diversifies not just individual holdings but also stock picking strategies.

The systematic approach to stock picking known as “long-only factor investing,” involves picking the stocks with the best characteristics according to academic research. Key sources of stock outperformance, according to the literature, include:

- Value: Cheap stocks tend to outperform expensive ones in the long run

- Momentum: Stocks whose prices have lately been rising tend to outperform stocks whose prices have lately been falling

- Profitability: Stocks of more profitable companies tend to outperform stocks of minimally or unprofitable companies

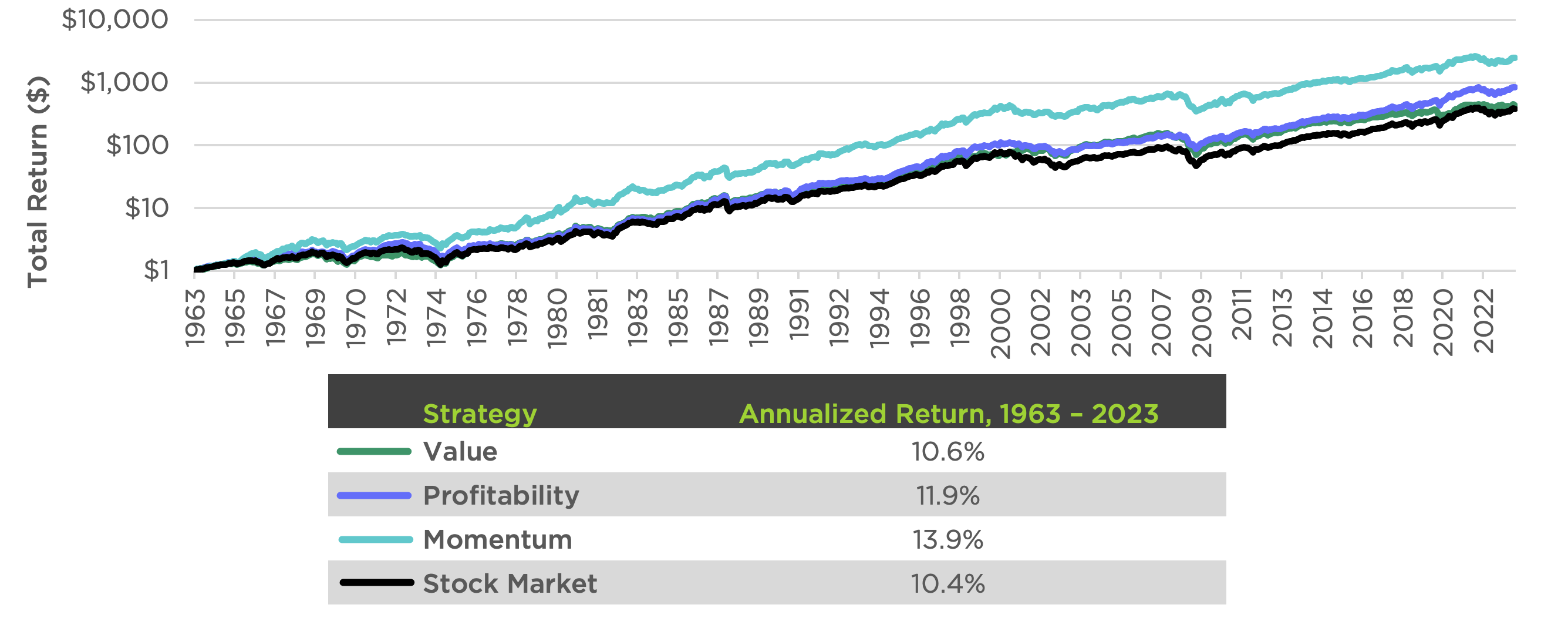

Over the long run, factor-oriented strategies have tended to outperform the stock market. Below are returns to hypothetical annually rebalancing market weighted portfolios of the stocks with the strongest exposures to value, momentum, and profitability returns.

Returns to Three Long-Only Factor Strategies and the Stock Market

Source: Kenneth French Data Library. Source: Kenneth French Data Library. “Value” represents returns to the stocks across all NYSE, AMEX and NASDAQ stocks in the top 30% as measured by book equity divided by market equity (“book to market”). Portfolio rebalances annually at the end of June. “Profitability” represents returns to the stocks across all NYSE, AMEX, and NASDAQ in the top 30% as measured by revenues minus cost of goods sold, interest expense, and SG&A divided by book equity. Portfolio rebalances annually at the end of June. “Momentum” represents returns to the stocks across all NYXE, AMEX, and NASDAQ in the top 30% as measured by (2-12) momentum, i.e. the change in price from the end of month t-13 to the end of month t-2. Portfolio rebalances monthly. Please note the returns represented by this momentum strategy are disproportionately optimistic as the strategy rebalances twelve times more frequently, but trading costs are not taken into account in any of these modeled returns. “Stock market” is represented by the risk-free rate plus the market risk premium, which is derived from the returns to all NYSE, AMEX, and NASDAQ stocks.

The indices shown above are for informational purposes only and are not reflective of any investment. It is not possible to invest an index. The data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features.

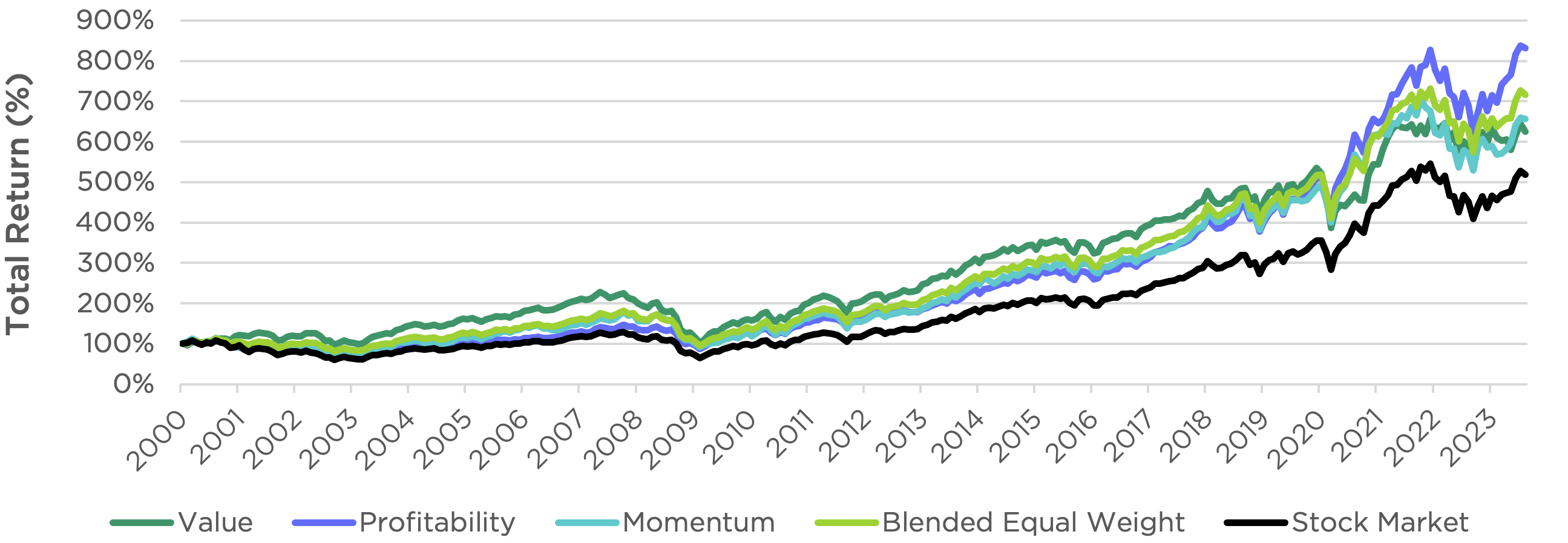

Equal Weight Blended Factor Strategy Returns: 2000-2023

Source: Kenneth French Data Library.

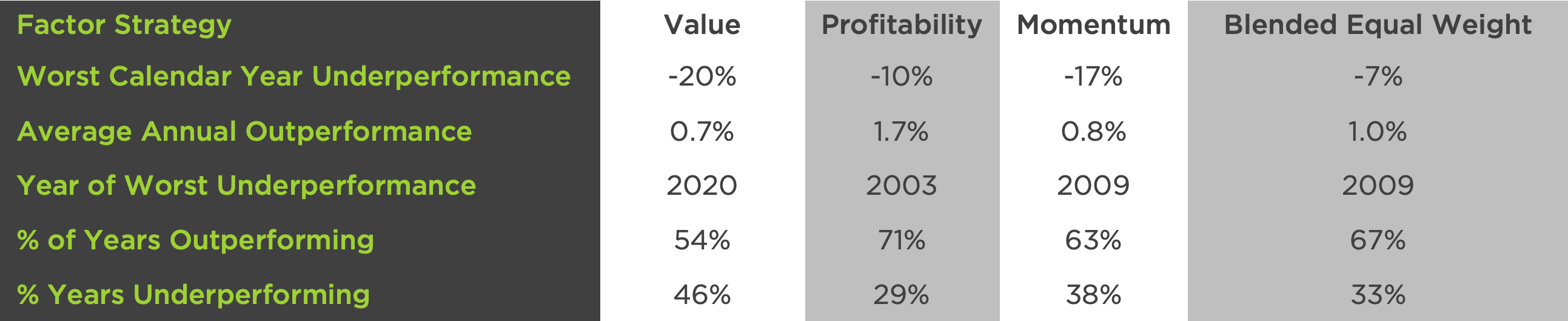

Source: Kenneth French Data Library.There are several reasonable rationales supporting factor diversification based on recent history:

-

- The diversified three-factor portfolio has outperformed two of the three single-factor strategies on an absolute return basis.

-

- In its worst relative-performance year, the diversified three-factor portfolio minimized underperformance of the broad stock market by 10 percentage points vs. any single-factor strategy.

-

- The past 20 years have been favorable to profitability-oriented strategies, but: We know of no reliable way to forecast which factor strategy may outperform in the future. Exposing stock portfolios to multiple factor sources of returns increases the chances of exposure to the dominant strategy of tomorrow.

Conclusion

Stock market investors tend to be attracted to certain types of companies and stocks. Whether their investment philosophy is more sympathetic to value, momentum, or profitability-oriented strategies, it makes sense to diversify exposure to different sources of return. Diversification allows an investor the opportunity to benefit from factor performance.

Additionally, diversification has historically helped reduce the severity of underperformance during challenging periods for any individual strategy. Investment strategies with dynamic factor exposure, like our quantitative artificial intelligence (AI) driven long-only equity strategy, offer even greater diversification with the ability to perform across a wider range of market environments – as compared to traditional blended factor strategies.