As the year draws to a close and many investors are confronting short-term turbulence in riskier asset classes, now is a good time to evaluate Counterpoint Tactical Income’s recent performance and current positioning in the context of the broader markets.

Please keep in mind that we consider Tactical Income’s performance in the past year to be in line with our strategic objectives – drawdown minimization and superior long-term risk-adjusted performance.

As we have discussed, Tactical Income investors should consider two key elements when looking at Fund performance. First, trend-following strategies are challenged in the short term by false risk-off or risk-on signals. Second, we can consider high yield credit as a portfolio of two different types of risk:

- Credit risk, which is directly related to the health of the economy (when times are good, firms with higher default risk tend to do well, and deliver their expected returns); and

- Interest rate risk, which is inversely related to the health of the economy (when times are good, central banks tend to raise interest rates, causing bond prices – including high yield bond prices – to fall).

Applying this framework to the past year, we can see that much of Tactical Income’s recent performance is explained by these elements.

Let’s first look at risk signals, then dive into recent market activity with respect to credit and interest rate risk.

Trend-following risk signals

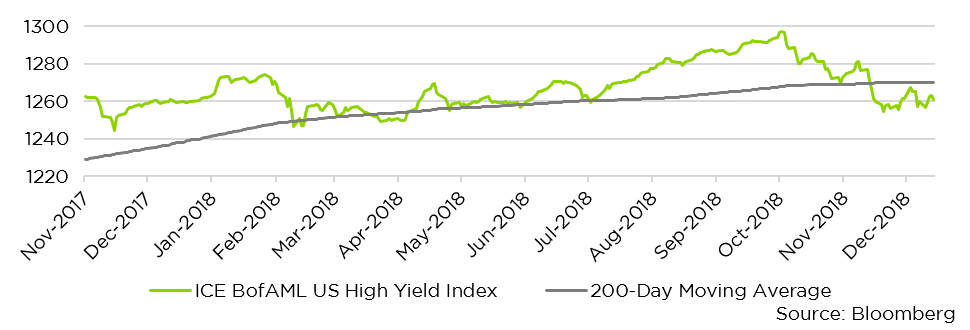

A trend-following model will underperform when its target index delivers false signals. When an index hovers around its overall trend, these false signals become more likely. This action has affected Counterpoint Tactical Income to some extent this past year. High yield credit as measured by the ICE BofAML High Yield Index has displayed choppy action in the past 12 months, and our trend-following model has traded along the stutter steps.

High Yield Credit and its 200-Day Moving Average

Most recently, high yield has been in a downtrend relative to its 200-day moving average since mid-November. As of this writing, the Fund is in a risk-off position, allocated to short-duration U.S. Treasuries as “safe haven” securities. Note that the 200-day moving average is used for illustrative purposes. Counterpoint Tactical Income does not use the 200-day moving average, but such an average is indicative of the essence of the Fund’s overall strategy. While periodic bouts of false signals and underperformance are to be expected, in the long run we expect our trend-following model to effectively manage downside risk, delivering reasonable risk-adjusted returns.

Now let’s turn to what we see as the main drivers of the action in high yield credit markets – credit risk and interest rate risk.

Credit risk

Investors have lately been less keen to take on credit risk, and their skepticism has helped to precipitate the recent downtrend in high yield. As investors have demanded greater returns on riskier credit investments, bond prices have fallen, contributing to the recent downtrend.

The yield on high yield bonds is not determined exclusively by the health of the economy. Recall that high yield credit is also an investment that includes interest rate risk, which is captured most purely by the yields on U.S. Treasuries.

Interest rate risk

You may have heard that the Federal Reserve has been raising interest rates. It’s true, and as the Fed funds rate has increased, so have yields on Treasury securities. Recall our expectation that in good economic times interest rates tend to increase, causing bond prices to fall. This activity usually affects Tactical Income fund performance when the Fund is positioned risk-off in short-dated Treasury securities.

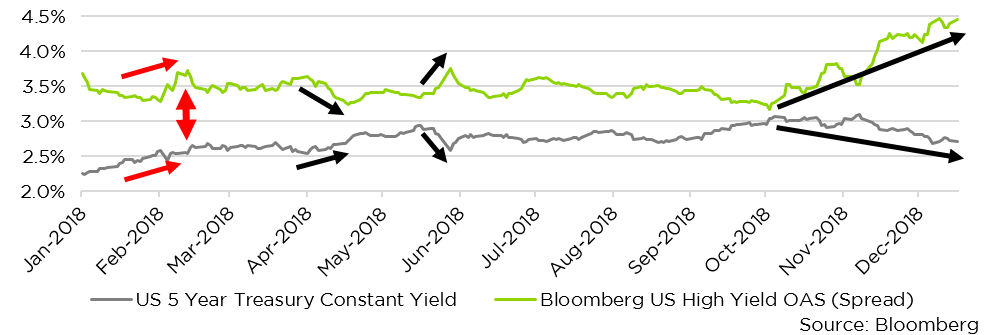

Treasury Yields Versus High Yield Credit Spreads

For the most part the above chart illustrates the attractive characteristics of high yield credit. Very often, tightening credit spreads (the premium above Treasury yields investors require to take on credit risk) negatively correlate to rising Treasury interest rates. This tends to stabilize the high yield asset class. Earlier this year, however, credit spreads did not narrow enough to offset the upward rate pressure. The event in early 2018 depicted by the red arrows shows that one major exception — rising rates (grey) were not accompanied by falling high yield credit spreads (green). Such unusual or unstable behavior can create noisy price action and complicate matters for trend-following strategies like the one Tactical Income employs.

In big picture terms, Tactical Income will tend to perform best when there are strong trends in high yield credit. The uptrend of the past several years has lately broken down, creating a modest drag on short-term performance. Overall, we continue to believe high yield offers an attractive risk-reward profile for trend-following strategies, owing to the smoothing effect of its dual exposure to interest rate risk and credit risk.

Conclusion: A trend should re-emerge

The recent market dynamics are creating short-term challenges for a wide variety of investment strategies. Investors are wondering whether declining stock prices and a flattening yield curve signal a coming recession. Sentiment is not great right now. Meanwhile, many economic indicators continue to signal strength in the broad economy. Investors are looking to the yield curve, trade policy, and the Fed’s policy statements for a sign of what’s next.

We don’t claim to know what’s in store in the coming year. But from Tactical Income’s point of view, we have general expectations under the three most likely scenarios:

- If risky asset returns remain choppy and hesitant, trend-following will face challenges relative to a passive holding approach. Regardless, the Fund will always pursue one of its objectives, that of capital preservation. Fortunately for trend-following high yield, the cost of noise signals in the short-term has been small compared to the benefit of being right.

- If risky assets enter a solid uptrend, we would expect Tactical Income to broadly keep pace with those returns.

- If risky assets enter a downtrend, we would expect Tactical Income to outperform, benefiting from a risk-off posture.

We have two main takeaways here. First: Rising interest rates and recent short-term declines in risky asset prices have created a challenging mix for investors. Counterpoint Tactical Income’s strategy is built around well documented trending behavior in risky asset classes. Because investors tend to exhibit herding, and because they can be slow to update their positioning as new information enters the market, we expect this trending phenomenon to eventually re-emerge. Regardless of direction, trending prices in high yield should work in Tactical Income’s favor. This brings us to our second point.

We believe trend-following strategies work in the long run because many investors abandon them during brief periods of volatility. This is true for almost any strategy that is validated over a long period. If it were easy to stick to it, everyone would, and such strategies would likely lose their advantages. Amid recent performance we cite a simple truth: Abandoning a strategy because of recent challenges is not a winning formula.

As always, Counterpoint Tactical Income remains driven to seek both income and capital preservation. Considering those strategic aims, we view the Fund’s 2018 performance as consistent with our expectations. We believe that over time, the Fund should deliver better than acceptable returns relative to its risk profile. We retain our long-term conviction in our strategy, and we are confident in our focus on downside risk management as we head into 2019.