Top holdings within a portfolio are often shorthand for how a manager thinks about stocks. If the ten holdings are cheap, we’re probably dealing with a value manager. If they’re tilted toward healthcare, maybe there’s some specialization going on. These rules of thumb can be crucial to an investor’s diligence process, especially in concentrated long-only strategies.

In the case of systematic factor strategies, though, rules of thumb can be misleading.

Factor strategies are often called “multifactor” strategies because they consider many features of a potential investment simultaneously – a stock’s valuation, momentum, volatility, etc. This approach tends to create portfolios with a variety of different stocks. A sample of only 10 “top picks” may not fully capture what’s “under the hood” in a multifactor strategy.

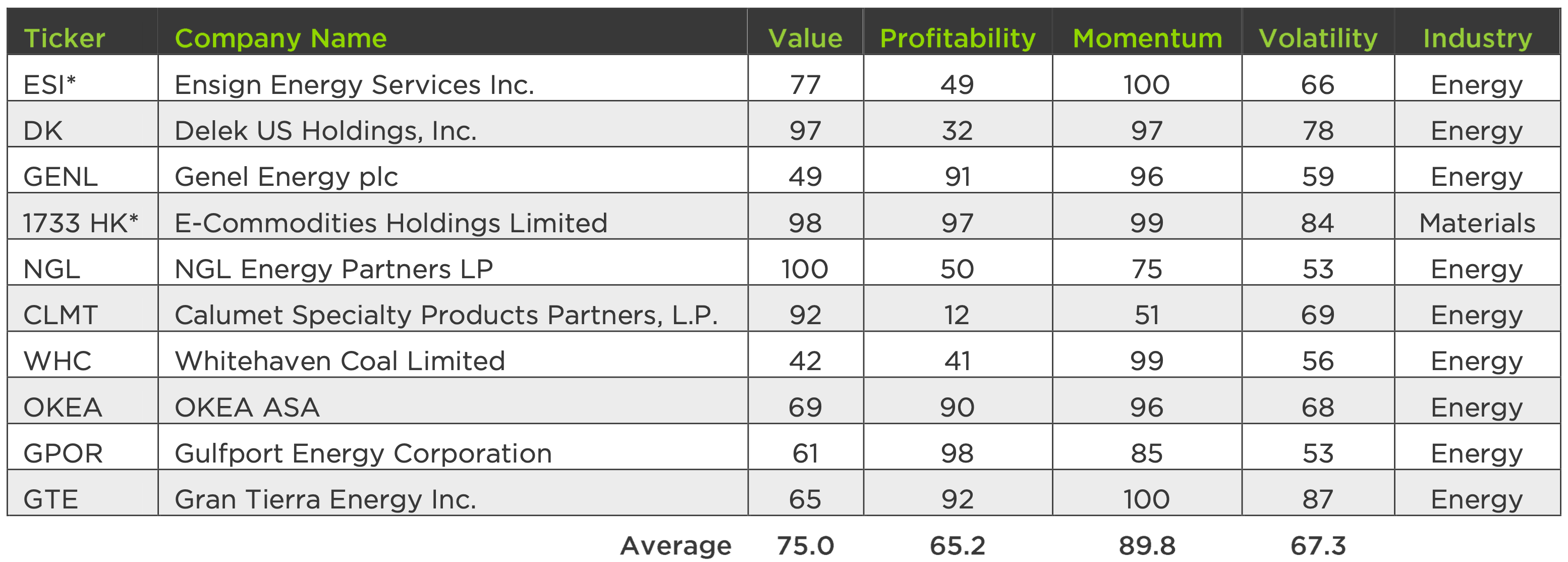

To illustrate the point, here is a modified version of the security selection model Counterpoint Mutual Funds uses for its Tactical Equity Fund as of May 20th, 2022. It lists 10 of the top global companies (min. market cap $200 million) based on their aggregate factor exposures that leverages a machine learning model to pull together various factors into one score between 0-100 (where 0=low and 100=high.)

Recent Top-Ranked Stocks in Counterpoint’s Multifactor Selection Model

An investor might reach several conclusions by looking at this list. These stocks are:

- All energy and materials stocks

- Very cheap

- Somewhat, but not amazingly, profitable

- Rallying strong as of the last 6-months

- Not overly volatile

Is the Counterpoint Tactical Equity Fund’s selection process built around finding deep-value, reasonable quality stocks in the energy sector? Actually, the answer is “No” and here’s why.

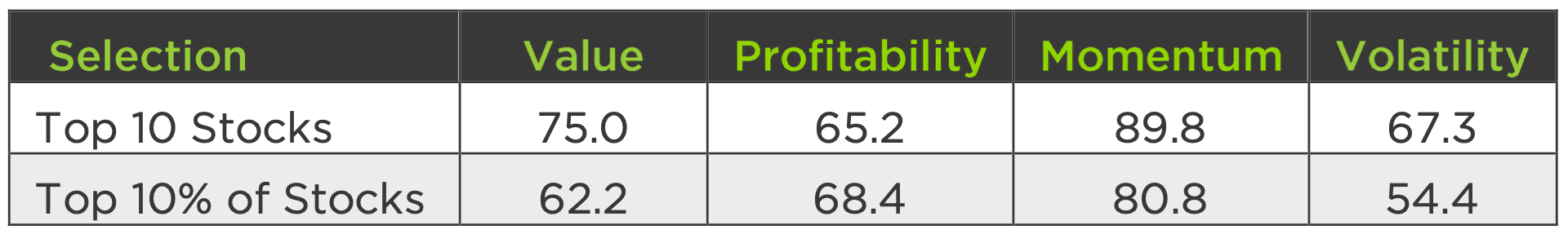

First, the actual fund’s long positions at the time of selection are among top 10-20% of ranked stocks (depending on optimization) in a universe of ~7000, which can include upwards of ~500 top long positions or more. Again, looking at the top-ranked stocks with market cap of $200 million or more, the top selections look like this:

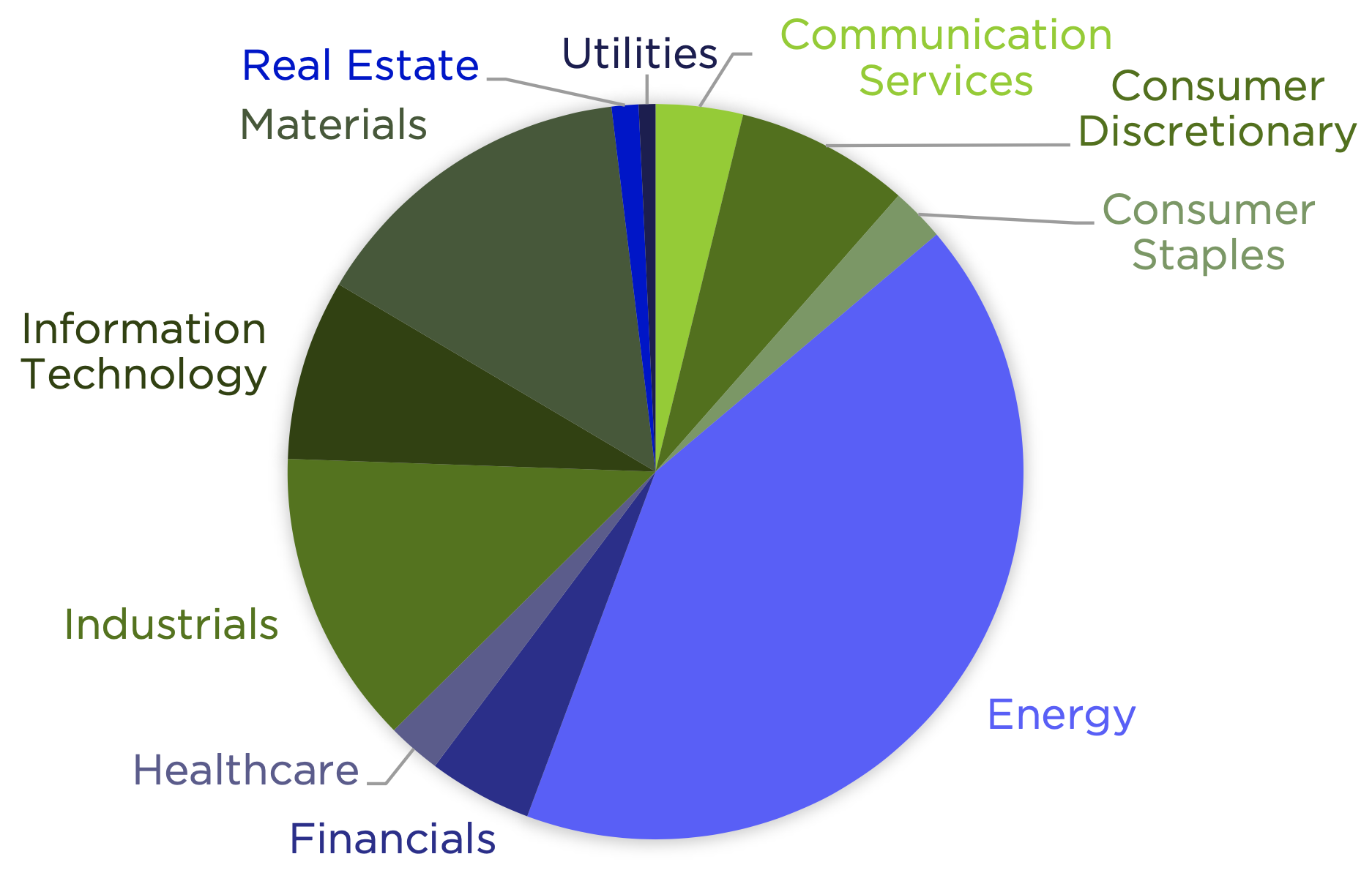

Top 10% of Global Stocks by Industry, >$200M Market Cap as of 05/20/2022

The model’s long book is somewhat concentrated in energy, but overall, much more diversified than the top holdings would indicate. The strong tilt toward value and momentum we saw in the top 10 moderates somewhat, and profitability improves when we look at the bigger picture.

Let’s also keep in mind: Counterpoint Tactical Equity’s portfolio optimization process neutralizes out sector and currency exposures. For every energy stock the model likes, there’s a corresponding short position within the same sector, so there is never net positive exposure within a specific sector.

These differences between our stock selection model’s top 10 holdings and the top 715 reveals some key aspects of Counterpoint’s approach to factor investing. A solid multifactor strategy should invest in hundreds of global stocks on both the long and short side. It should diversify across sectors and geographies – then neutralize those risks altogether by shorting companies in those same sectors and geographies that have unfavorable characteristics.

Conclusion

While the top holdings of other equity strategies may give a great sense for how a manager approaches stocks, that’s not the case for long-short factor strategies. These strategies instead seek to invest in stocks with great prospects as measured by an aggregate score by multiple factors (e.g. value, momentum, profitability) and short stocks with poor prospects as measured by those same factors. Factor strategies also seek strong diversification across hundreds of names, so a snapshot of a few top picks can be misleading.

When considering factor driven strategies, the main concerns ought to be:

- How well does the strategy get exposure to factors that have historically been associated with excess stock market returns?

- How diversified is the manager?

- Has the manager been effective in neutralizing out other sources of return – broad market risk, geographic risk, currency risk, industry risk?

And finally:

- How well has the manager stuck to the process even in difficult environment for factor strategies?

In the long run, managers who can answer “yes” to these questions deserve consideration within a factor-tilted sleeve of an investor’s portfolio. Answering these questions should tell an investor a lot more about a long-short factor manager’s capabilities than the top 10 holdings will.