San Diego, California – May 1, 2023 – Counterpoint Funds, a quantitative mutual fund and ETF provider specializing in defensive diversifier strategies, today announced the availability of the Counterpoint Tactical Municipal Fund (TMNIX) at UBS.

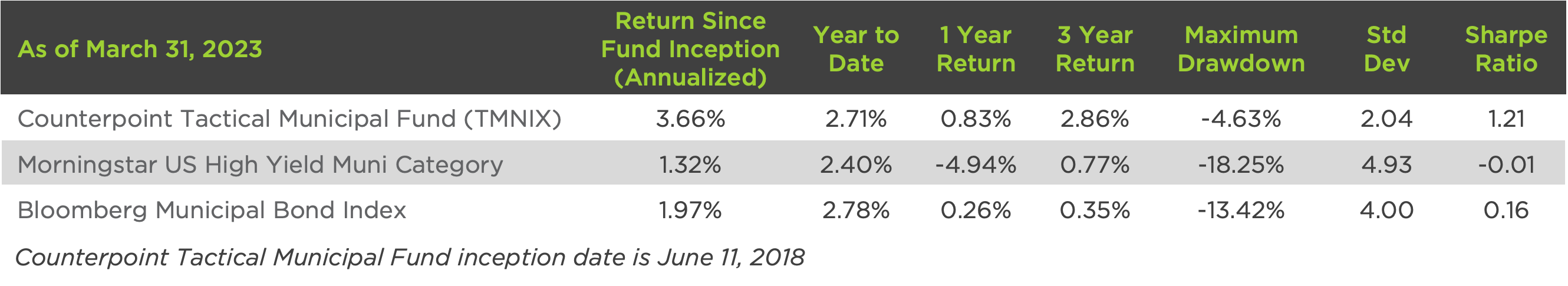

The agreement gives UBS advisors access to TMNIX, a 5-Star Morningstar rated fund overall1 in the high yield muni fund category out of 197 funds based on risk-adjusted returns ending March 31, 2023 by Morningstar Inc., a leading provider of independent investment research. Additionally, the fund is ranked 1st out of 204 funds and 6th out of 197 funds in the high yield muni fund category, for 1-year and 3-year periods respectively, based on total returns ending March 31, 2023.

“The Counterpoint Tactical Municipal Fund is a great addition at UBS, offering advisors a systematic, defensive fixed income diversifier strategy designed to deliver superior risk-adjusted tax-free returns for client portfolios while managing downside risk,” said Michael Taylor, Director of Institutional Partnerships at Counterpoint Funds.

Developed by Counterpoint Funds, the Counterpoint Tactical Municipal Fund (TMNIX) launched Jun., 2018, and had $208.4 million in net portfolio assets as of Apr. 26, 2023. Leveraging a binary municipal high yield trend-following strategy, Counterpoint Tactical Municipal Fund seeks tax-free income and capital preservation by providing municipal high-yield like returns during stable or recovering market environments and switching exposure to municipal money market in times of market stress..

“The risk management strategy utilized by TMNIX has shown strong resilience in today’s rising rate environment and has continued to perform, beating both its’ benchmark and Morningstar fund category last year as well as since inception,” added Mr. Taylor. “Additionally, the fund’s historically low correlation to traditional municipal bonds can make it a great tax-free fixed income diversifier for client portfolios at UBS.”

For more information on the Tactical Municipal Fund please visit cpfunds.com/tmnix

About UBS

UBS provides financial advice and solutions to wealthy, institutional and corporate clients worldwide, as well as private clients in Switzerland. UBS’ strategy is centered on our leading global wealth management business and our premier universal bank in Switzerland, enhanced by Asset Management and the Investment Bank. The bank focuses on businesses that have a strong competitive position in their targeted markets, are capital efficient, and have an attractive long-term structural growth or profitability outlook.

UBS is present in all major financial centers worldwide. It has offices in 50 markets, with about 31% of its employees working in the Americas, 32% in Switzerland, 19% in the rest of Europe, the Middle East and Africa and 18% in Asia Pacific. UBS Group AG employs approximately 67,000 people around the world. Its shares are listed on the SIX Swiss Exchange and the New York Stock Exchange (NYSE).

About Counterpoint Funds

Counterpoint Funds is a defensive, systematic and research driven mutual fund and ETF provider with 4 funds and over $1.4 billion in assets under management. Counterpoint is focused on offering defensive fixed income and equity diversifier strategies designed to drive portfolio performance over the long run. Counterpoint’s mutual funds and ETF employ quantitative investment strategies that base asset allocation and security selection decisions on academic research and statistical analysis. Counterpoint Mutual Funds, LLC, is located at: 12760 High Bluff Drive, Suite 280, San Diego, CA 92130. Tel: 858-771-4000

NOT FDIC INSURED – MAY LOSE VALUE – NO BANK GUARANTEE

Press Contact

Counterpoint Funds

John Held, VP of Marketing

+ 1 (619) 752-4087

press@counterpointmutualfunds.com