Trend-following strategies applied to high yield corporate and municipal credit may allow investors to mitigate the downside while seeking reasonable returns. In this piece we examine another risk management tool: asset class diversification. We find evidence that diversification helps investors using buy-and-hold or trend-following strategies, but that diversification is especially helpful in trend-following.

(As a reminder: trend-following, also known as time series momentum or tactical investing, seeks to own riskier assets when they are in an uptrend. When the riskier assets enter a downtrend, the strategy sells those riskier assets and invests instead in cash and short-dated Treasury securities.)

Buy-and-Hold Diversification in High Yield Credit

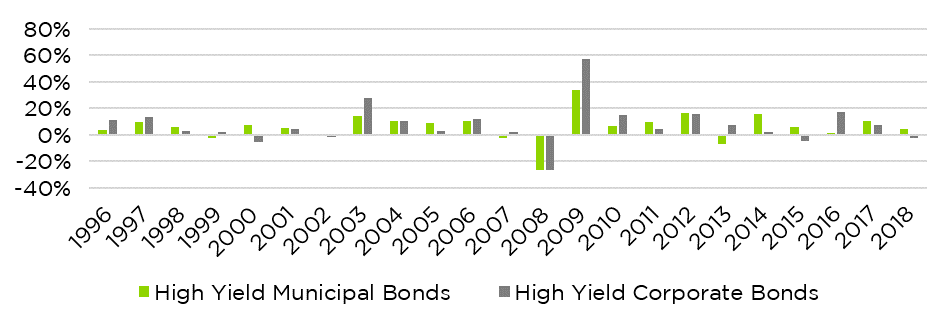

A portfolio that combines high yield municipal and high yield corporate credit offers some diversification benefit from a buy and hold perspective. If an investor holds multiple asset classes that have low correlations to one another, the total portfolio tends to be less volatile. From an annual return perspective, it’s clear that over the past several decades high yield municipal and corporate bonds have not traveled in lock step. We see the relationship between the two asset classes in the chart below.

Annual Returns, Municipal vs. High Yield Corporate Bonds

There’s a relationship, but it’s imperfect. From 1996 to 2018, high yield corporate bonds outperformed high yield municipal bonds about half the time, 12 out of 23 years. Munis beat corporates for the remainder. The two asset classes’ annual returns had the same sign (both positive or both negative) 16 out of 23 years, and the rest of the time they went in opposite directions. This variation between the two asset classes’ performances suggests a potential diversification benefit.

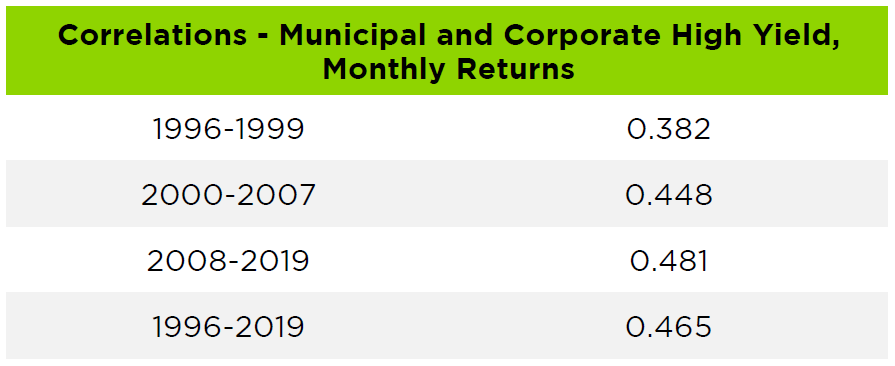

So let’s look at the monthly correlations between high yield municipal and high yield corporate bonds from 1996 to today. We also broke the data down to show results from different economic cycles (the dot-com boom, the housing boom, and the current post-crisis recovery).

It’s important to note that monthly and annual return correlations will tend to be higher than daily return correlations. Daily returns from August 2008 to February 2019 show a correlation of 0.217 between the two indices, much lower than what the monthly data indicate.

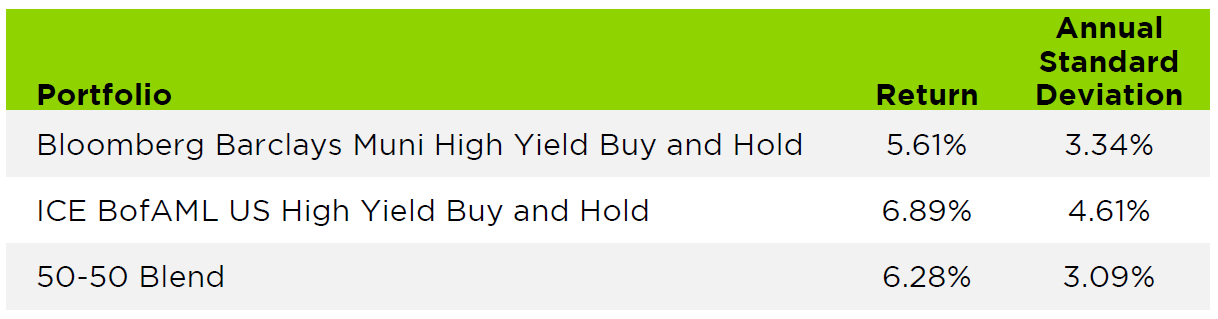

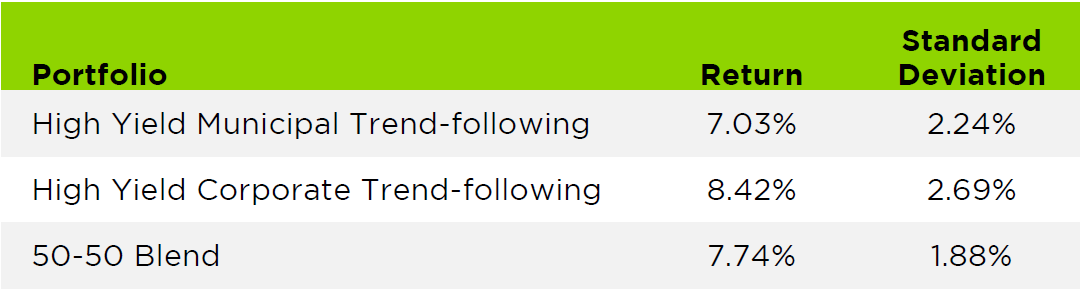

Here’s a modeled diversification impact of going from fully invested in high yield corporate or municipal bonds to a 50-50 blend over the course of the 2004-2019 time period. (Readily available daily index data dates back only to 2004, and is necessary for use in tactical strategies we are about to explore.)

The blended portfolio offers an attractive risk-reward trade-off – higher pre-tax returns than those offered by the municipal bond portfolio and a lower total standard deviation.

An imperfect correlation between high yield municipal and high yield corporate credit produces a clear buy-and-hold diversification benefit. Let’s investigate what happens when we add a moving average tactical trend-following model to each asset class. In both cases, we apply an identical strategy to each asset class – we hold the relevant high yield index when it is above its 200-day moving average, or hold the ICE BofAML 1-3 Month US Treasury Index when the same index falls below its 200-day moving average. These strategy returns reflect held indexes without management fees and transaction fees, so expectations of strategy performance should be appropriately discounted.

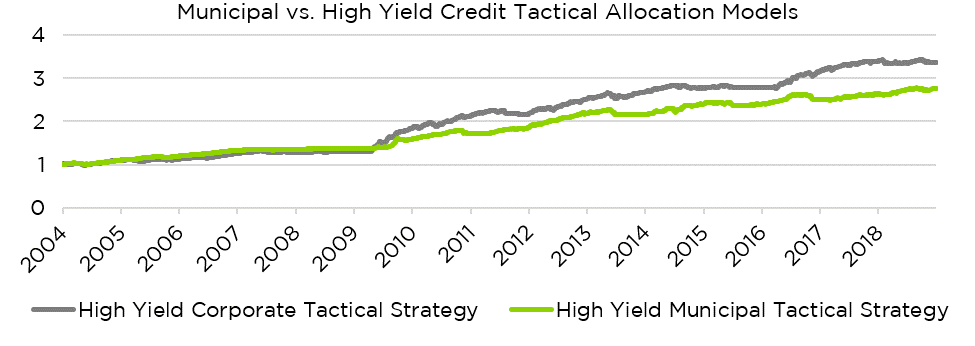

Growth of $1 Since 2004 to Present

You can see from the graph that these models have positive correlations with each other, but again do not march in lock step. For example, while both experienced risk-off periods in the 2007-2009 financial crisis periods, there are other periods where one asset class remains risk-on, while the other is risk-off. (For instance, municipal bonds suffered a rough patch in 2011 while corporate high yield kept climbing — and the reverse took place during 2015-2016.)

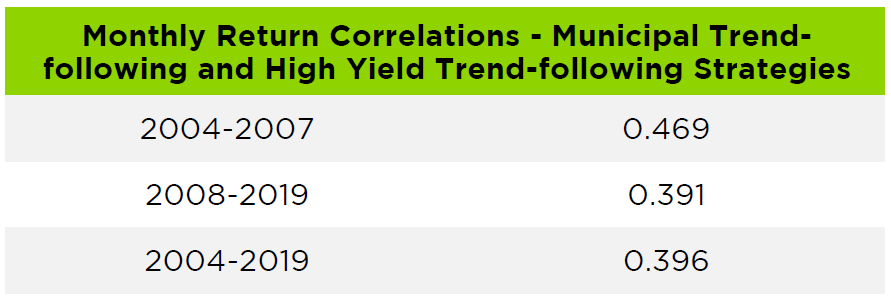

This is borne out when we examine the correlations between trend-following in high yield municipal credit and trend-following in corporate high yield credit.

Applying the same risk-reward framework we used above for the buy-and-hold portfolio, we again see a diversification benefit of a 50-50 blend between municipal and corporate high yield trend-following strategies.

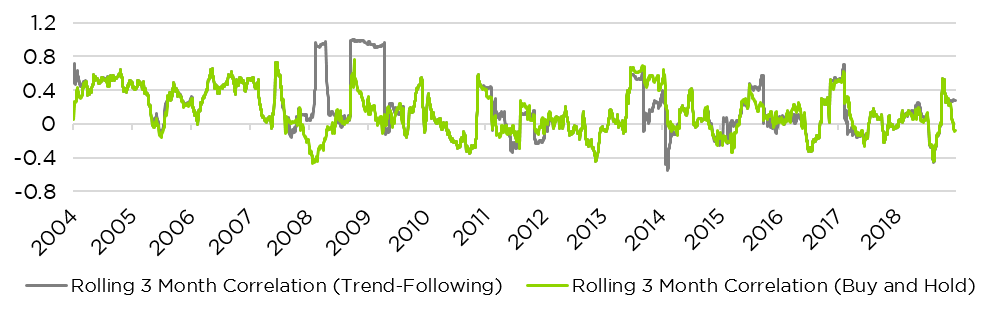

Again, the 50-50 blend reduces the risk (as measured by standard deviation) compared with full investment in corporate high yield, at a relatively modest return trade-off. Both Buy and Hold and trend-following 50-50 Blend strategies have lower standard deviations than their individual components. This is mainly because high yield municipal and corporate exposures frequently oscillate into short term negative correlation with one another, as pictured below. Both approaches do so unpredictably, as their returns are driven by different risk exposures (i.e. different duration and credit risks that have relatively low correlation to each other.)

High Yield Muni vs. Corporate Correlation That Oscillates into Negative

Although trend-following in high yield corporate credit has gained in popularity in recent years, investors have been slower to embrace the strategy’s application in municipal bonds. That creates an opportunity: Trend-following in high yield municipal bonds offers a strong diversification benefit to investors who use trend-following strategies in high yield corporate credit. For higher tax rate portfolios, a blended approach offers improved tax outcomes, because there is no federal tax on high yield municipal bonds. Overall, we believe that investors should strongly consider an application of volatility reducing trend-following strategies across diverse asset classes to improve portfolio risk-reward. The evidence indicates that diversification into high yield municipal bonds as well as high yield corporate credit clearly offers an opportunity to achieve that goal.