As a group, meme stocks underperform the rest of the stock market, except in brief, exhilarating periods of outperformance. The long-term risk-reward profile of meme stocks is important to consider, especially when some investors are considering whether the GameStop wave of 2020 and 2021 may now be behind us. As tech stocks, growth stocks, and innovation strategies have lately shown some signs of weakness, investors should evaluate how their portfolios are positioned when it comes to valuation risk.

The NASDAQ and S&P have Entered a Correction

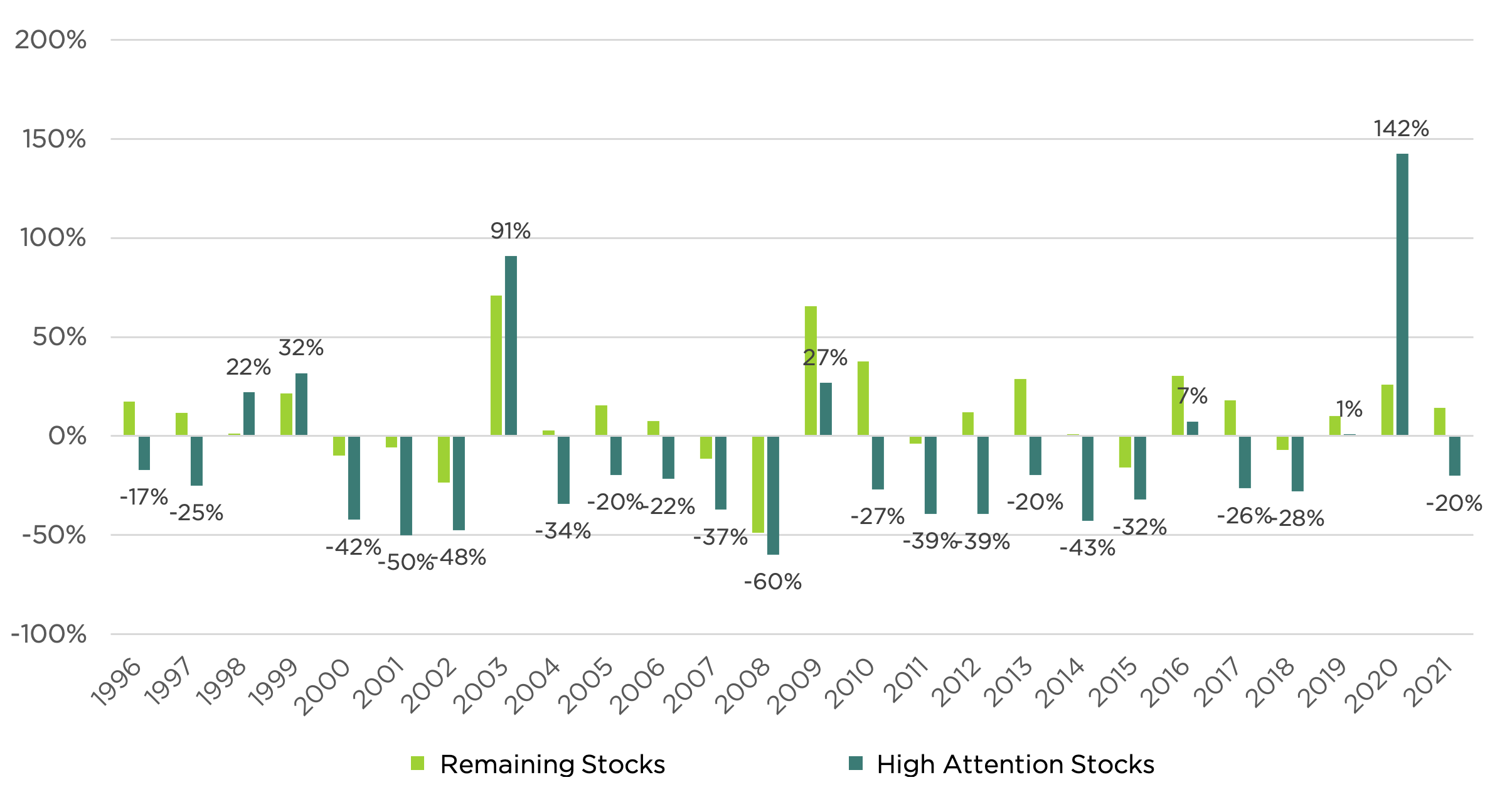

Since the mid-1990s, high attention stocks have grabbed hold of the market’s imagination in 1998, 1999, 2003, and most dramatically in 2020 when it became part of the US cultural zeitgeist and were coined “meme stocks.” Those periods are: The peak of the dot-com bubble; 2003, a very strong year for the stock market; and 2020, when global pandemic helped engineer a Reddit/GameStop day trading environment that is without precedent in investment history.

We all know meme stocks when we see them, but what are they exactly? We defined meme stocks as stocks whose trading volume (a measure of investor attention) has risen out of proportion to their size (measured by market capitalization). Stocks with monthly trading volume greater than their market cap are classified as “meme stocks.”

While the good times for meme-like stocks are usually exciting, those rallies are the exceptions. In the past 25 years, high attention “meme-like” stocks have generated positive 1-year returns only five times. In the other 20, they’ve lost investors’ money. Meme stocks have only outperformed non-meme stocks when both groups have had positive performance. And when meme stocks have negative returns, the rest of the market outperforms.

High Attention Stocks In the US vs Remaining Stocks (Equal Weighted Baskets)

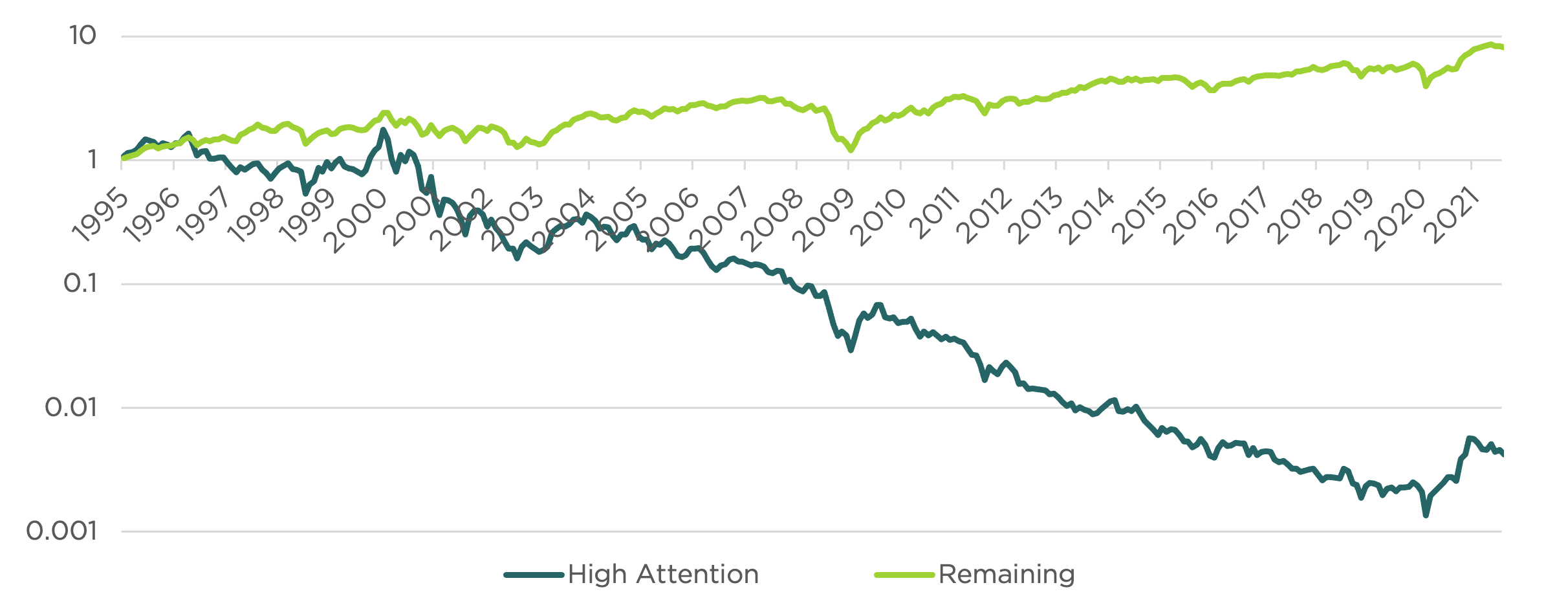

Meme stocks are generally defined by two characteristics: An exhilarating rocket ship ride up, and a subsequent bout of dismal performance. As long-term bets, they don’t tend to do very well.

Return of High Attention Stocks vs Remaining Stocks, 1995 – Present (>100M marketcap US)

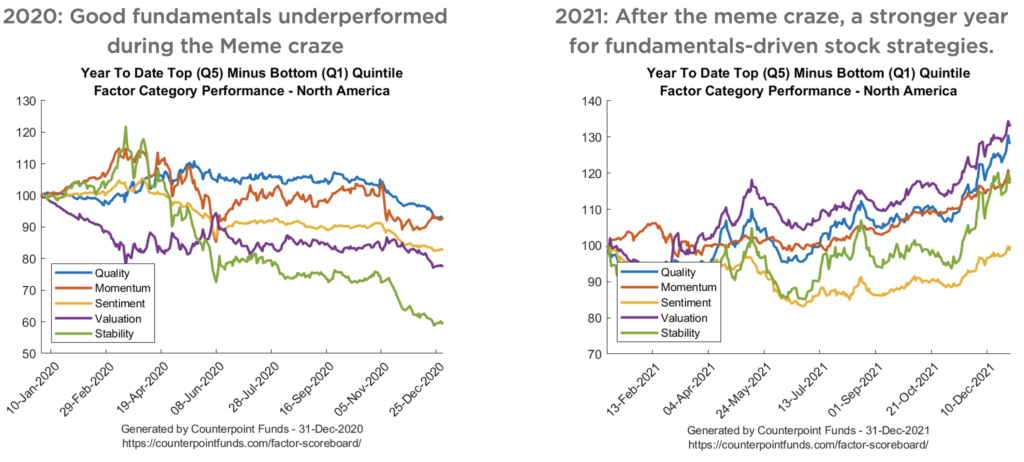

Meme stocks represent the extreme end of the stock market – the stocks whose prices are most affected by investor attention and enthusiasm. But there are other sources of risk that are related to meme stock risk. Investors may wish to consider whether valuation risk in U.S. stocks deserves additional attention. The swing from meme stock outperformance in 2020 to underperformance in 2021 accompanied a shift from historically bad performance for fundamentals-driven stock strategies to a period of very strong performance.

Conclusion

Systematic strategies that seek exposure to factors like quality, momentum, and value are designed to manage meme- and valuation-related risk in stock markets. Investors who may have become overweight growth, innovation, and sentiment-driven “meme” trades may wish to consider strategies that can diversify valuation-related risk within the stock market.