Counterpoint Mutual Funds Now All 5-Star Overall Morningstar Rated

San Diego, California – February 11, 2025 – Counterpoint Funds, a quantitative mutual fund and ETF provider specializing in diversifier strategies, today announced that the

Investing boils down to whether the returns to a strategy are worth the risk. Many investors, over the long run, should be able to realize sufficient returns to meet their goals. Yet many fail to do so: The average investor consistently underperforms the financial markets. This is largely due to human nature. Investors have biases and emotions hard-wired into their psychology; these intrinsic weaknesses are especially costly when they affect investment decisions.

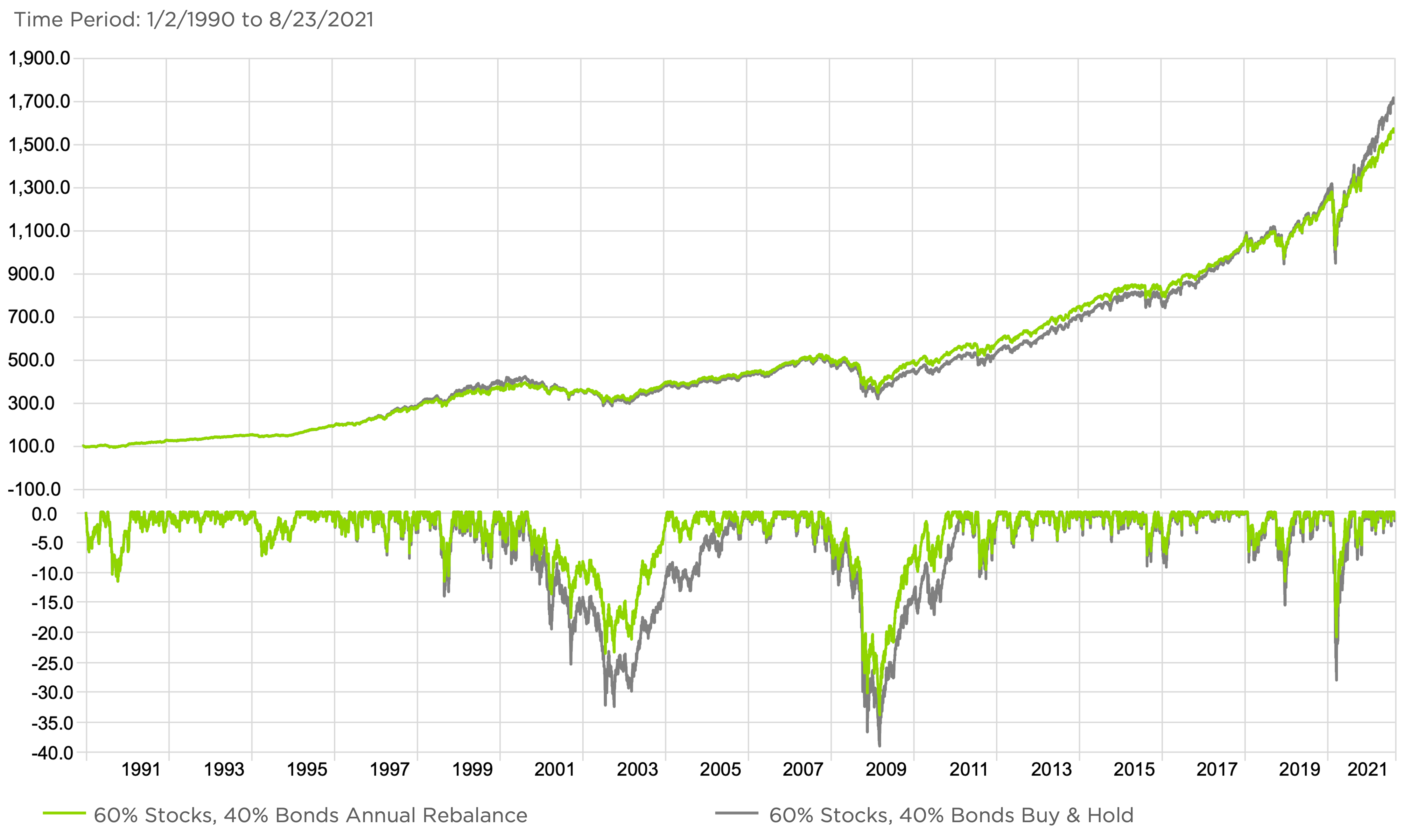

One way to defeat biased, emotional investment decisions is to commit to a systematic process with strong long-run statistical support. While tactical trend-following and multi-factor equity investment strategies best exemplify Counterpoint Fund’s systematic investment approach, advisors can benefit from other simple systematic approaches to portfolio management. Systematic rebalancing strategies provide advisors potential for performance improvement from a basic buy-and-hold strategic asset allocation approach.

Asset allocation is a key determinant in driving overall portfolio performance. Adding an annual rebalance represents a very basic example of how systematic strategies can improve portfolio performance. Stock market investments that were left alone during the 2008 financial crisis recovered by the end of 2012. Diversified portfolios that were rebalanced annually recovered faster.

Source: Morningstar. The referenced indices are shown for general market comparison and are not meant to represent the fund. Index performance is not illustrative of the fund’s performance. Investors cannot invest directly in an index.

[1] Following the 2008 recession, a 60/40 portfolio that was rebalanced annually recovered in less than 36 months, roughly 4 months sooner than the passive 60/40 portfolio without rebalancing. [2] The rebalancing 60/40 portfolio continued to outperform the passive portfolio during periods of recovery. Our example 60/40 model portfolio rebalanced annually on January 2nd, and is composed of 60% S&P 500 Index and 40% Bloomberg Barclays Aggregate Bond Index.Inflation puts investment grade bond portfolios at risk, especially when interest rates are already low. Tactical trend following in high yield credit has potential to capitalize on high yield’s historical resilience in rising rate environments, while managing the downside associated with added credit risk.

San Diego, California – February 11, 2025 – Counterpoint Funds, a quantitative mutual fund and ETF provider specializing in diversifier strategies, today announced that the

Year-ahead commentary is challenging for us: We don’t have a crystal ball, and we believe predictions contribute more to investment mistakes than outperformance. But the

How should an investment advisor think about building a portfolio for clients? Or how should an investor think about building a portfolio for themselves? Many

Firm-level variables that predict cross-sectional stock returns, such as price-to-earnings and short interest, are often averaged and used to predict the time series of market returns. We extend this literature and limit the data-snooping bias by using a large population of the literature’s cross-sectional return predictors. We find the literature

Investments cannot be made in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges. Past performance is no guarantee of future results.

© 2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

5516-NLD-09/01/2021

We’ve received your request for the featured event collateral. A Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your meeting request and a Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your event registration request and will be in touch shortly.

Subscribe to stay up to date on Counterpoint Funds and receive our monthly perspective.

We have received your application and look forward to reviewing your qualifications for the role. If your application seems like a good fit, we will contact you to discuss next steps.

Thank you again for your application and interest in joining the Counterpoint team!

We’ve received your message. A Counterpoint Funds team member will contact you soon.

Subscribe to stay up to date and receive our monthly perspective.