Since the market bottomed on April 8, 2025, investors have witnessed a highly speculative, “pro-junk” environment. Stocks with weak fundamentals—richly valued, unprofitable companies often fueled by hype—have surged sharply. 1 At one point in mid-June, nearly half of all trading volume came from penny stocks, the highest level ever recorded. This surge in speculative activity signals a fragile backdrop where sentiment, rather than fundamentals, is driving returns. 1

At the same time, market concentration risk has climbed to historic highs. Today, the 10 largest companies in the S&P 500 account for almost 40% of the index’s total value, meaning overall performance is heavily tied to a handful of mega-cap tech and growth names. 2 With valuations stretched well above historical averages 2, any earnings slip, regulatory challenge, or shift in sentiment could weigh disproportionately on the broader market. For investors, this environment highlights the need for smarter diversification strategies that go beyond index exposure and reduce reliance on the largest companies to drive returns.

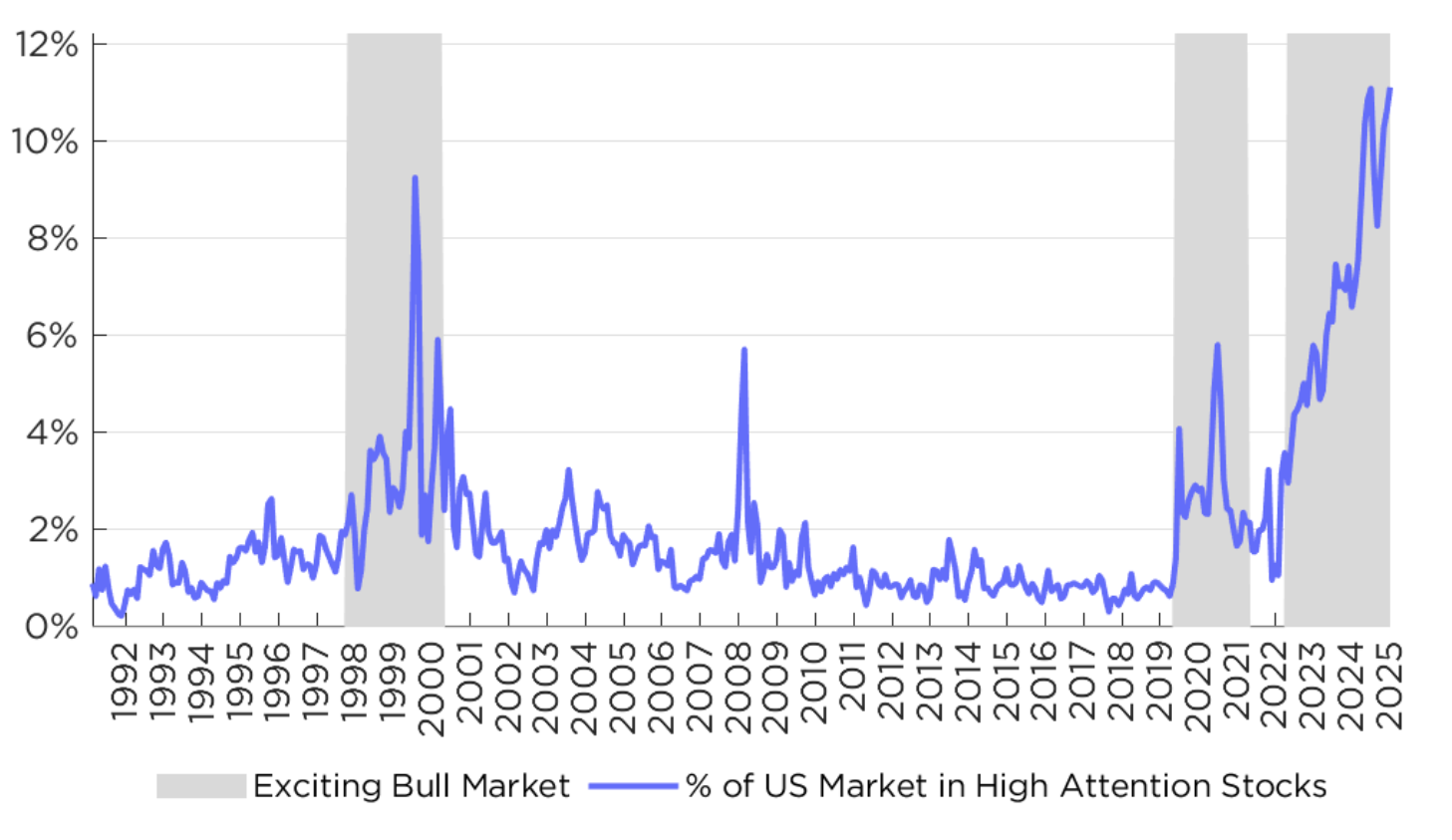

Counterpoint has its own way of measuring bubble-like enthusiasm and attention-driven pricing. Our Counterpoint Meme Stock Factor tries to identify specific stocks where attention (as measured by trading volume) is out of proportion with their importance (as measured by market cap).

Average Stock Attention Score of the US Market. 1991 – Present

According to our measurements, the number of stocks driven by investor attention, and thus potentially overvalued relative to fundamentals, has been rising sharply for several years, and is currently near all-time highs. This year, stocks with poor factor characteristics (expensive valuations, poor profitability measurements, etc.) have risen far faster than higher quality stocks.

Conclusion

Investors concerned about the risks posed by today’s elevated market concentration and valuations have several tools to diversify their sources of return. One straightforward option is to use strategies that equal-weight holdings rather than concentrating by market capitalization—such as the Counterpoint Quantitative Equity ETF (CPAI), which maintains 50 equally weighted U.S. stock positions (2% each) to reduce dominance by the largest names. For an even broader diversification approach, the Counterpoint Tactical Equity Fund (CPIEX) offers a market-neutral strategy that employs Artificial Intelligence (A.I.) and Machine Learning to construct an uncorrelated portfolio of long and short positions, seeking to capture opportunities from investor-driven stock mispricings.