Many investors are licking their wounds after 2022, a once-in-a-generation negative year for both fixed income and equities. A quarter into 2023, it’s hard to say we’ve escaped the doldrums. Bank failures, a sharply inverted yield curve, and a murky inflationary picture may leave some investors coming up short in the search for attractive opportunities – let alone opportunities that can diversify stock and bond holdings.

Despite these challenges, as we continue into 2023 we are confident in one group of recently overlooked investment strategies with a lot of long-term validation and limited exposure to stock and bond market risk: Long-short factor equity strategies.

Based on academic research, these strategies seek opportunities that arise when investors make common, recurring mistakes driven by emotion or psychological biases. Investors may be familiar with a few of these:

-

- Value: Cheap stocks tend to outperform expensive stocks over time. (Investors tend to overestimate earnings growth potential of the more expensive companies.)

-

- Profitability: Shares of more profitable companies tend to outperform shares of less- or profitable companies over time. (Investors tend not to properly value current profitability and overestimate the future profits of currently low- or unprofitable firms.)

-

- Volatility: Less-volatile stocks tend to outperform more-volatile stocks over time. (Investors tend to look for winning lottery tickets by investing in very volatile companies and overlooking steadier performers.)

Using these well documented investor mistakes, an investor can create long-short portfolios with a) low- to no sensitivity to the stock or bond markets; b) an objective to profit from these common investing mistakes.

These strategies earn the greatest profits when there’s a wide gap between the stocks they buy and the stocks they sell short – and then that gap closes. A wide gap in valuation between cheap and expensive stocks may signal a more favorable opportunity for a value strategy, for example; when that gap is narrow, an investor may not expect the strategy to deliver the same amount of return.

To help investors see where the opportunities might be in long-short factor strategies, we created tools designed to measure the gap, or “factor spread” between the stocks a long-short factor investor might buy or sell short. These tools are available on our Live Factor Spreads page, and they’re updated daily.

Factor Strategy Refresher

- Value: Buy the cheapest stocks, and sell short the most expensive stocks.

- Profitability: Buy the most profitable companies, and sell short the least and unprofitable companies.

- Volatility: Buy the least volatile stocks, and sell short the most volatile stocks.

These tools have been indicating meaningful opportunities in value, profitability, and volatility oriented long-short strategies for the past couple years. Let’s take a look.

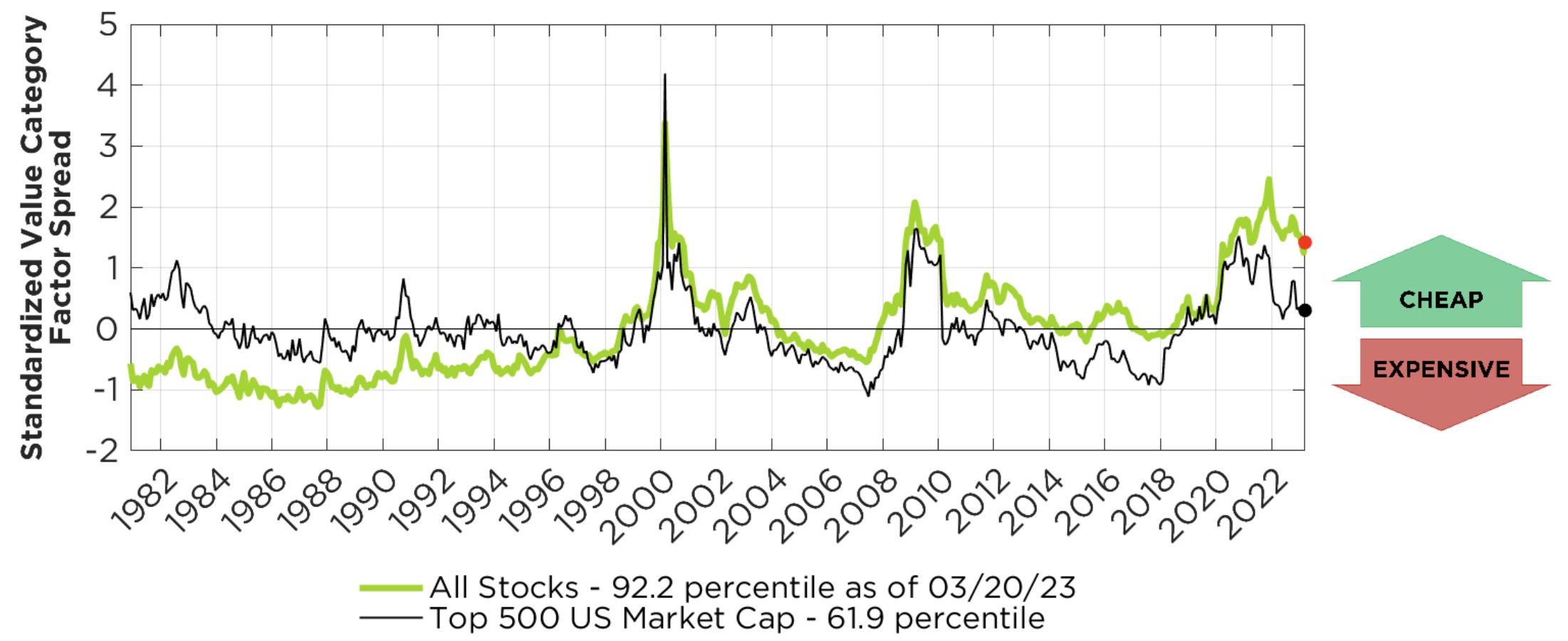

Valuation (Long-Short) Factor Spread – March 20, 2023

According to our valuation measurements, the gap between the most expensive and least expensive stocks in the global stock market (the “Valuation Factor Spread”) has been wider than it is today 9% of the time since 1981. If that gap closes toward the historical average, that would mean substantial profits for long-short value strategies.

Profitability (Long-Short) Factor Spread – March 20, 2023

The gap between the most- and least-profitable companies (the “Profitability Factor Spread”) is wider than the historical average – not to the same extent as value, but still wider than it’s been roughly 2/3 of the time since 1981.

It hasn’t all been smooth sailing. Difficulties across the board for traditional asset classes was the big investment headline of 2022. Amid the challenges, value stocks have shown relative resilience, and market neutral equity.

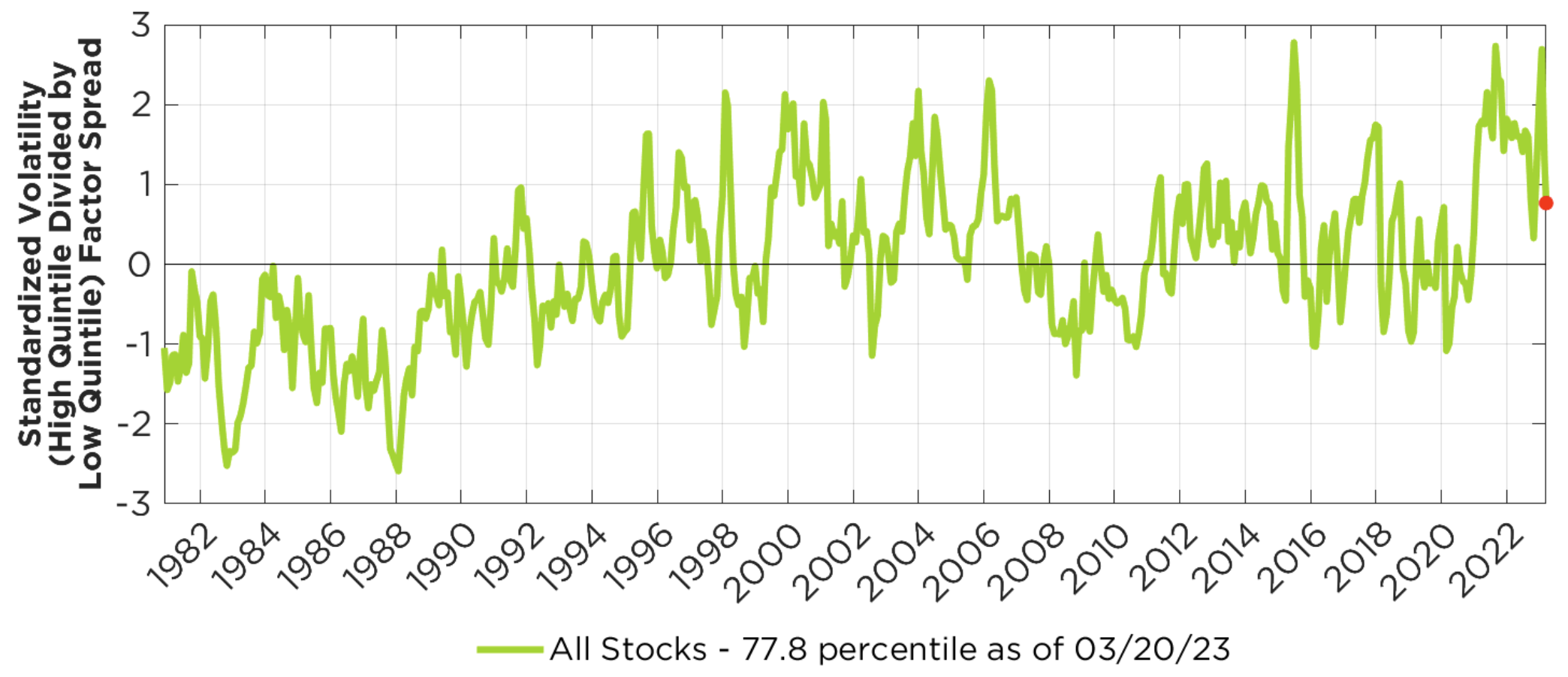

Volatility (Long-Short) Factor Spread

The gap between the least- and most-volatile stocks (the “Volatility Factor Spread”) is also pretty wide relative to its history – it’s only been wider less than 20% of the time since 1981. Rather than pick any single factor strategy, an investor can diversify across valuation, profitability, volatility, and other factors to avoid having their eggs all in a single factor-oriented basket. These strategies, called “multifactor” long-short strategies, are designed to provide investors with exposure to a variety of strategies that can diversify a stock-and-bond portfolio.

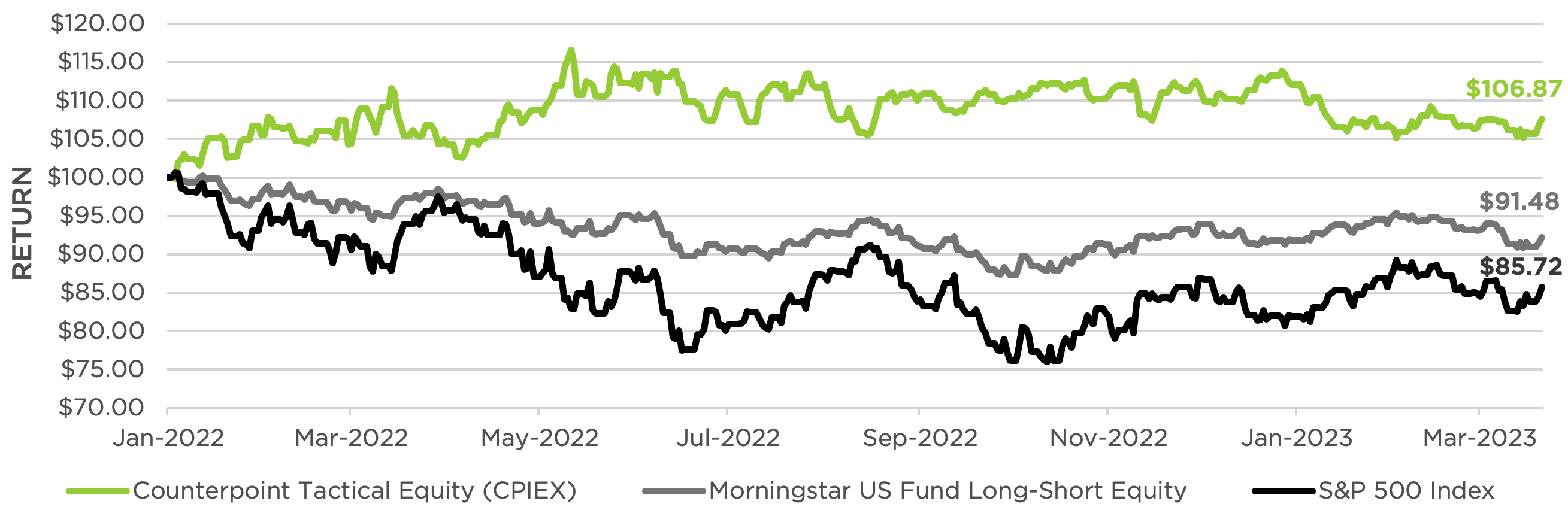

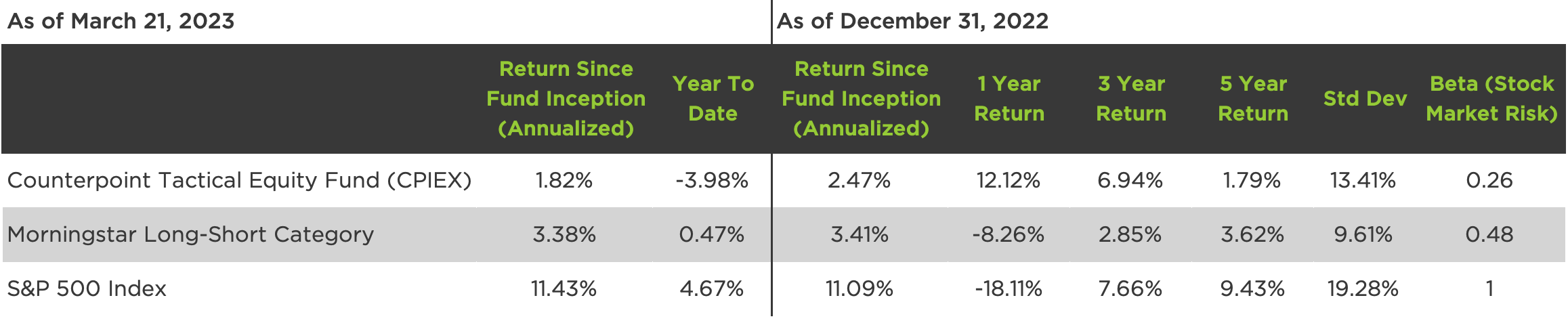

In 2022, the Counterpoint Tactical Equity Fund (CPIEX) illustrated the potential benefit of a long-short multifactor strategy, returning 12.12% in a down year for both stocks and bonds.

Conclusion

As investors contemplate a challenging macroeconomic environment and look for ways to diversify their stock and fixed income investments, they may want to take a closer look at long-short factor strategies. In addition to targeting strong diversification potential vs. traditional asset classes, we think there’s reason to believe that certain long-short equity strategies may be well positioned relative to their history.

Return of $100 – 01/01/2022 to 03/21/2023

The performance data displayed here represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The total annual fund operating expenses are 2.03%, 2.78% and 1.78% for Class A, C and I shares respectively. The Fund’s maximum sales charge for Class A shares is 5.75%. The Fund’s adviser has contractually agreed to waive its fees and reimburse expenses of the Fund, at least until February 1, 2024 to ensure that Total Annual Fund Operating Expenses After Fee Waiver and Reimbursement (excluding (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions; (iii) acquired fund fees and expenses; (iii) borrowing costs (such as interest and dividend expense on securities sold short); (iv) taxes; and (v) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers (other than the Fund’s adviser))) do not exceed 2.00%, 2.75% and 1.75% of average daily net assets attributable to Class A, Class C, and Class I shares, respectively. Without the fee waiver, total annual fund operating expenses would be, 2.13%, 2.88% and 1.88% for Class A, C and I shares, respectively. For performance information current to the most recent month-end, please call toll-free 844-273-8637.