Amid recent sharp daily declines in broad U.S. stock indices, advisors and portfolio managers are once again preparing their clients for possible sharp declines in risky assets. They point to possible sources of downside on the horizon to show preparation. They argue that adherence to a strategy through bouts of underperformance works out in the long term. They do these things out of self-interest – to retain their clients’ business. And they do these things to help. During a downturn, an investor may make emotional (poor) decisions that do hurt in the long run.

All this time and effort spent instructing investors to stay the course and avoid selling during a downturn is a function of human psychology. Loss aversion, anchoring, and other functions of the human psyche make investors prone to poor decisions during times of market stress. But investment professionals’ labored messaging campaigns are also a direct function of the predominant buy-and-hold portfolio strategy. But there is an alternative. When correctly applied, tactical strategies can help investors avoid drawdowns, and thus reduce the need for well-worn messaging about vigilance amid uncertainty and disciplined focus on the long term.

Where Should You Go Tactical? (Hint: Not Individual Stocks)

Although there are many approaches to tactical allocation, one common strategy involves trend-following according to a 200-day total return moving average. The strategy buys an asset class when it is above its 200-day moving average (signaling an uptrend), and sells when the asset class is below its 200-day moving average (signaling a downtrend).

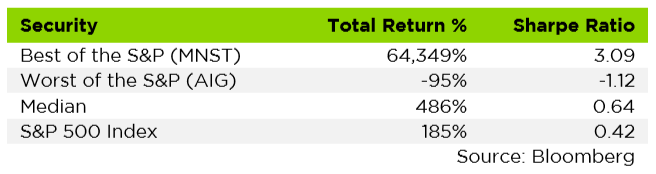

This strategy is popular among investors because of its intuitiveness and relative ease of application. So it’s worth looking at returns to individual stocks using this strategy, and how well it holds up against buy-and-hold. Here’s how a stock picker might have fared from January 1st, 2000 to September 30th, 2018 simply buying and holding stocks that are members of today’s snapshot of the S&P 500[i]. A very lucky investor would have bought a lot of Monster Beverage (MNST) stock and held on, multiplying portfolio value by a factor of 643. The unluckiest would have bought and held Financial Crisis poster child American International Group (AIG) and lost 95% of the investment.

Buying and Holding

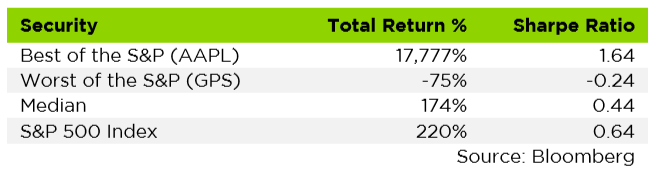

Now let’s look at a stock picker who applies a trend-following strategy.

The lucky investor who trend-followed in Apple Computer (AAPL) would have returned many multiples of his or her original investment. The worst-performing trend-following name, an investment in The Gap (GPS), would have lost our trend-follower 75% of the original investment – not as bad as AIG, but still very bad.

According to the Sharpe ratio, which measures investment returns relative to risk, the trend-follower in individual stocks is sacrificing too much upside by bailing out of longer-term uptrends whenever a stock trades below its 200-day moving average. If you’re stock-picking, trend-following has offered a relatively poor risk-reward compared with buying and holding.

However, a look at the improved total return (220% vs 185% for Trend vs Buy-and-Hold) and Sharpe Ratio (0.64 vs 0.42 for Trend Vs Buy-and-Hold) on the S&P 500 index as a whole suggests that trend-following in a passive index may boost returns, even adjusting for risk. There’s an intuitive rationale for this: Diversification via an index reduces volatility of returns, potentially smoothing out uptrends and downtrends enough to make trend-following worthwhile. Let’s investigate.

Which Asset Class?

Can we extrapolate our findings from the S&P 500 – that risk-adjusted returns would have been improved if investors had adopted a trend-following strategy when investing in the S&P 500? Does trend-following work on the asset class level? If so, in which asset classes does it work best?

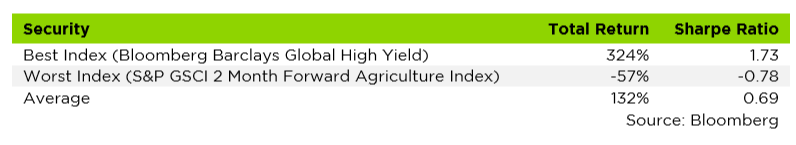

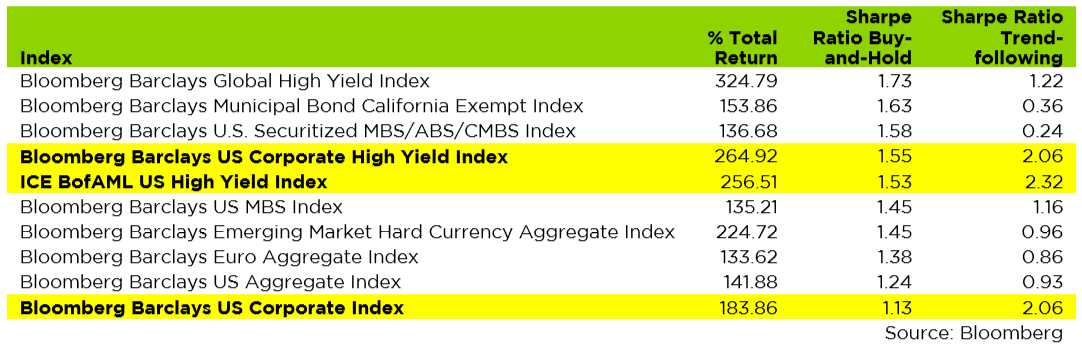

We looked at returns to a 200-day moving average trend-following strategy applied to 33 major indices – U.S. and global stocks, corporate credit, high yield, and several sector-level indices. Here are the best and worst asset classes in terms of their Sharpe ratios measured from January 1st, 2000 to September 30th, 2018.

Buying and Holding Indices

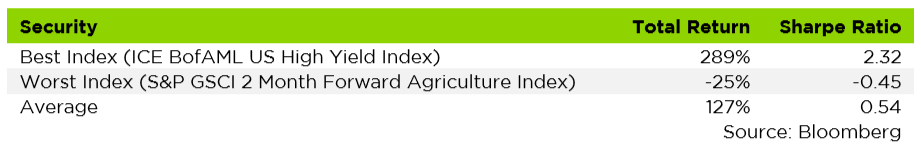

Trend-following Indices

At first glance, trend-following doesn’t seem to help when an investor picks an index at random – the Sharpe ratio of the average index goes down when we apply a trend-following strategy. But – what if we look only at indices with strong buy-and-hold Sharpe ratios, then apply a trend-following strategy?

Among the asset classes in our test group with the best Sharpe ratios in the past two decades, only three would have been improved with a trend-following strategy overlay. Interestingly, all three indices are in corporate credit, and two of them are in high yield. Recalling that the S&P 500 was also improved by application of a trend-following strategy, it seems possible that riskier asset classes have historically benefited from a trend-following tactical asset allocation model. There’s an intuitive rationale for this, as well: Changes in investor sentiment tend to take place over time, creating herding and momentum in riskier stocks.

Conclusion

Trend-following offers investors a substantial behavioral benefit. By seeking to avoid downtrends, investors can adopt a “risk off” posture during times of economic stress, potentially removing the temptation to make mistakes due to psychological bias. However, not every security type lends itself to trend-following. In volatile individual stocks, trend-following tends to cap returns, reducing Sharpe ratios. Meanwhile, on an index level, a trend-following strategy may potentially improve risk-adjusted returns to portfolios of riskier assets.

It’s under this rationale that Counterpoint Mutual Funds offers trend-following strategies in U.S. high yield credit, high yield municipal bonds, and equities. Investors have incentive to adopt trend-following strategies when their use can possibly improve risk-adjusted returns. Trend-following strategies can be especially beneficial with more volatile asset classes where investors are likely to experience swings that trigger poor decision-making. By applying these strategies to those asset classes – indexes representing high yield corporate and municipal credit and stocks – investors potentially gain not only the behavioral benefit, but also the chance for superior risk-adjusted performance.

[i] For simplicity, we looked at the snapshot of S&P 500 constituents as of early October 2018 to be the population for this trend-following analysis. We do realize there is a bit of survivorship bias baked in; that is, the worst names that have fallen out of the S&P 500 for the duration of the strategy run would not be in this sample. Buy-And-Hold average returns are indeed better than realized without survivorship bias weighing the returns down. But since we are trend-following the same group of names, this somewhat controls for the impact of survivorship bias. Our focus is on the spread of average Buy-and-Hold and Trend-Following Sharpe ratios being 0.22, not the absolute level.

To eliminate doubt, we took all S&P constituents whom were present in January of 2000 but no longer present in the current index (about half of the group), and compared the buy-and-hold approach to a 200-day moving average trend-following strategy. Buy-and-hold returned an average Sharpe ratio of 0.62, an average return of 225% and a median return of 55.8%. Trend-following the same group likewise underperformed buy-and-hold, and returned an average Sharpe ratio of 0.37, an average return of 146.5%, and a median return of 50.1%. This sample helps confirm that survivorship bias did not meaningfully distort our presentation of the performance spread between buy-and-hold and trend-following.