Bond investors and their advisors’ attitude toward interest rate risk tends to fluctuate over time. Sometimes, it’s a major consideration – other times, not so much. Today’s diminishing worry about rising rates clearly shows how quickly this concern can emerge and then recede from focus. As interest ebbs and flows, what eludes many investors is the unique role interest rates play in high yield bond returns. In early 2017, as the Fed was raising rates, we addressed the potential impact of a rising rate environment on high yield trend-following strategies like the one used by Counterpoint Tactical Income. We found that high yield was a relative safe-haven in rising rate environments, at least compared to other fixed income assets.

Now we face the same question, but in reverse. Federal Reserve chairman Jerome Powell’s July announcement of an interest rate cut has again raised questions about how a tactical high yield strategy might fare in a falling interest rate environment. We examined high yield credit’s relationship with interest rate risk, and found that while a passive allocation to high yield has notable limitations on this front, many of those issues can be mitigated via a trend-following strategy.

First, let’s briefly recap the relationship between interest rates and the economy. Recessions and periods of flat-to-negative GDP growth are associated with flat or falling interest rates, while periods of consistent positive GDP growth are associated with rising interest rates. This is the classic central bank countercyclical policy. When the economy slows down, the Fed loosens monetary policy to support its employment mandate. When the economy heats up, the Fed tightens monetary policy to keep inflation under control.

Meanwhile, high yield bond investors face two main risks – interest rate risk and credit risk.

- Interest rate risk: When rates rise, the price of fixed income assets tends to fall. This can be true at times for high yield bonds, but often isn’t the case, as rising rate periods can coincide with rising credit quality that offsets the impact on higher treasury interest rates. Investors closely watch U.S. Treasury markets to evaluate interest rate risk, because this is the chief risk facing investors in government bonds. (Because government bonds are seen as free of credit risk, they are “purely” exposed to interest rate risk.)

- Credit risk: When the economy is weaker and the Fed looks to lower interest rates, high yield borrowers tend to run a higher risk of default, driving bond prices down. The higher yield on these risky borrowers’ bonds is compensation for this additional risk.

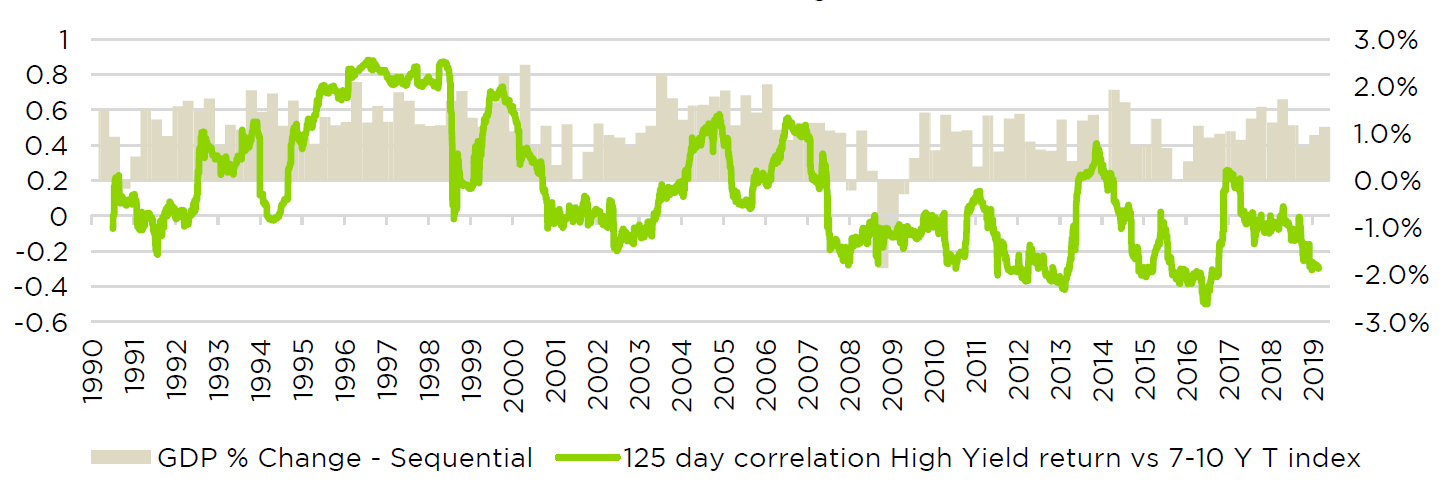

The chart below illustrates the correlations between high yield bonds and highly interest rate sensitive U.S. Treasuries. The good news is that high yield bonds don’t consistently exhibit a high level of interest rate risk. Most importantly, interest rate risk and credit risk are negatively correlated, which means that at times when high yield is facing interest rate headwinds, credit risk tends to pay off, providing an offsetting tailwind. Meanwhile, high yield also shows periods of negative correlation with rate-sensitive Treasuries when interest rates tend to be falling, as during the early 1990s recession, the dot-com recession, the Great Recession, and the 2015 shale bust.

Passive High Yield 125-Day Return Correlations to 7-10 Year Treasury Index

At first blush, that’s not an attractive risk profile. Rising interest rate movements can cause headwinds. But when rates are falling, high yield shows a negative sensitivity to interest rates – credit risk hurts high yield when the economy hits tough times. Could a passive allocation to high yield be the worst of both worlds?

Not quite. Interest rate risk is not the sole determinant of investor returns, and although high yield bonds are fixed income instruments, they arguably belong in their own category. Historically, high yield has disproportionately rewarded investors for taking credit risk. It provides higher returns than investment grade bonds, while showing relatively low volatility compared with stocks, and an attractively moderate correlation with the stock market. Most important, interest rate risk and credit risk are negatively correlated, which means that at times when high yield is facing interest rate headwinds, credit risk tends to pay off, providing an offsetting tailwind. (For more on this, see “High Yield’s Exposure to Stock Market Risk.”)

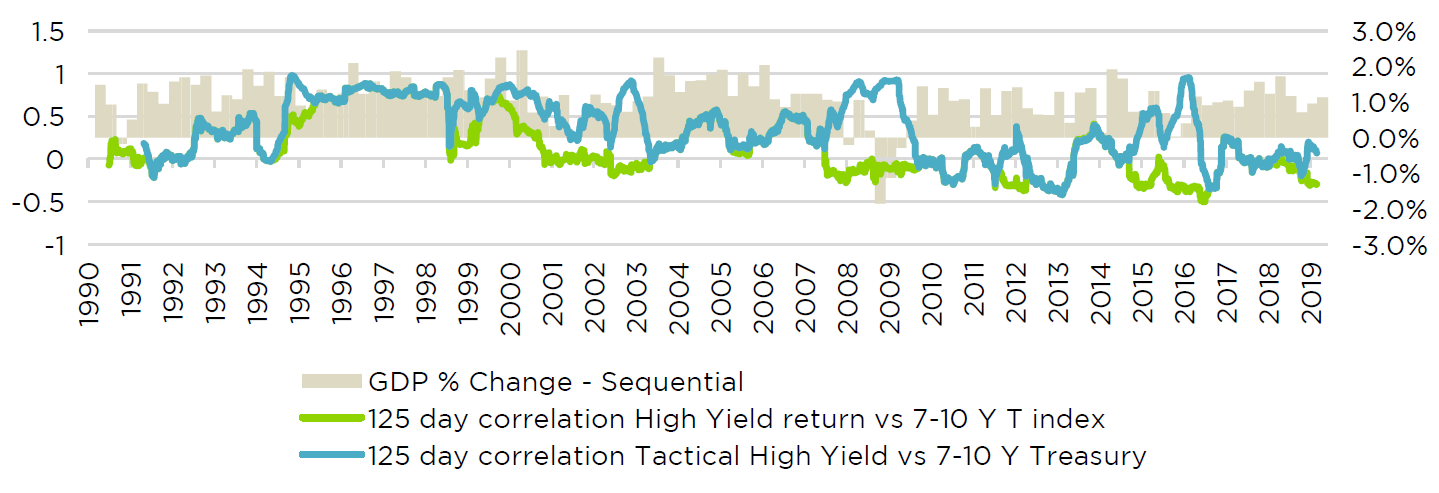

But even if we assume high yield’s relationship with interest rate risk is unforgivable, it’s worth looking at what happens when we apply a trend-following strategy to high yield. The below chart shows the same portfolio correlations with the interest rate-sensitive Treasury index, but we included a trend-following strategy in high yield alongside the passive strategy discussed above.

Passive and Tactical High Yield 125-Day Return Correlations to 7-10 Year Treasury Index

The stylistic example of a trend-following (or tactical) strategy invests in the ICE BofAML High Yield Master II Index on days when the index has closed above its 200 day moving average (signaling an uptrend), and invests in the shorter-dated Bloomberg U.S. Treasury 3-5 Year Total Return Index when the high yield index closes below its 200 day moving average.

Note the periodic divergences in correlations. During the economic down cycles of 2001, 2008, and 2015, the tactical strategy showed strong correlations with the Treasury index, indicating greater interest rate sensitivity. That’s a product of the strategy going “risk off” as the high yield index closes below its 200 day moving average, switching into full treasury exposure.

In other words, by investing in Treasuries while the Fed tends to be lowering rates, the tactical strategy ramps up interest rate sensitivity just when central banks are providing monetary tailwinds. Meanwhile, a passive investor in high yield would fail to benefit from this shift. It’s interesting to note another divergence between the tactical and passive strategy starting in 2018. According to this model, a tactical high yield strategy would have been better positioned than a passive high yield allocation for the most recent Federal Reserve rate cut. We don’t pretend to know what’s next for the bond market, but we do believe that tactical high yield strategies create an attractive risk profile through different phases of the interest rate cycle.

Investors are right to focus on interest rates as key determinants of outcomes for their portfolios. But it’s also important to understand different financial assets’ relationships with Fed policy. The recent shift to more accommodative monetary policy does have important implications for high yield and other asset classes. Fortunately, a tactical approach to high yield has historically improved on the interest rate risk profile of buy-and-hold strategies. The key for investors and advisors is to understand and prepare for the types of risks they are taking, so they can avoid emotional decisions when adverse events do inevitably arrive.