After a steep drawdown and the return of volatility to U.S. stocks in recent weeks, it’s worth investigating the level of stock market risk an investor in high yield credit faces. High yield has a reputation as a risky “junk” investment. However, our analysis shows a relatively low co-movement with the stock market.

January ended poorly for investors in U.S. stocks, and the start to February was not kind, either. A quiet march higher that began after the 2016 presidential election was interrupted as the S&P 500 dropped around 10% from late January into early February.

S&P 500 Index

Stock volatility as measured by the CBOE Volatility Index, which had been unusually low throughout 2016, spiked to levels last seen in summer of 2015.

CBOE Volatility Index (VIX)

High yield was not spared, drawing down about 1.6% from late January highs.

ICE BofAML US High Yield Total Return Index Value

Amid the tumult, the Counterpoint Tactical Income Fund entered a risk-off posture in early February and is now invested in short-duration U.S. Treasury securities and funds. This coinciding action between the U.S. stocks and high yield bonds prompts a question: How interrelated are the fates of these two asset classes?

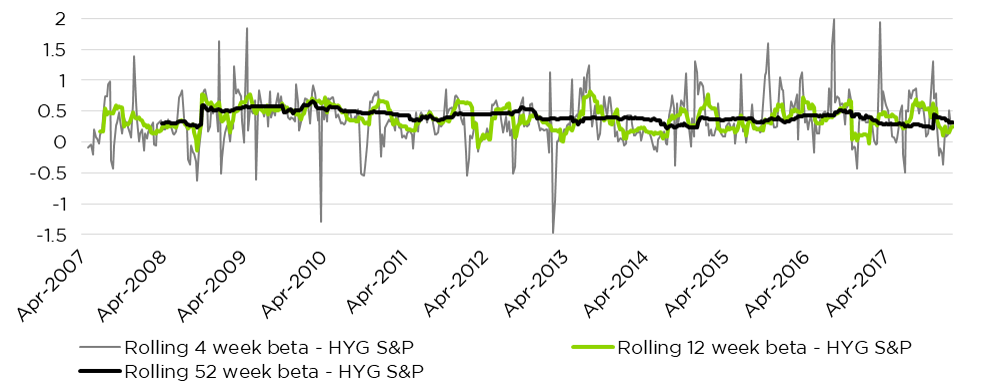

We evaluated the rolling one-month beta of the iShares iBoxx $ High Yield Corporate Bond ETF, a passive proxy for a high yield index, to the S&P 500 for the past decade. Beta is often used to evaluate individual stocks’ co-movement with an index such as the S&P 500. A beta of 1 indicates exact co-movement with the index; a beta of 0 indicates no co-movement; and a negative beta indicates in inverse relationship.

Rolling Betas – HYG vs. S&P 500

Over the past 10 years, high yield bonds have shown inconsistent short-term co-movement with stocks as represented by the S&P 500, as can be seen by the noisy one-month relationship. On a quarterly basis, high yield’s beta with stocks ranges from roughly zero (no relationship) to a weak relationship of around 0.6. Over the past decade, the beta of high yield to the S&P 500 is 0.42, so for every percent of movement in the S&P 500, we expect less than half of that in high yield. (By way of anecdotal comparison, AT&T and Wal-Mart are two examples of large-cap stocks with betas below 0.5.)

There are periodic spikes of high monthly co-movement, but even these do not appear to be a dramatic concern. During periods when the four-week beta was above 1, the average one-month return on the S&P 500 was 1.3%.

As we have discussed in the past, over recent economic cycles high yield has tended to display an attractive risk profile according to a variety of measures – drawdown, variance of returns, and semi-deviation. On further examination, we now also find that the short-term relationship between high yield and stocks has lately been weaker than one might expect given high yield’s reputation as a “junk” investment.

While investment risk can emerge in any number of ways and no quantitative measure is perfect, history suggests that high yield’s risk profile is not overly intertwined with that of the stock market. This gives us further confidence that high yield makes a solid addition to the asset class mix in many portfolios. We believe that risk management through our quantitative trend following discipline further enhances the appeal of high yield credit.