At Counterpoint, we’ve been championing diversifier strategies for a while now—like the wise old friend who keeps reminding you to bring an umbrella just in case. These strategies...

READ MOREEnsemble of trend following signals adds model diversification

ETF wrapper has potential to minimize capital gain events resulting from internal active management

Deep liquidity of underlying holdings for this alternative ETF

A blended trend following and time series momentum strategy that changes exposure, in 20% increments, based on a blended score from 202 weighted signals.

Blended Score

Momentum Signal

Moving Average Signal

Final Allocation

Risk-On: 100% High Yield Corporate Bond ETFs

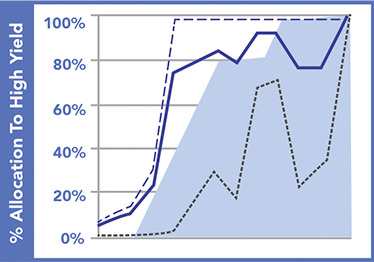

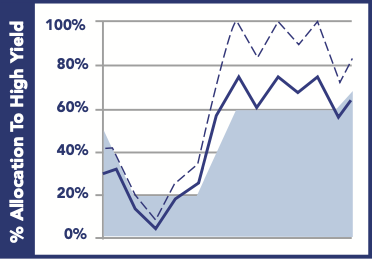

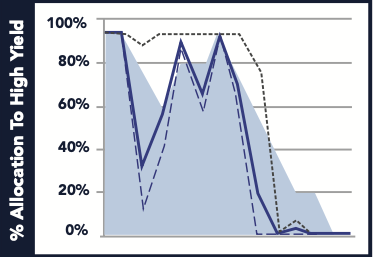

The system is 100% Risk-On when the blended score is above 90% and the model has had at least five days to become fully invested in High Yield Corporate Bond ETFs. The blended score is derived from the percentage of closing prices of a reference index above 101 different moving averages and lookback returns being positive for 101 time-series momentum signals. From the Risk-On position the Index can change to the Blended Position.

Blended: High Yield Corporate Bond ETFs

& U.S. Treasury ETFs

When not in the Risk-On or Risk-Off position the Fund can hold a blended 80/20, 60/40, 40/60 or 20/80 allocation of High Yield Corporate Bond ETFs and either U.S. 3-7 Year Treasury ETFs or T-bill ETFs. The CP High Yield Trend Index determines the optimal allocation, rounded to the nearest 20% increment to reduce turnover and transaction costs, using a 75%/25% blend of the 101 moving average and 101 time series (momentum) lookback return signals. The final allocation can only change exposure in increments of 20% day-over-day and will remain unchanged if the rounded allocation varies by more than 5% from the recommended allocation.

The decision to be invested in U.S. 3-7 Year Treasury ETFs versus T-bill ETFs is dictated by a 3% stop rule mentioned in the Risk-Off section.

Risk-Off: 100% U.S. Treasury ETFs

When the blended score is below 10% for at least five consecutive business days, exposure to either U.S. 3-7 Year Treasury or U.S. T-bill ETFs will usually be set to 100%. The blended score is derived from the percentage of closing prices of a reference index above 101 different moving averages and lookback returns being positive for 101 time-series momentum signals. From the Risk-Off position, the Fund can change to the blended position.

If a 3-7 Year Treasury ETF experiences a 3% drawdown or greater after initial entry from the system, at any weighting of 20% or greater to the Fund, the system will reallocate the Treasury portion of the model entirely to U.S. T-Bill ETFs.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

FUND DETAILS

As Of 2026-03-05

Ticker HYTR

Primary Exchange NYSE

Cusip 66538R722

ISIN US66538R722

Inception Date 2020-01-21

Net Assets $250,229,652

Shares Outstanding 11,550,000

Volume 43,020

30 Day Median Mid Bid-Ask Spread 0.0459%

Gross Expense Ratio 2.89%

Net Expense Ratio (After Waivers) 0.79%

Net Expense Ratio (After Waivers Excluding Acquired Fund Expenses) 0.60%

Advisor Management Fee 0.50%

IOPV Ticker HYTR.IV

Related Index Ticker HYTREND Index

| As of 2026-03-05 | 1 DAY | 1 MO | 3 MO | 6 MO | 1 YR | 3 YR | 5 YR | YTD | QTD | SINCE INCEPTION | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Market Price | 21.68 | -0.41% | -0.09% | 0.56% | 1.78% | 4.02% | 6.79% | 2.4% | 0.24% | 0.24% | 1.82% |

| NAV | 21.66 | -0.46% | -0.22% | 0.47% | 1.73% | 4.12% | 6.75% | 2.38% | 0.14% | 0.14% | 1.8% |

| As of 2025-12-31 | 1 MO | 3 MO | 6 MO | 1 YR | 3 YR | 5 YR | YTD | QTD | SINCE INCEPTION | |

|---|---|---|---|---|---|---|---|---|---|---|

| Market Price | 21.72 | 0.46% | 1.23% | 3.36% | 5.96% | 7.18% | 2.33% | 5.96% | 1.23% | 1.83% |

| NAV | 21.72 | 0.51% | 1.14% | 3.36% | 6.11% | 7.16% | 2.33% | 6.11% | 1.14% | 1.83% |

| Days Traded at Premium | Days Traded At Discount | |

|---|---|---|

| Calendar Year 2025 | 164 | 16 |

| Q1 2026 | 27 | 4 |

The Adviser has contractually agreed to waive its fees and reimburse expenses of the Fund, until at least February 1, 2026 to ensure that total annual fund operating expenses after fee waiver and/or reimbursement will not exceed 0.60% of the Fund’s net assets. This is excluding (i) of any front-end or contingent deferred loads; (ii) brokerage fees and commissions; (iii) acquired fund fees and expenses; (iv) fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); (v) borrowing costs (such as interest and dividend expense on securities sold short); (vi) taxes; and (vii) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers,other than the Adviser). This fee waiver and expense reimbursement are subject to possible recoupment from the Fund within the three years after the fees have been waived or reimbursed, if such recoupment can be achieved within the lesser of the foregoing expense limits in place at the time of recapture. This agreement may be terminated only by the Trust’s Board of Trustees on 60 days’ written notice to the Adviser.

At Counterpoint, we’ve been championing diversifier strategies for a while now—like the wise old friend who keeps reminding you to bring an umbrella just in case. These strategies...

READ MOREYear-ahead commentary is challenging for us: We don’t have a crystal ball, and we believe predictions contribute more to investment mistakes than outperformance. But the New Year does...

READ MOREYear-ahead commentary is challenging for us: We don’t have a crystal ball, and we believe predictions contribute more to investment mistakes than outperformance. But the New Year does...

READ MORE

Download Holdings

NAME SYMBOL NET ASSET % MARKET PRICE($) SHARES HELD MARKET VALUE

ISHARES IBOXX HI HYG US 29.85 80.08 920,476 $73,711,718.08

ISHARES BROAD US USHY US 39.74 37.08 2,646,882 $98,146,384.56

SPDR BLOOMBERG H JNK US 29.79 96.38 763,430 $73,579,383.40

BBH SWEEP VEHICLE 9BBH 0.64 100 1,572,705.54 $1,572,705.54

Ex-Date Record Date Pay Date Short-Term Capital Gains Long-Term Capital Gains Dividend Income Total Distribution

02/13/2026 02/13/2026 02/18/2026 0.0915 0.0915

12/12/2025 12/12/2025 12/17/2025 0.2296 0.2296

11/14/2025 11/14/2025 11/19/2025 0.0883 0.0883

10/17/2025 10/17/2025 10/22/2025 0.1269 0.1269

09/19/2025 09/19/2025 09/24/2025 0.0981 0.0981

08/15/2025 08/15/2025 08/20/2025 0.1059 0.1059

07/18/2025 07/18/2025 07/23/2025 0.1005 0.1005

06/13/2025 06/13/2025 06/20/2025 0.1043 0.1043

05/16/2025 05/16/2025 05/22/2025 0.1019 0.1019

04/17/2025 04/17/2025 04/23/2025 0.1018 0.1018

03/14/2025 03/14/2025 03/20/2025 0.1022 0.1022

02/14/2025 02/14/2025 02/20/2025 0.0963 0.0963

12/30/2024 12/30/2024 01/06/2025 0.0357 0.0357

12/12/2024 12/12/2024 12/18/2024 0.1372 0.1372

11/14/2024 11/15/2024 11/20/2024 0.1115 0.1115

10/17/2024 10/18/2024 10/23/2024 0.1109 0.1109

09/19/2024 09/20/2024 09/25/2024 0.1313 0.1313

08/15/2024 08/16/2024 08/21/2024 0.0574 0.0574

07/18/2024 07/19/2024 07/24/2024 0.1062 0.1062

06/13/2024 06/14/2024 06/20/2024 0.1057 0.1057

05/16/2024 05/17/2024 05/22/2024 0.1154 0.1154

04/18/2024 04/19/2024 04/24/2024 0.0947 0.0947

03/14/2024 03/15/2024 03/20/2024 0.105 0.105

02/15/2024 02/16/2024 02/21/2024 0.0954 0.0954

12/14/2023 12/15/2023 12/20/2023 0.2047 0.2047

11/16/2023 11/17/2023 11/22/2023 0.0525 0.0525

10/19/2023 10/20/2023 10/25/2023 0.1051 0.1051

09/14/2023 09/15/2023 09/20/2023 0.101 0.101

08/17/2023 08/18/2023 08/23/2023 0.0994 0.0994

07/13/2023 07/14/2023 07/19/2023 0.1031 0.1031

06/15/2023 06/16/2023 06/21/2023 0.0883 0.0883

05/18/2023 05/19/2023 05/24/2023 0.0953 0.0953

04/13/2023 04/14/2023 04/19/2023 0.0974 0.0974

03/16/2023 03/17/2023 03/22/2023 0.1124 0.1124

02/16/2023 02/17/2023 02/22/2023 0.1035 0.1035

12/15/2022 12/16/2022 12/21/2022 0.1431 0.1431

11/17/2022 11/18/2022 11/23/2022 0.0326 0.0326

10/18/2022 10/19/2022 10/24/2022 0.0182 0.0182

09/15/2022 09/16/2022 09/21/2022 0.0178 0.0178

08/18/2022 08/19/2022 08/24/2022 0.0136 0.0136

07/14/2022 07/15/2022 07/20/2022 0.0187 0.0187

05/17/2022 05/18/2022 05/23/2022 0.0147 0.0147

12/15/2021 12/16/2021 12/21/2021 0.1519 0.1519

11/15/2021 11/16/2021 11/22/2021 0.0645 0.0645

10/15/2021 10/18/2021 10/21/2021 0.0708 0.0708

09/15/2021 09/16/2021 09/21/2021 0.0669 0.0669

08/13/2021 08/16/2021 08/19/2021 0.1001 0.1001

07/15/2021 07/16/2021 07/21/2021 0.0742 0.0742

06/15/2021 06/16/2021 06/21/2021 0.067 0.067

05/14/2021 05/17/2021 05/20/2021 0.071 0.071

04/15/2021 04/16/2021 04/21/2021 0.0699 0.0699

03/15/2021 03/16/2021 03/22/2021 0.0748 0.0748

02/12/2021 02/16/2021 02/18/2021 0.0717 0.0717

12/15/2020 12/16/2020 12/21/2020 0.1701 0.1701

11/13/2020 11/16/2020 11/19/2020 0.0997 0.0997

10/15/2020 10/16/2020 10/21/2020 0.0707 0.0707

09/15/2020 09/16/2020 09/21/2020 0.0828 0.0828

08/14/2020 08/17/2020 08/20/2020 0.0717 0.0717

07/15/2020 07/16/2020 07/21/2020 0.0245 0.0245

06/15/2020 06/16/2020 06/16/2020 0.0104 0.0104

05/15/2020 05/18/2020 05/21/2020 0.0105 0.0105

04/15/2020 04/16/2020 04/21/2020 0.014 0.014

03/13/2020 03/16/2020 03/19/2020 0.0836 0.0836

02/14/2020 02/18/2020 02/21/2020 0.0958 0.0958

Investments in the CP High Yield Trend Fund involves risk including possible loss of principal and may not be suitable for all investors. The Fund is new with a limited history of operations. There is no assurance that the Fund’s strategy for allocating assets will achieve its investment objectives. The extent that Authorized Participants (AP) exit the business or are unable to proceed with creation or redemption orders, Fund shares may be more likely to trade at a premium or discount to net asset value and possibly face trading halts or delisting. Issuers of a security and other instruments may not be able to make principal and interest payments when due. Fluctuation in the value of equity securities held by the Fund causes the net asset value of the Fund to fluctuate.

The Fund is structured as an ETF and is subject to risks including, market price variance, trading issues and not being individually redeemable. ETF investments involve advisory and other expenses which will be indirectly paid by the Fund. The Fund’s investments may include ETFs with foreign securities, which are subject to risks beyond those associated with investing in domestic securities. Growth stocks may react differently to market events and are subject to more abrupt market movements. The Fund’s income may decline when yields fall and an increase in rates may cause the value of securities held by the Fund to decline. High yield or ‘junk’ bonds present greater risk than bonds of higher quality. There is no assurance that the Index Provider will compile, compose or calculate the index accurately and the Fund’s performance may diverge from that of the index.

ETF shares are not redeemable with the issuing fund other than in large Creation Unit aggregations. Instead, investors must buy or sell ETF Shares in the secondary market with the assistance of a stockbroker. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling. The NAV of the Fund’s shares is calculated each day the national securities exchanges are open for trading as of the close of regular trading on the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern time (the “NAV Calculation Time”). Shares are bought and sold at market price (closing price) not NAV. Market price returns are based on the midpoint of the bid/ask spread at 4:00 pm Eastern Time (when NAV is normally determined).

An active secondary market for the Fund’s shares may not exist. Although the Fund’s shares will be listed on an exchange, subject to notice of issuance, it is possible that an active trading market may not develop or be maintained. There is no guarantee that distributions will be paid.

5516-NLD-09/01/2021

We’ve received your request for the featured event collateral. A Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your meeting request and a Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your event registration request and will be in touch shortly.

Subscribe to stay up to date on Counterpoint Funds and receive our monthly perspective.

We have received your application and look forward to reviewing your qualifications for the role. If your application seems like a good fit, we will contact you to discuss next steps.

Thank you again for your application and interest in joining the Counterpoint team!

We’ve received your message. A Counterpoint Funds team member will contact you soon.

Subscribe to stay up to date and receive our monthly perspective.