Many investors have been wondering about what place high yield (or investments with high yield exposure, such as high yield trend following strategies) should play in a portfolio at this stage in 2023, given the way high yield credit spreads have narrowed year-to-date.

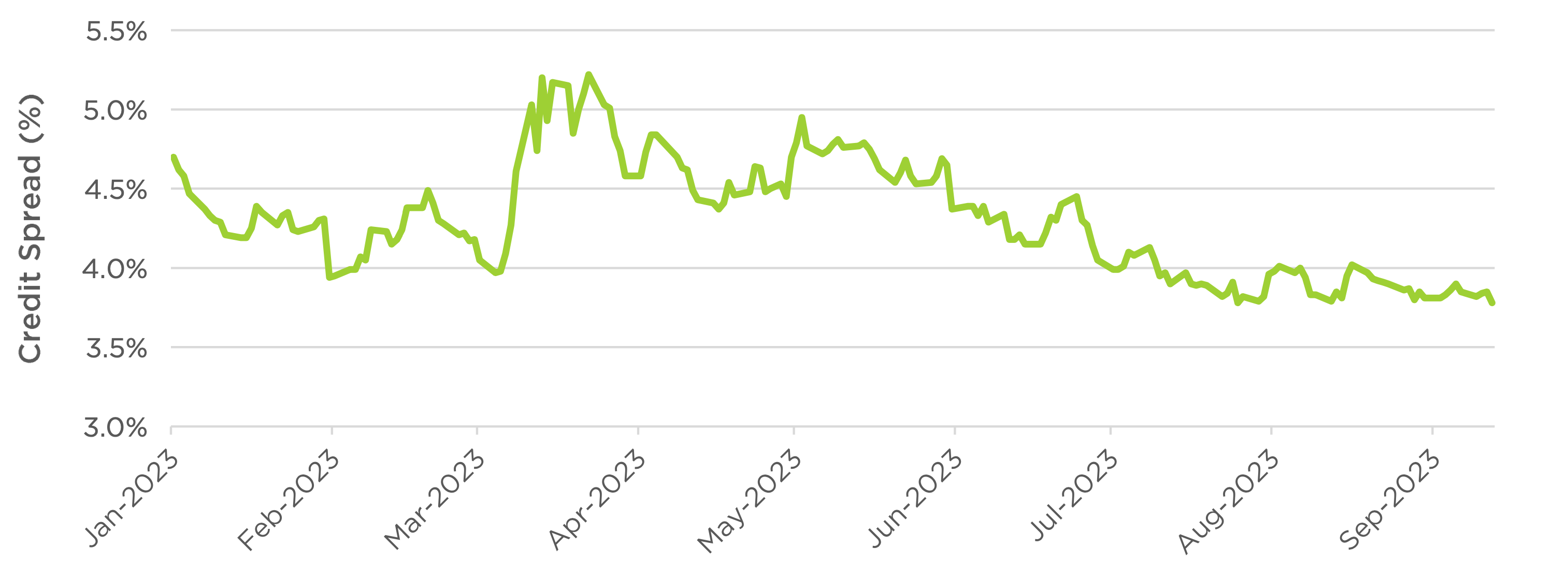

Credit spreads, which represent the additional yield investors earn above Treasury yields for taking on more credit risk, have been trending lower since March, when markets were scared by some high-profile regional bank failures.

High Yield Option-Adjusted Spread Year-To-Date

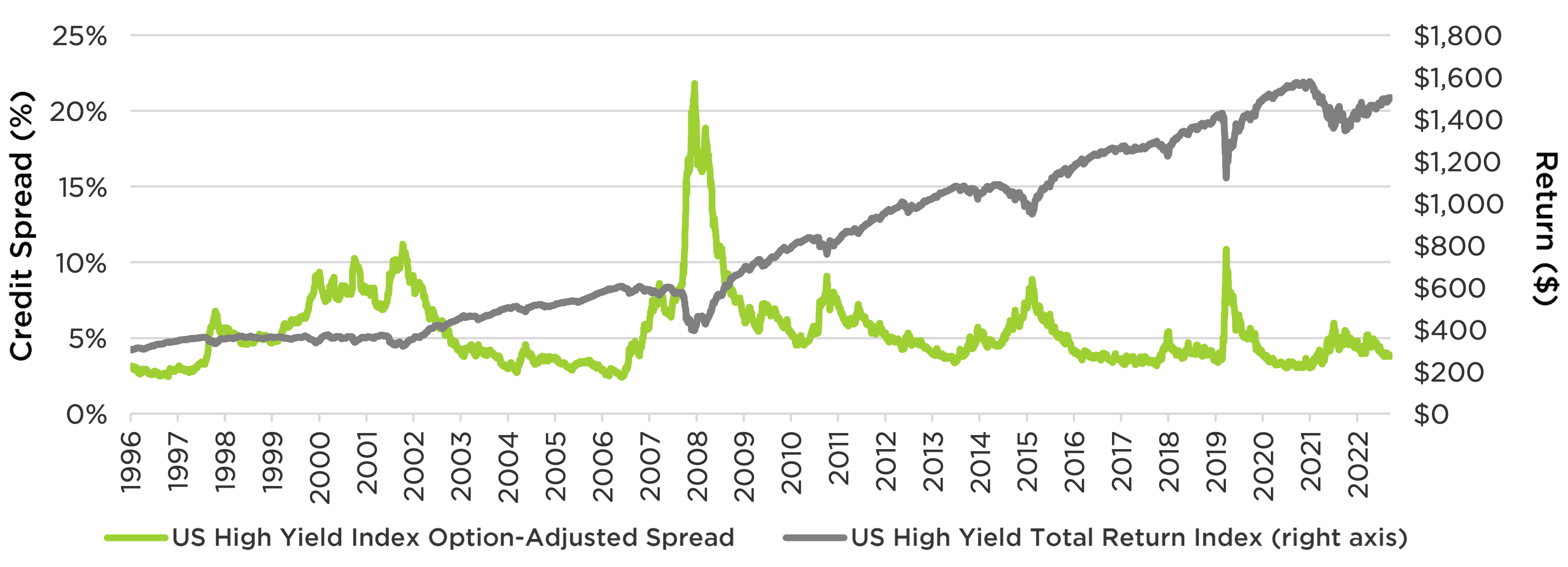

Narrower spreads mean investors earn less return for taking on credit risk. And in the past 25 years, we’ve seen some painful spikes in credit spreads that have created meaningful downside for high yield investors.

US High Yield Option-Adjusted Spread & Return: 1996 to Present

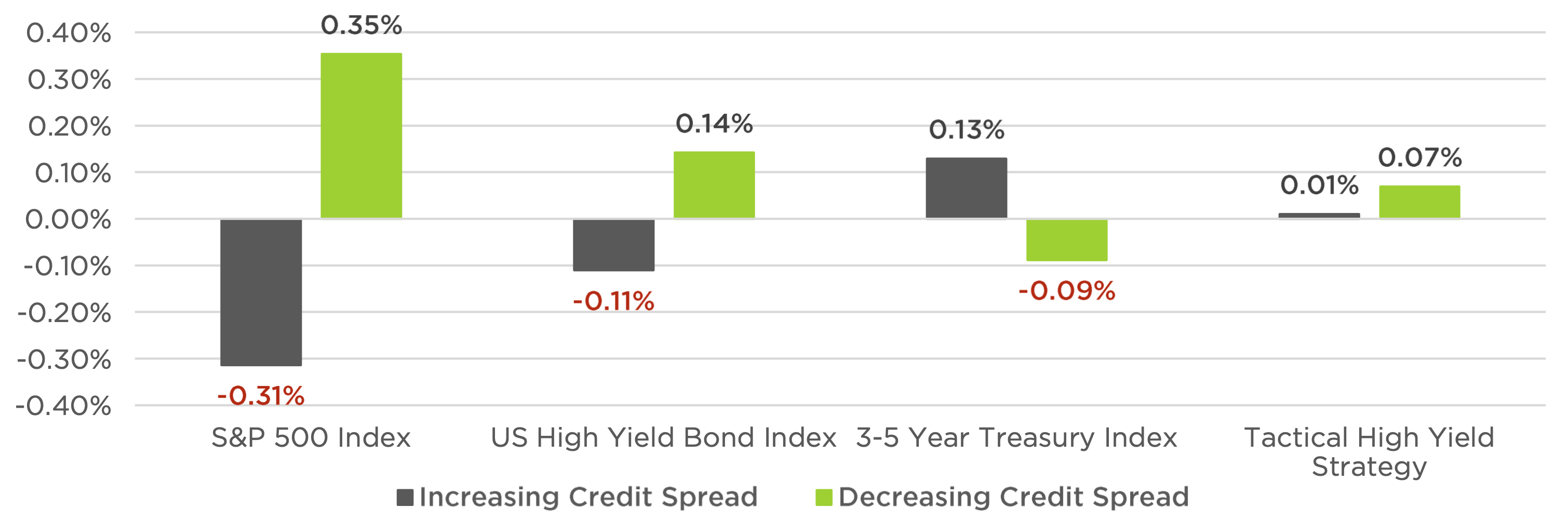

Quantifying the impact changes in high yield credit spread might have on a client portfolio, listed below are the average daily returns of various asset classes during periods of increasing and decreasing credit spreads.

Average Daily Returns of Various Asset Classes 1996 to Present

Looking at how investments faired from December of 1996 through September 2023, an increase in the credit spread on average negatively impacted stocks and high yield. Unsurprisingly 3-5 year treasuries were inversely correlated delivering higher average daily returns during periods of rising credit spreads, as they have historically appreciated during periods of market stress. Interestingly a Tactical High Yield Strategy, using a simple 200-day moving average to go from 100% invested in High Yield to 100% invested in 3-5 Year Treasuries when risk-off, fared a bit better delivering an average daily return of 1 bps during periods of increasing credit spreads. Even though average returns of the Tactical strategy during periods of decreasing credit spreads were lower than those of the High Yield Bond Index, the strategy historically has delivered High-Yield like returns over the long run due to the significant removal of downside volatility.

How the Current Credit Spread Environment Applies Today

Some investors are seeking the apparent safety of shorter-term Treasuries, CDs, and similar investments, and some others are betting that a recession may prompt a lowering of interest rates, giving a boost to longer-term high quality bonds. Those ideas could play out well or poorly in the near term; all can see from historical analysis is that high yield credit spreads aren’t a good predictor of the future for high yield bond investments.

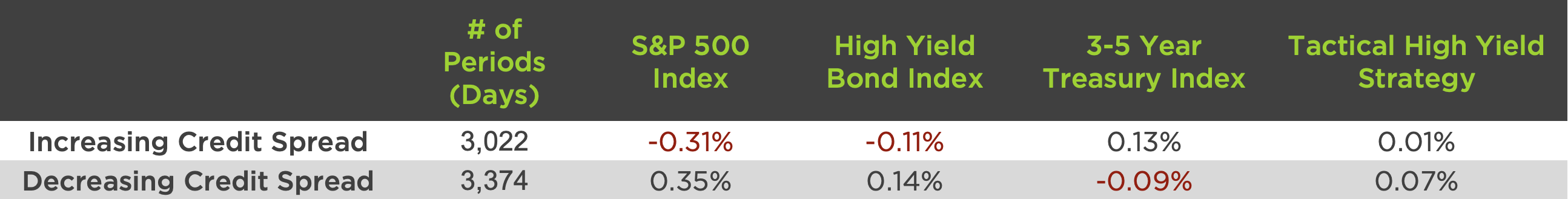

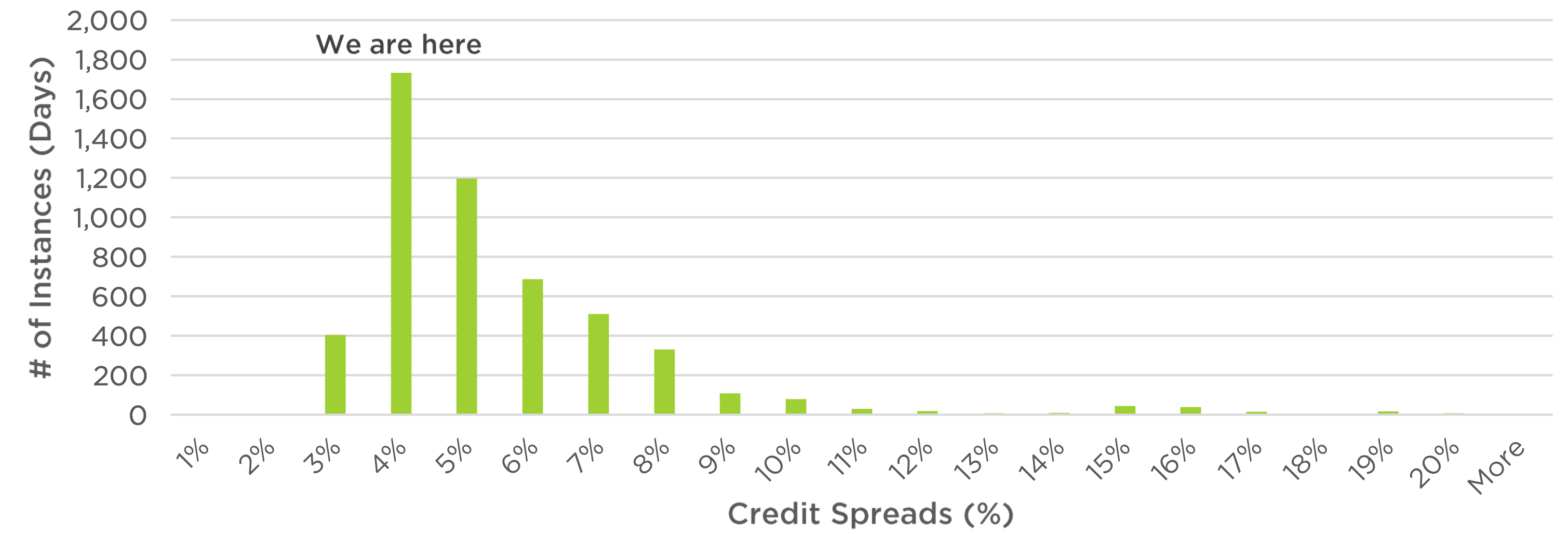

And anyway, although they’ve narrowed a bit this year, high yield credit spreads aren’t all that unusually low. The below chart represents how often high yield spreads have been within a certain range. We are at roughly the peak of the distribution – historically speaking, spreads aren’t overly wide or overly narrow, despite how it may feel in the current environment.

Histogram of the US High Yield Credit Spread: 9/17/2002 – 8/17/2023

That’s not a prediction. It doesn’t mean credit spreads can’t widen here, or that this is a particularly “safe” period for high yield. But it does offer some perspective.

Conclusion

Over the past couple decades, there has been a relationship between current spreads and how they change in the short term. But that relationship is cleanest when credit spreads are wide – in those cases they tend to drift downward. The data is much noisier on the left-hand side of the chart when spreads are narrower – and where we are today. Trying to time near-term moves in high yield bonds by looking at current credit spreads (or recent changes in credit spreads) doesn’t seem very well justified by historical data.

One-way investors can manage credit risk (and possible volatility in high yield credit spreads) is to use a systematic risk management strategy with a strong historical track record of mitigating portfolio downside risk. While Tactical High Yield offered lower average returns, if these returns are persistently positive, the strategy can potentially reduce the damaging impact credit spreads can have on a portfolio and help drive compounding returns over the long-run.

Register for our upcoming live-webinar event:

The Counterpoint Fall 2023 Fixed Income Update

Tuesday, November 7th

11:00 AM – 12:00 PM PST | 2:00 PM – 3:00 PM EST