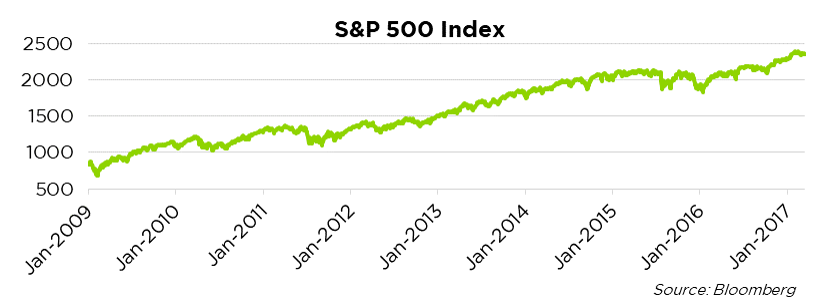

In the Counterpoint Tactical Equity Fund, systematically choosing the right time to take on broad equity market risk is a challenge we continually strive to improve our approach on. As we all know, the stock market has been on a tear over the past 8 years. Since its trough in February of 2009, the S&P 500 is up 184%.

That kind of run-up leads some people to start using the “b” word: bubble. What’s funny about the “b” word is that, while most investors intuitively understand what it means, many prominent economists who believe in efficient markets argue that there is no such thing as a bubble. University of Chicago professor Eugene Fama, who won the Nobel Prize in 2013, puts it this way:

“For bubbles, I want a systematic way of identifying them. It’s a simple proposition. You have to be able to predict that there is some end to it. All the tests people have done trying to do that don’t work. Statistically, people have not come up with ways of identifying bubbles.”

Fama’s point is simple: just because prices have gone up a lot it doesn’t mean they’ve gone up “too much.” In order for something to be called a “bubble” today, it must predictably pop.

Three Harvard economists — Robin Greenwood, Andrei Shleifer, and Yang You – take up this question in a new academic paper aptly titled “Bubbles for Fama.”

The paper asks a straightforward question: is it the case that, when the stock market rises a lot in a short amount of time, is it likely to crash?

Unfortunately the U.S. stock market hasn’t been around long enough to answer this question. We simply don’t have enough episodes of U.S. market spikes to say what typically happens afterwards with any of kind of statistical certainty. So, instead, Greenwood et al. look at U.S. industries. Since 1925, there were 41 instances in which the stock price of a U.S. industry increased over 100% in a two year period.

The authors come away with a few interesting findings. First, with these 41 cases of industry price spikes they don’t find any evidence of predictable declines after the spike. We all know about the “tech bubble” where prices in the internet technology industry spiked before March of 2000 and fell thereafter, but there are plenty of cases in other industries where price spikes were followed by more price increases. For example, Greenwood et al. point out that health stocks rose by over 100% between April 1976 and April 1978, and then continued going up by more than 65% per year on average over the next three years. On this point, Fama seems to be right: after an industry’s price spikes, it is just as likely to go up as go down.

However, the authors do find that large market declines, i.e. “crashes,” are more likely following industry price spikes. If a “crash” is a 40% drawdown over a subsequent two year period, they find that when an industry outperforms the market by 50% its crash risk is 19%. But when an industry outperforms the market by 100% its crash risk nearly triples to 54%! Investors who are sensitive to large drawdowns should we wary of industries whose prices spike quickly. Moreover, Greenwood et al. provide some industry characteristics that can help investors predict crashes. For example, if two industries have spiked the one whose firms are issuing more shares are more likely to crash. Moreover, Industries that have spiked while younger firms in the industry are outperforming older firms in the industry are also more likely to crash.

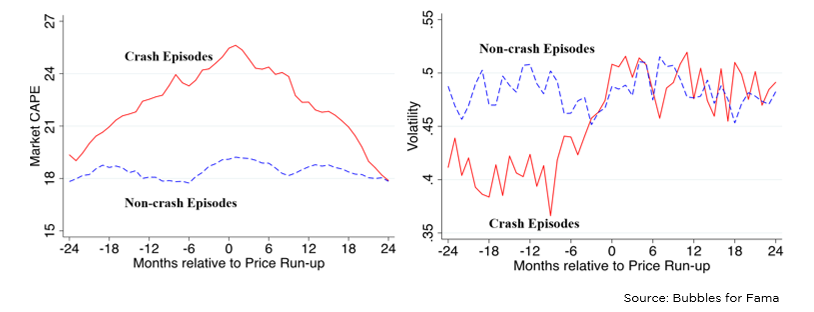

The authors also find that large price increases accompanied by valuation multiple expansions on average were followed by valuations coming back down to earth in the subsequent 24 month period. The above left figure shows the relationship between market valuation, in this case the Shiller CAPE index, in both scenarios of crash and non-crash episodes. Here, trailing average 10-year PE ratios elevating to higher levels (the red line) during a price increase were predictive of future valuation bubbles reverting after. This implies resolution of high valuations by either a drop in market price, a rise in earnings, or a combination of both.

Likewise, the above right figure depicts price rises of 100% or greater accompanied by volatility expansions are perhaps the best indicator that elevated market risk will persist after. This is the story of a parabolic move being generally followed by a reversal of similar proportion. In the year preceding the market price increase, standard deviation for crashing markets is shown to expand by almost 15% on an annualized basis, and persist for the two years following the peak. Non-crashing markets in the sample exhibit more persistent volatility before and after the run-up. The lesson here is that increasing market volatility during seemingly bubbly market behavior may be a warning increasing downside risk ahead.

The takeaway is that Fama is half-right. When an industry or broad market spikes in a short amount of time, it is just as likely to continue rising as it is to crash. However, after a spike, the likelihood of a big crash also rises and can be predicted by certain characteristics of the industry or market. Those characteristics are useful for investors interested in market timing.

Disclosures

Mutual Funds involve risk including the possible loss of principal. The use of leverage by the Fund or an Underlying Fund, such as borrowing money to purchase securities or the use of derivatives, will indirectly cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. Derivative instruments involve risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. There is a risk that issuers and counterparties will not make payments on securities and other investments held by the Fund, resulting in losses to the Fund. The Fund may invest in high yield securities, also known as “junk bonds.” High yield securities provide greater income and opportunity for gain, but entail greater risk of loss of principal. Past performance is no guarantee of future results. There is no assurance the Funds will meet their stated objectives.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Counterpoint Tactical Equity Fund and Counterpoint Tactical Income Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained at counterpointfunds.com or by calling 844-273-8637. The prospectus should be read carefully before investing. The Counterpoint Tactical Equity Fund and Counterpoint Tactical Income Fund are distributed by Northern Lights Distributors, LLC member FINRA/SIPC.

4366-NLD-4/20/2017