The Counterpoint Tactical Equity Fund (CPIEX) combines two investment approaches in a single fund:

- Global market neutral long-short stock portfolio:

- Targets no relationship with returns to traditional asset classes

- Historically profits when global stock mispricings are corrected

- Trend-following the US stock market:

- Targets positive exposure to extended US bull markets; targets no exposure to extended US down markets

The fund layers these strategies on top of one another: Returns to the fund equal returns to the global market neutral portfolio plus returns to the trend-following strategy.

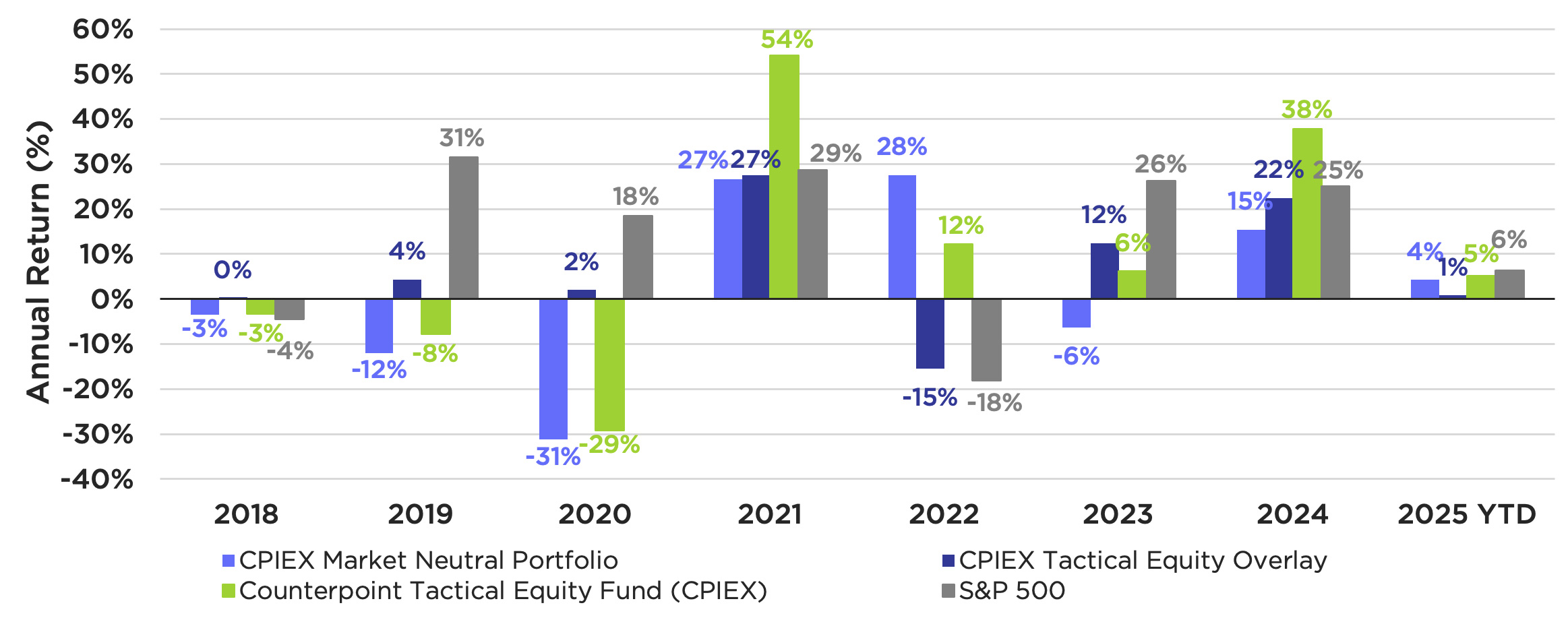

CPIEX Annual Return Composition

Investors often wonder why we include both strategies in a single vehicle rather than isolate one or both. Here’s why:

- Diversification: The global market neutral portfolio and the trend-following strategy both have positive long-term return expectations, but do not move together. While both can perform well simultaneously (2021 and 2024 were good examples of this), there is a good chance one can support the other in more challenging periods.

- In 2019, 2020, and 2023, the tactical trend-following strategy provided positive returns even as the market neutral strategy earned negative returns.

- Equity Market Participation: The market neutral portfolio can be a great source of differentiated returns that can diversify portfolios. But the US stock market may also be a great source of long-term returns. By including the tactical stock market overlay, the Tactical Equity Fund gives investors the opportunity to participate in some of those long-term benefits.

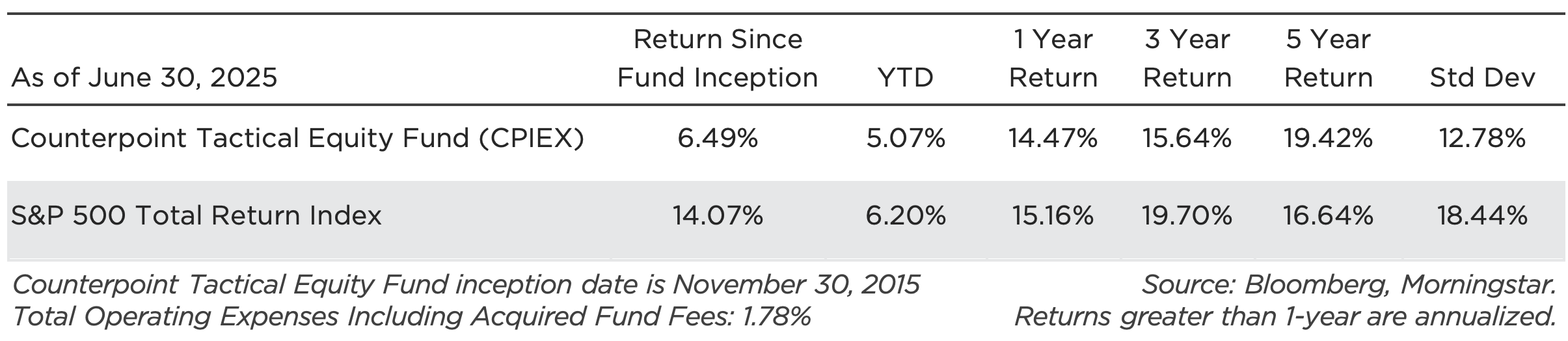

- We estimate the trend-following overlay has earned investors mid-single-digit positive annualized returns since fund inception, in addition to the returns to the market neutral strategy.

- Risk Management: The tactical overlay is designed to have no broad US stock exposure in extended down markets. This risk-managed approach gives the fund the opportunity to earn positive returns in difficult periods for US stocks.

- In 2022, when stocks were down nearly 20%, Tactical Equity was largely “risk-off,” having little exposure to the market during that challenging year. (The fund returned +12%.)

Conclusion

Counterpoint Tactical Equity seeks to provide investors with differentiated sources of positive return. The market neutral portfolio is designed to identify mispricings among global stocks and has historically profited when those mispricings are corrected. Investors may further benefit from the trend-following overlay to the US stock market, which gives natural diversification to the market neutral portfolio, may allow investors to participate in long-term uptrends in the US stock market, and offers a systematic objective to seek avoidance of long-term downtrends. This creates a highly effective complement to traditional buy-and-hold stock market exposure.

The performance data displayed here represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s maximum sales charge for Class A shares is 5.75%. The Fund’s adviser has contractually agreed to waive its fees and reimburse expenses of the Fund, at least until February 1, 2026 to ensure that Total Annual Fund Operating Expenses After Fee Waiver and Reimbursement but does not include: (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions, (iii) acquired fund fees and expenses; (iii) borrowing costs (such as interest and dividend expense on securities sold short); (iv) taxes; and (v) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers (other than the Adviser)) do not exceed 2.00%, 2.75% and 1.75% of average daily net assets attributable to Class A, Class C, and Class I shares, respectively. With the fee waiver and expense recapture, for 2025 total annual fund operating expenses would be 2.03%, 2.78% and 1.78% for Class A, C and I shares, respectively. For performance information current to the most recent month-end, please call toll-free 844-273-8637.

Download the factsheet to see how each strategy contributed to fund performance: