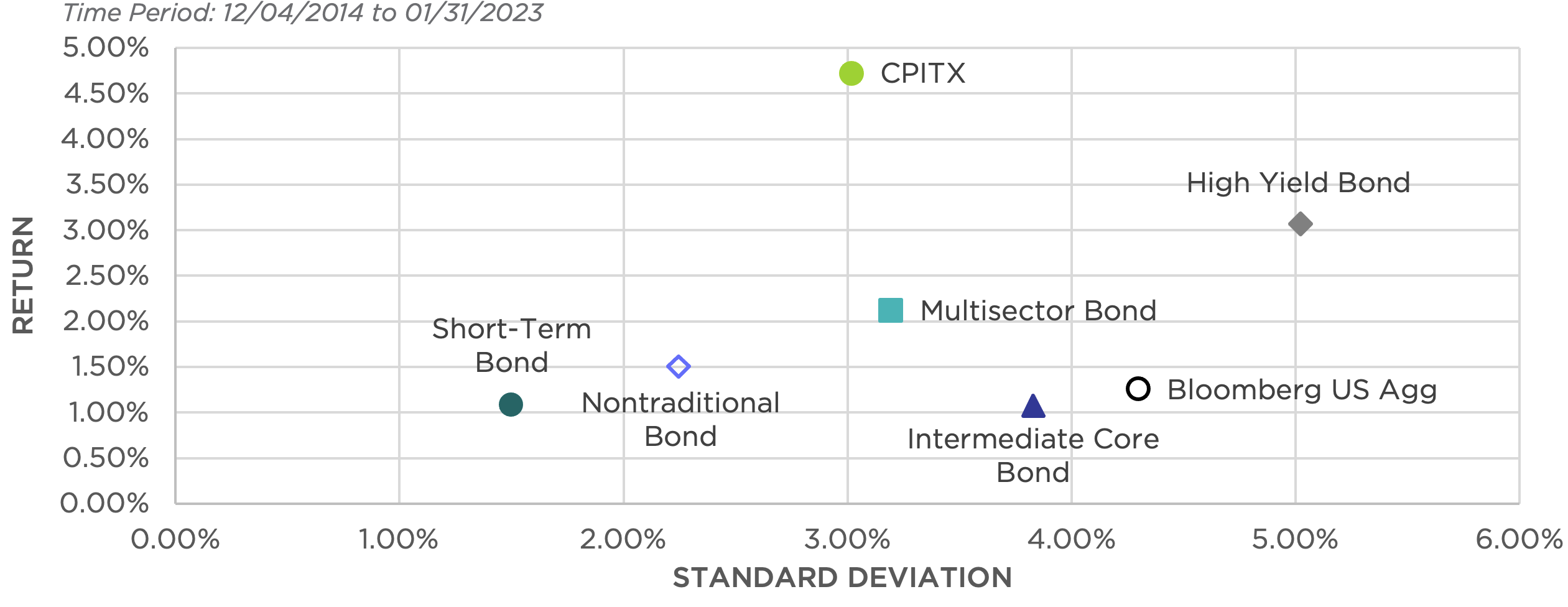

When considering tactical high yield strategies in general, like the Counterpoint Tactical Income Fund (CPITX), investors often ask where it fits within a fixed income portfolio, or what category it belongs to. Because CPITX is designed as a low-correlation diversifier of fixed income portfolios, it defies neat categorization.

However, this challenge is balanced by the unique contributions CPITX (and other systematic diversifier strategies) can make to a variety of bond fund categories. Let’s take a look at the case for assigning CPITX to a few different buckets as defined by Morningstar categories:

- Nontraditional Bond

- Intermediate Core Bond

- High Yield Bond

- Multisector Bond

- Short-Term Bond

- Core bonds (represented by the Bloomberg US Aggregate Index)

As we’ll see, a tactical high yield strategy’s unique structure enables it to contribute alongside a number of popular fixed income strategies.

Is CPITX Just a High Yield Fund?

High yield trend following strategies like CPITX invest in high yield when “risk-on,” so many investors tend to think of these strategies as high yield strategies. But the numbers tell a slightly different story.

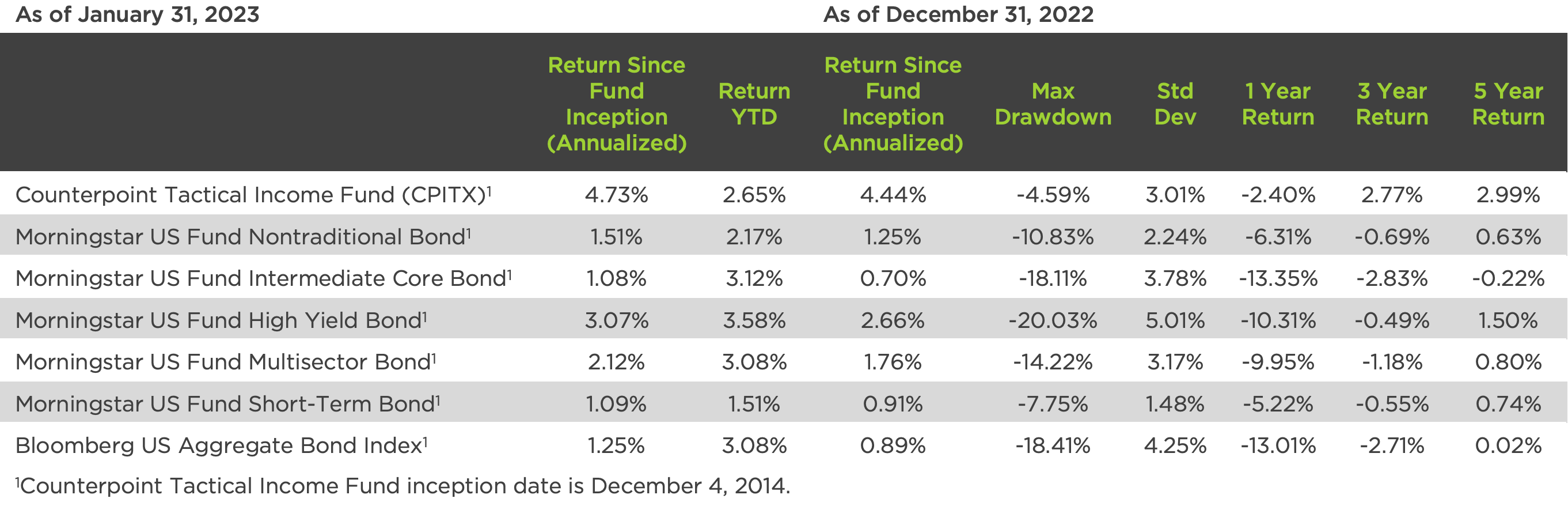

On the surface, CPITX has not historically shown a strong overall resemblance to any of its potential categories – including high yield. Its strongest relationships are with Nontraditional, Multisector, and High Yield bond categories – but the correlations are still fairly weak, topping out at 0.39 with the Nontraditional Bond category. (As a reminder, correlation is a scale from -1 to +1, where -1 means the strategies move exactly opposite, 0 means they have no relationship, and +1 means they are in lock step.)

Correlations – CPITX and Morningstar Bond Categories

Not Exactly Just a High Yield Bond Fund

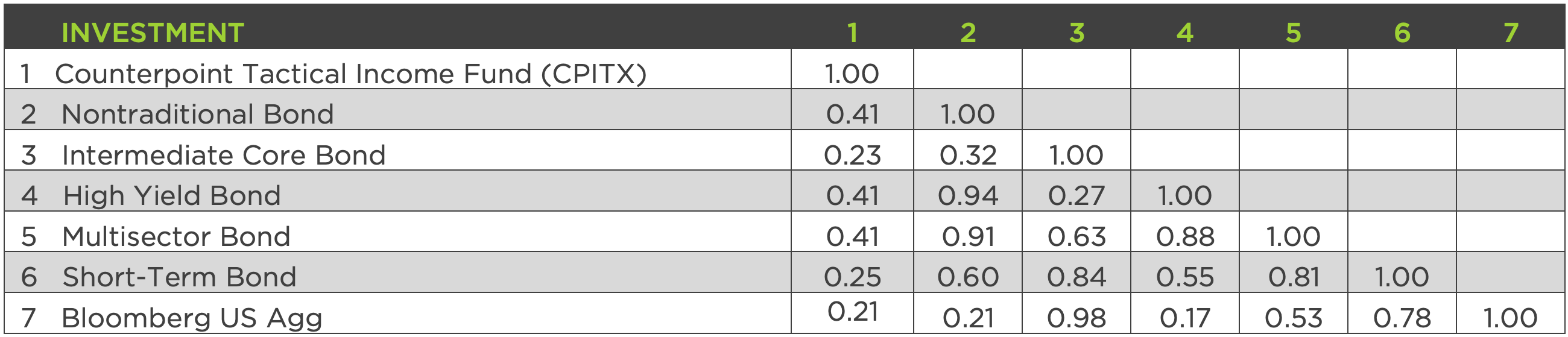

Another way to analyze an investment’s fit within a category is to match its risk/volatility/standard deviation against the category. One reason investors use categories is to set expectations, especially expectations around risk.

Annualized Standard Deviation

From the risk point of view, CPITX is actually least like the high yield bond category, and instead looks more like the nontraditional, multisector, and core-plus categories.

Where Does CPITX Contribute to Portfolios?

Typically, a fixed income portfolio will seek to behave similarly to its category – Nontraditional Bond portfolios should behave like the Nontraditional Bond category, etc. This objective balances against another important goal – an optimal risk-return profile.

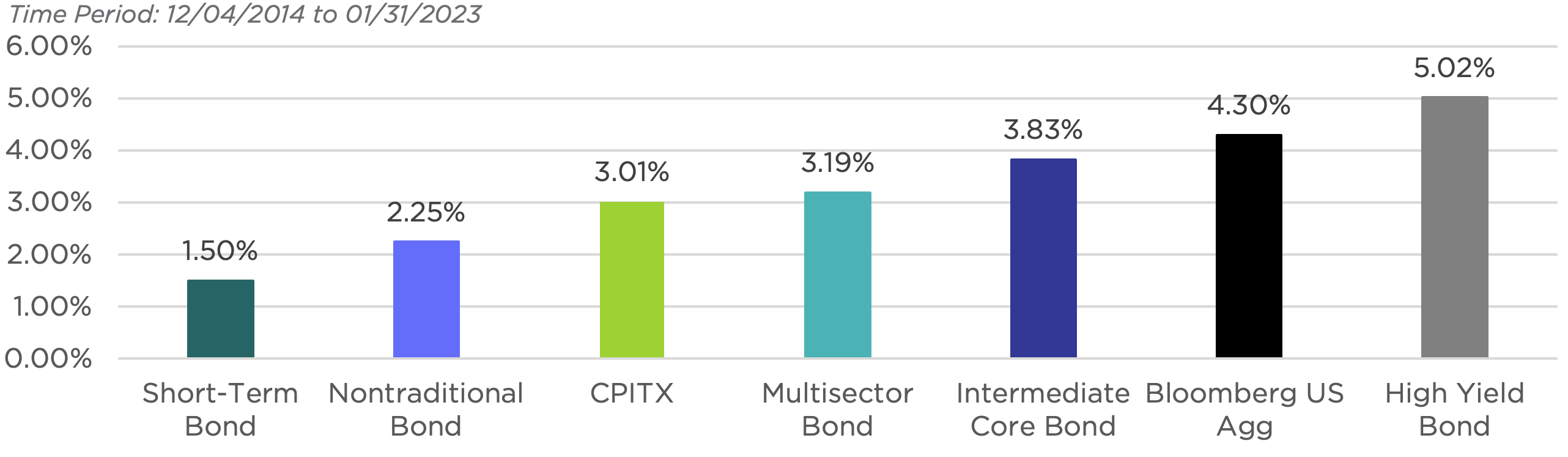

The chart below shows how adding CPITX to different bond categories may affect a portfolio’s risk reward. We modeled this by taking the Morningstar category (e.g., High Yield) and adjusting the portfolio to have an 80% weighting to the category and a 20% weighting to CPITX. The chart measures risk on the x-axis (riskier is further to the right) and return on the y-axis (more return as you go up). Strategies improve as they go up and to the left.

Risk – Reward Since Inception: 12/04/2015

Whatever the category, CPITX historically would have contributed on both a risk and return basis – adding return while reducing portfolio volatility.

Conclusion

Counterpoint Tactical Income’s categorization depends on which criteria are most important to the decision.

- Correlation analysis: CPITX’s strongest relationship historically has been with High Yield.

- Volatility: When assessing historical risk, CPITX has the most in common with Core Plus, Multisector, and Nontraditional Bond categories.

- Portfolio Contribution: There are meaningful historical benefits to including Counterpoint Tactical Income in a hypothetical model covering any of the four categories.

In our opinion, CPITX is most useful as a diversifier of core bond holdings, and we believe a reasonable allocation could replace up to 50% of an investor’s core bond sleeve. However, in conversations with investors and advisors, there tends to be a natural gravitation toward thinking of the strategy as a nontraditional or high yield bond strategy replacement. This owes in large part to investors’ understanding that the strategy invests in high yield bond markets when risk-on and displays low correlation with other traditional bond categories.