Markets always find new ways to challenge investors. In a difficult environment for quantitative factor-driven strategies, merely having factor diversification, substantial portfolio exposure to short positions, and international exposure aren’t enough. Investors must also consider size. Looking at data from 2000 to present, we find factor/anomaly strategies with small cap exposure on both the long and short side have tended to outperform their large cap counterparts. If the past couple decades are a good indication, long-short equity strategies should allocate meaningfully to small caps to capture alpha from this relatively inefficient segment of the market.

Small cap stock outperformance on the long side is a rare point of strategic consensus among investors. Active management’s patron saint, Warren Buffett, has said he could earn 50% annual returns on smaller opportunities[1]; his returns are held back today by a need to invest his enormous capital base in larger companies. On the efficient markets side, pioneering scholars Eugene Fama and Kenneth French showed that, along with cheap valuation, small company size is a key explainer of investment returns. You won’t get Warren Buffett and Eugene Fama on the same side of many debates[2], so there’s probably something to the small stocks idea.

Intuitive explanations for small caps’ factor-based outperformance abound. On the long side, the law of large numbers means it’s difficult to grow a gigantic company as fast on a percentage basis as it is to grow a tiny startup. Lower information quality could also play a role – efficient pricing is harder to come by as small companies get less analyst and media coverage and are less likely to be included in stock indexes, limiting the number of buyers and sellers that drive efficient pricing.

Whatever the explanation for small caps’ relative mispricing, it’s worth looking at recent economic history to see what type of risk adjusted excess return (alpha) is available to investors in global small caps.

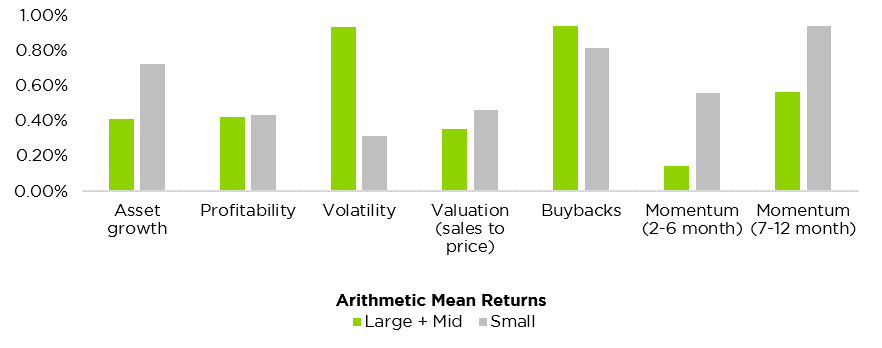

Academic research has established the presence of many investment anomalies – variables that drive stock returns because of market frictions and human psychological biases. For several well-known anomalies, we modeled portfolios that were long the stocks with the greatest exposure to positive factor/anomaly characteristics and short the stocks with exposure to negative characteristics. The below chart shows that small cap had greater exposure to anomalies such as asset growth, profitability, valuation, and momentum:

Anomaly Factor Returns to Global Small- and Large-Cap Stocks, 2010-2017

Small caps haven’t been completely dominant. Since 2010, large cap stocks showed greater exposure to alpha driven by buybacks (companies that repurchase shares tend to see shares outperform companies that issue shares) and volatility (stocks with lower volatility tend to outperform).

Share buybacks have lately been getting media scrutiny as commentators have tied Apple’s trillion-dollar valuation to share repurchases. It intuitively makes sense that larger companies like Apple have benefited disproportionately from the buyback boom. Successful companies tend to be large and profitable enough to afford shareholder friendly transactions like dividends or share repurchases. Meanwhile, investors’ search for income in the low-rate post crisis era helped boost returns on lower-volatility, cash-generating large caps.

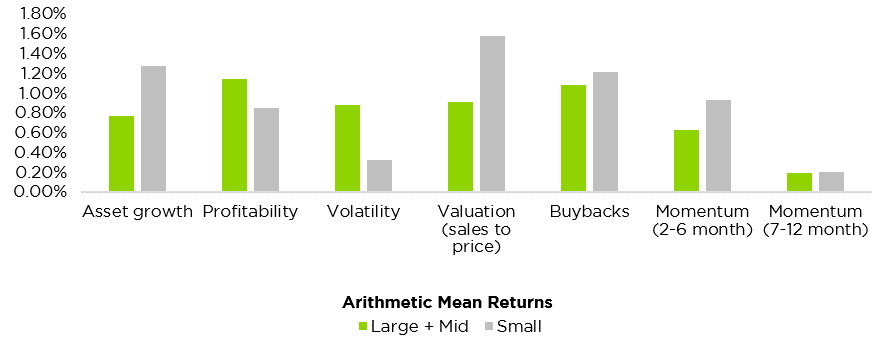

It’s worth investigating whether those dynamics hold over longer periods. If we zoom out to look at the past two economic cycles, small caps still delivered greater factor outperformance in aggregate, even if the details are slightly different. Since 2000, large caps outperformed with respect to the profitability and volatility anomalies, and nowhere else.

We could reach for narrative explanations. Perhaps the addition of the dot-com recession gave profitable large caps a better opportunity to distinguish themselves. Perhaps in the long run low-volatility small caps don’t typically outperform their high-volatility brethren because lottery payoffs are more frequently found amongst small cap stocks. Conversely, volatile large cap stocks may have had less room to outrun their less risky large cap peers due to reduced exposure to the distress and leverage found in many volatile small caps.

Anomaly Factor Returns to Global Small- and Large-Cap Stocks, 2000-2017

In any case, we venture two conclusions. First, since the turn of the century investment anomaly returns have disproportionately accrued to small cap stocks. We believe alpha-seeking strategies may be rewarded by a meaningful inclusion of small cap stocks to both the long and short side.

This informs the management process of Counterpoint’s Tactical Equity and Long-Short Equity Funds, with approximately half of our market neutral portfolio weight made up of small cap names (as of this writing in August 2018, 62% of our longs and 47% of our shorts are below $2 billion in market capitalization).

Second, returns to anomaly strategies can shift over time. We’re skeptical that investors can profitably market-time individual investment anomalies over the long run, which is why Counterpoint takes a portfolio approach. We diversify stock holdings broadly; we use multiple factors or anomalies; we invest across all market capitalizations and in many global markets.

An equity investor shopping for active management will be best served by maximizing his or her potential for risk-adjusted outperformance by not only selecting funds with the most active share, but by meeting the above diversification goals. Here we emphasize the benefits of size diversification: A sizeable allocation to smaller stocks makes prudent sense when viewed in the context of past evidence.

[1] Accounts of Buffett’s claim emerge from a 2005 meeting between Buffett and University of Kansas students. See Sanjay Kulkarni’s The Value Elephant: The Head and Tail of Wealth Creation and notes from the meeting hosted at Base Hit Investing.

[2] (“The Superinvestors of Graham-and-Doddsville,” Buffett’s oft-cited defense of value investing, is effectively a long subtweet directed at efficient market scholars like Fama and French.)