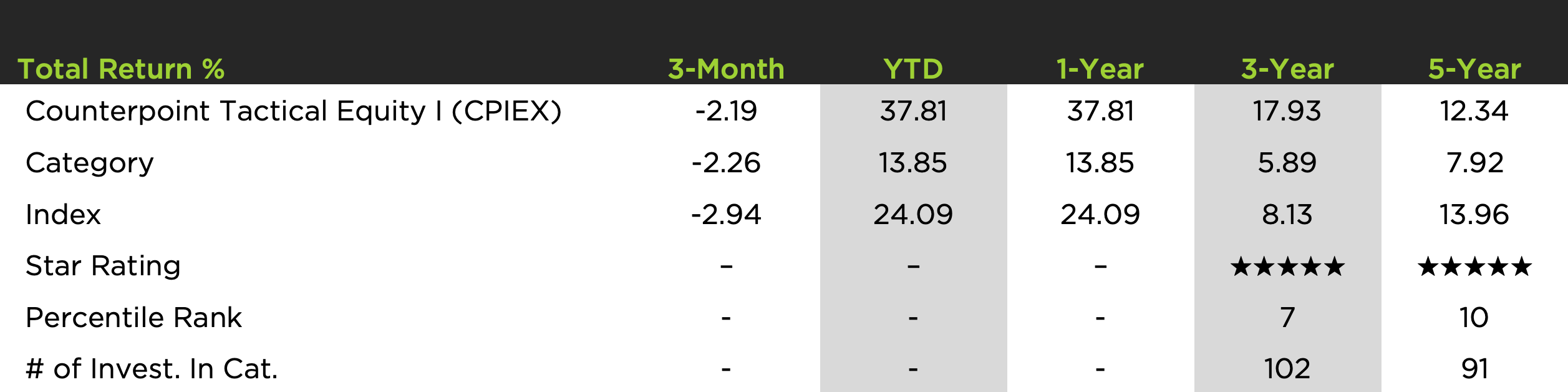

San Diego, California – January 16, 2025 – Counterpoint Funds, a quantitative mutual fund and exchange-traded-fund (ETF) provider specializing in diversifier strategies, today announced that the Counterpoint Tactical Equity Fund (CPIEX) is now 5-Star Morningstar Rated for both 3 and 5-year periods out of 102 and 91 funds respectively in the Long-Short Fund category, based on risk adjusted returns.

CPIEX is ranked 10th and 7th for 3 and 5-year periods in the Long-Short Fund category out of 102 and 91 funds respectively, based on total returns for the period ending December 31, 2024, by Morningstar Inc., a leading provider of independent investment research.

CPIEX Trailing Returns as of December 31, 2024

The performance data displayed here represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The total annual fund operating expenses are 2.06%, 2.81% and 1.81% for Class A, C and I shares respectively. The Fund’s maximum sales charge for Class A shares is 5.75%. The Fund’s adviser has contractually agreed to waive its fees and reimburse expenses of the Fund, at least until February 1, 2025 to ensure that Total Annual Fund Operating Expenses After Fee Waiver and Reimbursement (excluding (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions; (iii) acquired fund fees and expenses; (iii) borrowing costs (such as interest and dividend expense on securities sold short); (iv) taxes; and (v) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers (other than the Fund’s adviser))) do not exceed 2.00%, 2.75% and 1.75% of average daily net assets attributable to Class A, Class C, and Class I shares, respectively. Without the fee waiver, total annual fund operating expenses would be, 2.06%, 2.81% and 1.81% for Class A, C and I shares, respectively. For performance information current to the most recent month-end, please call toll-free 844-273-8637.

“In November 2023, we made significant improvements to the machine learning models used in CPIEX, which has helped it continue to perform as a strong equity diversifier,” says Joseph Engelberg, Ph.D. Chief Research Officer and co-portfolio manager at Counterpoint Funds.

Developed by Counterpoint Funds, the Counterpoint Tactical Equity Fund (CPIEX) launched Nov., 2015 has $298 million in net portfolio assets as of December 31, 2024. CPIEX seeks capital appreciation and capital preservation by investing in a global long-short portfolio, designed to be currency and sector neutral, while using a tactical model to adjust stock market exposure. Employing a long history of empirical evidence and academic research, the Fund leverages advanced machine learning and artificial intelligence techniques to dynamically adjust exposure to quantitative factors including momentum, value, sentiment, quality, and long-term reversal, during the stock selection process to seek optimal mispricing opportunities. This is used in combination with a tactical overlay of the US Stock Market, which was designed to provide exposure during periods of market appreciation and reduce market exposure during extended market downswings, to provide a low correlation strategy that makes a great equity diversifier for client portfolios.

“Counterpoint continues to innovate by refining the machine learning models it uses as well as testing new factors that can potentially help drive return. Such innovation is particularly important for CPIEX because, at its core, it’s a long-short fund with the aim to make money from relative mispricing and acts as a diversifier for client portfolios.,” added Mr. Engelberg. For more information on the Tactical Equity Fund please visit cpfunds.com/cpiex

About Counterpoint Funds

Counterpoint Funds is a defensive, systematic and research driven mutual fund and ETF provider with 5 funds and over $2.6 billion in assets under management. Counterpoint is focused on offering defensive fixed income and equity diversifier strategies designed to drive portfolio performance over the long run. Counterpoint’s mutual funds and ETFs employ quantitative investment strategies that base asset allocation and security selection decisions on academic research and statistical analysis. Counterpoint Funds, LLC, is located at: 12760 High Bluff Drive, Suite 280, San Diego, CA 92130. Tel: 844-273-8637

NOT FDIC INSURED – MAY LOSE VALUE – NO BANK GUARANTEE

Contacts

Counterpoint Funds

John Held, VP of Marketing

+ 1 (858) 859-8815

press@counterpointmutualfunds.com

Watch the most recent on-demand equity webinar:

The Counterpoint Winter 2025 Equity Update

DATE: Tuesday, February 11, 2025

LOCATION: On-Demand Webinar