We all know the 2008 financial crisis completely upended Wall Street. Storied firms disappeared; Dodd Frank ushered in a new regulatory regime; and central bankers unveiled unprecedented monetary policies.

Along with those tangible shifts, powerful narratives have emerged in our post-crisis world: hedge funds are struggling; indexing is more popular than ever; stock picking is a dying art.

We at Counterpoint believe we’ve found a key driver of these new stories: Stocks with characteristics (also known as factors or anomalies) that historically have led to outperformance seem to have lost their edge since the market lows of 2009. Equity portfolio managers really have been operating in a new environment for the past eight years – you can see it in the data.

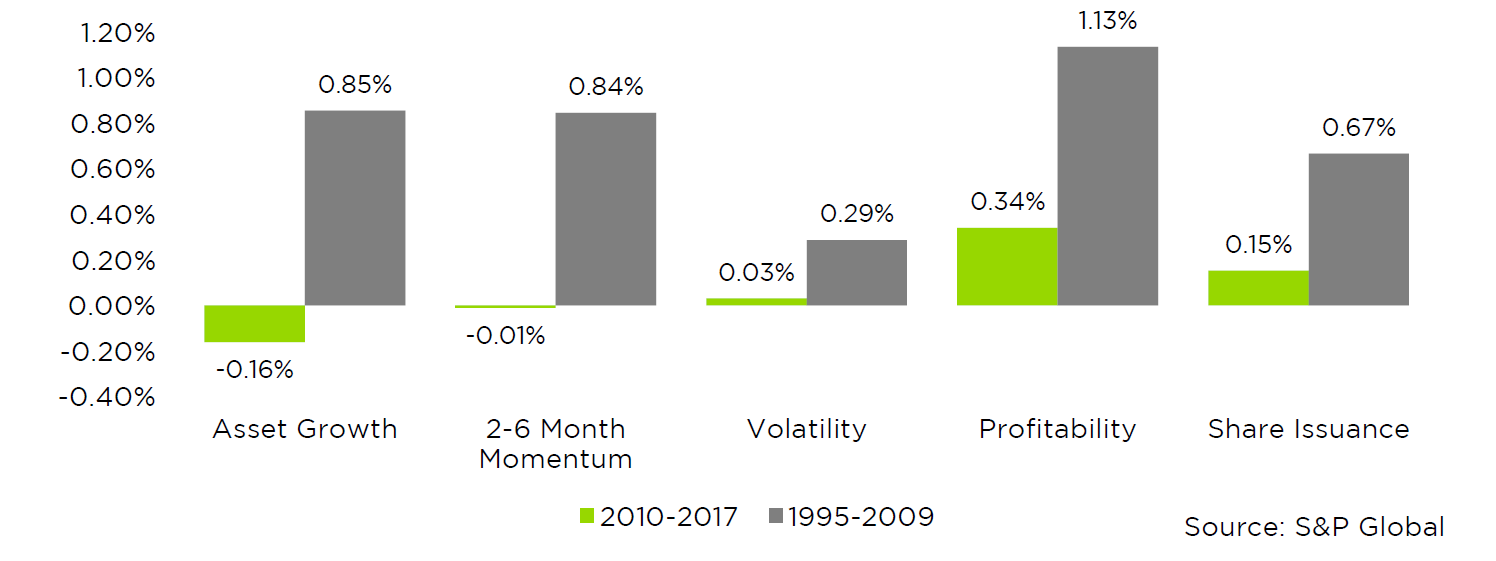

We looked at the top and bottom deciles of US stocks based on their exposures to a set of five well-studied anomalies. In the years leading up to the crisis, the best stocks according to these measures outperformed. But in the post-crisis era, a long-only portfolio of top-decile anomaly stocks with apparently favorable factor exposures would have slightly underperformed the S&P 500. Below are averages of relative returns to the S&P 500 over different time frames of the top decile of stocks within a few different factors.

Figure 1a: Average Monthly Top Decile Anomaly/Factor Returns Relative to the S&P 500

During the post-crisis period, assets have flowed into long-only “smart beta” strategies that aim to capture factor-based performance. We believe the two events are related. Flows into smart beta have pushed up prices of stocks with attractive factor exposures, impairing subsequent returns.

In light of this grim performance, some may wonder whether factor-based strategies have completely lost their edge. Some may further wonder whether Counterpoint jumped into a crowded environment, with little chance of delivering alpha. Our response on both counts: Not quite.

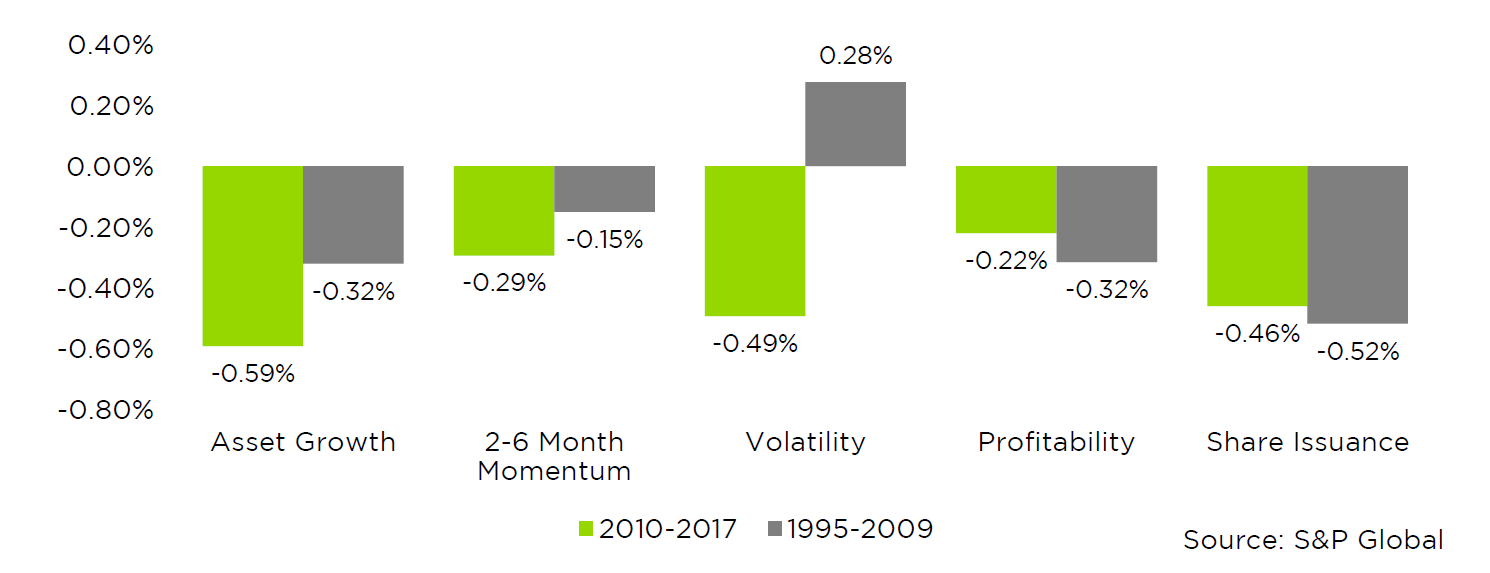

Figure 1b: Average Monthly Bottom Decile Anomaly/Factor Returns Relative to the S&P 500

As seen above in Figure 1B, alpha was still available (and actually improved for some factors) to strategies that sold short stocks with the worst factor-based profiles. Companies with bloating asset bases, downward trending or volatile share prices, poor profitability, and a tendency to issue shares continue to do poorly.

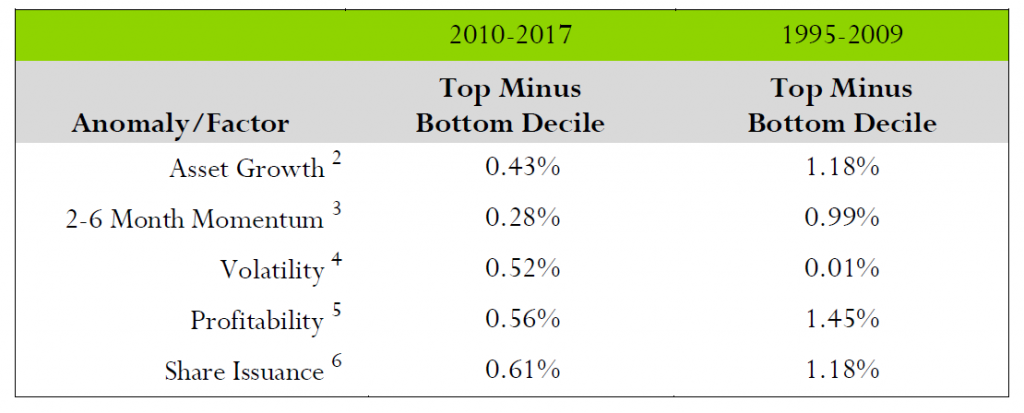

Figure 2: Average Monthly Long-Short Anomaly/Factor Returns

Pictured above, long-short and market-neutral strategies that go long the top decile of stocks with good qualities, and short the opposing decile of stocks have had access to alpha1 across both pre- and post-financial crisis time frames.What’s going on here? A few thoughts:

First, increased awareness of academic research may have led to strategy crowding, eliminating many factor-based long-only opportunities. If this is the case – and if recent history is a guide – investors shouldn’t expect too much from long-only smart beta strategies that have lately come into vogue. The excess returns available to such strategies during the past eight years, not factoring in transaction costs, appear as the green bars in Figure 1A above. Not great.

Second, logistical challenges and investors’ traditional distaste for short sellers and short selling may have preserved opportunities on the short side. In fact, long-short and market-neutral strategies may be “the best of what’s left” for investors seeking factor-based outperformance.

Interestingly, investing indiscriminately in any long-short strategy guarantees little. Evidence shows discretionary professional money managers on average invest in a manner opposite to the correct anomaly exposure. What remains is the sweet spot for opportunity in factor-driven (particularly multi-factor) long-short strategies.

Finally, readers should note that this analysis relates only to US stocks. Global factor-based strategies present a different set of opportunities. The data shows market efficiency and crowding within factor strategies is lower outside the US. We plan to discuss that subject in an upcoming piece.