Nearly a decade after the Federal Reserve’s interventions during the Great Financial Crisis, investors have been questioning whether Fed policy has corrupted the yield curve, a longtime recession indicator. Deep into this long bull market, it is tempting to rethink proven economic indicators. Looking at recent history, we find the yield curve is a helpful contextual tool – neither to be overemphasized nor to be dismissed.

Over its long-term history, the yield curve has been a strong predictor of recessions. However, over a shorter recent period, its predictive power seems underwhelming – not just for recessions, but also for stocks and high yield bonds, two important areas of focus for investors.

The Yield Curve in the Dot Com and Housing Cycles

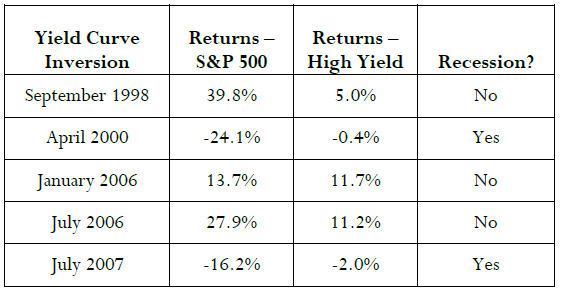

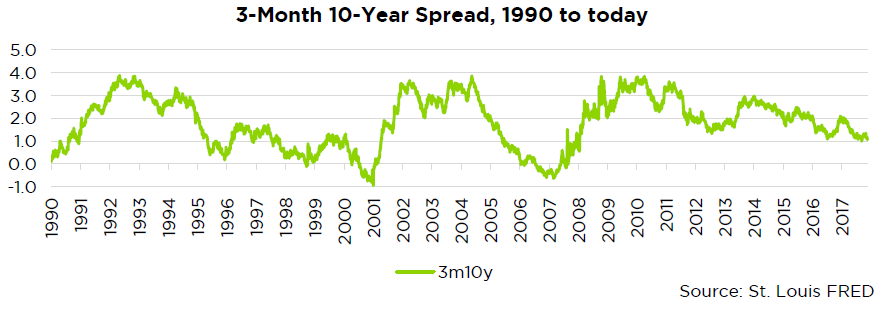

Drawing on data from 1990 to today, we examined the five most recent yield curve inversions measured by the difference between 10-year and 3-month yields. Lately, recessions have not consistently followed inversions. And twelve-month returns on the S&P 500 and high yield bonds have varied widely after each inversion.

Once in 1998 and then twice in 2006, the yield curve gave seemingly false signals. In each of those cases there was still plenty of upside left in the dot-com and housing booms: No recession emerged, and stocks and high yield provided solid returns.

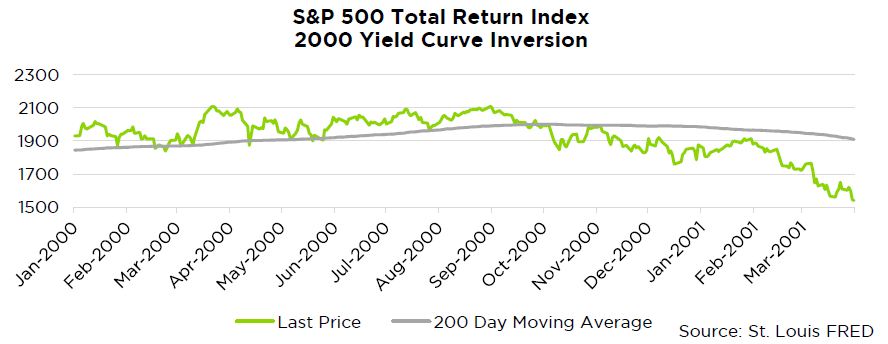

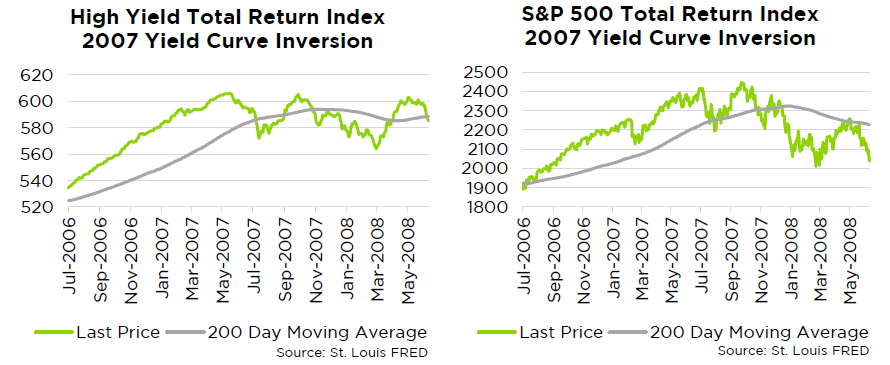

On the other hand, the 2000 and 2007 inversions preceded not only recessions but also disappointing returns in high yield and stocks.

Looking at the past 27 years, the yield curve has a mixed predictive track record. Still, owing to its robust long-term history and the two accurate positives it has lately produced, we’re not ready to abandon it entirely.

Where We Are Today

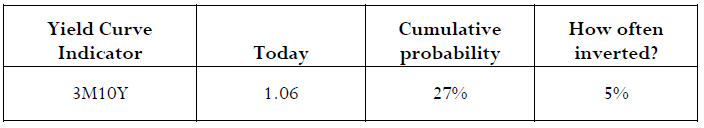

Today, the yield curve is not inverted, but it is not steep, either. Analyzing the past 27 years, we can see the yield curve has historically been flatter about 27% of the time, and steeper 73% of the time. We also see that inversions are rare, taking place about 5% of the time.

It’s not clear where the yield curve is headed next. When it’s been at today’s levels, the yield curve has followed up sometimes by steepening, sometimes by flattening, and sometimes eventually inverting.

3-Month 10-Year Spread, 1990 to Today

Abandoning the yield curve based on so-so recent performance ignores its initial intended purpose. In their pioneering work on the yield curve, Federal Reserve bankers Arturo Estrella and Frederic Mishkin saw the yield curve as one predictive piece of the economic puzzle:

We may draw some additional conclusions. First, stock prices provide information that is not contained in the yield curve spread and which is useful in predicting future recessions. Second, a simple model containing these two variables is about the best that can be constructed from financial variables for out-of-sample prediction.

According to Estrella and Mishkin, investors should integrate the yield curve into a broader analysis. Building on that insight we believe that, rather than suddenly add or remove data points to a strategy, investors should consider their long-term convictions and make updates after careful consideration.

Notably, Estrella and Mishkin tell us stocks are also useful recession predictors. If risky investments also help to forecast economic downturns, perhaps that is a point in favor of a trend-following approach. Regardless, Counterpoint Tactical Income continues to adhere to its quantitative discipline while observing economic variables to better understand the context. Our view remains consistent with that in recent updates: Riskier assets like stocks and bonds appear expensive on many fundamental valuation measures, but such an assessment has not consistently predicted short-term drawdowns.

Footnotes

1 Estrella, Arturo, and Frederic Mishkin. 1998. “Predicting U.S. Recessions: Financial Variables as Leading Indictors.” NBER Working Paper Series.