As we near the end of 2022 we thought it would be helpful to remind investors why diversifier strategies matter. No strategy works all the time, as was evident this calendar year, and prudent risk management often means not every investment should be moving in the same direction at the same time.

While some investors might be swayed to adjust investment strategy amid a down year for stocks and bonds, proper diligence requires more than a look at a couple years’ recent performance. Diversifier strategies seek to strengthen portfolios by functioning as a separate asset class, distinct from stocks and bonds. They target differentiated risk- reward profiles, attempting to support portfolios when traditional assets are stressed.

A blend of alternatives with stocks and bonds can potentially extend the risk-management benefits associated with traditional asset class diversification. Over the long run, diversifier strategies have tended to provide investors with reasonable returns as well as attractive risk-management benefits, making them suitable for many types of portfolio.

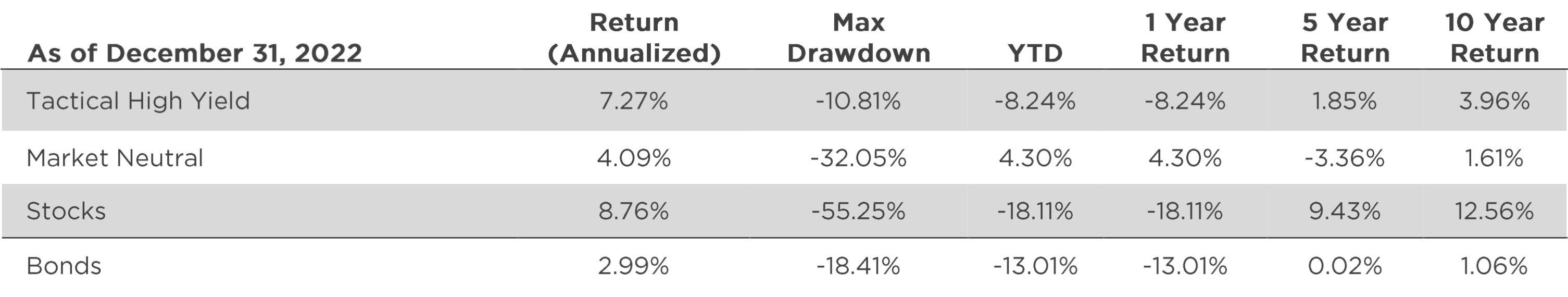

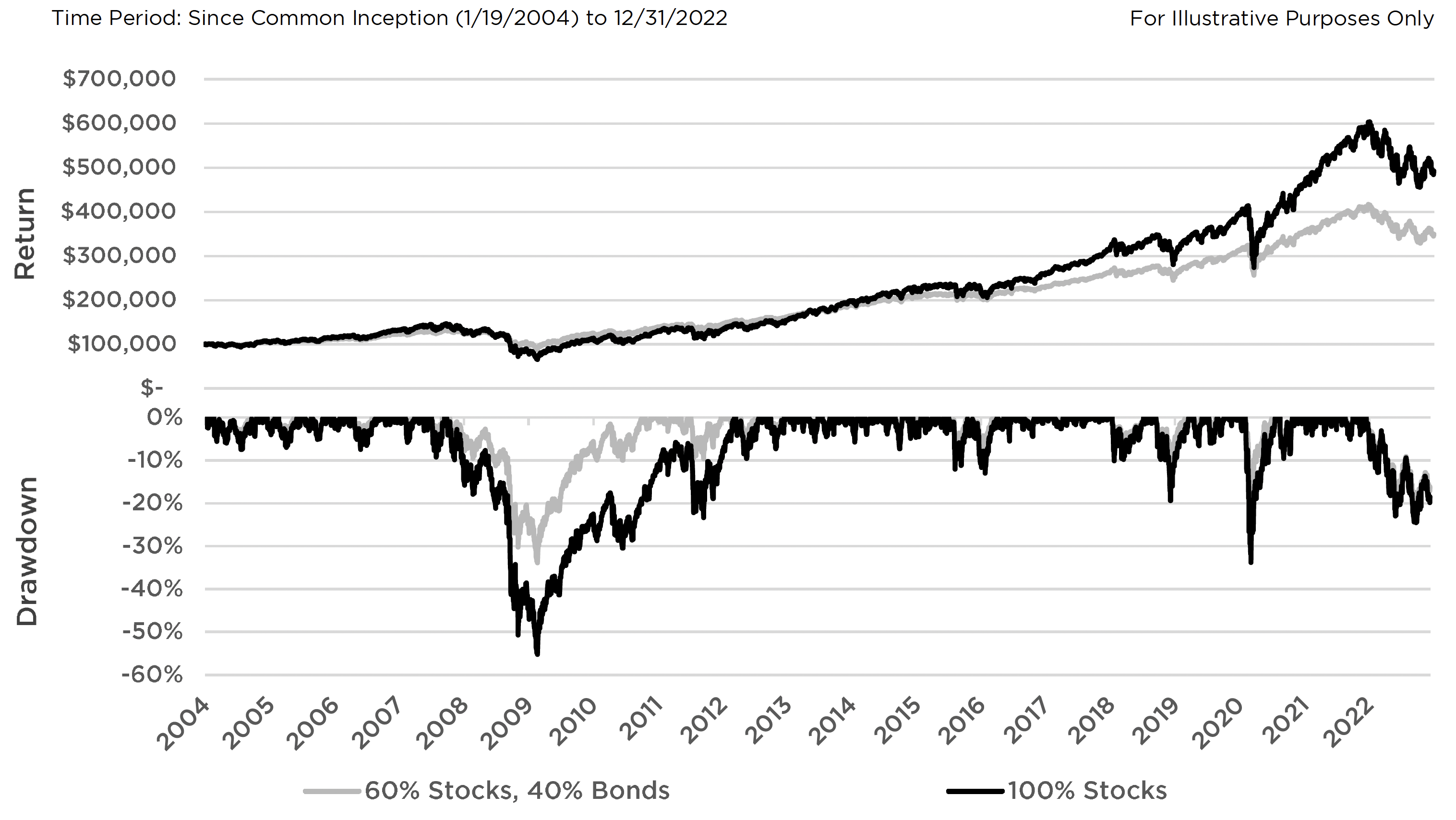

The Classic 60% Stock, 40% Bond Portfolio vs. 100% Stocks

Stocks and bonds each have pronounced strengths and weaknesses. The addition of bonds to an all-stock portfolio improved the drawdown profile, reduced the portfolio’s relationship with stocks, and lowered standard deviation – potentially all good things. Stocks, meanwhile, had a higher annualized return – but they had the worst drawdown profile and did not diversify away stock market risk.

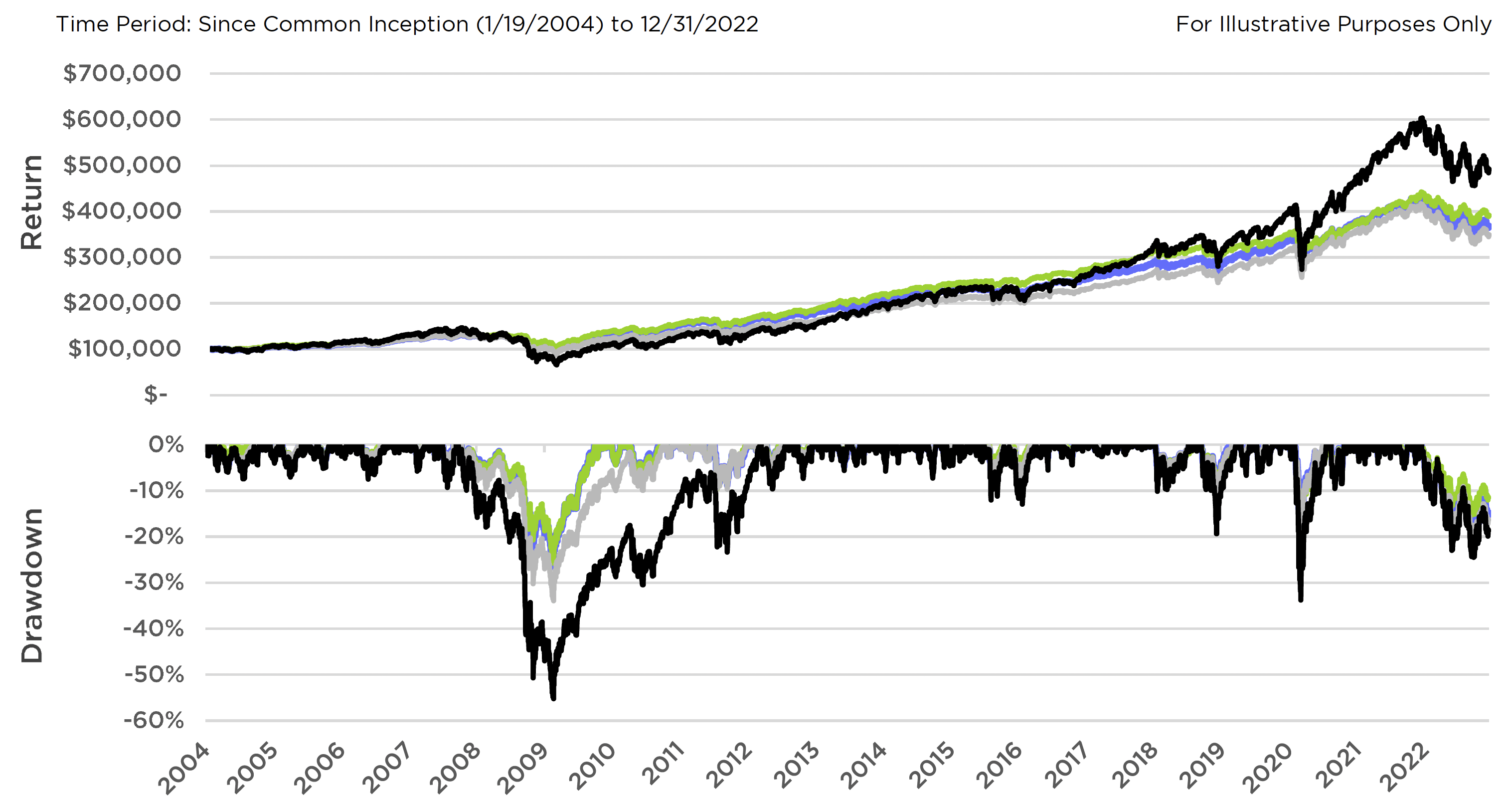

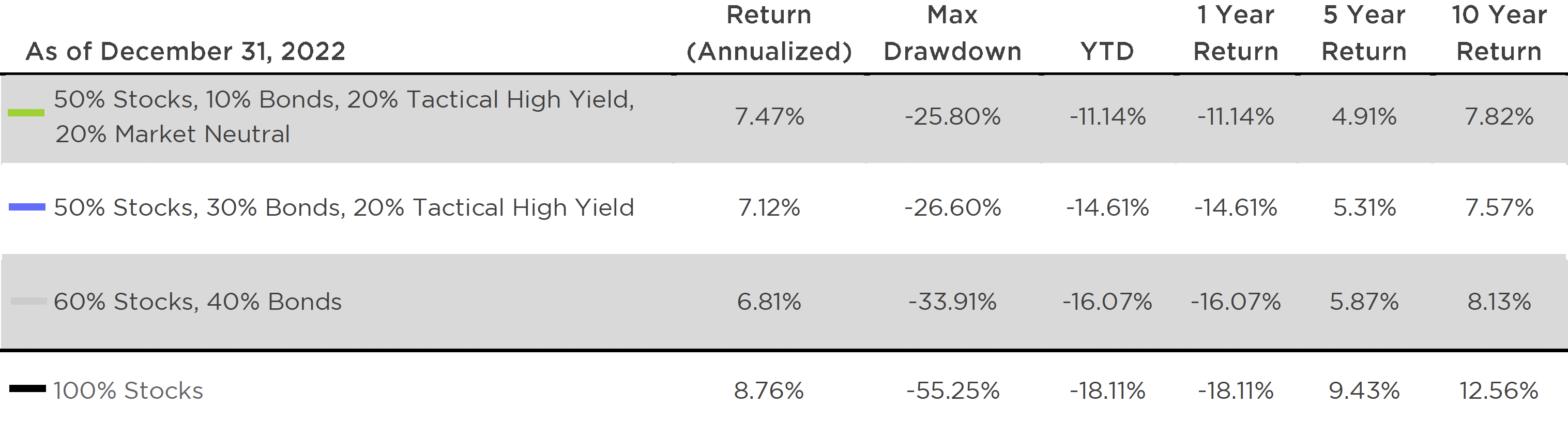

The addition of a tactical high yield strategy and a market neutral strategy, like the Counterpoint Tactical Income Fund and the Counterpoint Tactical Equity Fund respectively, to a portfolio further improved upon the benefits associated with stocks and bonds. Returns were higher than the traditional 60/40 portfolio but lower than the 100% stock portfolio, while max drawdown showed meaningful improvement. The chart below shows how these dynamics play out for investors over time.

50% Stocks, 10% Bonds, 20% Tactical High Yield & 20% Market Neutral Portfolio

Conclusion

Just as adding bonds to a portfolio strengthened its risk profile amid downturns, the addition of two distinct diversifier strategies can potentially make a stock and bond portfolio even more robust. History shows a diversifier strategy can improve portfolio drawdown performance without a major sacrifice of long-run performance.

Systematic diversifier strategies attempt to support portfolios in volatile markets. Although many diversifiers may lag amid strongly trending bull markets, the right strategy seeks to lower volatility of returns, reduce capital drawdowns, and enable managers to invest opportunistically when markets are stressed. Diversifier strategies often help advisors prepare for adversity. They can also position advisors to be proactive when markets provide fundamental opportunities.