Some investors have shown increased interest in long-short equity strategies amid a down year for stocks and bonds. But proper diligence requires more than a look at a couple years’ recent performance. Investors should consider how a low-correlation strategy like the Counterpoint Tactical Equity Fund (CPIEX) might fit within a total portfolio.

Building a Portfolio with Tactical Equity

Investors can use CPIEX to potentially moderate their overall exposure to stock markets. The table below shows how CPIEX and other asset classes have historically tracked the wider market and can infer a reduction in stock market risk if held since inception.

Stock Market Risk Since 2016 – 01/01/2016 to 09/30/2022

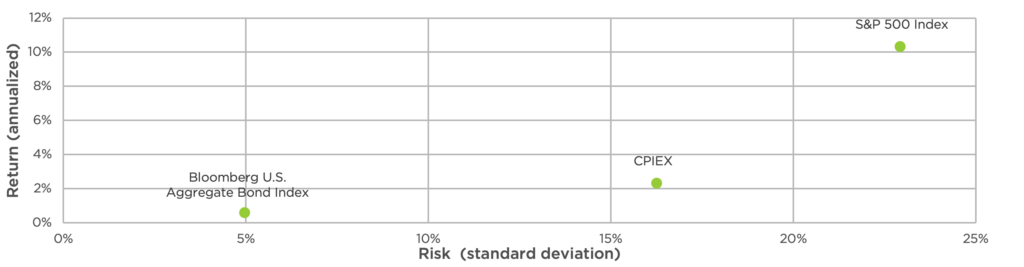

Reallocating from stocks into CPIEX can potentially reduce market beta. As can be inferred via the chart above, reallocating from bonds can increase stock market risk; however, reallocating a portion from both stocks and bonds in equal measure has the potential to hold market beta nearly steady. Let’s not forget the potential benefits of adding diversifier strategies to a portfolio that are uncorrelated to traditional asset classes. The chart below measures risk on the x-axis (riskier is further to the right) and return on the y-axis (more return as you go up). Strategies improve as they go up and to the left. Historically, reallocating equally from stocks and bonds into CPIEX could essentially preserve a portfolio’s risk and reward measurements. Reallocating from stocks may reduce risk, reallocating from bonds can increase risk.

Historical Risk-Reward Since 2016 – 01/01/2016 to 09/30/2022

The performance data displayed here represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free 844-273-8637.

What A Lower Stock Market Risk Looks Like in 2022

To realize the full benefits of many strategies, an investor usually needs to be invested through various market cycles. The following chart illustrates the performance of CPIEX over the last year relative to stocks and bonds:

Growth of $100 – 10/01/2021 to 09/30/2022

One of the keys to successful use of low-correlation strategies is to understand that they are designed to perform differently – which can mean showing resilience in challenging environments as well as struggling when other asset classes are doing well.

Conclusion

Investors who are interested in the Counterpoint Tactical Equity Fund (CPIEX) need to understand how it fits in an investor portfolio from the perspective of stock market risk. Additionally, position sizing is likely to be a key driver of an investor’s long-run ability to benefit from the strategy’s low-correlation return profile and unique multifactor approach to stock selection.

In a rising-rate environment where stocks and bonds have produced negative year-to-date returns at the same time, alternative strategies that target differentiated return sources. When stocks and bonds move in the same direction, there may be a benefit to finding diversifier strategies that don’t behave like either asset class. That’s one definition of “alpha” – the amount of return an investor can expect after adjusting for the strategy’s stock market risk.

The performance data displayed here represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. The Fund’s maximum sales charge for Class A shares is 5.75%. The Fund’s adviser has contractually agreed to waive its fees and reimburse expenses of the Fund, at least until January 31, 2023 to ensure that Total Annual Fund Operating Expenses After Fee Waiver and Reimbursement but does not include: (i) any front-end or contingent deferred loads; (ii) brokerage fees and commissions, (iii) acquired fund fees and expenses; (iii) borrowing costs (such as interest and dividend expense on securities sold short); (iv) taxes; and (v) extraordinary expenses, such as litigation expenses (which may include indemnification of Fund officers and Trustees, contractual indemnification of Fund service providers (other than the Adviser)) do not exceed 2.00%, 2.75% and 1.75% of average daily net assets attributable to Class A, Class C, and Class I shares, respectively. Without the fee waiver, for 2021 total annual fund operating expenses would be 3.77%, 4.52% and 3.52% for Class A, C and I shares, respectively. For performance information current to the most recent month-end, please call toll-free 844-273-8637.