We have information for investors who are rightly skeptical of today’s bond market and tilting their portfolios toward stocks. What we’re offering is unconventional, and it’s certainly not fashionable in today’s market, but we think we’ve potentially found a viable option to the TINA problem.

As a reminder: We are not fans of the TINA argument that There Is No Alternative to U.S. stocks in today’s low-rate world. We do understand where the TINA crowd is coming from: With interest rates this low, you probably don’t want to hold bonds, which would lock you into near-zero returns on your capital. We get it. The Federal Reserve is promising low rates for the foreseeable future, effectively pushing investors to take on more risk. Why fight it?

So in the spirit of collaboration, this one’s for the TINA crowd:

How can you keep low-paying bonds out of your portfolio without taking excessive stock market risk?

Here’s our wild proposition: TINA investors could consider multifactor market neutral alternatives as a viable replacement for traditional bonds.

You might be alarmed at this suggestion. Multifactor strategies have underperformed for the past decade. The stock market seems to have abandoned the traditional fundamentals that drive factor performance. Value and profitability factors have struggled, with only momentum strategies seemingly earning their premium.

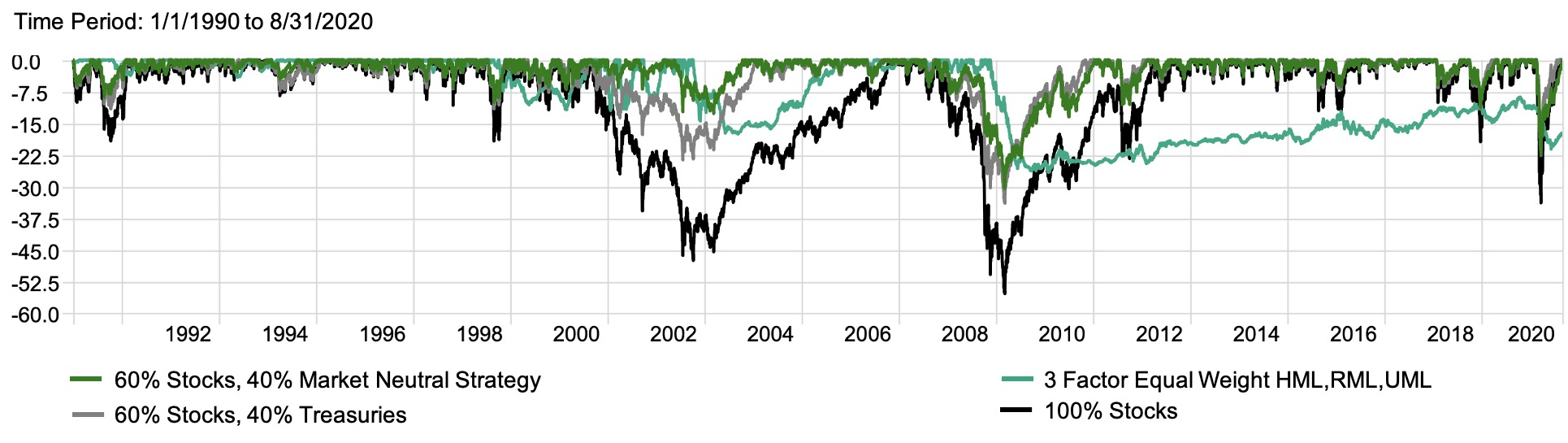

The going has been tough. The chart below shows drawdowns in a 3-factor market neutral strategy, a traditional 60-40 stock-and-bond strategy, a 60-40 stock and market neutral strategy, and an all stock portfolio. One of these things is not like the others.

Drawdown: 60% Stocks, 40% Bonds vs. 60% Stocks, 40% Market Neutral Strategy

The aqua line shows the huge drawdown for multifactor quant strategies – a slump we have still not exited more than a decade after the Financial Crisis. But there’s hope. In the context of an annually rebalanced portfolio, you will notice something surprising: A stock-and-quant portfolio (dark green) recovered from the 2008 crisis similarly to the stock-and-bond portfolio (light grey). Both reached new highs faster than stocks did by themselves. Despite the painful drawdown, multifactor quant strategies have been shown to add value to investor portfolios.

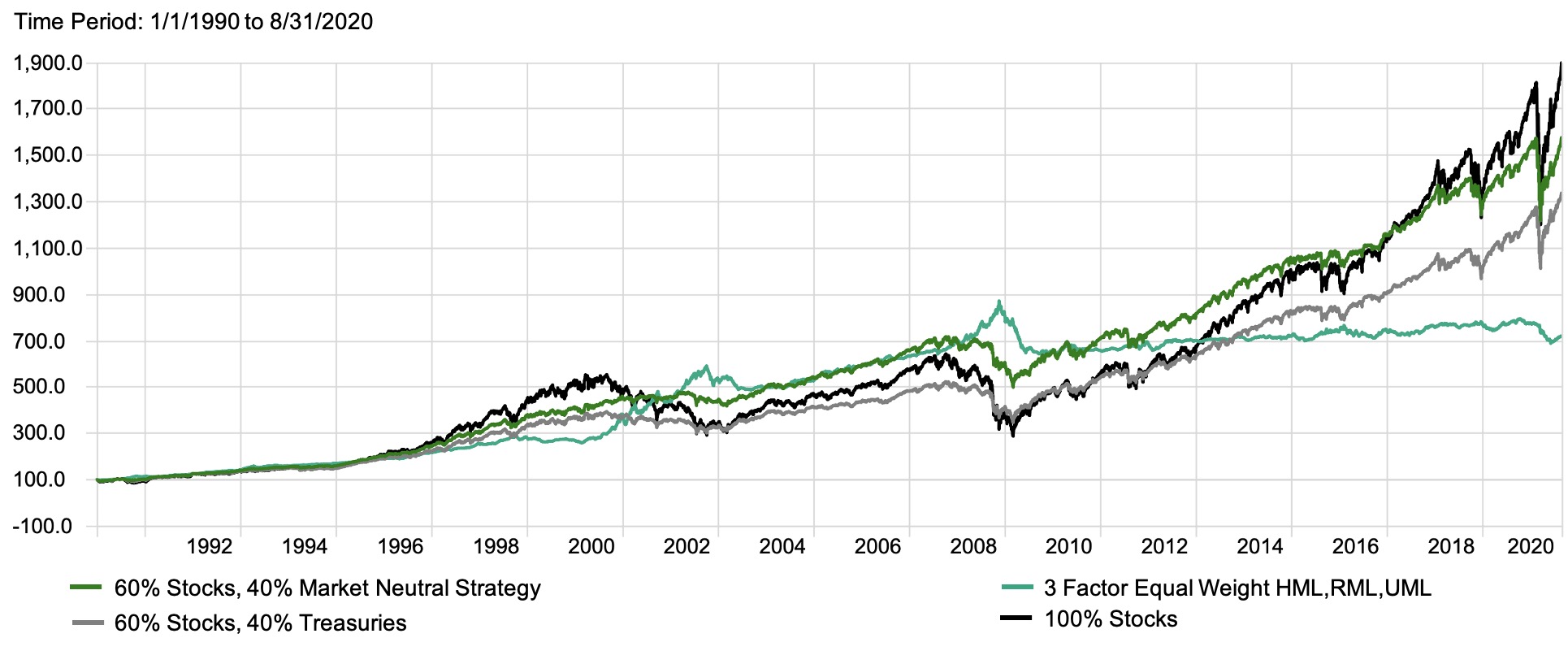

If we zoom out, it starts to look like multifactor quant strategies may have provided exactly what the TINA crowd has been looking for:

- Attractive long-run historical returns? Check.

- Limited volatility of returns? Check (though most TINA investors are fine with a little volatility).

- Low correlation with the stock market? Oh, for sure check (especially in the past decade, unfortunately).

Here’s something else that may surprise you: On a very long-term basis, holders of multifactor strategies instead of bonds have outperformed traditional 60-40 portfolios. They even stayed ahead of stocks until very recently:

Performance: 60% Stocks, 40% Bonds vs. 60% Stocks, 40% Market Neutral Strategy

If you hate bonds because you hate the idea of locking in near-zero returns over the long run, and you’re already not afraid to take the kind of downside risk inherent in stocks, what’s stopping you from buying an asset that has underperformed over the last few years?

TINA investors: If you’re already taking lots of stock market risk, perhaps more than you (or we are) comfortable with, why not consider diversifying into another strategy? Multifactor quant strategies take a different type of risk from stock market risk and have historically rewarded investors with returns well above what’s baked into today’s bond market.

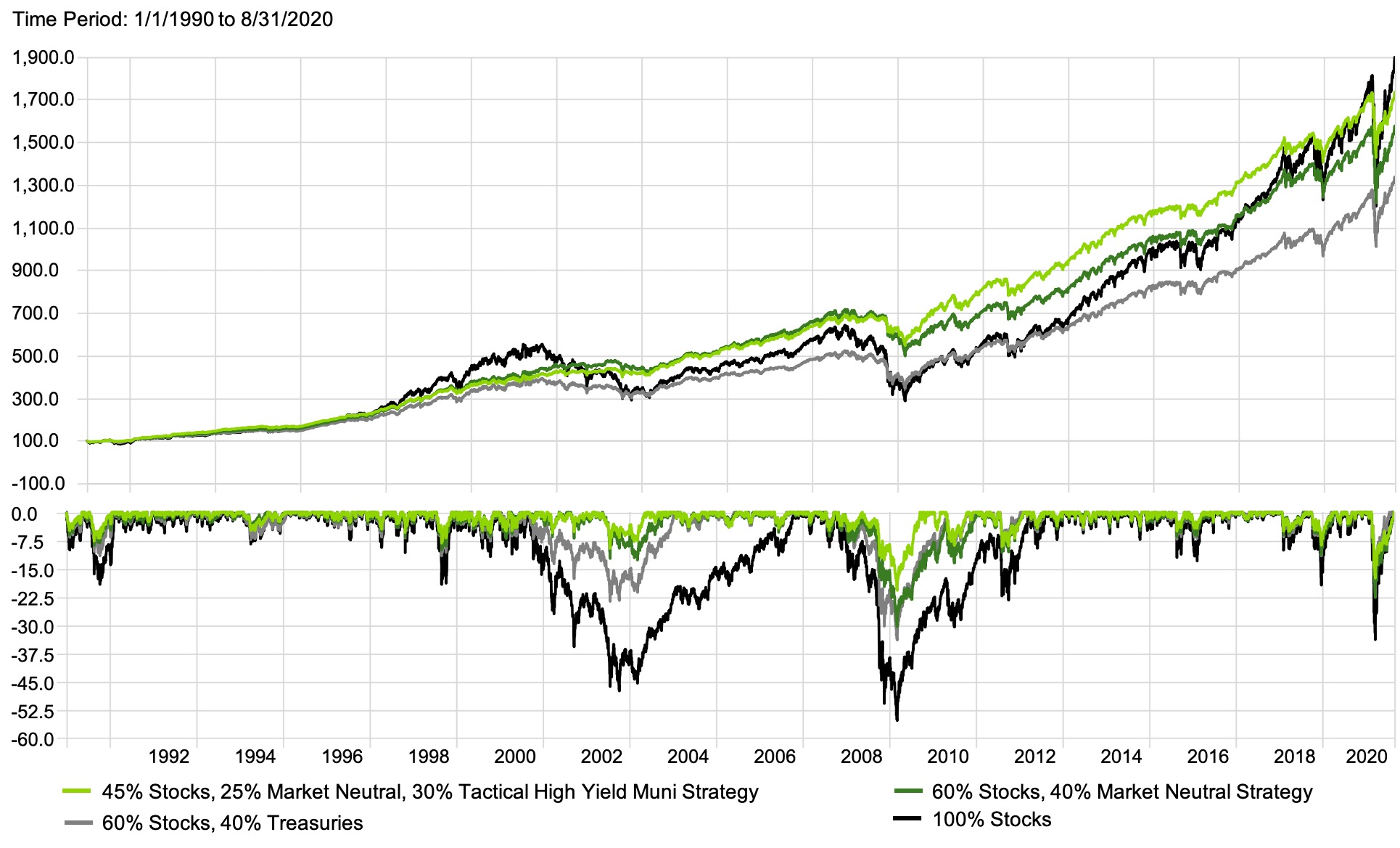

Not ready to go full TINA?

That’s ok! If multifactor quant’s recent performance is too ugly for an all-in bet, there is a compromise available. Tactical high yield diversifiers have a history of supporting portfolios in adverse conditions, and have also earned reasonable returns relative to their risk:

60% Stocks, 40% Bonds vs. 45% Stocks, 25% Market Neutral, 30% Tactical HY Strategy

Whether it’s tactical high yield or multifactor market neutral, a blend of alternatives with traditional stock and bond portfolio can potentially extend the risk-management benefits typically associated with 60-40 stock-and bond diversification. Meanwhile, over the long run, these strategies have tended to provide investors with reasonable returns — exactly what the TINA crowd might be looking for.

For investors skeptical of bonds’ expected returns, alternatives such as multifactor quant and tactical fixed income may provide a way forward. Before concluding There Is (absolutely) No Alternative, make sure you’ve done full diligence on out-of-favor diversifier strategies with strong long-run historical returns. The results may surprise you.