We believe investors looking to earn tax-exempt income while actively managing downside risk should consider tactical trend following strategies in high yield municipal bonds. These strategies have historically helped investors reduce portfolio drawdowns while generating reasonable levels of tax-advantaged income.

Tax Advantages

Municipal bond income is generally exempt from federal taxes, a useful feature for investors who hold assets in taxable accounts. A strategy that holds national exposure to high yield munis can distribute pro-rata benefits to reduce taxable income at the state level as well.

Adding Tactical Muni Strategies to a Portfolio

Many tactical trend following strategies seek to reduce portfolio drawdowns while maintaining municipal bonds’ tax and return benefits. These strategies often use systematic timing models to invest in high yield munis when they are in an uptrend. They adopt a defensive “risk-off” posture when high yield munis enter a downtrend, shifting to cash or short-term Treasury securities. This can help investors stick with their long-run strategies – even during times of market stress.

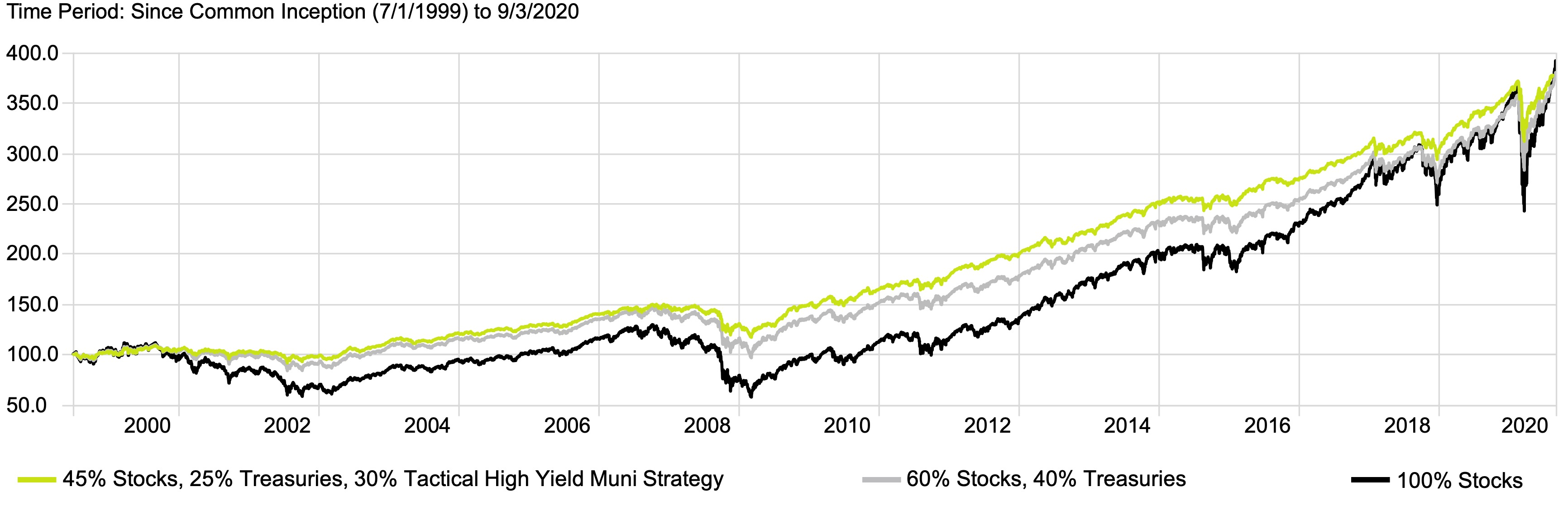

Shifting a portfolio from a traditional 60-40 stock-and-bond allocation to include a tactical high yield muni strategy historically helped investors manage stock market risk and portfolio drawdowns. The following chart illustrates the return profile for three hypothetical portfolios from 1999 through 2019: all stocks; 60% stocks and 40% Treasuries; and 45% stocks, 25% Treasuries, and 30% tactical municipal high yield.

Performance: Traditional 60-40 vs. 45-25-30 with Tactical High Yield Muni Strategy

Thanks to a strong stock market rally in the past few years, all three strategies have been close from a return perspective: The all-stock portfolio earned 6.48% annually, the 60-40 portfolio 6.41%, and the tactical muni portfolio 6.50%. Since these are pre-tax returns, after-tax benefits are understated for the portfolio with municipal bond income.

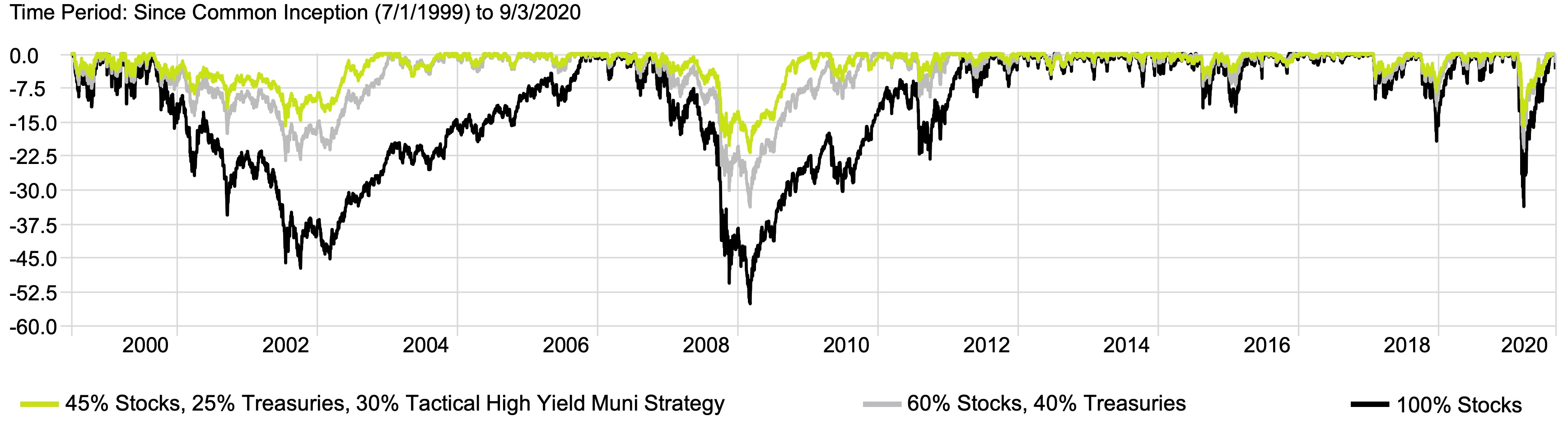

Meanwhile, the clearest differentiation for the tactical municipal bond strategy comes in terms of risk mitigation. During the dot-com recession, the Financial Crisis, the Euro crisis, the Shale Bust, and the COVID crisis, the tactical municipal strategy helped support portfolios, compared with more traditional all-stock or 60-40 portfolios.

Drawdown: Traditional 60-40 vs. 45-25-30 with Tactical High Yield Muni Strategy

Reduced portfolio drawdowns may help prevent investors from making emotional decisions that can ultimately impair long-run returns. Lower stock-market risk can help insulate investor portfolios from broad market drawdowns. Tactical muni strategies also helped advisors invest opportunistically, providing opportunities to allocate into assets that may become cheap on a fundamental basis.

Conclusion

Historically, the high yield municipal bond asset class has attractive tax characteristics. Tactical trend following strategies seek to mitigate portfolio drawdowns while retaining many of the benefits of investing in municipal bonds. Investors seeking tax advantaged income and a systematic approach to managing drawdowns should consider tactical asset allocation in high yield municipal bonds.