An eye-catching rise in corporate default rates has investors wondering whether now is a good time to invest in high-yield corporate bonds. We believe investors should be cautious about using default rates to try to time the market. Bond prices tend to reflect rising credit risk before default rates rise; historically, defaults are a lagging indicator. However, systematic tactical trend following can potentially help investors manage high yield default risk.

The Default Rate Is a Slow, Noisy Signal

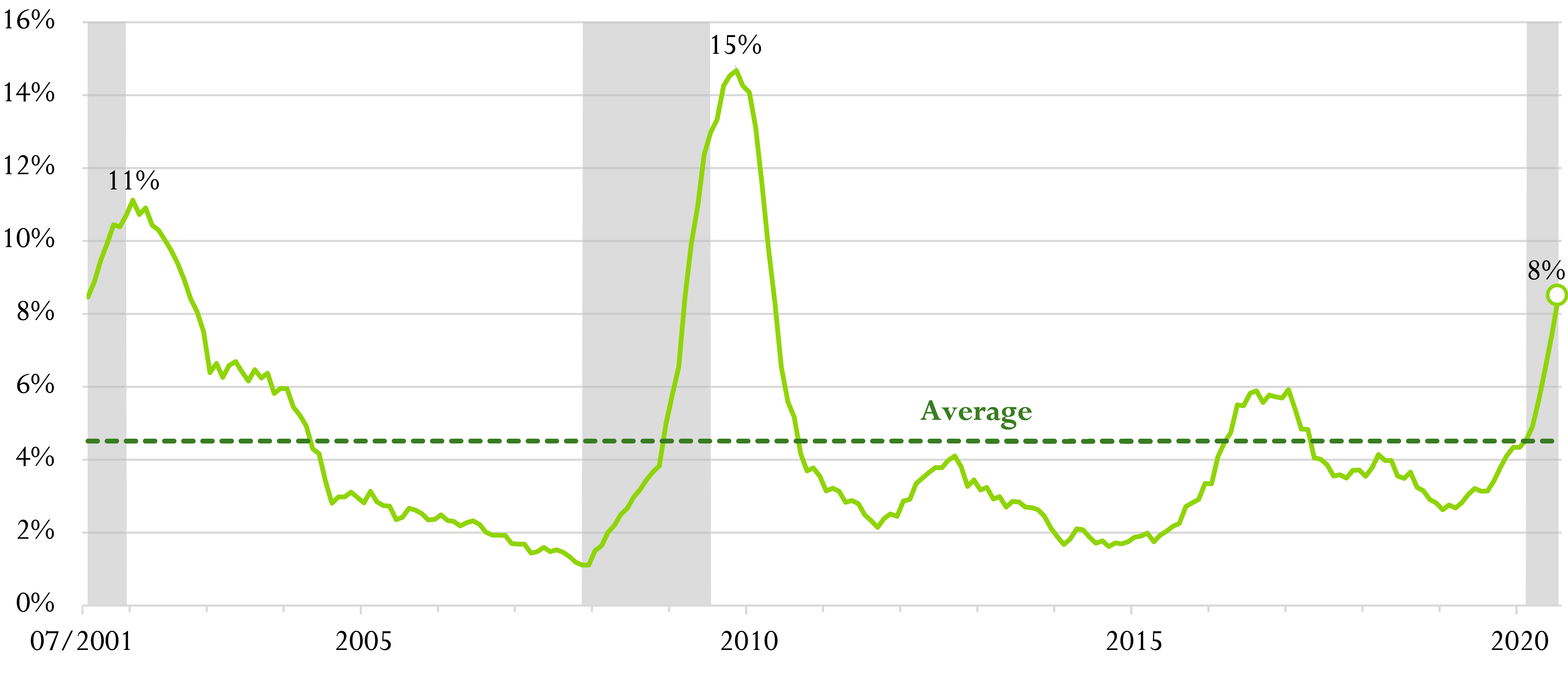

Investors who focus on corporate bond defaults can easily get caught wrong-footed. Default rates in high-yield bonds have spiked above their longer-term average four times in the past 20 years: during the dot-com bust, during the Great Recession, during the 2015 Shale Bust, and during the 2020 COVID outbreak. In each of the three past cases, the market has tended to predict a rise in credit risk before defaults started piling up. After each crisis passed, defaults only tended to fall well after the next bull market was underway. This makes intuitive sense: company management will often delay default as long as possible, even as worsening economic conditions become obvious to bond investors.

U.S. Speculative-Grade Default Rates

Investors who focus too intently on spiking default rates could be double-counting information the market has already accounted for. This makes the default rate a slow, noisy signal – and potentially useless for timing the high-yield bond market.

Tactical High Yield Strategies Can Help Manage Credit Risk

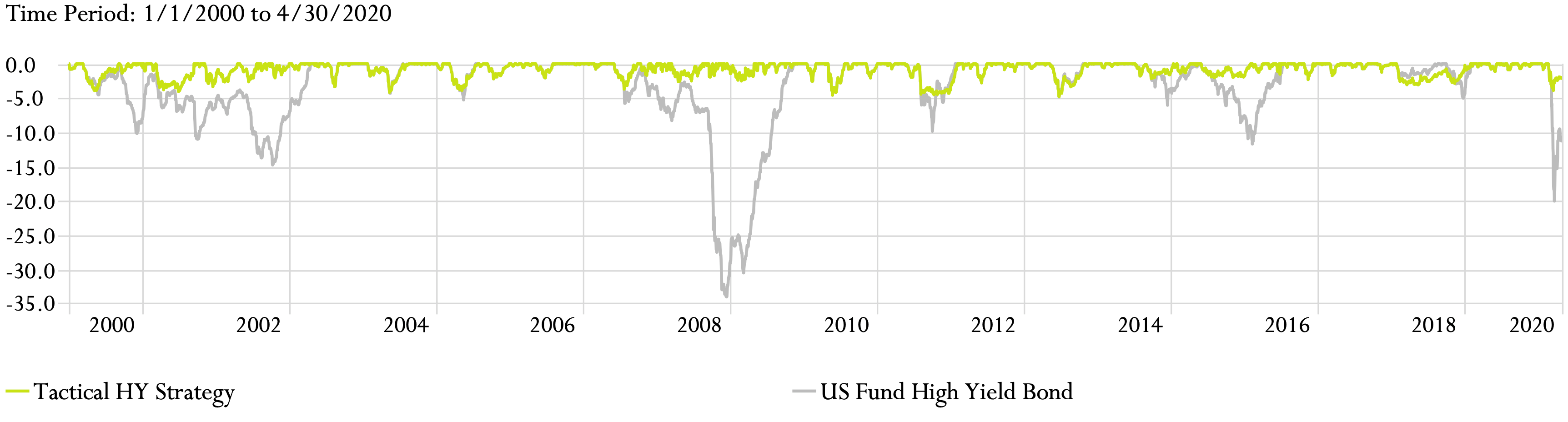

The misleading nature of the default rate reinforces the lesson: Discretionary market-timing decisions in high yield credit often leave investors worse off for their efforts. Meanwhile, systematic trend-following strategies in high yield credit have a strong track record in helping investors avoid portfolio drawdowns during periods of market stress. The following chart compares passive investment in high yield credit with a systematic 200 day moving average tactical timing strategy applied to the same high yield index.

High Yield vs. Tactical High Yield Drawdown

The tactical high yield strategy earns returns to the Morningstar Category US Fund High Yield Bond when the index is above its 200-day moving average, and otherwise earns returns on 3-5 year Treasury bills.

We believe investor should be cautious about focusing too intently on corporate defaults. However, statistically validated timing strategies have historically stood a good chance of helping investors manage high yield credit risk.

Conclusion

Corporate default rates are often a slow, noisy signal. If history is a guide, the recent spike in high yield defaults could just as easily be a contrarian buy indicator as a sign of trouble ahead. Whatever the default rate is telling us, we believe investors should rely on systematic tactical strategies with a stronger track record for managing risk. Investors who let their strategies do the work can potentially avoid biased market timing mistakes.