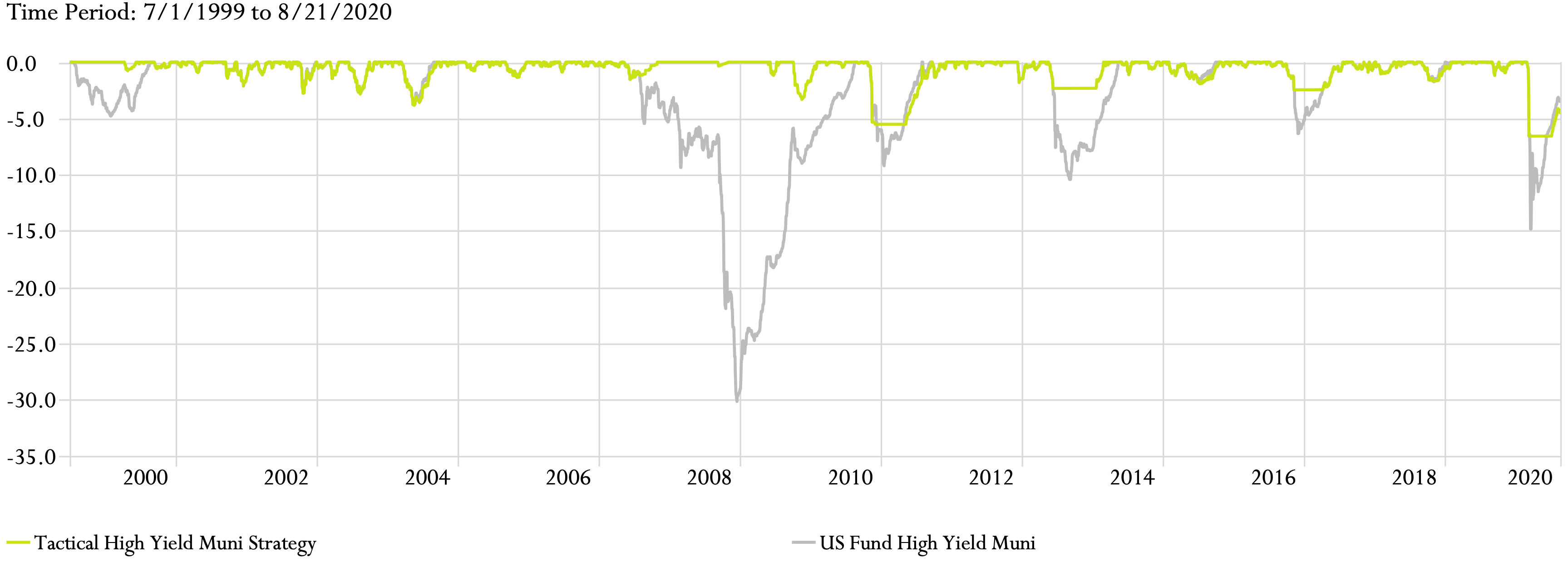

The municipal bond asset class shocked investors in March of 2020 by delivering their sharpest drawdown in at least 5 years. In only two weeks, municipal bonds broadly dropped around 15% while high yield municipal bond ETFs fell as much as 35%! This was highly unusual for what investors tend to consider a stable asset class. Amid a year of unusual events in financial markets, this serves to remind investors to consider systematic tactical strategies as a risk-management tool for their municipal bond investments. Tactical trend following is designed to reduce drawdowns, helping to preserve investment capital and keeping investors from making emotional decisions during stressed markets.

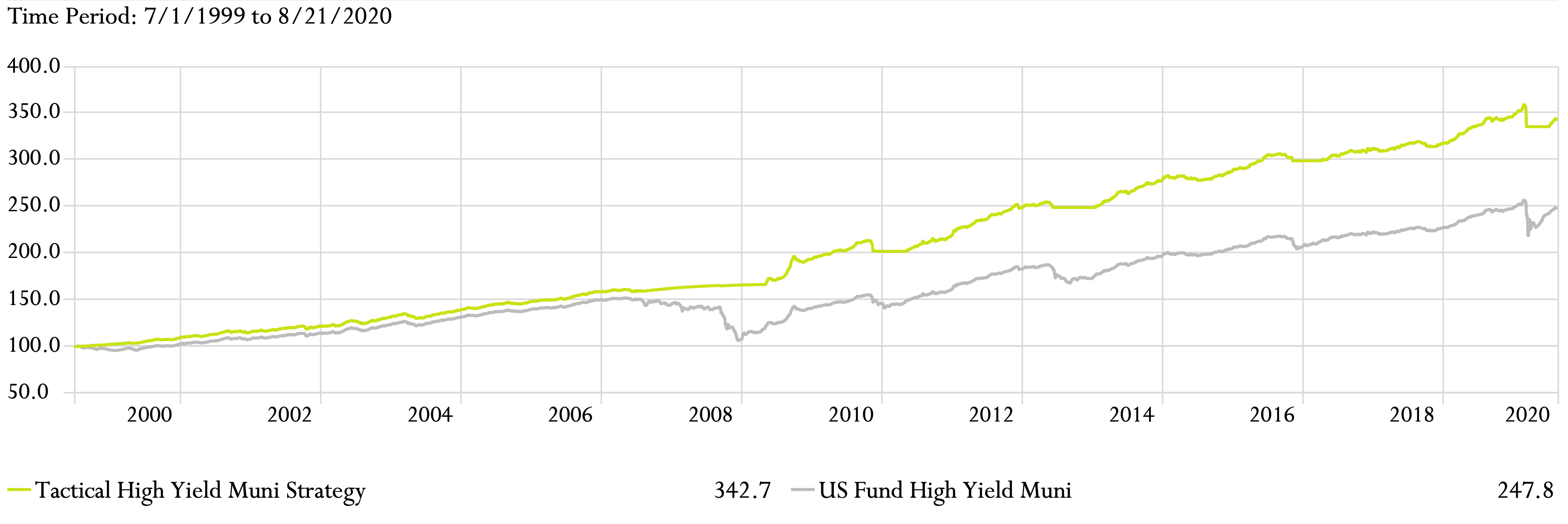

Performance: Tactical High Yield Muni vs. High Yield Muni

The specific source of the 2020 muni bond disruption depends on who you talk to. Some analysts attributed the swoon to a liquidity shortage amid a brief “flight to quality” trade in the bond market. Others attribute the drop to a legitimate sign of future strain on municipal finances as COVID-19 threatened to shut down local economies. Whatever the cause, the sharp drop in muni bond prices accompanied substantial fund outflows. Some investors who traded out of muni funds during the dip were caught wrong-footed – selling right before a sharp rebound.

This story highlights the benefit of a systematic risk-management strategy. When markets are unsure how to price the severity of a possible calamity like COVID-19, we believe investors need strategies that seek to avoid trading reactively, harming themselves by selling in a haphazard manner purely motivated by fear.

Drawdown: Tactical High Yield Muni vs. High Yield Muni

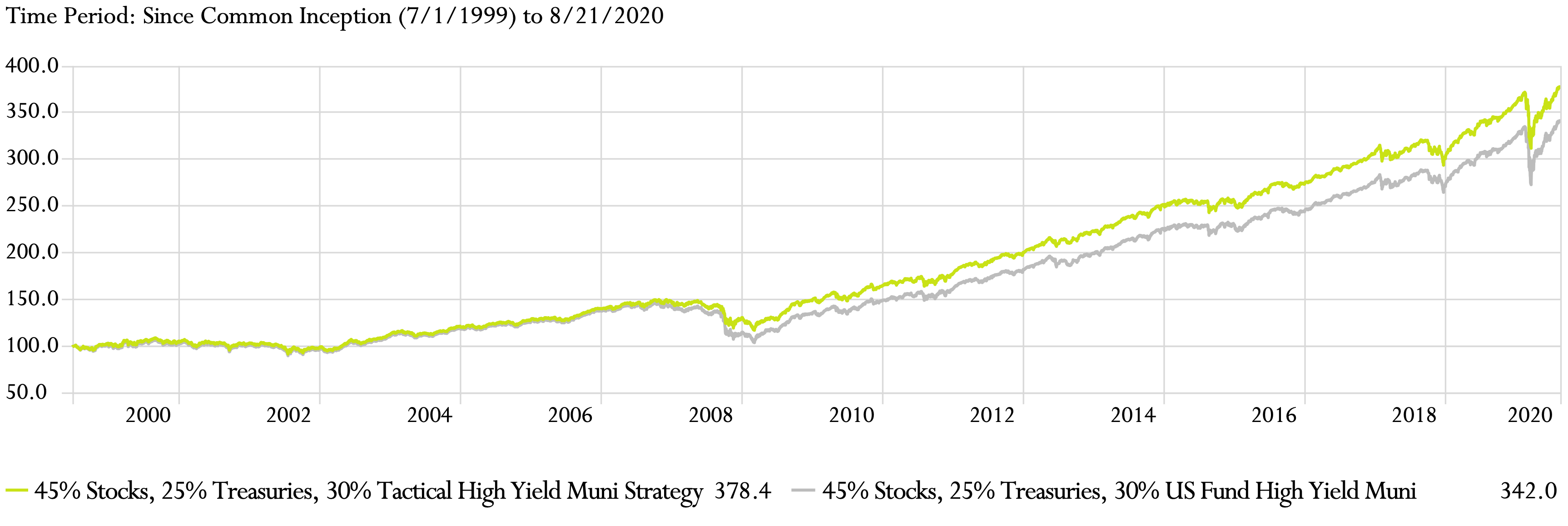

Like high yield corporate bonds, high yield municipal bonds have had attractive return profiles relative to their volatility. This quality makes them strong candidates for trend following. Systematic trend following strategies have historically helped reduce portfolio drawdowns without dramatically impacting returns, which has helped improve risk-adjusted performance. As is the case in corporate high yield investing, systematic trend following strategies can position investors to react opportunistically amid price declines. They can also, perhaps more importantly, help prevent investors from responding emotionally to portfolio drawdowns by seeking to minimize those drawdowns in the first place. The potential long-run benefits are brought into sharp relief when you place Tactical High Yield Muni into the context of a balanced portfolio, as can be seen in the chart below.

45/25/30 with Tactical High Yield Muni vs. 45/25/30 with High Yield Muni

Conclusion

Sharp drawdowns in municipal bonds during the first quarter of 2020 have brought into focus the potential need for proper risk management strategies. By implementing tactical trend following strategies in the high yield municipal bond asset class, investors seek to target reasonable returns while prioritizing reduction of portfolio drawdowns. This tactic can position portfolios to invest opportunistically, and it can help investors avoid the temptation to act emotionally during times of market stress.