As interest rates hit record lows, some investors argue that bonds are no longer a useful diversification tool. Howard Lindzon of StockTwits and Ron Lagnado of Universa Investments have made the case against bonds: There is no alternative (TINA) to holding U.S. stocks. We disagree.

The TINA argument amounts to: low or negative interest rates mean investors should not hold bonds.[1] On the surface it makes sense: With rates so low, investors can expect bonds to “drag” on returns – especially if stocks continue their decade-plus bull run. If bonds offer historically low returns today, the argument goes, why own them at all?

If You Can’t Time the Stock Market, Don’t Try to Time the Bond Market

The TINA crowd may be right that you can’t time the stock market on valuation. Stocks are expensive, yes, but that doesn’t mean they’ll go down any time soon or with any predictability. So far so good.

But if the market timing argument is true for stocks, why wouldn’t it also be true for bonds? The bond market is considered to be deeper, more liquid, and less volatile than the stock market. Bonds should be *more* efficiently priced than stocks, and therefore harder to time. And yet the TINA argument calls for investors to time the bond market based on valuation. Low interest rates mean bonds are expensive, so investors should not own them.

We agree with the TINA crowd that discretionary market timing is more likely to harm investors than help them. Unlike the TINA crowd, we believe this argument applies not just to stocks but to all asset classes. If investors can’t time market moves by valuation or gut feel, they should allocate to maximize expected returns given their risk tolerance. This usually means diversification into stocks, bonds, and alternative strategies, including systematic timing strategies that privilege long-run validation over in-the-moment, emotional decisions.

Stocks Don’t Have to Keep Going Up

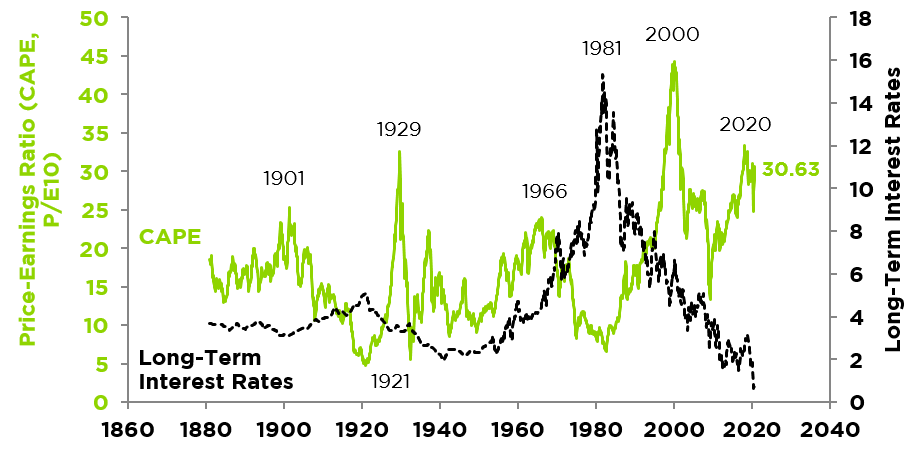

The TINA argument tends to assume stock returns will continue as they have over the past decade. That scenario is not impossible, but it’s not inevitable, either. Here is another plausible scenario:

- Interest rates climb back to 2%

- Stock prices return to their long-term historical valuations

An increase in interest rates to 2% has the potential to prompt an approximate price decline of 10% for bond allocations with duration (interest rate sensitivity) of 5 years. A return to long-run valuations could mean a 40%-50% price decline for stocks. In this downside scenario for both asset classes, bonds could help the investor retain more wealth.

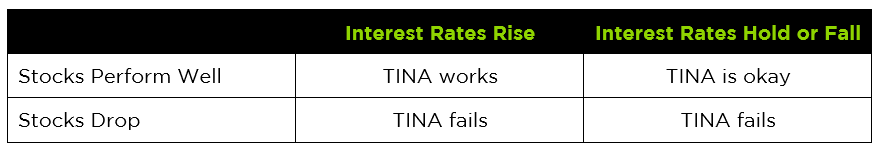

The Only Way TINA Works

On top of bonds’ diversification benefit, there don’t seem to be that many scenarios where an all-stocks approach wins out over a balanced portfolio. Basically, interest rates need to rise (hurting bonds) without stocks falling. We believe that may be plausible – if inflation runs rampant enough to grow stock earnings in proportion to their expensive valuations and offset the negative impact of rising interest rates, then holding bonds would likely turn out to be a mistake.

Investors could face some daunting prospects from here, including low expected returns for bonds as well as other asset classes. You don’t have to be a die-hard value investor to acknowledge that return expectations normally diminish as valuations expand; and on almost every metric U.S. stocks are expensive. Attempts to solve that problem by concentrating portfolios in higher-yielding but riskier assets tends to only *increase* tail risk. It does no good for an investor to accrue larger paper returns only to risk losing half of a portfolio’s value when liabilities start coming due.

Time Markets Systematically, Or Not At All

The TINA strategy calls for discretionary market timing in bonds – we believe this is a dangerous path for most investors. Discretionary timing based on interest rate forecasts or valuations can be subject to human psychological bias, and we believe it does more harm than good. Systematic market timing, on the other hand, aims to profit from investors’ psychological foibles. Systematic strategies follow predetermined processes, with the goal of helping to prevent emotional, biased decisions. We believe investors should only consider timing the market using systematic strategies in asset classes where there’s clear evidence of a timing benefit.

Conclusion

We believe the TINA argument that investors should only hold stocks relies too much on the past ten years of performance. Investors who extrapolate recent history into the future may be creating an incomplete picture of what may occur. In environments where stocks perform poorly, investors who hold bonds have historically experienced shallower drawdowns and reduced volatility. Timing the bond market on valuation, as TINA calls for, could be a mistake.

Investors need to consider downside scenarios when making risk-targeting and diversification decisions. Bonds are not the only solution to stock market risk, but they could be among the most attractive options. We believe investors should consider bonds as well as alternative strategies to create a cost-effective risk management plan that suits not only their return requirements but also their risk constraints.